Global Compression Garments and Stockings Market Size, Share, Trends & Growth Analysis Report - Segmented By Product Type, Application, End-user & Region - Industry Forecast (2025 to 2033)

Compression Garments and Stockings Market Size

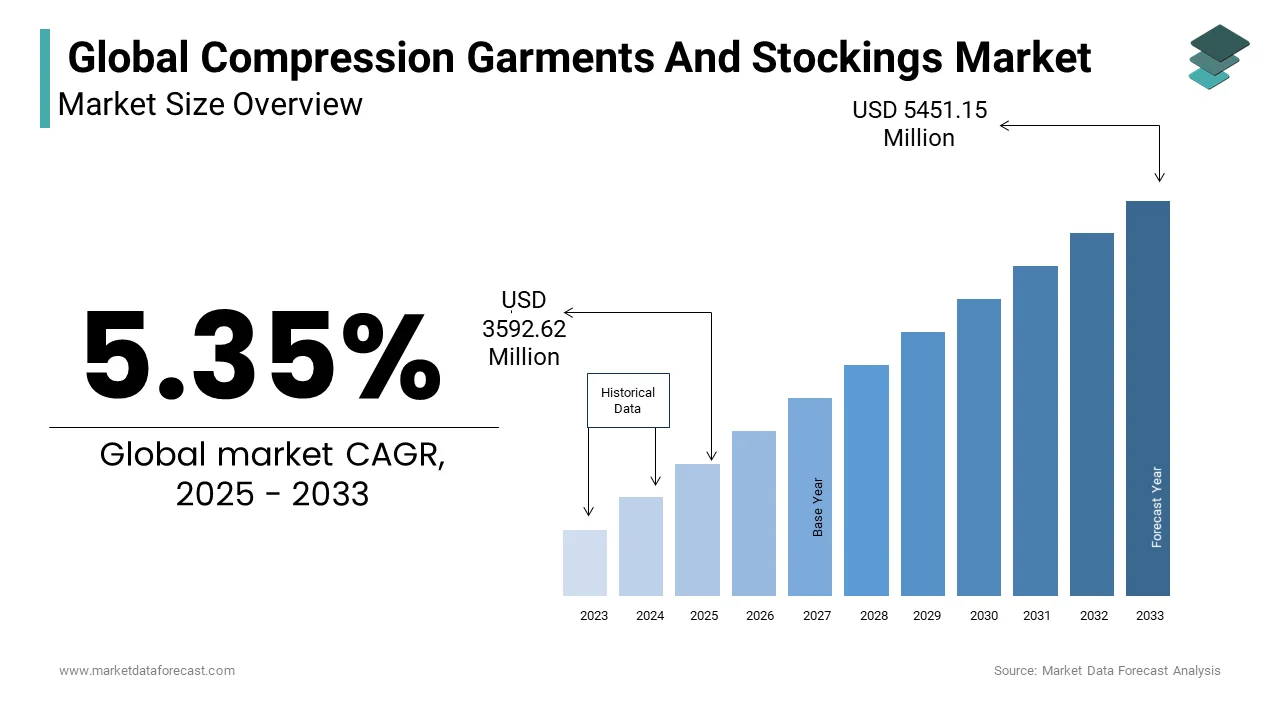

In 2024, the global compression garments and stockings market was valued at USD 3410.18 million and it is expected to reach USD 5451.15 million by 2033 from USD 3592.62 million in 2025, growing at a CAGR of 5.35 % during the forecast period.

MARKET DRIVERS

The growing awareness among people of the medicinal benefits of compression fabrics, such as healing properties, reduced bruising efficiency is majorly propelling the growth of the compression garments and stockings market.

Compression garments and stockings are growing in popularity due to the rates of varicose veins, lymphedema, and other muscle issues. Athletes and gymnasts are increasingly wearing compression garments and stockings because they have a perfect fit, absorb moisture, and help prevent injury during an event or sport. Other factors driving the global compression garments and stockings industry are advances in fabric quality and textile styles and increased awareness of physical fitness. The benefits of compression garments and stockings increased public awareness of health issues, an aging population, increased investment, and increased healthcare costs will positively impact the compression garments and stockings market in the coming years.

