Global Precooked Corn Flour Market Size, Share, Trends & Growth Forecast Report - Segmented By Nature (Conventional And Organic), Product (White Corn Flour, Yellow Corn Flour And Blue Corn Flour), Application (Soup/Sauces And Dressings, Bakery And Confectionery, Extruded Snacks, Infant Formula, RTC Food And Others), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Precooked Corn Flour Market Size

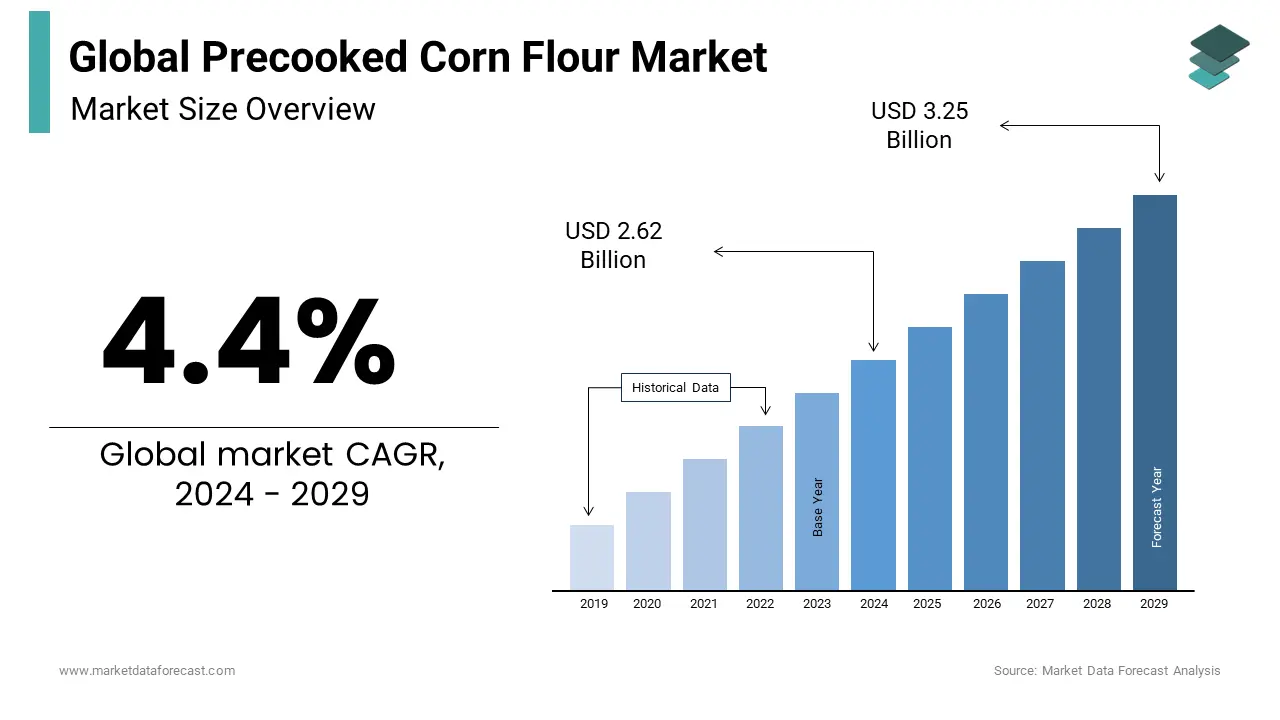

The size of the global precooked corn flour market was expected to be worth USD 2.62 billion in 2024 and is anticipated to be worth USD 3.87 billion by 2033 from USD 2.74 billion In 2025, growing at a CAGR of 4.4% during the forecast period.

As its name suggests, precooked corn flour is obtained from precooked cereals or by hydrothermal extrusion of cereals, corn or other sauces. Precooked cornmeal is mainly used in bakery products, home cooking, meat products, fast food, and soup making. Because precooked cornmeal is gluten-free, foods made from flour are consumed primarily by people with celiac disease. When corn is soaked in lime, niacin and calcium are infused, making it easier for the body to digest and giving the flour a unique flavor. This flour is rich in calcium and B vitamins. Precooked corn flour is also used in regional cooking preparations and at home to prepare regional dishes such as Latin America to prepare tortillas, a traditional Latin American dish. Precooked cornmeal has been found to provide a better texture and sensory experience than regular products in many cases due to the technique by which precooked corn flour is processed. The growing trend of healthy snacks has led manufacturers to develop new pre-cooked corn flour products on the market, resulting in several growth opportunities in the international marketplace.

MARKET DRIVERS

The growing demand for gluten-free foods and a growing preference for prepared foods are key factors driving the growth of the global precooked corn flour market.

North America had the largest market share in the entire market. Also, the introduction of organic and non-GMO precooked cornmeal to the market provides growth opportunities for key players operating in the global precooked cornmeal market. More and more manufacturers are developing food products that give food preparation a unique texture and flavor. These innovations have expanded the reach of these foods in the food and beverage industry. Manufacturers of precooked cornmeal are active around the world and regularly launch new products to attract and retain consumers in a highly competitive environment. As the demand for healthy and nutritious prepared foods increases in developed and developing countries such as the United States, Canada and Mexico, the demand for precooked corn flour is expected to increase in the region. Increased demand for healthy soups and pasta that use precooked cornmeal as a healthy alternative to flour is a key factor expected to drive demand for precooked corn flour in North America during the forecast period. The demand for precooked cornmeal has been approved as the demand for healthy corn-based snacks such as corn chips, corn chips, taco leaves and a variety of other popular products has increased. Precooked corn flour has been crucial in this development because fast food chains are using bread that is prepared from this flour.

