Global Polyethylene Terephthalate Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Bio-based, petroleum-based), Application, End-Use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Polyethylene Terephthalate Market Size

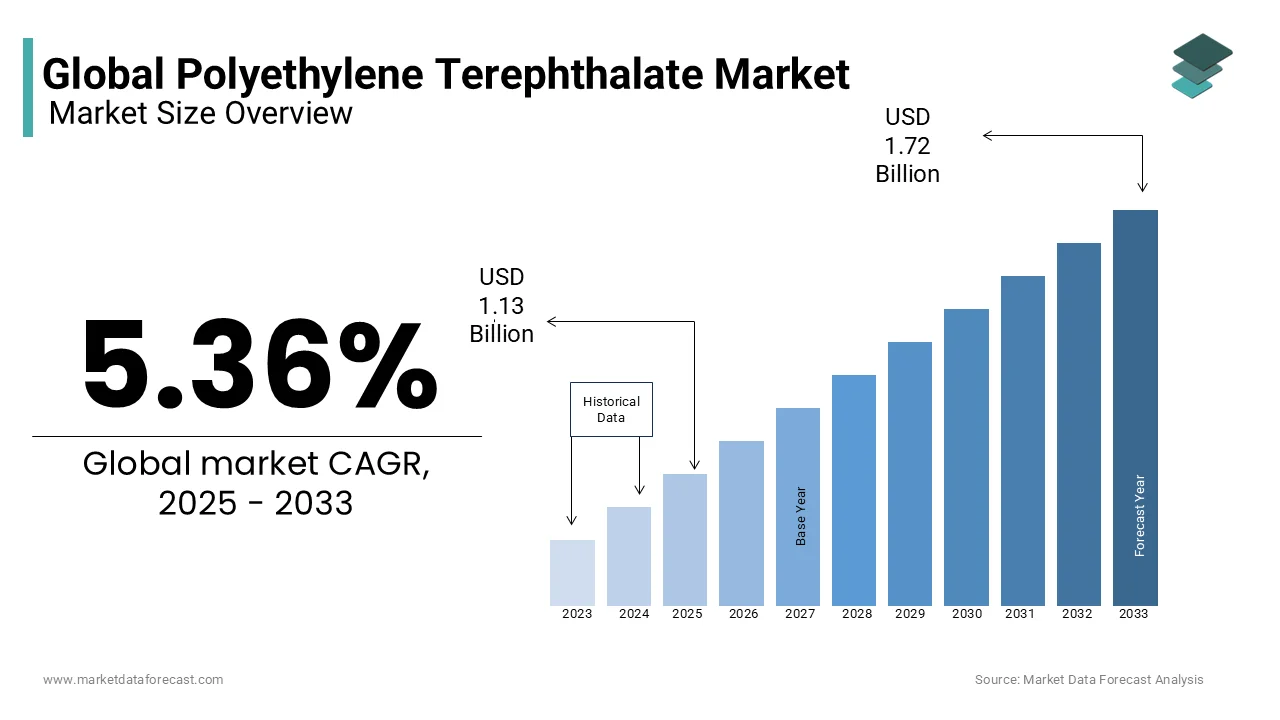

The global polyethylene terephthalate market size was valued at USD 1.07 billion in 2024, and the market size is expected to reach USD 1.72 billion by 2033 from USD 1.13 billion in 2025. The market's promising CAGR for the predicted period is 5.36%.

MARKET DRIVERS

Rising Demand for Sustainable Materials

One of the primary drivers of the PTT market is the escalating demand for sustainable materials in the textile and packaging industries. PTT derived from renewable resources like corn sugar reduces carbon footprints by 30% compared to petroleum-based alternatives by appealing to environmentally conscious consumers. According to the study published in Polymer Degradation and Stability, PTT achieves a 95% recovery rate in closed-loop recycling systems by making it an attractive option for brands seeking circular economy solutions. Additionally, government incentives for green technologies foster innovation, which is addressing unmet needs effectively.

