Global Pre-Harvest Equipment Market Size, Share, Trends & Growth Forecast Report, Segmented By Type (Primary Tillage Equipment, Secondary Tillage Equipment, Planting Equipment, Irrigation Equipment, Plant Protection & Fertilizing, Seed drills, Planters, Air seeders) And Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From (2025 to 2033)

Global Pre-Harvest Equipment Market Size

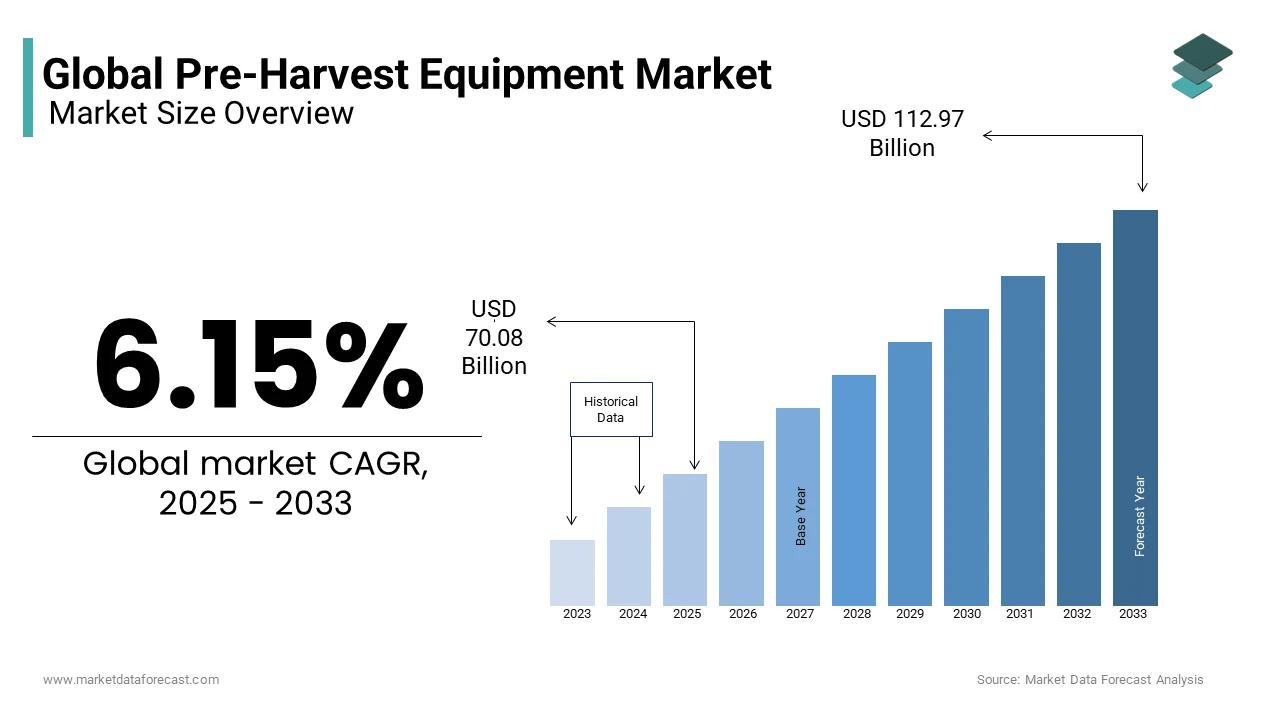

The global pre-harvest market was valued at USD 66.02 billion in 2024 and is anticipated to reach USD 70.08 billion in 2025 from USD 112.97 billion by 2033, growing at a CAGR of 6.15% during the forecast period from 2025 to 2033.

Current Scenario of the Global Pre-Harvest Equipment Market

Farm operations are timely performed, and the quality of agricultural commodities produced by the use of machinery is better. Further, the workload is reduced, and it also brings about a change in the characteristics of agricultural practices. The Agriculture industry is presently facing many challenges: producing more food to feed the rapidly growing population with a waning labor force. Without the use of agricultural equipment, it is likely to become very difficult to sustain the needs of this growing population. However, lately, there has been innovation in chemicals, fertilizers, and seeds, which empowered agricultural producers to try to meet the steadily rising demands of the world population. The use of pre-harvest equipment is likely to help farmers improve their production capacities to reduce the widening gap between demand and supply of agricultural produce. But despite successes in agricultural productivity, the challenges for the agricultural industry to supply the growing global economy with adequate supplies of agriculture are greater than ever before.

