Global Pad-Mounted Switchgear Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Air insulated, Gas insulated, & others), Voltage Rating (0-15kV, 16-25kV, & above 25kV), Application (Industrial, Commercial, & Residential) & Region - Industry Forecast From 2024 to 2032

Pad-Mounted Switchgear Market Size (2024 to 2032)

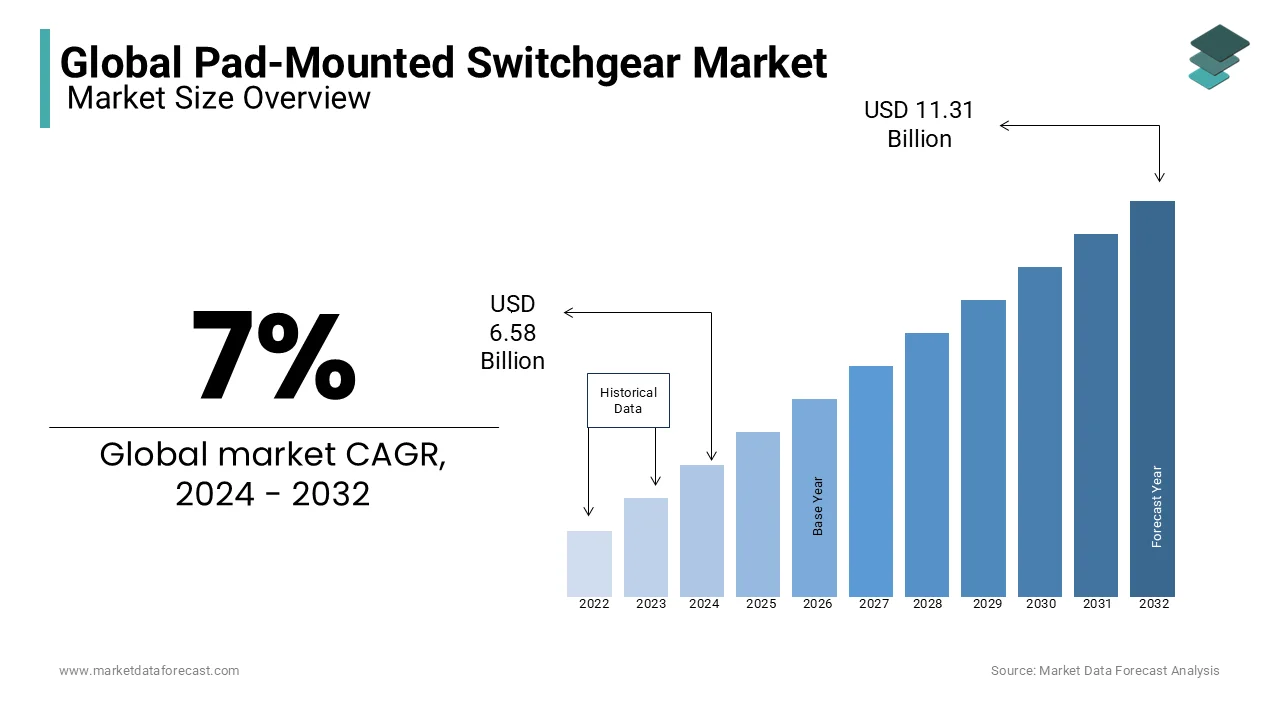

The Global Pad-Mounted Switchgear Market was worth USD 6.15 billion in 2023 and is anticipated to reach a valuation of USD 11.31 billion by 2032 from USD 6.58 billion in 2024, with a CAGR of 7% during the forecast period.

Current Scenario of the Global Pad-Mounted Switchgear Market

Pad-mounted switchgear is outdoor electrical equipment placed on a concrete pad containing switches, circuit breakers, and transformers within an enclosure. It safeguards these components from the elements. Mainly used in medium-voltage power distribution systems, it efficiently controls electricity for residential, commercial, and industrial areas. Installed in substations, it's durability and outdoor setup ensure reliable power distribution, making maintenance easier and ensuring safety across diverse environments and electrical systems.