Increasing Adoption in Automotive Interiors

Increasing adoption of PTT in automotive interiors represents another key driver propelling the market forward. PTT’s excellent elasticity and resistance to wear make it ideal for applications like seat covers, floor mats, and dashboard components. Similarly, collaborations between automakers and material suppliers enhance accessibility, particularly for electric vehicles (EVs). These innovations position PTT as a transformative force in the automotive industry.

MARKET RESTRAINTS

High Production Costs

A significant restraint facing the PTT market is the high cost associated with its production for small-scale manufacturers. According to the World Bank, the average cost of producing PTT exceeds $3,000 per ton by making it less competitive compared to cheaper alternatives like PET or nylon. This financial barrier limits adoption in regions where funding for advanced materials is scarce. Additionally, the lack of economies of scale further exacerbates affordability challenges. According to a report by the International Finance Corporation, over 60% of SMEs in developing countries struggle to justify investments in PTT due to budget constraints.

Limited Awareness and Technical Expertise

Limited awareness and technical expertise pose another major restraint, impacting both adoption and scalability in the PTT market. According to a survey conducted by the American Chemical Society, only 40% of manufacturers feel confident in optimizing PTT production processes by leaving others dependent on external expertise. For instance, improper handling of raw materials can degrade product quality, leading to inconsistent performance. A study in Materials Today reveals that errors in polymerization reduce yield efficiency by 25% by increasing costs and resource wastage. Additionally, insufficient training programs hinder workforce development.

MARKET OPPORTUNITIES

Expansion into Biobased Polymers

One promising opportunity lies in expanding PTT applications into biobased polymers, where sustainability and performance are prioritized. Derived from renewable resources like corn sugar, PTT reduces greenhouse gas emissions by 40% by appealing to industries seeking greener alternatives. For example, partnerships between biotech firms and research institutions enhance accessibility, particularly for large-scale textile and packaging applications. These developments position biobased polymers as a key contributor to market growth.

Growth in Emerging Markets

Another lucrative opportunity exists in supporting emerging markets, where rising investments in sustainable materials create immense demand for PTT. According to the Asian Development Bank, Asia-Pacific accounts for over 40% of global biopolymer production, with India and China leading adoption. Government initiatives like India’s Pradhan Mantri Swachh Bharat Mission promote innovation, fostering growth. For instance, collaborations with international organizations ensure mass production of affordable PTT products, particularly for low-income regions. According to study in Global Plastics Reports, that localized manufacturing reduces costs by 20% by enhancing accessibility. Additionally, advancements in recycling technologies appeal to circular economy initiatives. These trends position emerging markets as a transformative growth driver within the PTT market.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Issues

Regulatory hurdles and compliance issues represent a significant challenge for small-scale manufacturers entering the PTT market. According to the Environmental Protection Agency (EPA), stringent regulations mandate extensive validation and lifecycle assessments, which is delaying approvals by up to 3 years. For example, PTT-based products must meet ISO standards, which is requiring substantial R&D investments. This complexity increases operational costs and limits market entry for startups. Additionally, varying requirements across regions create logistical barriers, affecting global distribution.

Environmental Impact of Disposal Practices

The environmental impact of disposal practices poses another major challenge, particularly as plastic waste continues to rise globally. According to the World Health Organization (WHO), over 12 billion tons of plastic waste are improperly discarded annually, which is contributing to pollution and health hazards. While PTT is recyclable, improper disposal practices complicate outcomes. For example, a study in Environmental Pollution reveals that only 30% of PTT products are recycled effectively by leaving the rest to degrade ecosystems. Additionally, recycling initiatives face resistance due to contamination risks and lack of standardized protocols.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.36% |

|

Segments Covered |

By Type, Application, End-Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE (Germany), M&G Chemicals (Luxembourg), SABIC (Saudi Arabia), DAK Americas (US), JBF Industries Ltd (India), Indorama Ventures Public Company Limited (Thailand), Alpek S.A.B. de C.V. (Mexico), Jiangsu Sanfangxiang Group (China), DuPont de Nemours, Inc (US), NAN YA Plastics Industrial Co., Ltd (China), and Far Eastern New Century Corporation (Taiwan), and others |