The market participants should expect attractive business prospects in the future due to productivity growth and creative marketing and promotion strategies. Compression garments face significant difficulty in ensuring the accuracy and repeatability of applied pressure during their application. This is due to the fact that most compression garments have minimal size options. To improve the effectiveness of compression garments, key players in the industry should incorporate sensors into them as one of the opportunities for compression garments and stockings market growth.

MARKET RESTRAINTS

Compression garments and stockings are tight-fitting, which can cause itchiness and dry skin in some people.

This is a major stumbling block to the global compression apparel and stockings market's expansion. The availability of alternative therapies is likely to be a major factor restricting the global compression garments and stockings market's growth. Local wound care, dressings, topical or systemic antibiotics for untreated wounds, other pharmacologic agents, anesthesia, and adjunctive therapy are also options for treating chronic venous insufficiency.

Complications resulting from excessive compression stocking use can inhibit the compression garments and stockings market growth. While compression stockings tend to be easy to use, improperly worn stockings can cause serious problems. Breaking of skin, especially in the elderly, malnourished, and those with frail, fragile skin.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.35 % |

|

Segments Covered |

By Product, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Leonisa, Inc., Medical Z, 2XU Pty. Ltd, 3M, BSN Medical, Medi GmbH & Co KG, Nouvelle |

SEGMENTAL ANALYSIS

By Product Insights

The compression garments segment is expected to account for the largest share of the market during the forecast period due to the broad range of health benefits associated with the products, such as twists and enlargement of veins, lymphedema, and some chronic conditions.

By Application Insights

The varicose veins segment held 39% of the market shares in 2023 and is estimated to grow faster during the forecast period. The oncology segment stands second in leading the market by application.

By End User Insights

The hospital segment was the market leader and achieved a 34.7% share in 2023. However, the online sales segment is growing with the highest CAGR during the forecast period. It is also estimated that the online sales segment will beat the hospitals leading position by the end of the forecast period due to the growing internet and e-commerce usage across the world.