MARKET DRIVERS

In the dynamic landscape of the Pad-Mounted Switchgear market, ongoing technological advancements play a pivotal role in reshaping the industry.

The integration of cutting-edge digital monitoring and control capabilities has emerged as a key driver, rendering pad-mounted switchgear increasingly appealing to utilities seeking modern solutions. This evolution empowers utilities with real-time insights into the performance and condition of the switchgear, enhancing operational efficiency and facilitating proactive maintenance measures. The digital integration not only augment’s reliability but also aligns with the broader industry trend towards smart grid initiatives. As utilities embrace these advancements, pad-mounted switchgear positions itself at the forefront of innovation, offering a robust and intelligent solution for medium-voltage distribution. This technological stride underscores the industry's commitment to safety, efficiency, and the seamless integration of pad-mounted switchgear into the evolving landscape of electrical distribution systems.

However, the market growth is also escalating electricity demand, fuelled by burgeoning populations, rapid urbanization, and industrial expansion.

As these global trends propel an insatiable need for power, pad-mounted switchgear emerges as a cornerstone for efficient electrical distribution. Crucial in diverse applications spanning residential, commercial, and industrial sectors, pad-mounted switchgear facilitates the reliable and safe transmission of electricity. Its strategic outdoor installation and compact design make it a preferred choice in urban environments, aligning seamlessly with the demands of modern infrastructure. As the world increasingly relies on electricity to power its progress, the pad-mounted switchgear market stands at the forefront, addressing the escalating energy requirements with innovation and adaptability, ensuring a resilient and responsive solution for medium-voltage distribution across varied domains.

MARKET RESTRAINTS

The market faces a hurdle in the form of high initial costs, presenting a significant challenge, especially for smaller utilities and projects constrained by limited budgets.

The upfront expenses encompass the acquisition of the switchgear equipment and the necessary infrastructure for installation. This financial barrier could impede the adoption of pad-mounted switchgear solutions, particularly in regions or applications where financial resources are constrained. The industry must navigate this challenge by exploring cost-effective manufacturing processes, incentivizing financial models, and advocating for the long-term economic benefits of pad-mounted switchgear. Mitigating the initial cost barrier is crucial to ensuring broader market accessibility, fostering adoption, and realizing the manifold advantages of efficient medium-voltage distribution in diverse sectors, from residential to industrial, despite financial constraints faced by smaller utilities and projects.

The heightened vulnerability to cybersecurity threats also acts as another factor that leads to the downfall of the market.

The growing reliance on digital technologies exposes these systems to potential breaches, demanding a robust cybersecurity framework. Safeguarding against cyber threats becomes imperative for the industry, introducing a complex dimension to the development and deployment of pad-mounted switchgear. Ensuring the resilience of these systems against cyber-attacks necessitates continuous innovation in cybersecurity measures, proactive risk assessments, and adherence to evolving industry standards. As digitalization becomes integral to efficient medium-voltage distribution, the industry must navigate the intricate landscape of cybersecurity, fortifying its technology to guarantee the reliability and security of electrical infrastructure. By addressing these concerns head-on, the pad-mounted switchgear market can bolster confidence in its digital capabilities, assuring stakeholders of a secure and resilient energy distribution landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7% |

|

Segments Covered |

By Type, Voltage Rating, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

Eaton Corporation plc, Schneider Electric SE, Siemens AG, ABB Ltd., Powell Industries, Inc., G&W Electric Company, S&C Electric Company, Hubbell Incorporated, AZZ Inc., Lucy Electric UK Ltd. (part of WESCO International, Inc.), EATON MEDC (a part of Eaton Corporation plc), Thomas & Betts Corporation (a part of ABB Ltd.), GE Grid Solutions (part of General Electric Company), WEG SA, Trench Group (Siemens AG), Entec Electric & Electronic Co., Ltd., Trayer Engineering Corporation, Pioneer Power Solutions, Inc., R&B Switchgear Group plc, and Others. |

SEGMENTAL ANALYSIS

Global Pad-Mounted Switchgear Market Analysis By Type

GIS holds the largest market share in the era of 2024-2032 as it involves the use of sulphur hexafluoride (SF6) or other insulating gases to achieve a compact design and efficient insulation. GIS is often favoured in situations where space is limited, such as densely populated urban areas. The encapsulated design minimizes the physical footprint, making it suitable for applications where land is scarce. The gas insulation also contributes to improved reliability by reducing the risk of environmental influences.

