Global Compression Therapy Market Size, Share, Trends & Growth Forecast Report By Product (Garments (Stockings, Bandages & Wraps and Other Garments), Braces and Pumps), Technique, Application, Distribution Channel, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Compression Therapy Market Size

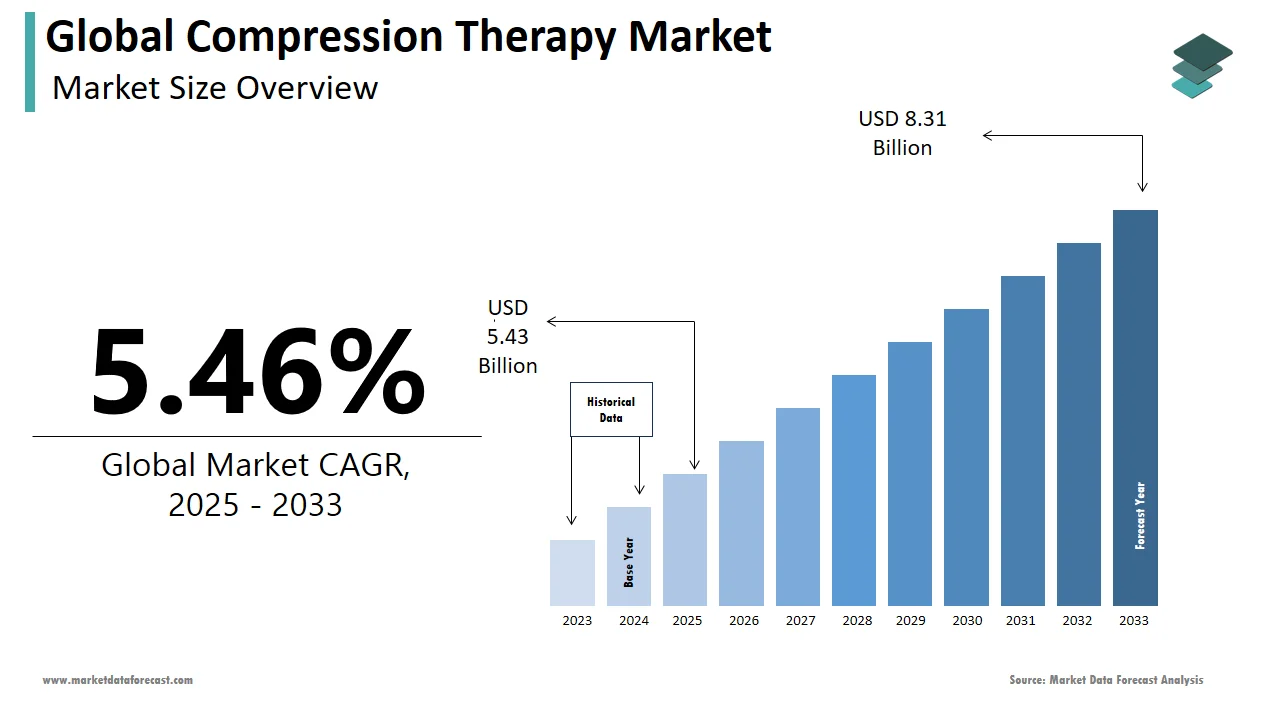

The global compression therapy market was worth US$ 5.15 billion in 2024 and is anticipated to reach a valuation of US$ 8.31 billion by 2033 from US$ 5.43 billion in 2025, and it is predicted to register a CAGR of 5.46% during the forecast period 2025-2033.

Compression therapy is a frequent treatment to improve blood flow in your lower legs. Typically, elastic stockings or wraps are used. Your legs, ankles, and feet are compressed by the elastic. This aids in preventing fluid and blood build-up and blood pooling in specific locations. It is a successful treatment for swelling and pain brought on by circulatory disorders such as varicose veins, chronic venous insufficiency, deep vein thrombosis, edema, leg ulcers, wounds, orthostatic hypertension, etc. Compression therapy equipment comes in various forms and can be purchased without a prescription or over the counter. The therapy equipment includes compression garments and stockings, bandages, wraps, and inflatable devices.

