Global Printed Circuit Board Market Size, Share, Trends & Growth Forecast Report - Segmented By Board Type (Single-Sided, Double Sided, Multi-Layer), Pattern (Rigid Flexible, And Rigid-Flex), End-User (Automotive, Healthcare, Aerospace & Defense, Industrial Electronics, It And Telecom, Consumer Electronics), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2024 to 2032

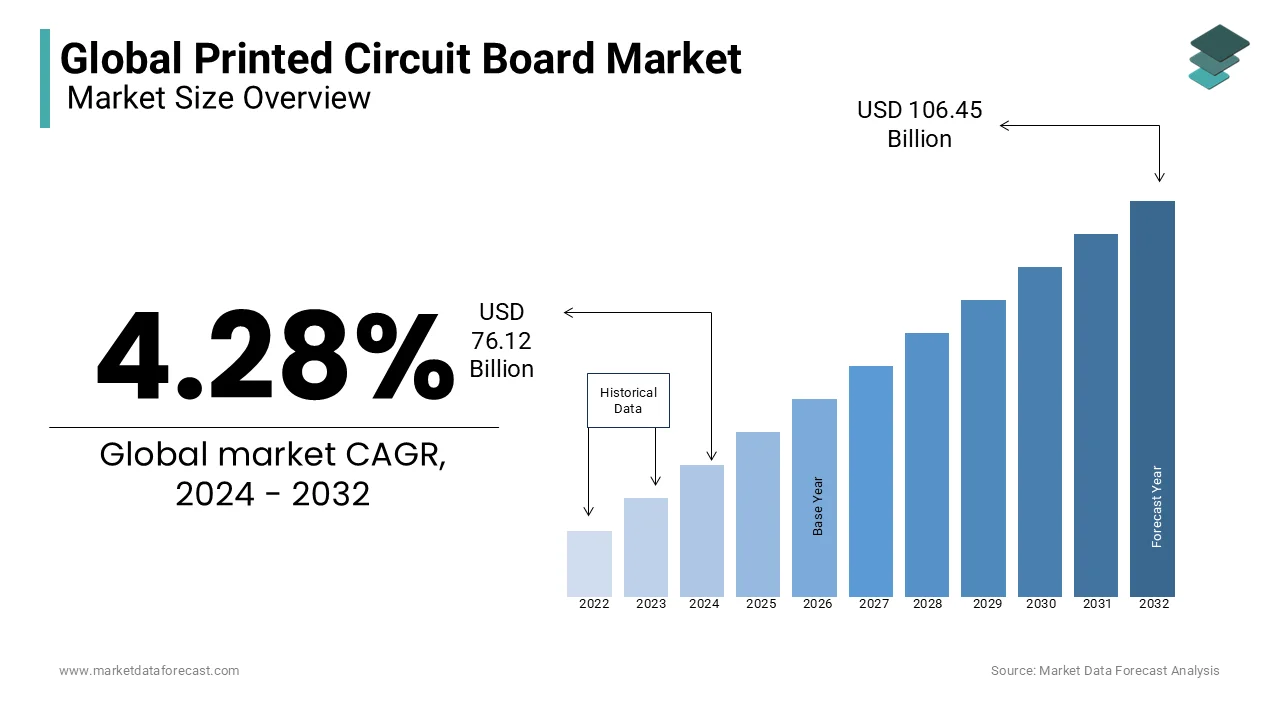

Global Printed Circuit Board Market Size (2024 to 2032)

The size of the global printed circuit board market was worth USD 73 billion in 2023. The global market is anticipated to grow at a CAGR of 4.28% from 2024 to 2032 and be worth USD 106.45 billion by 2032 from USD 76.12 billion in 2024.

Current Scenario of the Global Printed Circuit Board Market

A printed circuit board comes with conductive lines printed or etched with non-conductive materials, and electrical components are mounted on the board. This board can also act as a multilayer connected with the conductors separated with insulating layers; it looks like a sandwich. The PC boards are designed to fit in convoluted spaces made of a variety of materials. This is used in many electronic devices, especially with the growing popularity of automation devices. The launch of innovative technological developments in the electronic industry is attributed to leveraging the growth rate of the printed circuit board market.

