Global Pumps Market Size, Share, Trends & Growth Forecast Report, Segmented By Type (Centrifugal Pumps, Positive Displacement Pump, Reciprocating Pump) Application (Agriculture, Water & Wastewater, Mining, Oil & Gas, Infrastructure Application (HDD), Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis from 2025 to 2033

Global Pumps Market Size

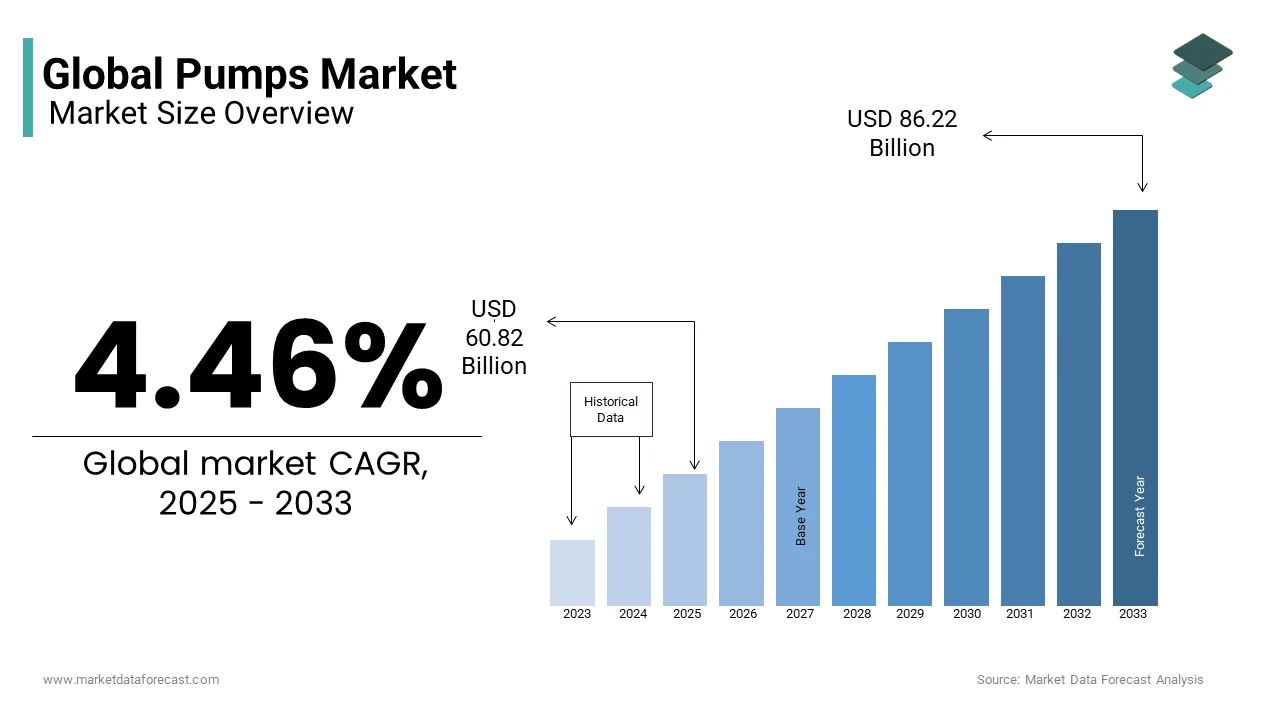

The global pumps market size was valued at USD 58.22 billion in 2024 and is anticipated to reach USD 60.82 billion in 2025 from USD 86.22 billion by 2033, growing at a CAGR of 4.46% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Industrial Expansion and Automation

Industrial growth is a primary driver of the pumps market, with sectors like oil & gas, chemicals, and manufacturing relying heavily on efficient pumping systems. According to the International Energy Agency, global energy demand is projected to grow by 50% by 2050 by necessitating robust infrastructure for fluid transportation. In the oil & gas sector alone, pumps are used in upstream, midstream, and downstream operations, with the U.S. Energy Information Administration reporting that over 70% of pipelines require high-performance centrifugal pumps. Automation further amplifies demand. The rise of Industry 4.0 has led to increased adoption of smart pumps equipped with IoT sensors for real-time monitoring. These advancements ensure that pumps remain indispensable in modern industrial ecosystems.