Air-insulated switchgear (AIS) relies on ambient air for insulation. It is a second important type used in applications where space constraints are less critical, and there is a preference for a straightforward and accessible design.

Global Pad-Mounted Switchgear Market Analysis By Voltage Rating

The 0-15 kV range is commonly associated with medium-voltage applications, covering a significant portion of residential, commercial, and some industrial power distribution networks. This range is most dominating in the Pad-Mounted Switchgear Market growth characterized by widespread usage in urban and suburban settings, where the demand for reliable and efficient medium-voltage distribution is high.

The 16-25 kV range is second most frequently utilized in larger industrial complexes, utility substations, and some medium-voltage transmission applications. This range caters to areas with higher power demands and is often chosen for its ability to handle increased loads while maintaining a balance between efficiency and cost.

Global Pad-Mounted Switchgear Market Analysis By Application

Industrial settings often demand robust and reliable electrical distribution systems to support heavy machinery, manufacturing processes, and critical operations. Pad-mounted switchgear is prevalent in industrial applications due to its ability to handle medium-voltage distribution efficiently. The industrial sector tends to prioritize switchgear solutions that offer durability, high performance, and the capability to withstand demanding operational conditions.

REGIONAL ANALYSIS

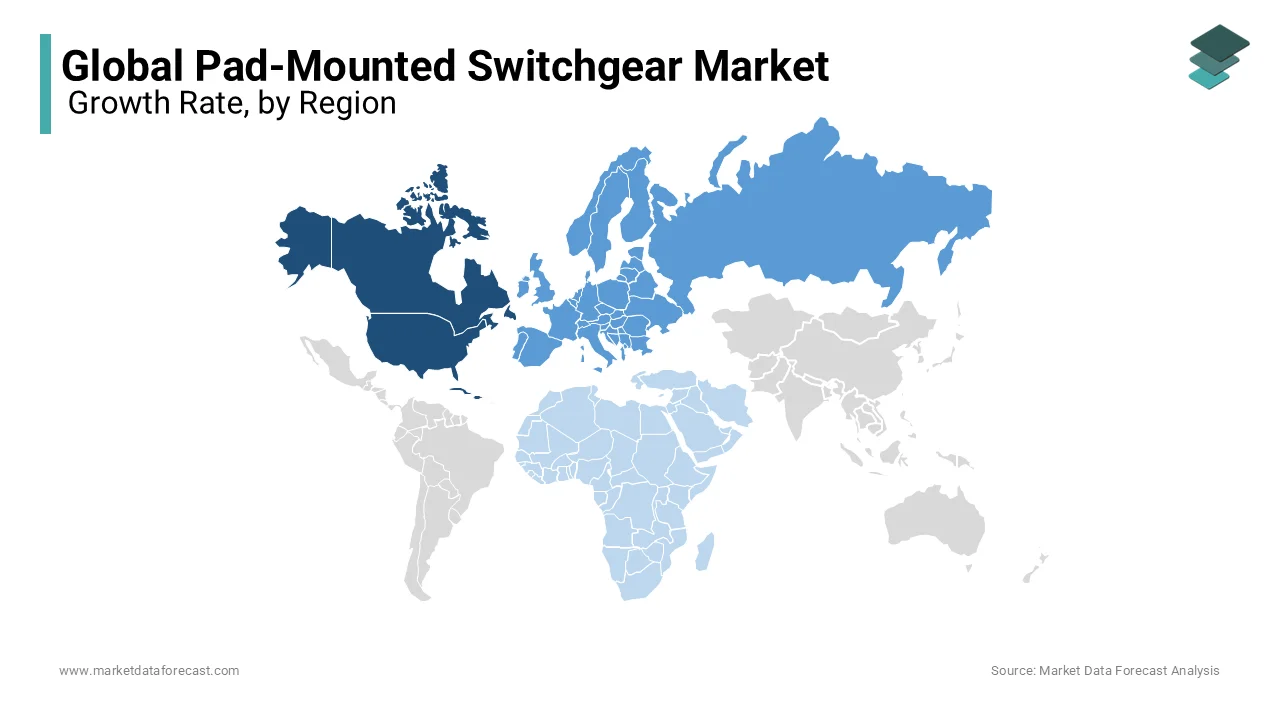

North America is the most dominating region as it has a mature and well-established power infrastructure. The region has also seen consistent demand for Pad-Mounted Switchgear, driven by ongoing investments in grid modernization, reliability improvements, and the integration of renewable energy sources.

Europe is a second significant market for Pad-Mounted Switchgear, with a focus on enhancing energy efficiency and sustainability. The European Union's emphasis on renewable energy and stringent environmental regulations has driven the adoption of modern switchgear technologies.

The Asia-Pacific region is third witnessing substantial growth in the Pad-Mounted Switchgear market. Rapid urbanization, industrialization, and the expansion of power infrastructure to meet the needs of a growing population are key drivers. Government initiatives in countries like India, such as the Smart Cities Mission, also contribute to the demand for advanced switchgear solutions for urban development projects.

Latin America is another emerging market for Pad-Mounted Switchgear, with increasing investments in electricity infrastructure. The region's focus on improving energy access, coupled with the need for reliable distribution networks, has led to the adoption of modern switchgear solutions.