MARKET DRIVERS

The growing geriatric population worldwide is majorly propelling the compression therapy market.

The rising geriatric population has led to increased conditions that need compression therapy assistance. Problems like varicose veins, chronic venous insufficiency, deep vein thrombosis, edema, leg ulcers, wounds, and orthostatic hypertension commonly occur in older people. According to the U.N., there were around 703 million people aged 65 or above in 2019. the world geriatric population is expected to reach 1.5 billion by 2050, doubling the current percentage. Additionally, the increasing rates of surgical procedures needing compression therapy during rehabilitation drive the growth of the compression therapy market. Furthermore, the rising investments and new markets in compression therapy are supporting its growth. The increasing concerns for better healthcare systems and the development of disposable incomes among populations are raising the market for global compression therapy.

The growing cancer patient population worldwide promotes compression therapy market growth.

Dissection of lymph nodes is a common component of cancer treatment, particularly for breast and prostate tumors. This interferes with the body's lymphatic system's filtration process. As a result, lymph fluid builds up and results in lymphedema and severe swelling of the tissues or limbs. According to the National Institutes of Health, over 250 million people have this illness worldwide. Compression therapy is one of the most often used lymphedema treatment methods, and as the prevalence of this ailment rises, the demand for these therapies will also increase.

Additionally, the growing cases of diabetes and cardiac problems leading to leg ulcers and requiring treatments support the growth of the market. Compression therapy helps muscle recovery and reduces soreness in the body. Sports athletes use it often to regulate the blood flow in the body before or after exercising. Additionally, dancers and professional gymnasts also use compression therapies to relieve injured body parts and muscle inflammation due to excessive pressure on the muscles. Compression therapies are also used before and after amputation to regulate residual limb blood circulation. Additionally, professional occupations with extended standing and working hours may require compression therapy, like doctors, teachers, food services, etc. The growing cases of orthopedic surgeries due to rising musculoskeletal problems that need compression therapy drive the demand for the market.

MARKET RESTRAINTS

The market is restrained due to the lack of standard rules and procedures or guidelines for using compression therapy. The FDA has not formed any standards for the production and usage of compression materials and treatments. Therefore, the procedures do not successfully accommodate for too much credibility leading to a hindrance to the compression therapy market growth. Additionally, compression therapy can cause occasional skin irritation and pain, leading to another drawback to the market.

Impact of COVID-19 on the Global Compression Therapy Market

There have been difficult times because of the COVID-19 pandemic in many different places. All businesses suffered losses because of the stringent lockdowns and quarantines imposed due to the limitations on the production and supply of commodities. Access to even the most necessities of daily life became quite complicated. In addition, hospitals shifted their attention to providing care for COVID-19 patients due to the pandemic, which also substantially impacted the healthcare industry. As a result, additional health department activities were regularly postponed.

As all the attention shifted towards the COVID-19 patients and the hospitals faced a crisis, it became challenging to handle the influx of patients, leading to a scarcity of hospital resources and more hospital expenditure, especially for private hospitals, as they needed to buy more consumables, equipment, resources and even workforce. Furthermore, the orthopedic industry also suffered as the orthopedics staff was assigned to the COVID-19 cases, and the surgical procedures that weren't deemed extremely urgent were postponed, thus causing a shortage of staff and treatments. As a result, the market for compression devices faced losses as the number of patients and priority toward patients declined. However, as the COVID-19 situation subsidizes, the market is expected to recover from the loss.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.46% |

|

Segments Covered |

By Product, Technique, Application, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M Company, ConvaTec Inc., ArjoHuntleigh, Julius Zorn GmbH, BSN medical, Medi GmbH & Co. K.G., Tactile Medical, SIGVARIS, Sanyleg S.r.l., and DJO Global, Inc., Medtronic plc, Smith & Nephew plc, Spectrum Healthcare, Bio Compression Systems Inc., Paul Hartmann AG, Gottfried Medical Inc., and Colfax Corp, and Others. |