Water Management and Infrastructure Development

Water scarcity and aging infrastructure drive significant demand for pumps in municipal and agricultural applications. As per the World Health Organization, 2 billion people globally lack access to safe drinking water by creating immense opportunities for pump manufacturers. Governments worldwide are investing in desalination plants, sewage systems, and irrigation networks. For example, Saudi Arabia plans to invest $50 billion in desalination projects by 2030 by requiring large-scale pumping solutions. Additionally, urbanization fuels demand for water distribution systems. The United Nations reports that 68% of the global population will live in urban areas by 2050 by necessitating upgrades to existing infrastructure.

MARKET RESTRAINTS

High Energy Consumption and Operational Costs

Energy consumption poses a significant challenge to the pumps market, as inefficient systems contribute to rising operational costs. According to the U.S. Department of Energy, pumps account for 20% of global electricity usage, with many systems operating below optimal efficiency. This inefficiency not only increases utility bills but also exacerbates carbon emissions, drawing scrutiny from regulatory bodies. Retrofitting outdated systems with energy-efficient alternatives requires substantial investment, deterring small-scale operators. As per a report by the International Energy Agency, replacing traditional pumps with variable frequency drives (VFDs) can reduce energy consumption by 30-50% , yet adoption remains slow due to upfront costs.

Supply Chain Disruptions and Raw Material Volatility

Supply chain disruptions and volatile raw material prices hinder market growth for manufacturers reliant on metals like stainless steel and cast iron. This volatility forces companies to either absorb higher costs or pass them on to consumers by reducing affordability. Additionally, labor shortages and port congestion exacerbate delays, impacting production timelines. For instance, the American Supply Chain Association reported that 40% of manufacturers faced delays exceeding six months in 2023.

MARKET OPPORTUNITIES

Smart Pumping Solutions and IoT Integration

The integration of IoT and AI technologies into pumping systems presents a transformative opportunity for the market. Smart pumps equipped with sensors can monitor performance metrics such as flow rate, pressure, and temperature by enabling real-time adjustments to optimize operations. For example, Grundfos introduced IoT-enabled pumps in 2023 by achieving a 20% reduction in energy consumption for its clients in the water treatment sector.

Renewable Energy Projects

Renewable energy initiatives create significant opportunities for pump manufacturers in solar and wind power generation. According to the International Renewable Energy Agency, global solar capacity is projected to quadruple by 2050 by requiring advanced pumping solutions for cooling and heat transfer systems. Solar thermal plants, for instance, rely on high-efficiency circulating pumps to maintain optimal operating temperatures. Additionally, offshore wind farms drive demand for submersible pumps used in turbine cooling and foundation stabilization. The Global Wind Energy Council reports that 12,000 kilometers of new pipelines annually are needed to support renewable energy projects, creating opportunities for durable and corrosion-resistant pumps.

MARKET CHALLENGES

Stringent Regulatory Standards

The regulatory standards aimed at ensuring safety and environmental compliance pose significant hurdles for pump manufacturers. The International Organization for Standardization mandates rigorous testing and certification processes, which can increase production costs by up to 20%. For instance, pumps used in hazardous environments must adhere to API 610 standards, which is requiring advanced materials and quality control measures. Smaller players often struggle to meet these requirements, which is limiting market entry. Additionally, evolving regulations, such as the EU’s ban on certain plastic components, force companies to invest in R&D for compliant designs.

Competition from Alternative Technologies

Emerging technologies threaten traditional pump manufacturers, intensifying competition. Magnetic drive pumps, for example, are gaining traction due to their leak-proof design and reduced maintenance requirements. Additionally, innovations in bioplastics challenge established players. However, these alternatives often come at a premium, deterring cost-sensitive customers. Manufacturers must balance innovation with affordability to remain competitive in this evolving landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.31% |

|

Segments Covered |

By Type, End Use, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

SLB, Ingersoll Rand, The Weir Group PLC, Vaughan Company, KSB SE & Co. KGaA Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation., ITT INC., EBARA CORPORATION., IWAKI CO., LTD., Sulzer Ltd, SPX FLOW, Inc |

SEGMENTAL ANALYSIS

By Type Insights

The centrifugal pumps segment was the largest and held 60.2% of the pumps market share in 2024 with the adoption is driven by their versatility and efficiency in handling large volumes of fluids across diverse industries. The oil & gas sector, for instance, relies heavily on centrifugal pumps for upstream and downstream operations, with the International Energy Agency reporting that 70% of pipeline systems utilize centrifugal technology. Urbanization further amplifies demand. The United Nations projects that 68% of the global population will live in urban areas by 2050 with robust water distribution and wastewater management systems. Municipalities favor centrifugal pumps due to their high flow rates and low maintenance costs. Additionally, advancements in energy-efficient designs, such as variable frequency drives (VFDs), have reduced operational costs by 30-50%, as per the U.S. Department of Energy.

