Global Ostomy Care Market Size, Share, Trends & Growth Forecast Report By Type, Application, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Ostomy Care Market Size

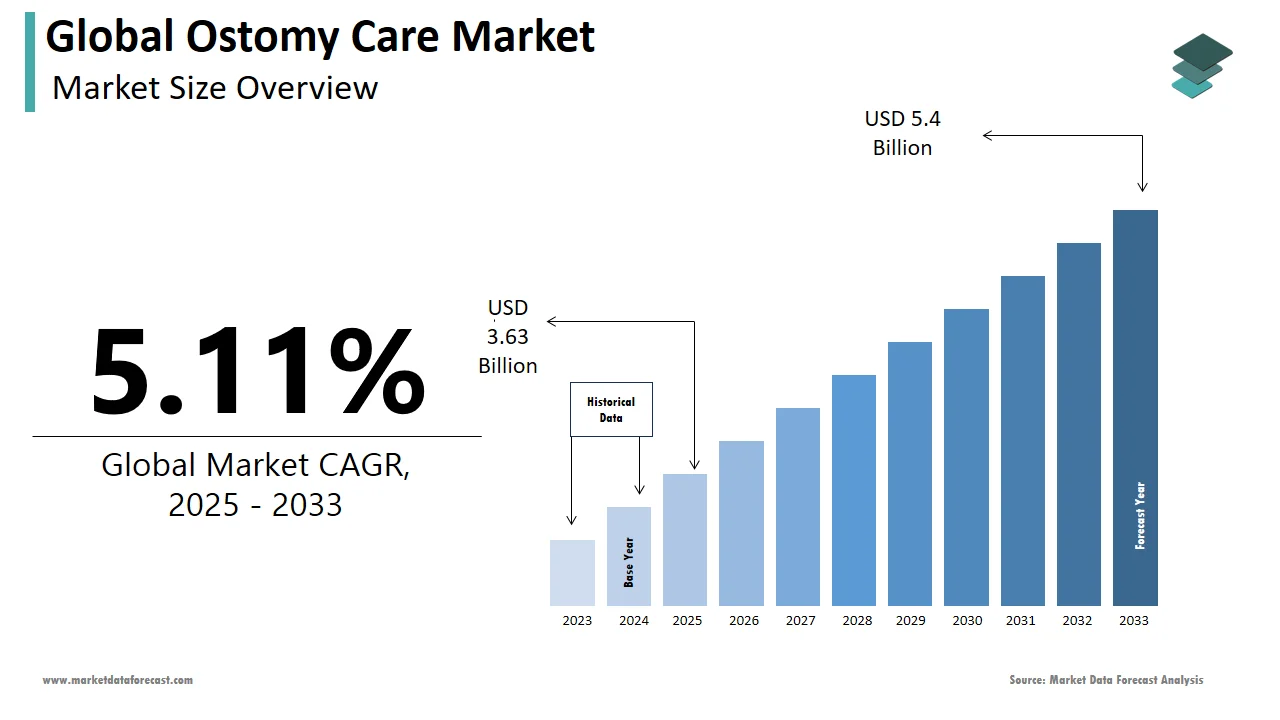

The size of the global ostomy care market was worth USD 3.45 billion in 2024. The global market is anticipated to grow at a CAGR of 5.11% from 2025 to 2033 and be worth USD 5.4 billion by 2033 from USD 3.63 billion in 2025.

MARKET DRIVERS

The global ostomy care market is primarily driven by the factors such as the increasing prevalence of diseases, technological advancements in the healthcare sectors, and supportive government policies by the government through medical awareness programs. Also, the rising internet usage for online sales of ostomy products, rising medical tourism in several patients with colorectal cancer and defective bladder, and favorable reimbursement policies. Furthermore, factors such as skin-friendly, waterproof, unbreakable, and extended durability, which further propel their adoption of ostomy bags as a life-saving opportunity has increased their demand among the population.

The growing geriatric population worldwide and rising inflammatory disorder cases are further expected to boost the ostomy care market.