SEGMENTAL ANALYSIS

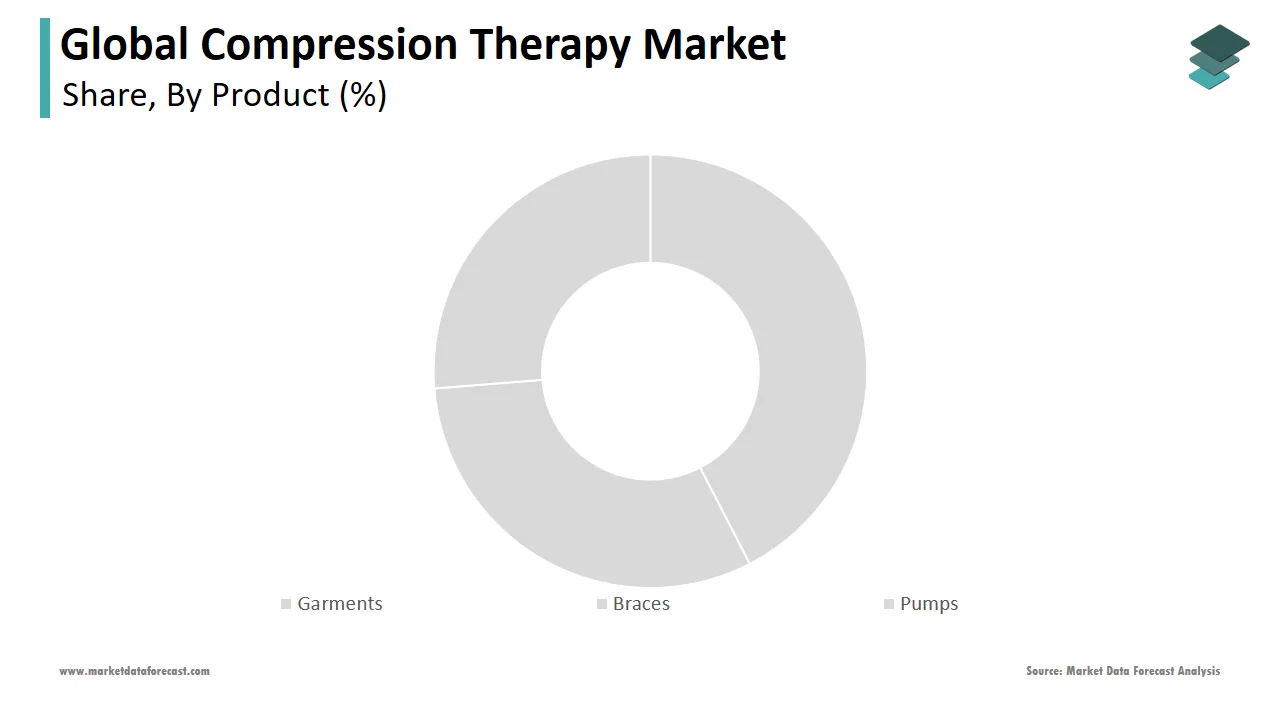

By Product Insights

Based on the product, the compression garments segment is currently dominating the market and is expected to continue growing throughout the forecast period. This segment's dominance is due to the product's wide range of uses. The product is used for several conditions like managing several chronic illnesses and treating edema, lymphedema, DVT, and varicose veins.

Compression bandages are expected to dominate the market during the forecast period due to the high usage of bandages for varicose veins, edema, etc. In addition, the high tensile strength and elasticity support the segment's growth. Additionally, the different types of bandages, like short- and long-stretch bandages, lead to more demand for the segment.