Printed Circuit Board Market Drivers

The rising use of PCBs, from simple to complex electronic devices that are used in daily life, substantially elevates the growth rate of the market. The world is evolving with all the new inventions, especially in the electronic industry. These boards have a unique role in modern technology and electronic devices that enhance the growth rate of the market. The growing usage of smartphones substantially elevates the printed circuit board market growth rate. In recent times, mobile phones have become one of the most popular electronic devices, even in remote areas. PCB is the backbone for efficient smartphone functionality. Major components, like processor, memory, display, and battery, are connected simply with this board, enabling seamless operations. China is one of the topmost countries across the globe in launching or manufacturing a huge number of smartphones with the most advanced technologies. More than one billion people in China use smartphones. This represents the launch of a high number of mobile phones across the country with all the latest updates in the electronic industries.

In addition, the growing prominence of electric vehicles with automation technology is gearing up the growth rate of the printed circuit board market. There is a lot more to do with the PCB in electric vehicles. From anti-lock braking systems to connecting many electronic systems in these vehicles, the demand for the use of the boards has escalated to an extent.

Growing disposable income and rising prominence for luxurious cars in most developed countries like the US are augmented in elevating the growth rate of the market.

Printed Circuit Board Market Restraints

However, disruptions in the supply chain are proportionally raising the cost of the raw materials, which is slightly degrading the growth rate of the printed circuit board market. The design and manufacturing of the printed circuit board involve huge complexity, which is one of the reasons for the high cost of the final electronic devices. Due to fluctuations in the raw materials and difficulty in designing high complex circuits shall limit the growth rate of the market. Also, the rising number of failure cases of electronic devices due to their sensitivity towards environmental changes is attributed to hindering the growth rate of the market.

Printed Circuit Board Market Opportunities

The expansion of the electronics and automotive industries across the world is a substantial way to leverage growth opportunities for the printed circuit board market. The rising prominence of launching innovative electric vehicles with the most advanced technologies by customizing the consumer’s interests is ascribed to bolstering the growth rate of the printed circuit board market. The rising use of PCBs in medical devices also greatly emphasizes the growth rate of the

market to an extent. Many of the medical devices used in diagnostics centers, laboratories, hospitals, and clinics need specially designed PCBs according to their requirements. For instance, the rising use of health applications in laptops or smartphones is likely to expand the use of PCBs in the healthcare industry. The rising popularity of effective treatment procedures is likely to enhance the growth rate of the printed circuit board market during the forecast period.

Printed Circuit Board Market Challenges

The lack of skilled professionals in manufacturing the boards with utmost care and with advanced technology is a solely challenging factor for the market key players. PCB should be manufactured under skilled professionals where a minor mistake can alter overall performance. Optimizing and routing electrical connections to arrange all the components in a specific order can only be done by the skilled workforce, and the lack of these people will degrade the growth rate of the market. Frequently changing software updates in every industry can also negatively impact the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 – 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2032 |

|

CAGR |

4.28% |

|

Segments Covered |

By Type, By Substrate, By End User, By Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Wurth Elektronik Group, TTM Technologies, Inc., Advanced Circuits Inc., Tripod Technology Corporation, Nippon Mektron Ltd, Becker & Muller Schaltungsdruck GmbH, Zhen Ding Technology Holding Limited, Sumitomo Corporation, and Murrietta Circuits, Unimicron Technology Corporation, and Others. |

SEGMENTAL ANALYSIS

Global Printed Circuit Board Market Analysis By Type

- Single-Sided

- Double-Sided

- Multilayer

- HDI

The multilayer segment will continue to be the major segment under this category during the forecast period. Because they have various advantages over single-sided or double-sided PCBs, multilayer printed circuit boards are highly sought after in many applications. The density of components and connections is larger with multilayer printed circuit boards. It enables more functionality in a smaller footprint by facilitating the efficient routing of intricate and densely packed circuitry by designers. For small electrical gadgets like wearables, tablets, and smartphones, this is helpful.