The growing geriatric population is one of the key growth contributors to stoma care products. According to the estimations of WHO, the aged population percentage to increase from 7% in 2000 to 16% by 2050. For over 50 years, people have been affected mainly by this ostomy disease. According to the National Centre for Biotechnology Information (NCBI), patients aged 70 and the elderly have more permanent ostomy surgeries than younger people, with more extended hospital stays and a greater mortality rate, which is expected to boost the growth rate of the market.

Rising health care expenditure with advanced products in ostomy care, and increasing prevalence of inflammatory bowel diseases, including Crohn’s disease or ulcerative colitis, fecal incontinence, diverticular disease, and intestinal cancer, are projected to surge the growth of the ostomy care market.

MARKET RESTRAINTS

Increasing adoption of alternative treatments and issues with ostomy bags are restraining the growth of the ostomy care market. In addition, challenges such as lack of reimbursement for ostomy care bags and weak economies of developing regions are expected to affect the global ostomy care market during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.11% |

|

Segments Covered |

By Product, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ALCARE Co., Ltd., Braun Melsungen AG, Coloplast A/S, ConvaTec Group Plc., Cymed, Hollister Inc., Marlen Manufacturing & Development Co., Nu-Hope Laboratories, Perma-Type Company, Inc., Salts Healthcare and Welland Medical Ltd, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the bags segment is projected to hold a significant share of the ostomy care market during the forecast period. The growth of the segment is primarily driven by the increase in the older population undergoing permanent ostomy procedures, the growing number of stoma surgeries, and a rise in demand for home care services.

By Application Insights

Based on the application, the colostomy segment dominated the ostomy care market and is likely to continue its growth during the forecast period. The segment growth is attributed to the high incidence of stomach cancer and growing awareness among people about surgeries and IBD in developed countries.

By End-User Insights

The hospitals & clinics segment accounted for the most significant share of the ostomy care market in 2024. Favorable reimbursement policies and an increase in the patient population in most developed countries are the major factors supporting the growth of this segment. In addition, hospitals provide training to healthcare professionals to improve the success rate associated with the procedure and reduce postoperative complications. Thus, a rise in several hospital admission of stoma patients is expected to drive market growth.

