Global Project Logistics Market Size, Share, Trends, & Growth Forecast Report By Service (Transportation, Forwarding, Inventory Management and Warehousing, and Other Value-added Services), End-User (Oil and Gas, Mining, and Quarrying, Energy and Power, Construction, Manufacturing, and Others), & Region, Industry Forecast From 2024 to 2033

Global Project Logistics Market Size

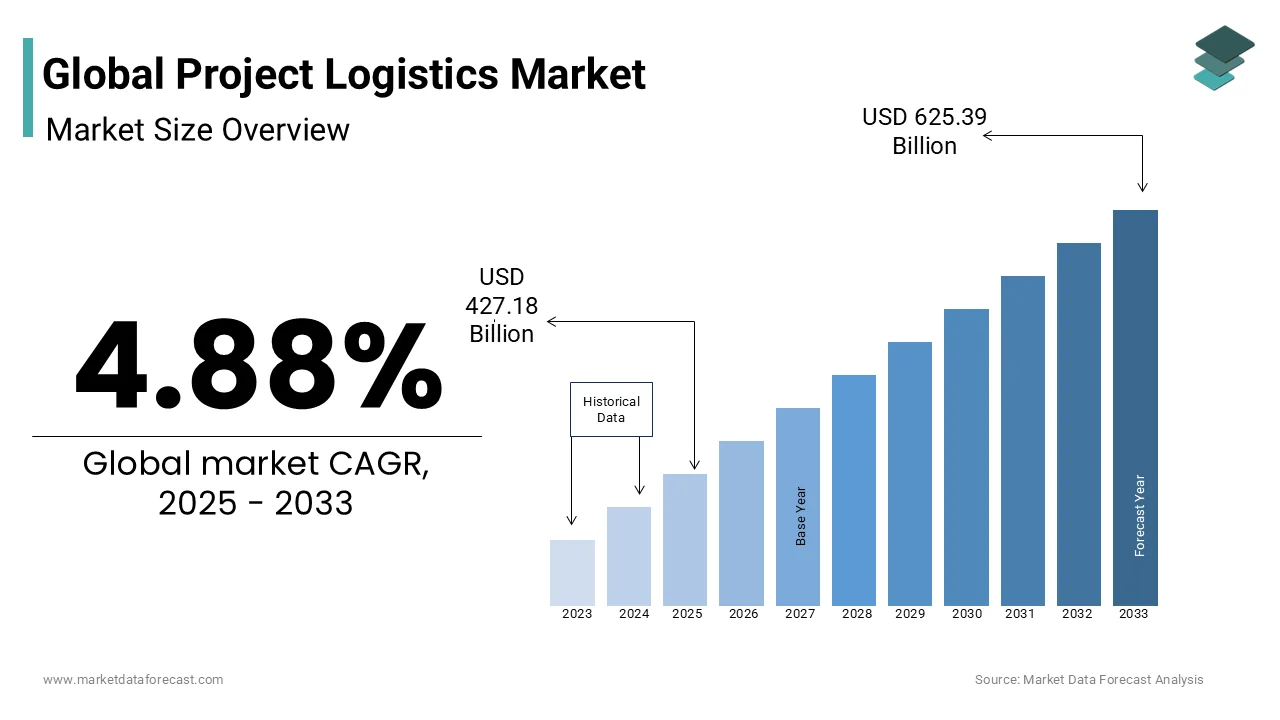

The size of the global project logistics market was worth USD 407.3 billion in 2024. The global market is predicted to be worth USD 625.39 billion by 2033 from USD 427.18 billion in 2025, growing at a CAGR of 4.88% from 2025 to 2033.