By Technique Insights

Based on the technique, the static compression therapy segment is expected to dominate the compression therapy market due to its ease of application and efficiency. The sports application of compression therapy is very high as professionals need it in surgical procedures, injuries, pre-game workouts, and practice to prevent many conditions like edema and leg pain. In addition, static compression therapy is the fastest way to provide relief in conditions pushing the market to grow.

Dynamic technology is recently gaining traction due to its benefits like external control, sustained effects, and venous return. The newer technological additions to the dynamic type of compression support the segment. This technology is often used for deep vein thrombosis; growing cases support segment growth.

By Application Insights

Based on the application, the lymphedema treatment segment accounted for a significant share of the global compression therapy market in 2022. The prevalence of lymphedema treatment has led the segment to grow. It is expected to dominate the market during the forecast period due to increased lymphedema cases and the need for lymphedema treatments. These two lymphatic and soft tissue problems occur after the first 18 months of therapy in neck and head cancers. Therefore, the repeated occurrence of the problem supports the segment's dominance in the market.

The growing cases of diabetes leading to leg ulcers and deep vein thrombosis support the growth of the segments during the forecast period. According to NIH, diabetic foot ulcer cases are between 9.1 to 26.1 million annually, and around 900,000 people in the US are potentially affected by deep vein thrombosis in a year.

By Distribution Channel Insights

Based on the distribution channel, the e-commerce platforms segment is expected to grow significantly during the forecast period. The popularity and usability of E-commerce technologies are to blame for this domination. Additionally, the E-commerce platform's accessibility, usability, rapid acceptance of new technologies, flexibility, and adaptability encourage the growth of this sector. Furthermore, the E-commerce method is very convenient because it can be accessed from anywhere at any time and is affordable to the population, making it a preferred section.

The hospitals and clinics segment is also expected to have grown during the forecast period due to the rising need for compression therapies in hospitals for surgeries and treatment procedures. Additionally, the high influx of patients in hospitals and rising healthcare investments and advancements support the segment's growth.