REGIONAL ANALYSIS

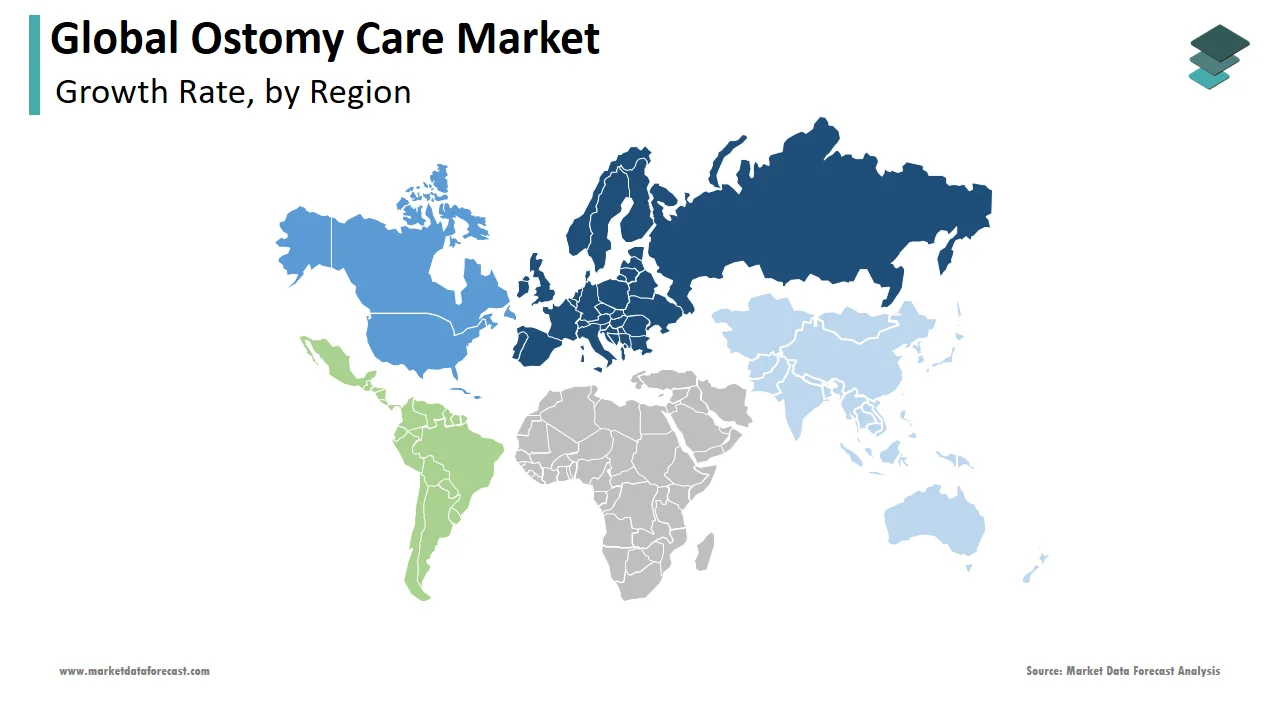

Europe accounted for the largest share among others during the forecast period. This is due to the growing patient population, rising geriatric population, and strict reimbursement policies. European Ostomy Association organizes World Ostomy each year. It helps to improve the treatment of ostomates worldwide by bringing them together. Awareness events, such as educational programs, support meetings, and electronic information networks, are organized by many organizations. Factors such as an increase in the number of stoma patients and an increase in the incidence of Inflammatory Bowel Disease are expected to drive the market growth in Europe. Germany leads the European market for ostomy care products and will continue to expand its growth in the coming years in the country.

North America is expected to be the second-largest ostomy care market worldwide in 2024 due to the growing geriatric population, increasing investments in R&D activities, and the growing pool of patients with intestinal disorders in the region. The U.S. dominates the North American market due to the presence of key players such as Coloplast Group, 3M Company, Hollister Incorporated, and others contributing to the market growth in the country.

The Asia Pacific region is predicted to have a faster market share in the coming years. Factors such as investment by public and private organizations, motivational programs and educational seminars, a large patient population, and the rising geriatric population are the key factors driving the growth of the stoma care market. Japan dominates the Asia Pacific market due to the factors such as education support and awareness campaigns by local authorities to lead a better quality of life for ostomates in Japan are driving the market growth.

TOP COMPANIES IN THIS MARKET

ALCARE Co., Ltd., Braun Melsungen AG, Coloplast A/S, ConvaTec Group Plc., Cymed, Hollister Inc., Marlen Manufacturing & Development Co., Nu-Hope Laboratories, Perma-Type Company, Inc., Salts Healthcare and Welland Medical Ltd are a few of the prominent companies operating in the global ostomy care market profiled in this report.

RECENT HAPPENINGS IN THIS MARKET

- Welland is pleased to announce the debut of Aurum Plus, our brand-new ostomy pouch line, in 2021. The pouches come in various sizes and can be closed, drainable, or urostomy.

- Coloplast developed ostomy care products for premature newborns and children in 2019.

- In 2021, a global medical solutions company ConvaTec focused on therapies for the management of chronic conditions has been issued a contract for Ostomy products with Vizient, Inc.

- In 2022, DKSH, a leading partner for healthcare companies trying to grow their business, has partnered with life cycle management company Pharmanovia to bring high-quality pharmaceutical products to patients across the Asia Pacific.

MARKET SEGMENTATION

This global ostomy care market research report is segmented and sub-segmented into the following categories.

By Product

- Bags

- One Piece

- Two-Piece

- Accessories

- Seals/Barrier Rings

- Pouch Cover

- Pouch Closures

- Stoma Caps/Hat

- Others

By Application

- Colostomy

- Ileostomy

- Urostomy

By End-User

- Hospitals and Specialty clinics

- Home care settings

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving the global ostomy care market?

Y-O-Y's rise in the prevalence of inflammatory bowel illnesses, the growing aging population, and advancements in technology are a few of the key factors boosting the ostomy care market.

Which are a few of the major companies in the ostomy care market?

Companies playing a key role in the global ostomy care market include ALCARE Co., Ltd., Braun Melsungen AG, Coloplast A/S, ConvaTec Group Plc., Cymed, Hollister Inc., Marlen Manufacturing & Development Co., Nu-Hope Laboratories, Perma-Type Company, Inc., Salts Healthcare and Welland Medical Ltd.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com