The Middle East and Africa region exhibit demand for Pad-Mounted Switchgear due to urbanization, industrialization, and investments in infrastructure projects. Countries in the Gulf Cooperation Council (GCC) are particularly active in upgrading and expanding their power networks, creating opportunities for switchgear manufacturers.

KEY PLAYERS IN THE GLOBAL PAD-MOUNTED SWITCHGEAR MARKET

Companies playing a promising role in the global pad-mounted switchgear market include Eaton Corporation plc, Schneider Electric SE, Siemens AG, ABB Ltd., Powell Industries, Inc., G&W Electric Company, S&C Electric Company, Hubbell Incorporated, AZZ Inc., Lucy Electric UK Ltd. (part of WESCO International, Inc.), EATON MEDC (a part of Eaton Corporation plc), Thomas & Betts Corporation (a part of ABB Ltd.), GE Grid Solutions (part of General Electric Company), WEG SA, Trench Group (Siemens AG), Entec Electric & Electronic Co., Ltd., Trayer Engineering Corporation, Pioneer Power Solutions, Inc., R&B Switchgear Group plc, and Others.

DETAILED SEGMENTATION OF THE GLOBAL PAD-MOUNTED SWITCHGEAR MARKET INCLUDED IN THIS REPORT

This research report on the global pad-mounted switchgear market has been segmented and sub-segmented based on type, voltage rating, application, and region.

By Type

- Air insulated

- Gas insulated

- Others

By Voltage Rating

- 0-15KV

- 16-25 KV

- Above 25 KV

By Application

- Industrial

- Commercial

- Residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the primary factors driving the growth of the pad-mounted switchgear market globally?

Key factors include increasing investments in smart grid infrastructure, rapid urbanization, rising demand for reliable and uninterrupted power supply, and the need for enhanced grid security. The global shift towards renewable energy integration also plays a significant role.

What types of pad-mounted switchgear are most commonly used worldwide?

The most commonly used types include gas-insulated, air-insulated, and solid dielectric switchgear. Gas-insulated switchgear is widely preferred due to its compact design and enhanced safety features.

What are the key applications of pad-mounted switchgear globally?

Pad-mounted switchgear is primarily used in industrial, commercial, and residential applications. It is essential in electrical distribution networks for ensuring efficient power management, especially in urban and semi-urban areas.

How is renewable energy adoption influencing the pad-mounted switchgear market?

The integration of renewable energy sources, such as solar and wind power, is driving demand for advanced switchgear solutions to manage decentralized power generation efficiently. This trend is especially prominent in Europe and North America.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]