SEGMENTAL ANALYSIS

By Type Insights

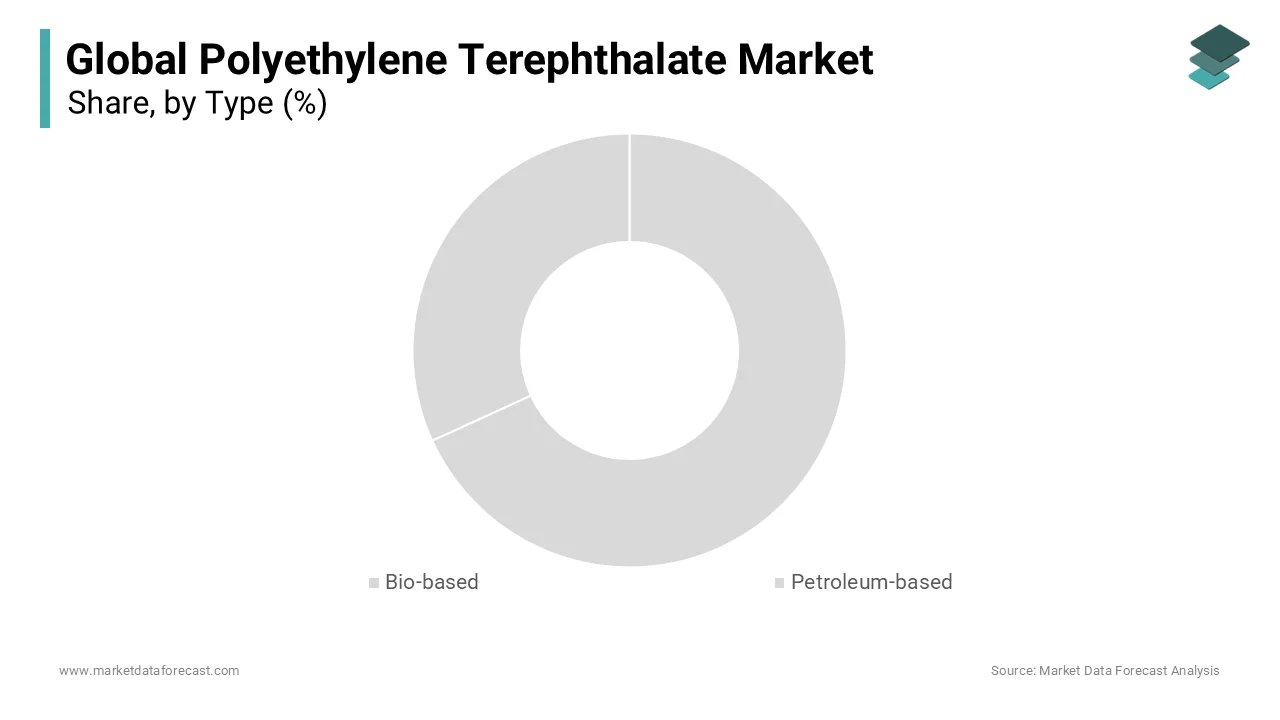

The petroleum-based polytrimethylene terephthalate (PTT) segment was the largest and held dominant share due to its cost-effectiveness and widespread availability, making it a preferred choice for industries like textiles and packaging. According to the International Energy Agency (IEA), petroleum-based polymers account for over 80% of global polymer production , underscoring their critical role in material science. A key factor propelling this dominance is the established supply chain infrastructure. For instance, refineries producing petrochemical feedstock reduce production costs by 20% by enabling competitive pricing. Additionally, collaborations between manufacturers and suppliers ensure consistent quality, by addressing scalability challenges effectively.

The bio-based PTT segment is the likely to register a CAGR of 12.3% throughout the forecast period owing to the increasing demand for sustainable materials in eco-conscious markets. As per a study published in Renewable Materials Journal, bio-based PTT reduces carbon emissions by 40% compared to petroleum-based alternatives by appealing to industries seeking greener solutions. Emerging trends in biotechnology further accelerate adoption. For example, advancements in fermentation technologies enhance yield efficiency by 30% thereby reducing costs. Additionally, government incentives for green technologies foster innovation, addressing unmet needs effectively. These innovations position bio-based PTT as a transformative force in the PTT market.

