Global Agriculture Equipment Market Size, Share, Trends, And Growth Forecast Report - Segmented By Equipment Type (Agriculture Tractor, Harvesting Equipment, Irrigation and Crop processing Equipment, Agriculture and Hand Spraying Equipment, Soil Preparation and Cultivation Equipment), Application, Automation and Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) - Industry Analysis (2025 to 2033)

Global Agriculture Equipment Market Size

The global agricultural equipment market was valued at USD 181.26 billion in 2024 and is anticipated to reach USD 188.93 billion in 2025 from USD 263.17 billion by 2033, growing at a CAGR of 4.23% from 2025 to 2033.

Current Scenario of the Global Agriculture Equipment Market

The demand for agricultural equipment has gradually grown over the last few years, and the trend is expected to continue during the forecast period. Several countries have launched favorable policies and allowances to boost the agriculture industry and ensure economic stability and food security due to multiple conflicts and wars around the world. Hence, the agricultural equipment market is pushed forward by economies worldwide. Moreover, these programs involve funding for the purchasing of cutting-edge farming equipment, assistance with the latest agricultural methods, and support for scientific research and development. Furthermore, it helps solve issues like labor shortages and climate change effects in addition to increasing output.

MARKET DRIVERS

Technological developments and an increasing number of programs and incentives by governments of several countries in favor of agricultural equipment are driving global market growth.

Artificial intelligence, the Internet of Things, and GPS incorporation will improve machine efficiency and this includes harvesters, tractors, and planting tools. With the help of these technologies, farmers can also practice precision agriculture. Thus, it will increase crop yields and decrease waste by optimizing planting, harvesting, and resource management. Furthermore, agricultural operations are revolutionized by inventions such as autonomous tractors and drones for crop monitoring, which makes farming practices less labor-intensive and more effective. In addition, this technology is drawing the attention of tech-savvy farmers, which is further propelling the expansion of the agricultural equipment market.

Smart farming, remote monitoring, precision agriculture, data-based decision-making, automation, and performance optimization are factors expected to elevate the agriculture equipment market during the forecast period. The IoT devices and sensors can provide remote farm monitoring and optimize business processes. This helps in gathering and analyzing live data. Also, it enhances operational effectiveness and decision-making. Moreover, precision agriculture is done by the integration of analytical tools with IoT systems such as drones and sensors. In addition, planting, harvesting, and other operations are achieving high efficiency through integration. Hence, it boosts output and makes better use of available resources. Additionally, IoT technology may automate tractors and harvesters, resulting in higher performance and fewer errors when paired with GPS and other cutting-edge systems.

MARKET RESTRAINTS

The high maintenance costs and initial procurement costs are hindering the global agricultural equipment market growth.

Input costs for equipment commissioning across farms rise because of expanding agricultural and technical advancements in the sector. Moreover, the employment of such automated farming machinery results in elevated expenses for upkeep and operation, leading to reduced revenue from farming pursuits. Farmers were concerned about the need for experienced labor to manage and oversee operations due to the machine's detailed engagement in agricultural activities, which increased complexity. Most of the agricultural activity is carried out in rural areas of emerging nations and many farmers in these nations lack literacy and thus are ignorant of the advantages of using agricultural technology to increase crop yields. The persistence of outdated agricultural methods brought about by illiteracy lowers the soil's capacity to support crops as they are unsustainable and deteriorate the quality of the soil. Additionally, the lack of digital infrastructure in rural regions including networks, skills, and resources and reduces the adoption of sophisticated agricultural equipment in these locations. Thus, the market growth for agricultural equipment is constrained by all these issues together.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.23% |

|

Segments Covered |

By Equipment Type, Application, Automation, Sales Channel and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A, Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V, Deere & Company, Escorts Limited, Iseki & Co. Ltd, JC Bamford Excavators Ltd, Kubota Corporation, Mahindra & Mahindra Limited, SDF Group. |

SEGMENTAL ANALYSIS

Global Agriculture Equipment Market Analysis By Equipment Type

The agricultural tractor segment is predicted to have the maximum market share under this category during the forecast period. This could be because they are less expensive to operate and have better environmental effects; electric tractors are becoming more and more common. Since electric tractors emit no emissions, air pollution and greenhouse gas emissions are decreased. Because electricity is less expensive than diesel fuel, they also have lower running expenses than tractors that run on diesel.