The tillage and planting equipment are the major segments, capturing nearly 60% of the total market share. The production of self-propelled equipment has shown incredible growth in the last two decades because of its increased use by farmers, facilitated by simplicity in the application. The Planting Equipment accounts for 30% of the total market. Steadily increasing the use of pre-harvest equipment worldwide in order to increase production capacity and efficiency is the cause of the observed market growth. Moreover, increasing awareness among farmers and several government initiatives, especially in developing economies, are anticipated to increase the demand for the market in the coming few years.

MARKET DRIVERS

The pre-harvest market is driven by linked advantages such as enhanced farm yield and lessening labor requirements. Other factors propelling the demand for the industry include increased consumption of food due to population growth, augmented farm mechanization level, and rising income of middle-class farmers in developing nations. Additionally, several government initiatives and subsidiaries provided by them, especially in developing economies, are projected to augment the global pre-harvest market throughout the forecast period. But still, the lack of awareness and hefty cost of farm equipment, are the major challenges in the growth of the market. Primary restraining factors for the agricultural equipment market are the small and fragmented land holdings in various parts of the world.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.15% |

|

Segments Covered |

By Type and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Deere & Company (U.S.), CNH Global (The Netherlands), and AGCO Corp (U.S.) are the market leaders with a combined share of about 60%. The other players include Mahindra & Mahindra Ltd (India), Valmont Industries Inc.(U.S.), Iseki & Company Ltd(Japan), etc. |

SEGMENT ANALYSIS

The Pre-Harvest Equipment market is segmented into two broad categories, Type and Geography. Type mainly covers various kinds of equipment that are available in the market. The following are the major equipment that has been covered in this report: Primary Tillage Equipment, Secondary Tillage Equipment, Planting Equipment, Irrigation Equipment, Plant Protection & Fertilizing, seed drills, planters, air seeders, and others.

REGIONAL ANALYSIS

The Asia Pacific is the fastest-growing market during the forecast period. This is due to the increased consumption of agricultural food and the growth in the agricultural machinery industry. Further, robust economic growth and rapid rise in population size are fuelling the growth of the agricultural sector in countries such as India, China, and Thailand. In addition, the increased awareness about increasing farm yield and improved efficiency of equipment, which results in high-quality products, are also the cause of this rapid growth in these countries.

KEY MARKET PLAYERS

The global pre-harvest equipment market industry is highly consolidated, with few companies manufacturing most of the products, and the rest of the market share is divided among small companies. Deere & Company (U.S.), CNH Global (The Netherlands), and AGCO Corp (U.S.). are the market leaders with a combined share of about 60%. The other players include Mahindra & Mahindra Ltd (India), Valmont Industries Inc.(U.S.), Iseki & Company Ltd(Japan), etc. Deere & Company is the market leader with 38% in 2020. In order to produce lines, John Deere has introduced various equipment. The company also adopted expansion and investments as its strategies for expanding its market globally. It invested around USD 58 million in its John Deere Seeding manufacturing plant in Moline to enhance its operations.

MARKET SEGMENTATION

This research report on the global pre-harvest equipment market is segmented and sub-segmented into the following categories.

By Type

- Primary Tillage Equipment

- Secondary Tillage Equipment

- Planting Equipment

- Irrigation Equipment

- Plant Protection & Fertilizing

- Seed drills

- Planters

- Air seeders

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle-East & Africa

Frequently Asked Questions

What is considered pre-harvest equipment in agriculture?

Pre-harvest equipment includes all machinery used before crop harvesting, such as tractors, tillers, seed drills, sprayers, and irrigation systems—tools essential for land preparation, seeding, fertilizing, and crop maintenance.

What is driving the growth of the global pre-harvest equipment market?

Rising global food demand, labor shortages, and increasing farm mechanization—especially in emerging economies are key factors pushing farmers toward efficient, time-saving equipment solutions.

How is technology reshaping pre-harvest equipment?

Modern pre-harvest machines are integrating GPS, automation, and data analytics, enabling precision seeding, smart spraying, and optimized field coverage to improve crop outcomes and reduce input waste.

What challenges does the global pre-harvest equipment market face?

Barriers include high upfront investment, lack of access to financing for smallholder farmers, uneven rural infrastructure, and the need for training on operating and maintaining advanced machinery.

What does the future hold for pre-harvest equipment in global agriculture?

The future points toward compact, tech-enabled, and energy-efficient machines tailored for small farms, alongside growth in leasing models and government incentives to support widespread adoption.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com