By Application Insights

The fiber segment was accounted in holding 55.5% of the polytrimethylene terephthalate market share in 2024 with its superior elasticity, stain resistance, and durability, which is making it ideal for high-performance textiles. According to the Carpet and Rug Institute, PTT-based fibers account for nearly 30% of all carpet installations in the U.S., underscoring its critical role in flooring applications. A major factor propelling this dominance is the growing demand for durable and aesthetically pleasing materials. For instance, partnerships between textile manufacturers and designers enhance accessibility for premium products.

The film materials segment is expected to exhibit a CAGR of 10.7% in the foreseen years owing to the rising adoption in packaging and medical applications, where flexibility and barrier properties are prioritized. A study published in Packaging Technology and Science reveals that PTT-based films achieve a 95% barrier efficiency against moisture and oxygen, which is appealing to food and pharmaceutical industries. Emerging trends in recyclability further accelerate adoption. For example, closed-loop recycling systems recover 90% of PTT film materials by reducing waste and environmental impact. Additionally, collaborations between manufacturers and regulatory bodies ensure compliance, fostering innovation.

By End-Use Insights

The textiles segment led the polytrimethylene terephthalate market with 40.3% of share in 2024 owing to the PTT’s excellent elasticity, stain resistance, and softness, making it ideal for applications like carpets, sportswear, and upholstery. A key factor propelling this dominance is the growing trend toward athleisure and activewear. For instance, collaborations between brands and material suppliers enhance accessibility for large-scale production.

The automotive is likely to grow with a projected CAGR of 11.5% throughout the forecast period owing to the increasing demand for lightweight, durable, and aesthetically pleasing materials in vehicle interiors. Emerging trends in electric vehicles (EVs) further accelerate adoption. For example, partnerships between automakers and material suppliers optimize performance for EV interiors. Additionally, government incentives for sustainable materials foster innovation, addressing unmet needs effectively.