The positive displacement pumps segment is likely to register a CAGR of 7.5% in the next coming years. The growth of the segment can be driven by their ability to handle viscous fluids and high-pressure applications, which is making them indispensable in industries like chemicals, pharmaceuticals, and food processing. For example, the chemical industry requires precise dosing systems, with the American Chemistry Council estimating that 40% of chemical production processes rely on positive displacement pumps. Additionally, innovations in pump design, such as magnetically driven models, enhance safety and reliability.

By End Use Insights

The water & wastewater segment led the pumps market with 30.4% of total share in 2024 with the global water scarcity and aging infrastructure. According to the World Health Organization, 2 billion people lack access to safe drinking water by creating immense opportunities for pump manufacturers. Governments worldwide are investing in desalination plants, sewage systems, and irrigation networks. Urbanization further fuels demand, with the United Nations projecting that 68% of the global population will live in cities by 2050, which is necessitating upgrades to water distribution systems.

The horizontal directional drilling (HDD) segment is likely to register a CAGR of 8.2% during the forecast period. The growth of the segment is driven by rising investments in underground utility installations, such as pipelines and cables. The Global Infrastructure Hub estimates that $94 trillion is needed globally for infrastructure development by 2040 by creating significant demand for HDD pumps. Additionally, urbanization and environmental regulations favor trenchless technologies by reducing surface disruption. For example, the European Union mandates eco-friendly construction methods.

