Global Breast Pumps Market Size, Share, Trends & Growth Forecast Report By Product Type (Closed and Open), Application (Personal Use Pumps, Healthcare/hospital Grade Pumps), Technology (Battery Powered, Manual and Electric) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Breast Pumps Market Size

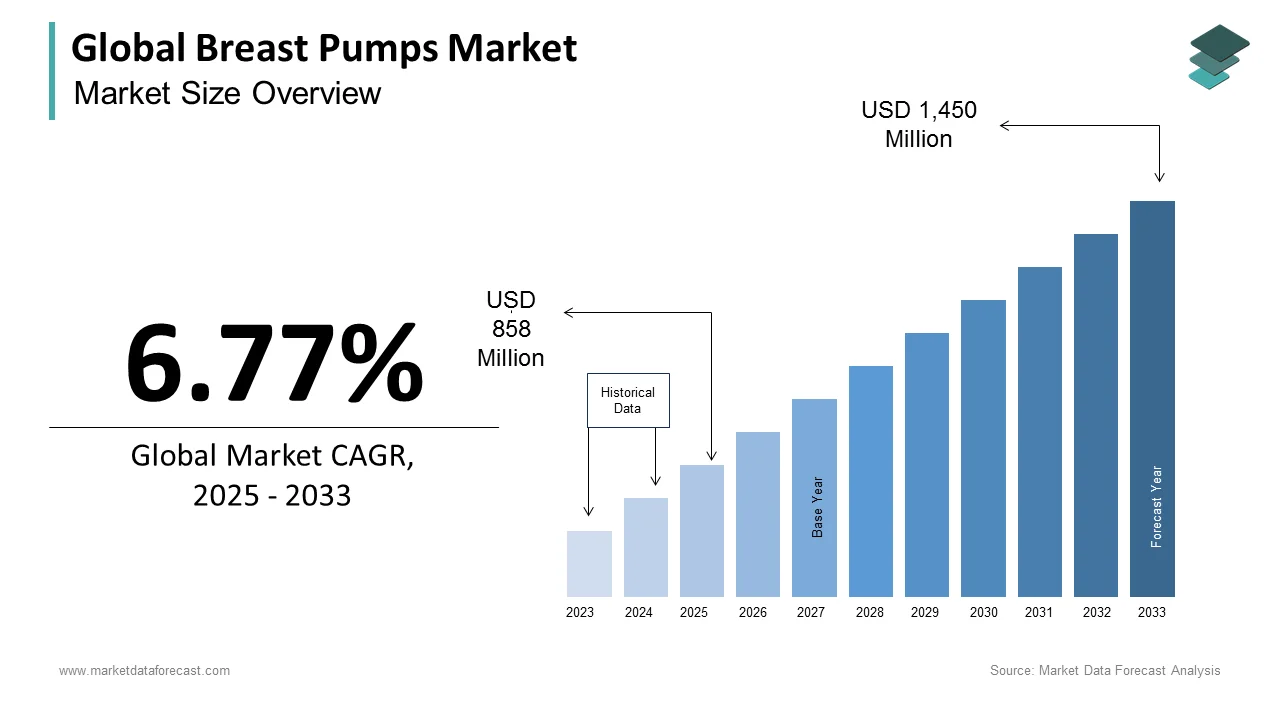

The size of the global breast pumps market was worth USD 804 million in 2024. The global market is anticipated to grow at a CAGR of 6.77% from 2025 to 2033 and be worth USD 1,450 million by 2033 from USD 858 million in 2025.

Breast pumps are the devices used to extract milk from the breasts of lactating women. These may be manual devices powered by hand movements, or automatic devices that work by electricity. Breast pumps are also used to maintain or enhance milk production and relieve swollen breasts and blocked milk ducts. Working women highly prefer breast pumps as these devices are convenient to use and store milk in case they are away from the baby. Breast pumps are an excellent solution for lactating problems, breastfeeding in public places, multiple births, adopted babies, completion of maternity leave, and others.

MARKET DRIVERS

The growing birth rates in developing countries and increasing breastfeeding rates worldwide are majorly promoting the growth of the breast pumps market.

The increasing population across the world and the significantly growing number of pregnant women worldwide are majorly driving the adoption of breast pumps. The increasing advantages of breast pumps kike enhancing milk production, insufficient maternity leave periods, convenience, and affordability, are some prominent factors driving the global market growth. The increasing awareness among the people regarding the benefits of breast pumps fuels the market expansion. The growing government initiatives for supporting the adoption of breast pumps among people by creating awareness regarding the necessity of breast milk for babies is expected to propel the market revenue. For Instance, the Baby Friendly Hospital Initiative (BFHI) promotes breastfeeding success with evidence established by UNICEF and WHO to increase breastfeeding rates and create awareness among families. The increasing number of working women in all sectors worldwide and the growing healthcare infrastructure are escalating the global breast pump market expansion. According to the International Labor Organization (ILO) statistics in 2024, women's present labor force participation is under 47%, which is expected to increase in the upcoming years. Most working mothers are choosing breast pumps to balance work and breastfeeding. WHO and government organizations recommend that women breastfeed for a minimum of the first six months of infant life. All these factors encourage working mothers to adopt breast pumps as the milk can be stored until they return from work, augmenting market growth.

The growing disposable income in emerging markets and the increase in the number of working mothers are further supporting the global breast pump market growth.