REGIONAL ANALYSIS

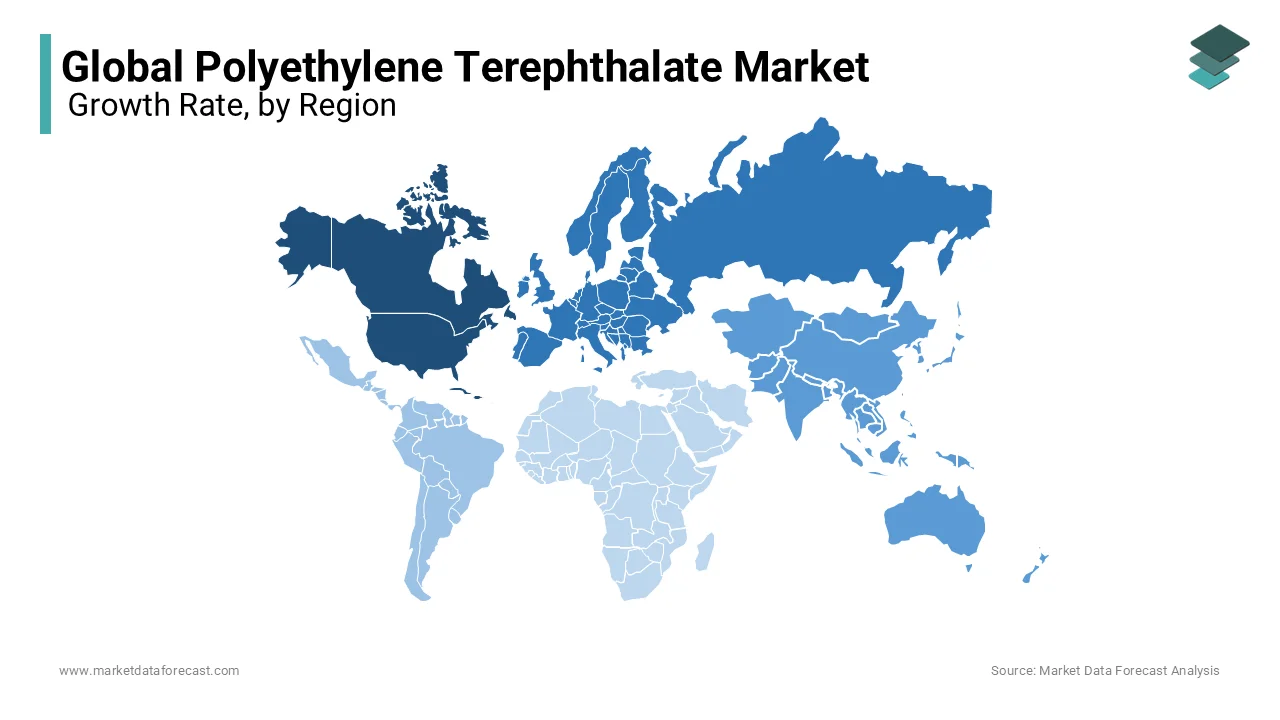

North America led the global polytrimethylene terephthalate (PTT) market by holding 35.3% of the share in 2024 owing to its robust manufacturing base and increasing adoption in the carpeting and automotive industries. A key factor propelling this leadership is the presence of advanced R&D facilities. For instance, collaborations between universities and biotech firms enhance accessibility for large-scale textile production. Additionally, government incentives for sustainable materials foster innovation, addressing unmet needs effectively.

Europe led the PTT market by accounting for 25.5% of the share in 2024. Germany, Italy, and France emerging as key contributors. According to Eurostat, Europe’s focus on sustainability and eco-friendly materials drives demand for bio-based PTT. A major driver is the integration of advanced recycling technologies. For example, closed-loop systems recover 90% of PTT materials by reducing waste and environmental impact. Additionally, government mandates for circular economy initiatives foster innovation, addressing scalability challenges effectively.

Asia-Pacific is swiftly emerging with prominent growth rate in the next coming years where India and China lead adoption, which are driven by rising investments in sustainable materials and growing demand for eco-friendly textiles. Technological advancements further boost growth. For instance, partnerships between multinational pharma companies and local healthcare providers enhance affordability and distribution. Additionally, government initiatives like India’s Pradhan Mantri Swachh Bharat Mission improve awareness and access to care.

Latin America PTT market is growing steadily in the coming years with Brazil and Mexico as primary contributors. According to the Pan American Health Organization, rising investments in healthcare infrastructure and increasing focus on sustainable materials drive adoption. Government programs promoting scientific research address logistical challenges effectively. Key drivers include collaborations with international organizations and localized manufacturing. For example, partnerships with global firms ensure mass production of affordable PTT products for low-income regions.

The Middle East and Africa PTT market is steadily growing in the next coming years. Meanwhile, South Africa’s focus on sustainability addresses unmet needs effectively. A major driver is the rise of public health campaigns targeting pollution reduction. For example, awareness programs reduce plastic waste by 15% in targeted regions. Additionally, collaborations with international organizations enhance local expertise by ensuring compliance with quality standards.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

BASF SE (Germany), M&G Chemicals (Luxembourg), SABIC (Saudi Arabia), DAK Americas (US), JBF Industries Ltd (India), Indorama Ventures Public Company Limited (Thailand), Alpek S.A.B. de C.V. (Mexico), Jiangsu Sanfangxiang Group (China), DuPont de Nemours, Inc (US), NAN YA Plastics Industrial Co., Ltd (China), and Far Eastern New Century Corporation (Taiwan) are playing dominating role in the global polyethylene terephthalate market.

The PTT market is highly competitive, with established giants and emerging players vying for dominance. Companies like DuPont, Celanese Corporation, and Eastman Chemical leverage their expertise in manufacturing, R&D, and distribution to differentiate themselves. Consolidation through mergers and acquisitions is common, enabling firms to expand geographically and diversify product portfolios. For instance, DuPont’s acquisition of a biotech startup strengthened its pipeline for advanced bio-based PTT solutions. Meanwhile, startups disrupt traditional dynamics by introducing innovative materials and sustainable technologies, appealing to environmentally conscious consumers. Regional players also pose a threat, capitalizing on localized expertise to challenge global leaders. This competitive landscape drives continuous innovation, benefiting end-users through improved product quality, affordability, and sustainability.