A transporter's job is never easy when it comes to dealing with a cargo of unusual proportions. Larger-sized cargo necessitates an entirely distinct set of equipment, infrastructure, and experienced staff. On the other hand, shippers and service providers are getting more adept in the transportation of oversized and heavyweight shipments. Furthermore, manufacturing complexity complicates matters. Parts and modular packages are manufactured in far-flung corners of the globe and then sent to their final destinations. Technology advancements in modes of transportation services and collaborative logistics approaches are propelling the adoption of project logistics. The use of driverless cars and an increase in the use of blockchains for effective logistical operations will drive the project logistics market forward.

MARKET DRIVERS

Digital technology advancements and changing customer tastes resulting from e-commerce are likely to drive the change of the logistics ecosystem.

The increased need for project logistics from the automotive industry is one of the key factors propelling the growth of the global market. As a result of technology advancements, the project logistics market is expected to accelerate during the forecast period. When two or more organizations form a collaboration, they are said to accomplish collaborative logistics. The partnership's goal is to optimize logistics operations by pooling equipment, trucks, information, or carriers to minimize costs. As a result, the logistics method will contribute to the expansion of the project logistics market shortly. To suit industry demands and expectations, central global logistics businesses offer a particular project cargo segment.

Furthermore, local companies are expanding their fleet size, business solutions, sectors addressed, and technologies. Global manufacturers produce enormous and oversized components at plant locations (off-site), which complicates the lives of heavy cargo haulage businesses. Multinational corporations with significant resources and assets can invest in improved fleets and benefit from the scenario mentioned above. Moreover, regional and local players are developing better industry solutions to support clients completing projects on time. The project logistics market is being driven by the bright future forecast for renewable energy. Energy businesses must create the necessary infrastructure, start new projects, and install power-producing equipment to generate the appropriate amount of power in the future. This scenario will increase the demand for project logistics. Construction companies are looking for numerous options to prevent bottlenecks. One method is moving components to installation sites early and employing regional laydown facilities to marshal goods at or near a site well before construction begins. These strategies would assist developers in avoiding trailer shortages during peak shipping periods, extend the window for finding competent heavy-haul drivers in limited supply, and mitigate cost overruns owing to driver overtime and late permitting.

MARKET RESTRAINTS

Problems with logistics and players necessitate a significant initial capital expenditure, inhibiting the growth of the project logistics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.88% |

|

Segments Covered |

By Service, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Rhenus Logistics, Bollore Logistics, Agility Logistics, EMO Trans, Hellmann Worldwide Logistics, Ceva Logistics, Rohlig Logistics, Ryder System Inc., CH Robinson Worldwide Inc., and Kuehne + Nagel International AG. |

SEGMENTAL ANALYSIS

By Service Insights

The transportation services category accounted for the majority of project logistics market growth. The global project logistics market's prominent competitors provide customized and unique mobility solutions. As an outcome, the project logistics service market size in the transportation service segment will constantly expand. However, the industry's development in this category will be slower than the market's growth in the other segments.

By End-User Insights

Rising oil prices and a thriving liquefied natural gas (LNG) and petrochemical manufacturing industry may enormously benefit the transportation logistics business. Some firms have been developed to conduct project logistics activities all over the globe. The decade-long trend of rapid increase in renewable energy capacity continued in 2018, with 171 gigawatts added globally (G.W.). Hydropower, wind energy, bioenergy, solar power, and geothermal power are all part of it. The 7.9 percent yearly increase was boosted by new solar and wind energy additions, which accounted for 84 percent of the expansion. Notably, sustainable energy accounts for one-third of worldwide power capacity. This tendency is anticipated to expand in the following years to determine climate patterns and sustainability targets.

REGIONAL ANALYSIS

Chinese contractors completed 7,217 construction projects along the Belt and Road in 2017 alone and 13,267 construction contracts worldwide. Asia-Pacific leads the market research and is also projected to be the most vital area. In recent times, infrastructure investment has been a crucial driver of economic development in Asia-Pacific countries. Some countries priorities the construction of infrastructure building (such as Australia and the ASEAN countries). In recent times, China's construction sector has seen substantial development. This creates a massive potential for local project cargo firms to serve such projects with logistical services shortly. Some regional logistics organizations are managing large shipments with improved capacities.