With the growing disposable incomes of people and the increasing number of working mothers, prominent market strategies are all enhancing the adoption of breast pumps by raising the market value. The presence of breastfeeding complications like unattachment, breast engorgement, and nipple pain in women is leading to accelerated market share due to broad adoption.

Technological advancements in breast pump design are contributing to the expansion of the global market.

The increasing technological advancements in the healthcare industry are enhancing product launches, which is anticipated to provide significant opportunities for market expansion during the forecast period. Market players are investing in research activities to enhance the effectiveness and design of breast pumps, which are convenient and comfortable to use and drive global market growth. The increasing marketing strategies by the manufacturers, where social media is providing awareness among people across the globe, enhance the adoption of breast pumps by escalating the market growth.

MARKET RESTRAINTS

High prices for breast pumps are a significant factor restraining the growth of the global breast pump market due to a reduction in adoption rate.

The automation breast pumps are expensive, which may be difficult to afford for people from low economic status, limiting the expansion of the global market size. The availability of breast pumps is low at retail stores and pharmacies, especially in developing and underdeveloped countries, which is expected to hamper the market growth worldwide. Most people prefer direct breastfeeding to breast pumps as they do not offer the same immune system to the baby, which hinders the market share due to reduced adoption.

The presence of various challenges is impeding the market growth of breast pumps. The notable social and ethical humiliations of using breast pumps, especially in underdeveloped and developing countries, limit the adoption rate across the globe. The chances of contamination are high while storing the milk with foreign substances, which is expected to impede the market growth. Privacy concerns are estimated to be a key challenge for the adoption of breast pumps. It may concern the use of breast pumps in public places.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Pigeon Group (Pigeon Corporation), Koninklijke Philips N.V., Ameda, Inc., Ardo Medical Ag, and Evenflo Feeding, Inc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The closed segment held the largest share of 68.3% of the global breast pump market revenue in 2024. A breast pump with a milk barrier is known as a closed-system breast pump, where the barrier prevents the milk from overflowing and leaking with a hygiene route. The hygiene process of the closed breast pump is driving the segment growth. The closed breast pumps are prone to contamination and fungus formation. The open systems do not contain barriers and can leak into the pump machinery. However, the open breast pumps are cheaper than the closed breast pumps.

By Application Insights

The hospital-grade pumps segment witnessed the most significant global breast pump market revenue share in 2024. These pumps have powerful motors and are primarily used in hospitals. They can also be rented monthly for personal use, which boosts segment growth. These pumps are closed breast pumps, fueling the adoption of hospital-grade pumps and raising the market revenue. Due to the presence of barriers, there is a low risk of contamination, and they are safe for multiple users.

By Technology Insights

The electric pumps segment dominated the global breast pumps market in 2024 and is anticipated to grow fastest during the forecast period. Motors and supply suction power electric pumps through plastic tubing that fits over the nipple. The electric pumps provide more suction, which pumps faster and allows the pumping of both breasts at the same time, driving the segment growth. Most working mothers prefer electric pumps to save time as they extract more milk.

Battery-powered pumps are estimated to grow prominently during the forecast period as they are convenient to carry and do not depend on external power like electricity.

REGIONAL ANALYSIS

North American region held the largest share in the global breast pump market revenue in 2024 and is anticipated to maintain growth during the forecast period.

The increasing number of working women, growing healthcare expenditure and technological advancements, and the presence of advanced healthcare infrastructure in the U.S. and Canada are majorly driving the regional market growth. The growing government initiatives supporting the adoption of breast pumps among people and the presence of prominent market players in the region fuel the expansion of the regional market. Increasing product launches and company collaborations in the North American region positively impact market share growth.

European region is expected to have significant CAGR over the forecast period due to increasing birth rate and rising women employment in the region. The UK breast pumps market is in initial stage of growth with more opportunities in the forecast period due to growing support from government and rising awareness among the people are expected to drive the market growth in the upcoming years.

Asia Pacific region is estimated to have the fastest growth with prominent CAGR during the forecast period due to increasing advancements in healthcare, the establishment of franchises of leading market players, and a growing population.

KEY MARKET PLAYERS

Companies playing a leading role in the global breast pump market are Pigeon Group (Pigeon Corporation), Koninklijke Philips N.V., Ameda, Inc., Ardo Medical Ag, and Evenflo Feeding, Inc. Other players in the market are Mayborn Group Limited (Shanghai Jahwa Co. Ltd), Spectra Baby USA, Albert Manufacturing USA (Albert Group) and Hygeia Health.

RECENT HAPPENINGS IN THE MARKET

- In April 2022, Ardo Medical Inc. launched the Ardo Alyssa breast pump with 250mmHG double pumping. It is a hospital-grade breast pump with NICU capabilities.

- In November 2023, Pigeon officially launched a second-generation GoMini Electric Breast Pump known as GoMini Plus.

- In January 2023, Willow Innovations, Inc. launched its first breast pump companion app, Willow 3.0, for Apple Watch. This app allows breastfeeding parents to track, control, and view their pumping sessions easily.

MARKET SEGMENTATION

This research report on the global breast pumps market has been segmented & sub-segmented based on the product type, application, technology, and region.

By Product Type

- Closed

- Open

By Application

- Personal Use Pumps

- Healthcare/Hospital-Grade Pumps

By Technology

- Battery Powered

- Manual

- Electric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com