TOP PLAYERS IN THE MARKET

DuPont de Nemours, Inc.

DuPont de Nemours, Inc. is a global leader in the PTT market, known for its innovative bio-based solutions tailored to diverse industries. The company specializes in Sorona®, a high-performance PTT fiber derived from renewable resources, serving over 50 countries . DuPont prioritizes R&D, investing heavily in fermentation technologies to enhance yield efficiency. Its commitment to sustainability ensures consistent quality and performance by making it a trusted partner for manufacturers worldwide.

Celanese Corporation

Celanese Corporation excels in developing high-quality PTT resins and fibers, including both bio-based and petroleum-based variants. The company offers a wide range of products by addressing diverse customer preferences. Celanese collaborates with automotive and textile industries globally to develop customized solutions by enhancing durability and flexibility.

Eastman Chemical Company

Eastman Chemical Company is a pioneer in sustainable PTT materials, known for its high-performance polymers and resins. The company supplies products for both industrial and consumer applications, catering to diverse markets globally. Eastman invests heavily in training programs, equipping manufacturers with hands-on expertise. With a strong emphasis on recyclability, Eastman continues to expand its footprint in emerging economies by ensuring broader adoption.

TOP STRATEGIES USED BY KEY PLAYERS

Product Innovation

Key players prioritize product innovation to stay ahead in the competitive PTT market. For example, DuPont introduced Sorona®, a bio-based PTT fiber that reduces carbon emissions by 40% compared to petroleum-based alternatives, appealing to eco-conscious consumers. These innovations not only enhance sustainability but also address unmet needs effectively, which is fostering customer loyalty and market growth.

Strategic Partnerships

Strategic partnerships are another major strategy used by industry leaders to enhance scalability. In April 2024, Celanese partnered with AI firms to optimize workflows for polymer production, which is improving efficiency by 25%. Such collaborations streamline operations and foster knowledge sharing by addressing regional challenges while expanding market reach.

Geographic Expansion

Expanding into emerging markets strengthens market presence and operational efficiency. In June 2024, Eastman Chemical launched new distribution centers in sub-Saharan Africa, targeting underserved populations. This move enhances supply chain resilience and fosters inclusivity, meeting diverse customer needs globally while elevating its competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, DuPont acquired a biotech startup specializing in fermentation technologies. This move expanded its product portfolio and solidified its leadership in bio-based PTT solutions.

- In June 2024, Celanese launched a new line of lightweight PTT resins designed for automotive interiors. This initiative diversified its offerings and addressed shifting consumer preferences.

- In August 2024, Eastman Chemical partnered with a recycling firm to enhance accessibility for recycled PTT products. This collaboration reduced costs by 20% by aligning with sustainability goals.

- In October 2024, DuPont announced a $1 billion investment in long-term R&D for bio-based PTT, improving performance and environmental impact. This reinforced its commitment to innovation.

- In December 2024, Celanese signed a distribution agreement with Amazon, enabling direct-to-consumer sales of its PTT products. This partnership expanded accessibility and tapped into the booming e-commerce segment.

MARKET SEGMENTATION

This research report on the global polyethylene terephthalate market has been segmented and sub-segmented based on type, application, End-Use, and region.

By Type

- Bio-based

- Petroleum-based

By Application

- Film Materials

- Fiber

- Carpet Fabric

- Automotive Fabric

- Apparels

- Engineering Plastics

By End-Use

- Automotive

- Building & Construction

- Packaging

- Medical

- Consumer Goods

- Textiles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected size of the global polyethylene terephthalate market by 2033?

The global polyethylene terephthalate market size is expected to reach USD 1.72 billion by 2033.

2. What are the key trends driving the polyethylene terephthalate market?

Key trends include increasing demand for sustainable and recyclable packaging, growing use of PET in the food and beverage sector, and innovations in bio-based PET materials.

3. What are the major opportunities in the polyethylene terephthalate market?

Opportunities lie in the development of eco-friendly PET variants, increasing PET applications in textile and automotive industries, and expansion into emerging economies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com