Global Olefins Market Size, Share, Trends & Growth Forecast Report - Segmented By Types (Butadiene, Ethylene, Propylene, Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2025 to 2033)

Global Olefins Market Size

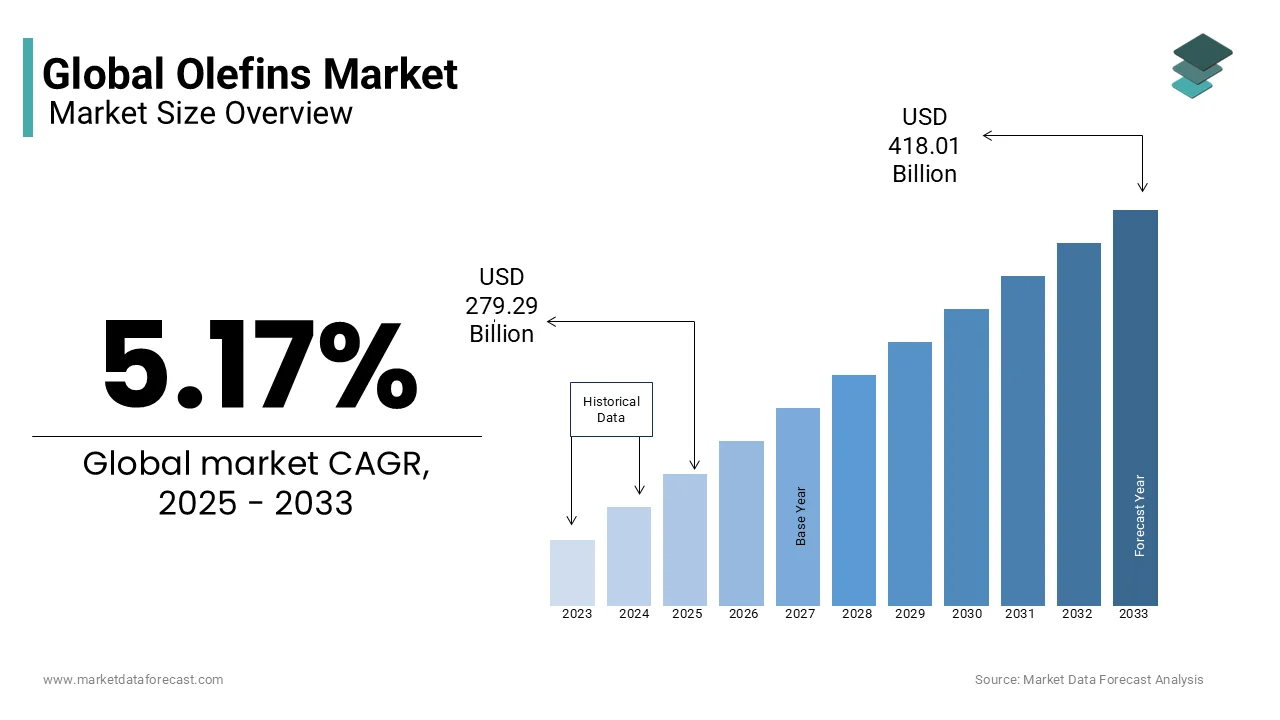

The global Olefins Market size was valued at USD 265.56 billion in 2024, and the market size is expected to reach USD 418.01 billion by 2033 from USD 279.29 billion in 2025. The market's promising CAGR for the predicted period is 5.17%.

MARKET OVERVIEW

Olefins are chemical compounds that are used as a manufacturing component for a variety of other chemical components. They are alkenes made up of hydrogen and carbon containing one or more carbon atoms linked by a double bond. Ethylene occurs naturally in the environment and is produced by plants of all kinds. Olefins are a class of compounds that include ethylene, propylene, and butadiene. Olefin production is primarily dependent on natural gas processing products or crude oil fractions. Ethylene is produced from various raw materials, such as crude oil condensate, natural gas, ethane, butane, propane, and others.

Lubricants are used in crankcase lubricants, hydraulic fluids, gear oils, etc. Higher olefins are used in the formulation of lubricant additives for automotive lubricants and industrial lubricants. Lubricant additive technology offers many benefits for the environment and end-users. Concern for the environment is an important parameter that is taken into account when formulating and using the lubricant. The steady evolution of engine oil specifications for different automotive vehicles has increased the demand for new lubricant formulations, which has increased the demand for lubricant additives. Automotive, Plastics, and Other End Industries, In addition, the discovery of shale gas and the demand for PAO-based synthetic lubricants are fueling the growth of the alpha-olefin market. This opens the doors to the use of alternative, profitable, and bio-based raw materials for the production of olefins. The olefins market focuses on the use of biomass, a material rich in carbon, as a feedstock. Manufacturers aim to get the most out of high-yielding organic products so that production is profitable. Due to technological advancements and refinements in the hydraulic fracturing process, methane production has increased significantly, and the price of methane has dropped significantly. This has caught the attention of several olefin manufacturing companies in the United States. Due to the wide availability of shale gas, manufacturers are finding ways to upgrade methane in the form of olefins, either directly or indirectly.