REGIONAL ANALYSIS

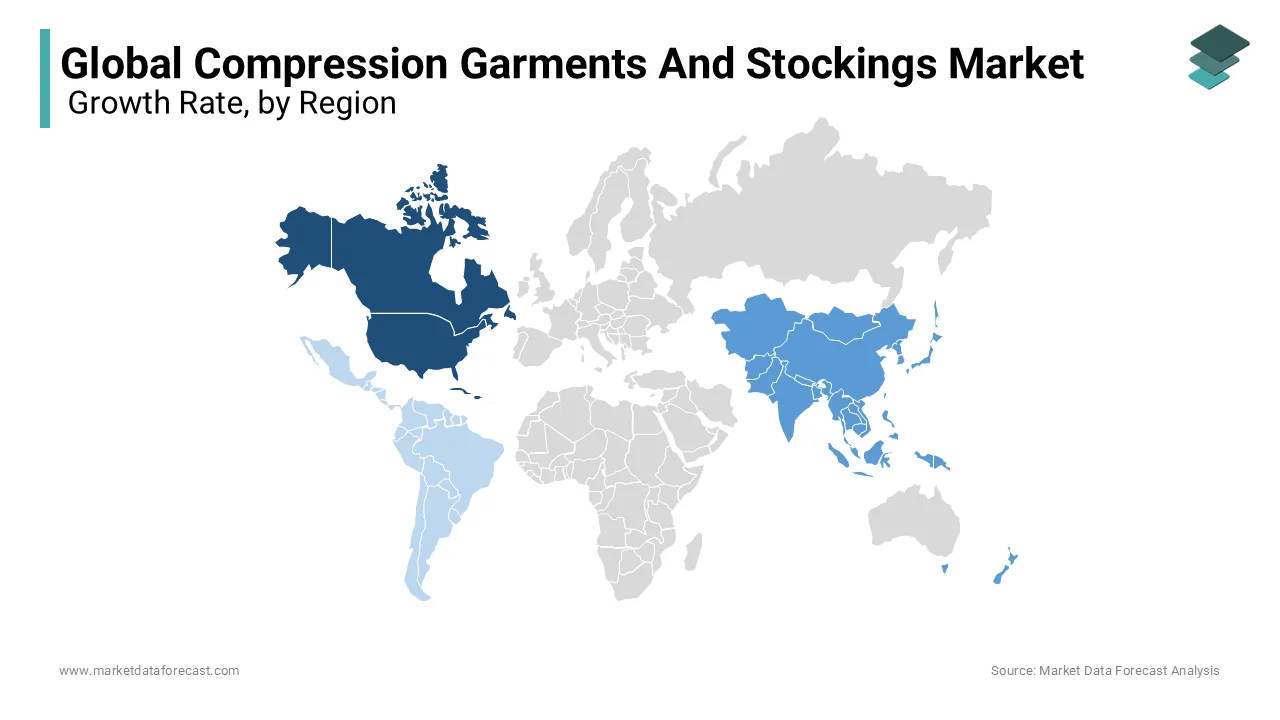

Geographically, the North American regional market is expected to retain its dominating position in the compression garments and stockings market during the forecast period. An increasingly aging population and Y-O-Y growth in sports injuries are leveling up the market demand. The European market is estimated to have promising growth during the forecast period due to increased demand for these compressed garments, a growing geriatric base, growing disposable income, and growing advertising of products.

The APAC market is projected to grow at the highest CAGR during the forecast period due to the growing patient sympathy towards the usage of compressed garments. Rising online shopping trends also mark up the growth of this region. India and China are the major contributors to the APAC market growth.

The Latin American market is expected to have a steady growth rate over the forecast period. Rising incidences of chronic diseases are a major factor propelling the demand of the market in this region. The MEA market is expected to sluggish growth rate over the forecast period. Growing awareness among people over the availability of different treatment procedures is prompting the demand of the market.

KEY MARKET PLAYERS

Companies such as Leonisa, Inc., Medical Z, 2XU Pty. Ltd, 3M, BSN Medical, Medi GmbH & Co KG, Nouvelle, Inc., and Santemol Group Medical are a few of the major participants in the global compression garments and stockings market.

RECENT HAPPENINGS IN THIS MARKET

- In 2020, AIROS Medical Inc. received an acceptance from the US FDA of the clearance of 510 (K) to sell its updated compressed therapy devices and garments.

- On March 18, 2020, Nouvelle Compression introduced bras for pre-eminent healing that give outcomes for breast enhancement. These can be worn 24 hours a, and the company also includes Bra bands, bras with cups, sleeves, and without cups, and Cotton Bras. These were designed for safety and to make them steady.

- On July 23, 2019, 2XU teamed up with Tryzens to increase their evolvement and customer experience. The launch is of e-commerce sites related to sportswear that include compression garments, fitness wear for cycling and running, and so on.

- DJO Global, one of the leading players in manufacturing compression garments and inserters and therapy shoes, has made a partnership with Siren MD, where DJO Global has become the premier vendor for Siren MD’s sports team market.

MARKET SEGMENTATION

This market research report on the global compression garments and stockings market has been segmented based on the product, application, end-user, and region.

By Product

- Compression garments

- Compression stockings

By Application

- Varicose veins

- Wound care

- Burns

- Oncology

By End User

- Hospitals

- ASC’s

- Clinics

- Online sales

- Healthcare

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are compression garments and stockings?

Compression garments and stockings are specially designed clothing items that apply gentle pressure to certain parts of the body, typically to improve blood flow

Are there any challenges faced by the compression garments market?

key challenges Lack of awareness in developing regions , High cost of premium products, Improper usage or poor fitting reducing effectiveness

What are the current trends in the compression garments and stockings market?

Smart compression wear (with sensors) ,Customized and 3D-printed garments, Eco-friendly and sustainable materials

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]