Global Printed Circuit Board Market Analysis By Substrate

- Rigid

- Flexible

- Rigid-Flex

The flexible segment is expected to grow further in the coming years. Benefits like low weight and cost, easy assembly, and flexibility in design propel the flexible printed circuit board market expansion. Additional factors will further expand the market, which includes dependable applications, high packaging flexibility, and high-quality performance. Furthermore, increased manufacturing and demand for consumer electronics like cell phones have a positive impact on the market's expansion.

Global Printed Circuit Board Market Analysis By End User

- Industrial Electronics

- Healthcare

- Aerospace & Defence

- IT and Telecom

- Automotive

- Consumer Electronics

The consumer electronics segment is anticipated to have the maximum share of the printed circuit board market. Most electronic gadgets are built on printed circuit boards. These circuits are smaller than individual components, resulting in a smaller product and easier assembly and routing of traces. Durable and long-lasting, they can withstand heat, moisture, and physical force, making them ideal for hazardous areas like under the hood of an automobile. Furthermore, printed circuit boards are highly efficient and economical, which enables device creation with fewer components, thereby saving costs for both individuals and businesses. They are easy to repair and recycle with easy access to components and the ability to be recycled at the end of their lifespan without negative environmental impact.

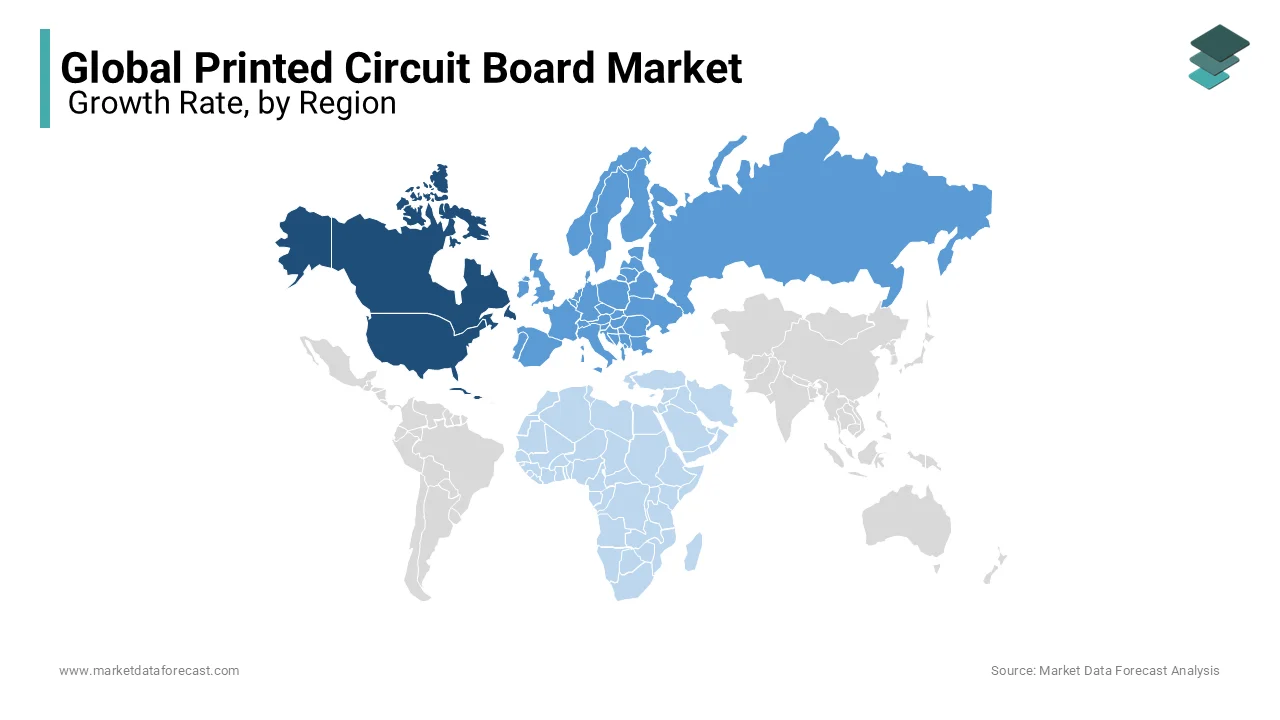

REGIONAL ANALYSIS

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

North America's printed circuit board market is the biggest market as compared to other regions. Increasing investment in aerospace is driving the demand for printed circuit boards in the US market. May 2023 saw more than a six percent increase in PCB shipments to North America overall over the same month the previous year. May shipments decreased by close to two percent from the previous month. Consumer electronics, automotive electronics, industrial equipment, and aerospace and defense applications all have substantial markets in North America.

Europe's printed circuit board market is expected to grow at a faster CAGR during the forecast period. The demand for PCB products produced by European manufacturers is steadily rising, and they have a sizable customer base on the continent. The expansion of IoT-connected equipment in the area has been assisted by the development of wearable technology, such as smartwatches with embedded CPUs and flexible PCB sensors made possible by the Internet of Things. Also, China is heavily dependent on Europe for PCB fabrication and electronic manufacturing services, according to the printed circuit trade association, which claims that European support for local chip manufacturing ignores this fact.