REGIONAL ANALYSIS

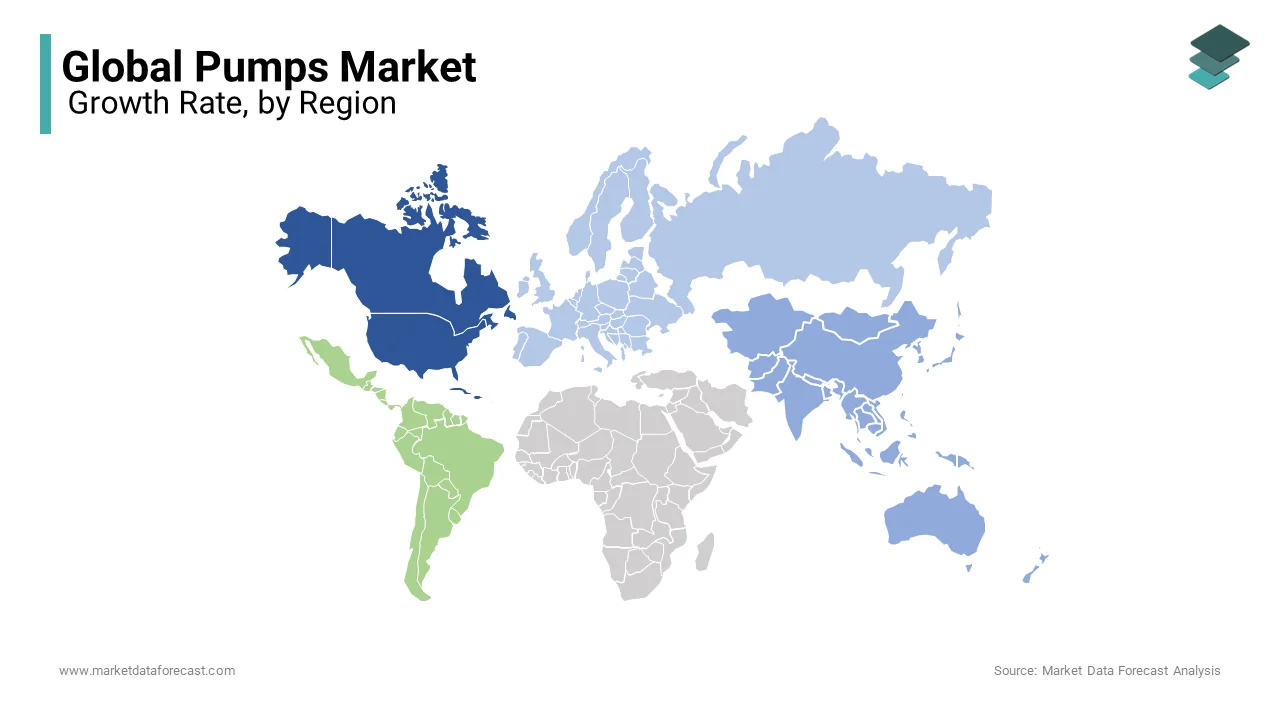

North America was the largest contributor with 25.5% of the global pumps market share in 2024. The region’s dominance is driven by its focus on sustainability and technological innovation. The American Society of Mechanical Engineers states that 30% of industrial energy consumption is linked to pump operations by prompting investments in energy-efficient designs. Sustainability initiatives further shape the market. Additionally, shale gas exploration boosts demand for high-performance pumps by ensuring steady market expansion despite mature conditions.

Europe pumps market held 20.3% of the share in 2024. Germany leads with investments in green infrastructure, including energy-efficient pumps for water treatment and renewable energy projects. The European Union’s Energy Efficiency Directive mandates replacing outdated systems by driving adoption of advanced technologies. Industrial demand remains strong, with the chemical sector requiring reliable pumping solutions.

Asia-Pacific is growing lucratively with prominent growth opportunities. China leads the market by producing nearly 30% of global centrifugal pumps for energy and infrastructure projects. India follows, with Smart Cities Mission projects driving demand for water and sewage systems.

Latin America is likely to grow steadily in the next coming years. Urbanization and agricultural expansion drive demand for water and wastewater pumps. The Inter-American Development Bank reports that 60% of rural areas lack reliable water infrastructure, which is creating opportunities for growth.

The Middle East and Africa is deemed to have prominent growth opportunities in the next coming years. Saudi Arabia and the UAE lead, investing heavily in desalination plants requiring large-scale pumping solutions. Africa’s urbanization and rural development create additional opportunities.

KEY MARKET PLAYERS

SLB, Ingersoll Rand, The Weir Group PLC, Vaughan Company, KSB SE & Co. KGaA Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation., ITT INC., EBARA CORPORATION., IWAKI CO., LTD., Sulzer Ltd, SPX FLOW, Inc. are the market players that are dominating the global pumps market.

Top Players in the Pumps Market

Grundfos

Grundfos is a global leader in the pumps market, renowned for its innovative and energy-efficient solutions. The company specializes in centrifugal pumps, submersible pumps, and smart pumping systems, which is catering to industries like water treatment, HVAC, and agriculture. Grundfos emphasizes sustainability, with products designed to reduce energy consumption by up to 50% , as per the U.S. Department of Energy. Its IoT-enabled pumps provide real-time monitoring and predictive maintenance, making them a preferred choice for smart infrastructure projects.

Xylem Inc.

Xylem Inc. dominates the water & wastewater segment by offering advanced pumping solutions for municipal and industrial applications. The company focuses on sustainability, introducing eco-friendly designs that align with global environmental goals. It also collaborates with governments on large-scale desalination and wastewater treatment projects, ensuring steady demand. Xylem’s commitment to digital transformation and energy efficiency positions it as a key player in modernizing water infrastructure globally.

Sulzer Ltd.

Sulzer Ltd. specializes in high-performance pumps for demanding applications in oil & gas, chemicals, and mining. The company leverages advanced materials and engineering to produce corrosion-resistant and energy-efficient pumps. Sulzer’s focus on customization allows it to meet specific client needs, particularly in offshore drilling and petrochemical processing. According to Allied Market Research, Sulzer’s investments in R&D have resulted in breakthroughs like magnetically driven pumps, which reduce leakage risks by 90%.

Top Strategies Used by Key Market Participants

Emphasis on Sustainability and Energy Efficiency

Leading players prioritize sustainability to meet regulatory standards and consumer expectations. For instance, Grundfos introduced energy-efficient pumps that reduce electricity usage by 50% by aligning with global decarbonization goals. According to the International Energy Agency, pumps account for 20% of industrial energy consumption, making energy savings a critical competitive advantage. Companies are also adopting eco-friendly materials and recyclable components to appeal to environmentally conscious buyers by ensuring compliance with regulations like the EU’s Green Deal while enhancing brand reputation.