Global Agriculture Equipment Market Analysis By Application

The threshing and harvesting segment had significant progress in demand in recent years. It is fuelled by factors like a growing requirement for mechanized and effective farming, the desire to increase farming production, and the rising global acceptance of modern agricultural techniques.

Global Agriculture Equipment Market Analysis By Automation

The manual segment is anticipated to generate the most revenue, while the semi-automatic segment is forecasted to register a higher annual growth rate. Some semi-automatic technologies also require human intervention. This is because fully automated tools are expensive and come with a riskier return on investment. On the other hand, S.M. equipment is better suited for farmers with modest farm incomes. Additionally, the market growth is further propelled by the usage of natural resources and access to inexpensive and skilled labor in subcontinental nations like China and India.

Global Agriculture Equipment Market Analysis By Sales Channel

The original equipment manufacturers segment is anticipated to maintain the largest share of the agricultural equipment market. However, the aftermarket segment is expected to grow at a faster growth rate in the future. This segment's growth is due to factors such as the increasing number of aftermarket centers in emerging countries like India, Brazil, and Argentina. This growth is also driven by the need for modern machinery and the associated demand for aftermarket services. Furthermore, the strong position of OEM brands is credited to elements like trust, dependability, longevity, and after-sale services.

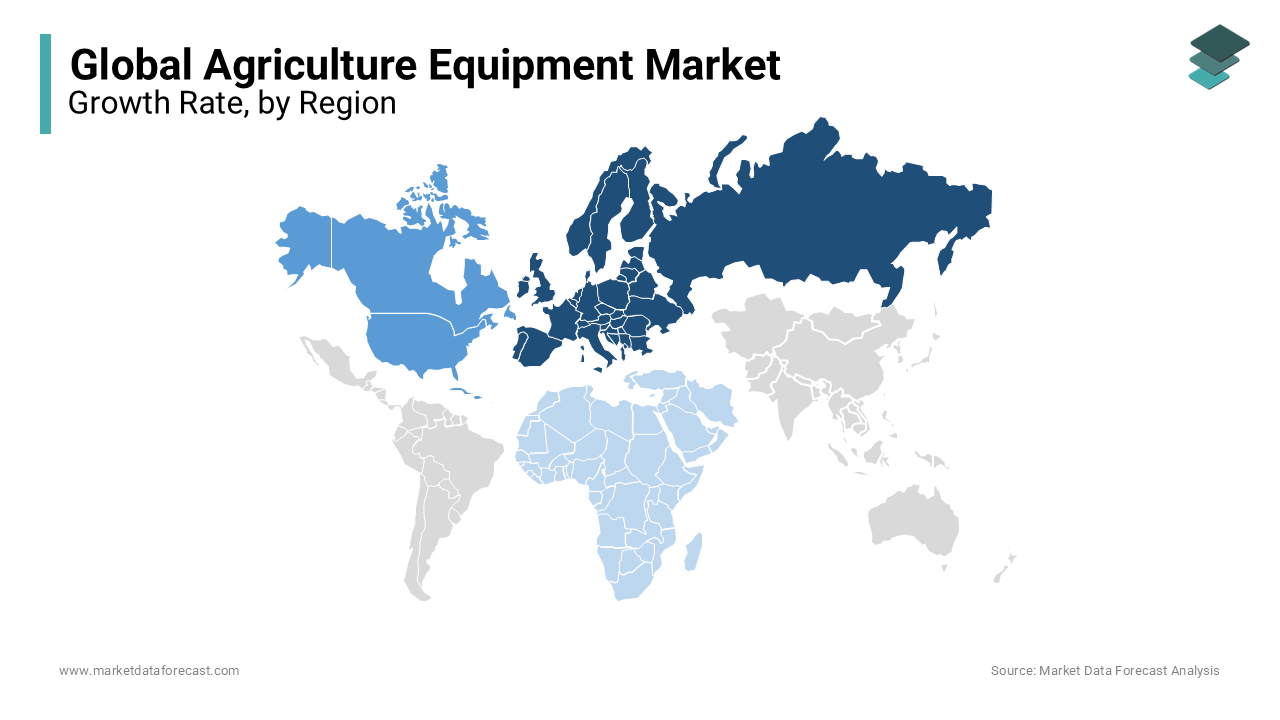

REGIONAL ANALYSIS

Europe continues to be a major net exporter in the global agricultural equipment market. In the middle of 2023, the agricultural machinery market peaked. Sales of agricultural machinery organized in the VDMA reached a solid 6 billion euros in the first half of the year, with growth rates in the high double digits. Moreover, Russia imports agricultural gear worth around 2.8 billion euros per year from the world. The European Union accounts for the largest share of these imports, with Germany being the most vulnerable country at 583 million euros. Other major providers are the Netherlands, Italy, France, Finland and Poland.