Asia Pacific's printed circuit board market is anticipated to flourish with considerable market share in the coming years. Asia Pacific, led by nations like China, South Korea, and Japan, has become a key hub for the production of Substrate-like PCBs. Substrate-like PCBs are revolutionizing the Asia Pacific region with their thin, flexible, and superior electrical performance, making them ideal for compact and portable electronic devices. Furthermore, The Indian government has urged the industry to manufacture printed circuit boards (PCBs) locally, as this would significantly boost local value addition.

Latin America's printed circuit board market is estimated to propel further with a significant market share. The growing use of flexible PCB in automotive applications is one of the major trends in the PCB market in the region. Flexible polycarbonate boards have become increasingly popular in the healthcare sector, as a result of which flexible medical devices and sensors can now be produced.

Middle East and Africa's printed circuit board market will continue to grow at a steady pace during the forecast period. Due to the boom in the Internet of Things, healthcare, surgical robots, and electric cars, the printed circuit board market is anticipated to drive the market in the region. The MEA region is also experiencing an increase in demand for printed circuit boards due to rising emphasis on smart grid infrastructure and renewable energy.

KEY MARKET PLAYERS

The major players in the Printed circuit board market are Wurth Elektronik Group, TTM Technologies, Inc., Advanced Circuits Inc., Tripod Technology Corporation, Nippon Mektron Ltd, Becker & Muller Schaltungsdruck GmbH, Zhen Ding Technology Holding Limited, Sumitomo Corporation, and Murrietta Circuits, Unimicron Technology Corporation.

RECENT HAPPENINGS IN THE MARKET

-

In 2024, Sumitomo Corporation is all set to make more investments in Hanoi with a whopping amount of USD 27 million. The deal is to manufacture sustainable and flexible circuits with the granted investment certification of Sei Electronic Components.

Frequently Asked Questions

1. What are the challenges faced by the PCB industry?

Challenges may include price fluctuations of raw materials, environmental concerns related to the manufacturing process, and the need for constant innovation to keep up with evolving technologies.

2. What are the current trends in the PCB industry?

Current trends in the PCB industry include the adoption of flexible and rigid-flex PCBs, miniaturizing electronic components, and using advanced materials for improved performance.

3. What factors are driving the growth of the PCB market?

The growth of the PCB market is driven by factors such as the increasing demand for electronic devices, advancements in technology, and the rise of IoT (Internet of Things) applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com