MARKET DRIVERS

The increasing implementation in the automotive industry has had a great influence on the growth of the olefins market. With this in mind, the increasing demand for polycarbonates also acts as a key determinant supporting the growth of the olefins market during the forecast period 2022 - 2027. In addition, the increase in the global population contributes significantly to the growth in the food and beverage industry as the extreme demands on packaging materials and the increasing population. The main factor responsible for the growth of the market is the growth of the automotive industry, which demands the high-quality olefin used to make car interiors. The domestic olefin market is also expected to benefit greatly from the growing global demand for greener and cleaner industrial fluids and the increasingly stringent emissions regulations in place in a number of developed and developing economies. In addition, the high use of internal olefins in oil drilling and related activities is also expected to boost the olefins market, as the global demand for crude oil and its derivatives has exploded again. The market is also benefiting from the higher global demand for agrochemicals in agrarian and emerging economies reduction in the cost of energy and raw materials for the production of light olefins drives olefins market growth.

The planned replacement of petroleum by Shale gas, extracted from ethylene, further drives the market growth during the assessment period. One of the main factors that are likely to have a noticeable positive impact on the domestic olefin market is the increased demand for lubricants from the automotive industry. Over the past decade, sales of passenger cars and luxury cars have increased dramatically in developing economies in regions such as Asia-Pacific and Latin America. The number of vehicles in circulation in developed economies has also remained steadily high, if not significantly increased. As consumers are more open to regular servicing and servicing of their vehicles to reduce their impact on the environment, the growing demand for motor oils is also likely to improve global demand for lubricants in the near future, increasing even more. The olefin market is also expected to benefit greatly from the growing global demand for greener and cleaner industrial fluids and the increasingly stringent emissions regulations in place in a number of developed and developing economies. In addition, the high use of internal olefins in oil drilling and related activities is also expected to boost the market, as the global demand for crude oil and its derivatives has exploded again. The market is also benefiting from increased global demand for agrochemicals in agrarian and emerging economies.

MARKET RESTRAINTS

Fluctuating prices of raw materials for the manufacture of olefins and high investments may be key constraints to the olefins market's growth rate during the forecast period 2022 - 2027 due to factors such as the availability of substitutes. As alpha-olefins, LAO, and PAO, with improved properties and high purity, pose a threat to the market. In addition, the ease of availability and cost-effectiveness of ethylene as the main raw material for substitutes is inhibiting the growth of the domestic olefin market. Readily available alternatives such as poly-alpha-olefins and fluctuating raw material costs could negatively impact the market's growth prospects to some extent during the forecast period of the report.

MARKET OPPORTUNITIES

The strong penetration of electronics in various applications and innovations and increasing advancements in production methods leading to greater efficiency of the production process and better product offering will provide a variety of growth opportunities. For the olefins market during the forecast period. The trend of biofuel production from bioethylene using sugarcane and corn is likely to offer substantial market growth opportunities during the forecast period.

MARKET CHALLENGES

Strict environmental regulations on the production and manufacture of crude oil by-products have the potential to challenge the growth of the olefins market during the aforementioned forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.17% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Market Leaders Profiled |

Exxon Mobil Corporation, INEOS AG, Royal Dutch Shell, National Petrochemical Company, China Petroleum & Corporation, SABIC, DuPont, Total, NOVA Chemicals Corporate, Chevron Phillips Chemical Company LLC, and others. |

SEGMENTAL ANALYSIS

By Type Insights

Ethylene is the major segment in the types of the olefins market because of its high demand in the production of various polyethylene and ethylbenzene.

By Application Insights

Steadily changing specifications of engine oils for different automotive vehicles have increased the demand for new lubricant formulations, thereby increasing the demand for the lubricant additives segment.