Urbanization has led to a consumer base that prefers bakeries and fast-food products, the demand for which increases every day despite the perception of the adverse effects of fast food. The pace of urbanization has increased around the world and modern food culture is evolving accordingly. An increase in urbanization indicates an increase in the use of precooked corn flour at homes. This increase in demand is much greater in developing countries due to high rates of urbanization and rising per capita income. Precooked cornmeal contains nutrients and is available in a variety of varieties. Corn and its products are considered healthy to consume. The rapidly increasing incidence of celiac disease has led to a preference for gluten-free options. Therefore, it is used more and more not only in the food processing industry, but also in the food service industry, especially in bakery products. Using precooked cornmeal as a substitute is more widely used in developed countries and is a healthier popular alternative. The demand for gluten-free foods has increased significantly in recent years as the prevalence of celiac disease has increased in developing and developing countries. This damage is caused primarily by a reaction to eating foods high in gluten, such as wheat, rye, barley, and oats. Eating gluten causes a variety of health problems for some people. In addition, excessive consumption of these products can cause serious health problems such as sensitivity, allergy to wheat and celiac disease. Therefore, foods made with precooked corn flour are suitable for those with gluten intolerance or celiac disease. Additionally, precooked cornmeal made from pure ground corn is gluten-free. Instead of gluten, precooked cornmeal contains hemicellulose, an adhesive-like ingredient found in corn. The usage of precooked corn flour in infant foods to offer better texture and more nutrition creates a lucrative opportunity for development in the global precooked corn flour business.

MARKET RESTRAINTS

Lack of consumer awareness and confidence in precooked corn flour products remains one of the main constraints in this market.

Also, increasing resistance to GM crops, coupled with regulations from regulatory agencies that prohibit the use or cultivation of GM crops in certain countries, has created mistrust among consumers. Therefore, manufacturers of precooked cornmeal and other corn products declare on their packaging that they are non-GMO products. This had a negative impact on the growth of the corn industry. Besides, the lack of consumer confidence in the products is having a negative impact on the corn industry and its products. This is more common in developed countries where consumers recognize food ingredients in the products they consume and require a higher level of transparency from manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.4% |

|

Segments Covered |

By Nature, Type of Product, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Inc, Archer Daniels Midland Company, Harinera Del Valle, Gruma SAB de CV, Empresas Polar, Bunge Ltd, Bob's Red Mill Natural Foods, Inc, Molino PeilaExisteSpA, The Quaker Oats Company, Lifeline Foods, Cool Chile Company, Groupe Limagrain, Goya Foods, Inc and Others |

SEGMENTAL ANALYSIS

By Nature Insights

Traditional precooked cornmeal occupies the majority of the global precooked corn flour market, while the organic segment is expected to grow at a higher CAGR during the forecast period.

By Type of Product Insights

The yellow cornmeal segment represents the majority of the global market, while the white cornmeal segment is expected to record the fastest growth rate during the forecast period. Precooked yellow and white cornmeal is widely available in the market and used to make a variety of products such as tortillas, corn snacks, and bread.

By Application Insights

The extruded snacks segment occupies the majority of the global precooked corn flour market, while the RTC food segment is expected to record the fastest growth rate during the outlook period. Precooked corn flour is widely used in the production of precooked foods such as tortilla chips for dipping, or eaten as ethnic snacks, tacos, soft tortillas, corn chips, etc.

REGIONAL ANALYSIS

North America accounted for the majority of the precooked cornmeal market prior to 2018, and the market growth in this region is primarily driven by the rapid growth of the food and beverage sector in the nation of the United States, Canada and Mexico. The growth of the precooked corn flour market in this region is mainly due to the rapid growth of the food and beverage industry in those nations. Additionally, the growing demand for healthy ready-to-eat and convenience foods is expected to increase demand for precooked corn flour in North America.

KEY PLAYERS IN THE GLOBAL PRECOOKED CORN FLOUR MARKET

Major Key Players in the global Precooked Corn Flour Market are Cargill Inc, Archer Daniels Midland Company, Harinera Del Valle, Gruma SAB de CV, Empresas Polar, Bunge Ltd, Bob's Red Mill Natural Foods, Inc, Molino PeilaExisteSpA, The Quaker Oats Company, Lifeline Foods, Cool Chile Company, Groupe Limagrain, Goya Foods, Inc and Others

RECENT HAPPENINGS IN THE MARKET

- In August 2018, Corn Squash Brand P.A.N. Kicks Off North America's First Food Truck Tour to Introduce Arepa to U.S. Consumers.

- In April 2016, Bunge Ltd. decided to launch a non-GMO corn-based product at a corn plant in Nebraska and increase production.

DETAILED SEGMENTATION OF THE GLOBAL PRECOOKED CORN FLOUR MARKET INCLUDED IN THIS REPORT

This research report on the global precooked corn flour market has been segmented and sub-segmented based on nature, type of product, application, and region.

By Nature

- Organic

- Traditional

By Type of product

- White Corn Flour

- Yellow Corn Flour

- Blue Corn Flour

By Application

- Soups/Sauces And Dressings

- Baking & Confectionery

- Infant Formula

- Rtcfoods

- Extruded Snacks

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the current trends in the precooked corn flour market?

Current trends include the growing demand for gluten-free products, increased interest in traditional and ethnic foods, and the rising popularity of plant-based diets. There is also a trend towards organic and non-GMO precooked corn flour.

2. What are the growth prospects for the precooked corn flour market?

The market is expected to grow due to increasing demand for convenience foods, the rise in gluten-free diets, and the popularity of traditional and ethnic foods. Innovations in packaging and new product formulations also contribute to market growth.

3. How is the market adapting to health trends?

The market is adapting by offering more organic, non-GMO, and fortified options. Additionally, there is an emphasis on producing precooked corn flour that is free from additives and preservatives.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]