North America is the second biggest industry in the agricultural equipment market and accounts for a 29 percent share. Farm mechanization is in great demand due to the abundance of farmland. Smart combine harvesters with monitoring technologies are also becoming more and more popular in the North American area to increase agricultural productivity. Large farms' increased need for high-capacity machinery, rising labor costs, the inclusion of robotic systems and GPS in tractors and harvesters, and the growing inclination towards self-propelled machines are anticipated to accelerate market expansion throughout the projected period. Furthermore, the U.S. is the largest food market in North America, with about 333.2 million food consumers.

Asia Pacific holds the biggest portion, more than 37 percent of the agriculture equipment market share. The stability and economic expansion of China, India, and other agro-based nations in the Asia-Pacific area are projected to propel the market's growth. The rise of agricultural equipment in these regions has been facilitated by government measures to promote farm equipment, increased GDP, growing per capita income, and a tendency towards mechanization. In 2020, China's tractor unit count was a mere 22 million despite the country's significantly bigger agricultural population. Hence, there is a lot of scope for agricultural mechanization in these markets.

Latin America presents a significant opportunity for the agriculture equipment market. Brazil is the sixth-largest exporter of machinery units, and the domestic machinery manufacturing sectors dominate the market. Deere & Company, AGCO Corporation, Buhler Industries Inc., Mahindra & Mahindra Ltd, Escorts Limited, and TAFE are major companies. Furthermore, the most widely used tools are still tractors and combine harvesters, which have a thriving production and distribution network made up of several local and regional producers.

Middle East and Africa are expected to have decent growth rates in the agriculture equipment market. The market for agricultural equipment is being driven by the growing automation in farming and agriculture. Due to the increased need for food, the expanding population is also responsible for the market's expansion. Furthermore, the market demand is also being supported by the lack of competent labor in the agricultural and agriculture sectors. Moreover, as farm equipment technology advances, more research and development are being done to support this technological innovation, which is expected to support market expansion into the future.

KEY MARKET PLAYERS

AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A, Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V, Deere & Company, Escorts Limited, Iseki & Co. Ltd, JC Bamford Excavators Ltd, Kubota Corporation, Mahindra & Mahindra Limited, SDF Group. Some of the market players are dominating the global agriculture equipment market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2023, Case I.H. published that it will manufacture the largest combine harvester called A.F. Series.

- In February 2023, LINTTAS Electric Company announced that it would build the first electric combine harvester in history. The aim is to change how the industry views agricultural gear.

MARKET SEGMENTATION

This research report on the global automotive agriculture equipment market has been segmented and sub-segmented based on equipment type, application, automation, sales channel and region.

By Equipment Type

- Agriculture Tractor

- Harvesting Equipment

- Irrigation and Crop Processing Equipment

- Agriculture Spraying and Handling Equipment

- Soil Preparation and Cultivation Equipment

- Others

By Application

- Land Development

- Threshing and Harvesting

- Plant Protection

- After Agro Processing

By Automation

- Manual

- Semi-automatic

- Automatic

By Sales Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current size of the agriculture equipment market globally?

The global agriculture equipment market was valued at USD 188.93 billion in 2025.

Which regions are leading in terms of market share for agriculture equipment?

North America and Europe are currently leading in market share due to advanced farming techniques and high adoption rates of agricultural machinery.

What are the key trends driving growth in the Asia Pacific agriculture equipment market?

In the Asia Pacific region, the adoption of mechanized farming techniques, government subsidies, and increasing awareness about farm productivity are driving market growth.

What factors are hindering the growth of the agriculture equipment market in Europe?

In Europe, factors such as high initial investment costs, stringent government regulations, and limited farm sizes are posing challenges to market growth.

What are the top agricultural equipment manufacturers dominating the North American market?

John Deere, CNH Industrial, and AGCO Corporation are among the key players dominating the North American agriculture equipment market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com