KEY MARKET PLAYERS

Companies playing a vital role in the global project logistics market include Rhenus Logistics, Bollore Logistics, Agility Logistics, EMO Trans, Hellmann Worldwide Logistics, Ceva Logistics, Rohlig Logistics, Ryder System Inc., CH Robinson Worldwide Inc. and Kuehne + Nagel International AG.

RECENT HAPPENINGS IN THE MARKET

-

Avigna Industrial & Logistics Park, a subsidiary of Chennai-based Avigna Group, will invest Rs 500-600 crore to develop a 4 million sq ft Grade A warehousing facility in Hoskote Karnataka. The industrial park will feature Grade A warehouse capacity to meet the most technologically advanced supply chain management requirements. Avigna intends to hand over the first 1 million square feet at Hoskote Industrial Park in 2022-23.

-

GEODIS, a global transportation and logistics service company, has leased a 30,000-square-foot multi-use facility at the LOGOS Logistics Estate in Buhari, north of Delhi. The first operation with LOGOS is the Buhari facility, which will be operating by March 2022. The company is also in negotiations with LOGOS about opening more of these facilities in the Asia Pacific.

-

Sites Logistic Solutions, a Palakkad-based tech-enabled comprehensive supply chain firm, is growing into Europe, the United States, Canada, Indonesia, and Vietnam. As a result, it intends to increase its international revenue share to 20%.

- Flock Freight, sponsored by SoftBank, has raised $215 million in a fresh fundraising round to promote its load-matching technology, allowing shippers to group their goods on trucks to avoid freight hubs. The new capital will enable the six-year-old company to hire 300 more staff next year and develop its shipment-pooling algorithm and machine-learning technology to process more shipments per minute.

- LaserShip Inc. agreed to acquire Western U.S. rival OnTrac Logistics Inc. in a $1.3 billion deal to expand the local last-mile delivery specialist's reach across a broader section of the United States at a time of booming e-commerce demand. The acquisition would establish a network that would enable two-day shipment to 74 percent of the U.S. population.

MARKET SEGMENTATION

This research report on the global project logistics market has been segmented and sub-segmented based on service, end-user, and region.

By Service

- Transportation

- Forwarding

- Inventory Management and Warehousing

- Other Value-added Services

By End-User

- Oil and Gas

- Mining and Quarrying

- Energy and Power

- Construction

- Manufacturing

- Others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What factors are driving the growth of the global Project Logistics Market?

The global Project Logistics Market is driven by factors such as increasing infrastructure development, growth in the renewable energy sector, rising investments in the oil & gas industry, and the globalization of supply chains. Additionally, the need for customized logistics solutions for complex projects is also contributing to market growth.

What role does technology play in the Project Logistics Market?

Technology plays a crucial role in enhancing the efficiency and effectiveness of project logistics. Innovations such as IoT, AI, blockchain, and advanced tracking systems enable real-time monitoring, predictive analytics, and better coordination across the supply chain. These technologies help in optimizing routes, reducing costs, improving transparency, and ensuring the safe handling of complex cargo.

How does the Project Logistics Market differ from traditional logistics markets?

The Project Logistics Market differs from traditional logistics markets in its focus on handling complex, large-scale projects that require specialized equipment, customized transport solutions, and meticulous planning. Unlike traditional logistics, which deals with standardized cargo and regular shipments, project logistics often involves irregular, one-off shipments of heavy, oversized, or high-value goods, requiring a higher level of expertise and coordination.

What are the emerging trends in the Project Logistics Market?

Emerging trends in the Project Logistics Market include the increased use of digitalization and automation, a growing emphasis on sustainability and green logistics practices, and the rising importance of risk management and compliance in cross-border projects. Additionally, there is a trend towards greater collaboration and partnerships among logistics providers to offer integrated, end-to-end solutions for complex projects.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com