Strategic Acquisitions and Partnerships

Acquisitions and partnerships are pivotal strategies for expanding capabilities and market reach. In April 2024, Xylem acquired a leading IoT solutions provider, enabling it to integrate advanced analytics into its pumping systems. Similarly, Sulzer partnered with renewable energy firms to develop pumps tailored for solar thermal plants. These collaborations not only enhance product portfolios but also position companies as innovators in emerging sectors like green energy and smart infrastructure, which is driving long-term growth.

Investment in Digital Transformation

Digital transformation is reshaping the pumps market, with companies investing in IoT, AI, and predictive maintenance technologies. By leveraging digital tools, companies can optimize operations, reduce costs, and enhance customer satisfaction.

COMPETITION OVERVIEW

The pumps market is highly competitive, characterized by a mix of established giants, mid-tier players, and emerging innovators vying for dominance. Large-scale manufacturers like Grundfos and Xylem dominate the water & wastewater segment by leveraging their expertise in energy-efficient and IoT-enabled solutions. Meanwhile, Sulzer Ltd. leads in industrial applications, focusing on high-performance pumps for oil & gas and mining sectors. Regional dynamics shape competition, with Asia-Pacific favoring cost-effective options and Europe prioritizing sustainability.

Technological advancements, such as smart pumping systems, are intensifying rivalry, as companies strive to offer cutting-edge solutions. Regulatory pressures further complicate the landscape, with stringent environmental standards forcing smaller players to innovate or exit the market. Despite these challenges, the market remains lucrative, driven by urbanization, infrastructure development, and renewable energy projects.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Xylem Inc. acquired SmartFlow Technologies, an IoT solutions provider, enabling the integration of predictive maintenance features into its pumping systems and enhancing its competitiveness in smart infrastructure projects.

- In November 2023, Grundfos launched a line of energy-efficient submersible pumps designed for agricultural irrigation, reducing energy consumption by 30% and capturing significant demand in water-scarce regions like Africa and India.

- In August 2023, Sulzer Ltd. partnered with renewable energy firms to co-develop specialized pumps for solar thermal plants, positioning itself as a key supplier in the growing green energy sector.

- In December 2022, Xylem expanded its manufacturing facility in Germany, focusing on eco-friendly materials to meet EU Green Deal requirements and strengthening its position in Europe’s sustainable infrastructure initiatives.

- In October 2022, Grundfos introduced a new range of IoT-enabled pumps for municipal water distribution systems, which is achieving a 20% reduction in operational costs for clients and its dominance in smart water management solutions.

MARKET SEGMENTATION

This research report on the global pumps market is segmented and sub-segmented into the following categories.

By Type

- Centrifugal Pumps

-

- Centrifugal Pumps

- Single Stage

- Multistage

- Centrifugal Pumps

- Radial Flow Pump

- Mixed Flow Pump

- Axial Flow Pump

- Centrifugal Pumps

-

- Positive Displacement Pump

- Rotary Pump

-

-

- Gear Pump

- Screw Pump

- Vane Pump

- Lobe Pump

-

- Others

-

- Reciprocating Pump

- Diaphragm Pump

- Piston Pump

- Plunger Pump

By End Use

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

- Others

By Region

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East And Africa

Frequently Asked Questions

What are industrial pumps, and where are they commonly used?

Pumps are mechanical devices that move fluids by mechanical action and are essential in industries like oil & gas, water treatment, chemical processing, construction, mining, and HVAC systems

What factors are driving the growth of the global pumps market?

Key drivers include rising infrastructure development, increased demand for clean water, expanding oil & gas operations, and rapid urbanization in developing economies, leading to stronger utility and municipal investments.

What are the major types of pumps dominating the market?

The market is primarily divided into centrifugal pumps (widely used for water, chemicals, and wastewater), and positive displacement pumps (preferred for high-viscosity fluids, such as in oil, food, or pharmaceutical sectors).

What challenges does the global pumps market face?

Challenges include high energy consumption, fluctuating raw material costs, the need for frequent maintenance, and growing competition from low-cost regional manufacturers in Asia.

What future trends are shaping the global pumps market?

Trends include the adoption of smart pumps with IoT integration, a focus on energy-efficient designs, predictive maintenance solutions, and customized pump systems tailored to niche industrial applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com