REGIONAL ANALYSIS

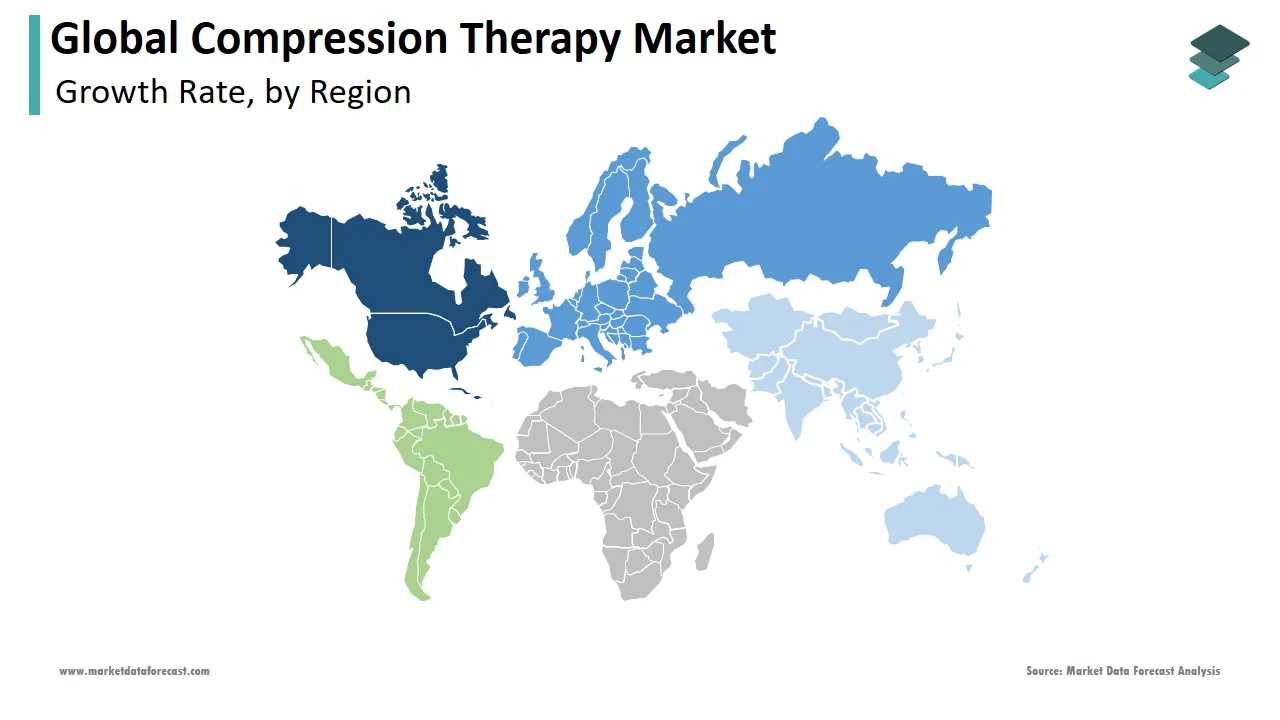

The compression therapy market in North America is expected to be the most significant in the global market during the forecast period, supported by coordinated private and public sector investment in healthcare research and development. Additionally, it is predicted that the region will dominate the compression therapy market share during the forecast period due to the growing elderly population and the strong presence of international firms. This is primarily due to the increase in orthopedic and spinal procedures, lymphedema, varicose veins, and DVT cases, the frequency of sports injuries, and numerous compression therapy product producers in countries like the U.S. and Canada. Therefore, the most considerable portion of the market for compression therapy is anticipated to come from North America.

The creation and release of novel products by regional players will serve as Europe compression therapy market main growth engine in countries like the U.K., Italy, and France. On the other hand, the constantly rising number of patients with venous and lymphatic diseases is anticipated to bode well for the Asia-Pacific compression therapy market in countries like China, India, South Korea, and Japan.

KEY MARKET PLAYERS

3M Company, ConvaTec Inc., ArjoHuntleigh, Julius Zorn GmbH, BSN medical, Medi GmbH & Co. K.G., Tactile Medical, SIGVARIS, Sanyleg S.r.l., and DJO Global, Inc., Medtronic plc, Smith & Nephew plc, Spectrum Healthcare, Bio Compression Systems Inc., Paul Hartmann AG, Gottfried Medical Inc., and Colfax Corp. are some of the noteworthy players in the global compression therapy market.

RECENT MARKET DEVELOPMENTS

- AIROS released its updated AIROS 6 Sequential Compression Therapy product and Arm Plus garments in May 2020, which are FDA-approved for treating lymphedema in the chest, shoulder, arm, and back.

- In 2018, Tactile Systems Technologies, Inc. agreed to purchase patents relating to pneumatic compression device technology from Wright Therapy Products, Inc.

- Tactile Medical released the Flexitouch Plus System in 2018. The garments for the Flexitouch Plus device have been redesigned to offer better fit, comfort, and coverage, as well as make it easier for patients to put on and take off.

- Koya Medical, a company that aims at innovative lymphatic and venous care, has been selected to present at the Academy of Managed Care Pharmacy (AMCP) conference about NILE, a clinical study comparing novel wearable compression technology to pneumatic compression devices, on March 13, 2024.

MARKET SEGMENTATION

This research report on the global compression therapy market has been segmented based on the product, technique, application, distribution channel, and region.

By Product

- Garments

- Stockings

- Bandages & Wraps

- Other Garments

- Braces

- Pumps

By Technique

- Static

- Dynamic

By Application

- Varicose Vein Treatments

- Deep Vein Thrombosis Treatments

- Lymphedema Treatments

- Leg Ulcer Treatments

- Others

By Distribution Channel

- Pharmacies & Retailers

- Hospitals & Clinics

- E-Commerce Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region has the fastest growth rate in the global compression therapy market?

The APAC compression therapy market is predicted to have the fastest CAGR of 7.37% among all the regions in the global market for the forecast period.

Who are the leading players in the compression therapy market?

The global compression therapy market was valued at USD 5.15 billion in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com