REGIONAL ANALYSIS

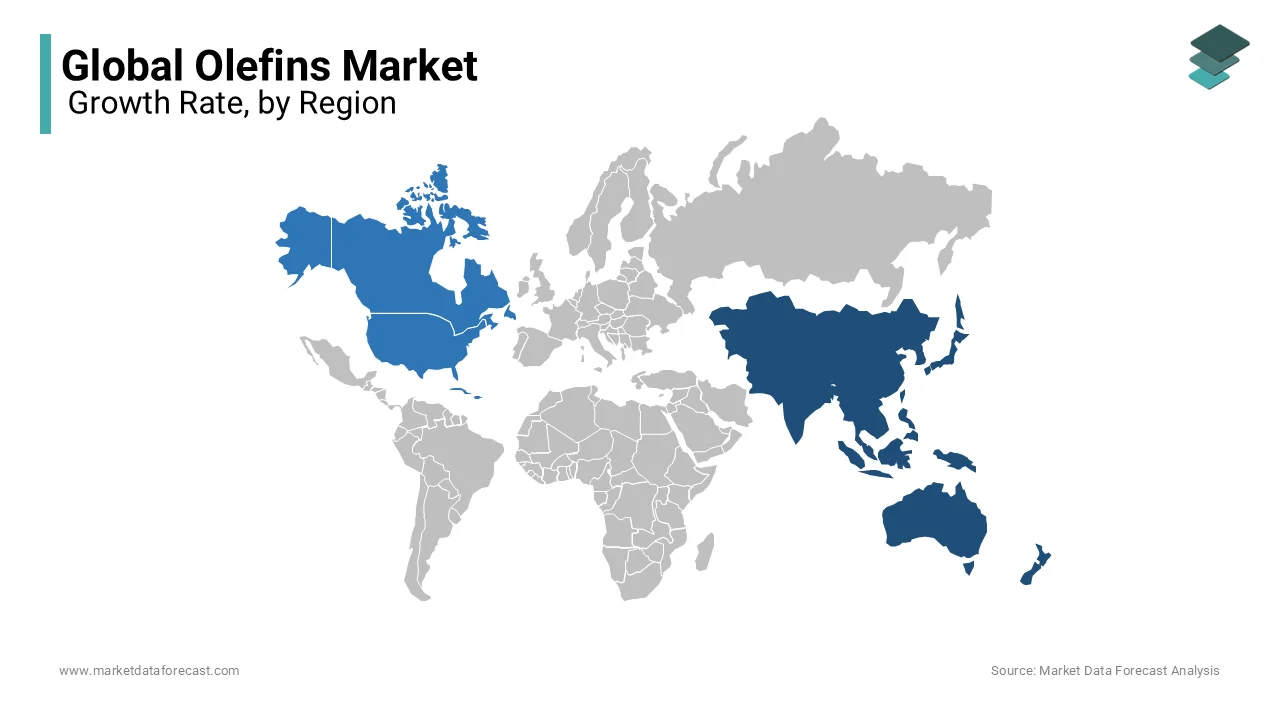

The Asia Pacific Region (APAC) is expected to offer a lucrative market in terms of volume and revenue as the field has cheap labor and labor prices, and tire manufacturers have reduced their amenities to the Asia-Pacific Province (APAC). The Asia-Pacific region dominated the global olefins market share. China is one of the fastest-growing economies.

China is the region's largest consumer and producer of surfactants, which is supported by domestic consumption and the presence of a large number of local producers in the country. Liquid. Therefore, various end-users growth is expected to result in higher olefin consumption, as these are the reactive intermediates used to make automotive products, surfactants, agricultural chemicals, coatings, and corrosion inhibitors.

North America leads the olefin market because of its high production rate and strict regulations of the environment.

KEY PLAYERS IN THE GLOBAL OLEFINS MARKET

Exxon Mobil Corporation, INEOS AG, Royal Dutch Shell, National Petrochemical Company, China Petroleum & Chemical Corporation, SABIC, DuPont, Total, NOVA Chemicals Corporate, Chevron Phillips Chemical Company LLC, LyondellBasell Industries Holdings B.V., Sasol, Evonik Industries AG, Qatar Chemical Company Ltd, Mitsubishi Electric Corporation, Idemitsu Kosan Co.Ltd., Mitsui Chemicals, Inc., Jam Petrochemical Company, TPC Group, BASF SE are some of the notable companies the global Olefins Market.

MARKET SEGMENTATION

This research report on the global olefins market has been segmented and sub-segmented based on type, application, and region.

By Type

- Butadiene

- Ethylene

- Propylene

- Others

By Application

- Lubricant Additives

- Surfactants

- Agricultural Chemicals

- Paints and Coatings

- Corrosion Inhibitors

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the expected Compound Annual Growth Rate (CAGR) for the olefins market?

The olefins market is expected to exhibit a CAGR of approximately 5.17% from 2025 to 2033, reflecting robust growth driven by increasing demand across various applications.

2. Which regions are expected to lead in olefins market growth?

North America and Asia Pacific are anticipated to be key regions for olefins market growth, driven by industrial expansion, increasing consumption, and advancements in manufacturing technologies.

3. How does the demand for olefins vary across different industries?

The demand for olefins varies across industries based on their applications: packaging, construction, and automotive sectors drive growth due to their use in polyethylene, polypropylene, lubricants, and synthetic fibers

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com