Global Regenerative Medicine Market Size, Share, Trends & Growth Analysis Report – Segmented By Product (Cell-Based Products and Acellular Products), Therapy (Cell Therapy, Gene Therapy, Tissue Engineering and Immunotherapy), Application (Orthopedic & Musculoskeletal Spine, Dermatology, Cardiovascular, Central Nervous System, Oncology, Diabetes and Other Applications) and Region - Industry Analysis From 2025 to 2033

Global Regenerative Medicine Market Size

As per our report, the global regenerative medicine market size is expected to reach USD 211.09 billion by 2033 from USD 39.67 billion in 2025, growing at a compound annual growth rate (CAGR) of 23.24% during the forecast period. The global regenerative medicine market size was valued at USD 32.19 billion in 2024.

Regenerative medicines repair, replace and regenerate tissues and organs affected by injuries, diseases, and natural aging processes. These medicines restore functionalities of cells & tissues used in several degenerative disorders, including cardiovascular, orthopedic applications, dermatology, and neurological disorders. Regenerative Medicine is a medical field growing significantly to renovate tissues and organs. The U.S. National Institutes of Health involves cell therapy, tissue engineering in regenerative Medicine, and biomaterials. Uncurable chronic diseases and conditions such as Alzheimer's disease and Parkinson's disease can be cured through regenerative Medicine. Around 1,028 clinical trials are going on, as per the reports given by the Alliance for Regenerative Medicine. The National Institutes for Health supports the scientific research community through NIH regenerative medicine programs.

MARKET DRIVERS

The growing chronic disease patient population worldwide is majorly driving the regenerative medicine market growth.

The number of people suffering from chronic diseases such as cancer, cardiovascular diseases, autoimmune diseases, diabetes and others is growing rapidly and boosting the demand for regenerative medicine and also can cause significant mortality. As per the data published by the World Health Organization (WHO), an estimated 71% of deaths are due to chronic diseases worldwide. According to the study conducted by the Global Burden of Disease, an estimated 80% of premature deaths in low- and middle-income countries are due to chronic diseases. As per the estimates of the Centers for Disease Prevention and Control (CDC), 6 in 10 Americans have 1 chronic disease and 4 in 10 Americans have 2 or more than 2 chronic diseases in the United States. Traditional treatment procedures such as chemotherapy, radiation therapy, and surgery to treat chronic diseases have limitations, which has fuelled the demand for effective and personalized therapies. Regenerative medicine has the ability to cure these unmet diseases by restoring or replacing damaged or diseased cells, tissues, or organs. Likewise, the growing need for effective and personalized therapies in the treatment procedures of chronic diseases is fuelling the growth of the regenerative medicine market growth.

Technological developments are further fuelling the growth rate of the regenerative medicine market. Technological developments such as 3D bioprinting technology, gene editing technologies, advanced biomaterials, artificial intelligence (AI) and machine learning (ML) technologies have helped regenerative medicine to improve its capabilities in the form of development and manipulation of cells, genes, tissues and organs and to analyze large datasets and the identification of new therapeutic targets and personalized treatment options. The growing number of initiatives and investments by several governments for the R&D of regenerative medicine, the increasing aging population worldwide and the shortage of organ donors are contributing to the growth of the regenerative medicine market. In recent years, regenerative medicine has been used to replace or regenerate damaged organs such as the liver and heart.

Furthermore, the rising adoption of personalized medicine, increasing awareness among people and healthcare providers regarding the potential benefits of regenerative medicine such as improving clinical outcomes and reducing healthcare costs, the favorable regulatory environment for regenerative medicine, increasing number of collaborations and partnerships between academic institutions, research organizations, and pharmaceutical companies to conduct R&D around regenerative medicine are supporting the market growth. The growing healthcare expenditure, an increasing number of applications of regenerative medicine, and rising usage of regenerative medicine in cancer research & drug discovery, further stimulate the growth of the global regenerative medicine market.

MARKET RESTRAINTS

However, the presence of stringent regulatory pathways for tissue-engineered products & cell-based products, strict ethical regulations for the utilization of human tissue, certain post-implantation infections & complications, and high costs for the research & development of cell-based products (such as stem cells) are expected to hamper the growth rate of the regenerative medicine market. Furthermore, high costs associated with the treatments through regenerative medicines are another significant restraint to the market growth in developing countries. In addition, the response to these therapies is less than traditional ones, which further diminishes the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2023 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Therapy, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Vertex Pharmaceuticals Incorporated (U.S.), Acelity L.P. Inc. (U.S.), Celgene Corporation (U.S.), StemCells, Inc. (U.S.), Organogenesis Inc. (U.S.). |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the cell-based products segment is estimated to account for a largest share of the global regenerative medicine market during the forecast period due to their usage for different indications and early adoption in clinical applications. In addition, the Cell-based products segment is classified as autologous and allogeneic products. The cell-based therapies segment is forecasted to grow at an impressive CAGR during the forecast period due to high investments, growing research activities, and redrafting regulatory policies for their use in clinical applications.

On the other hand, the acellular products segment is predicted to hold a considerable share of the global market during the forecast period.

By Therapy Insights

Based on therapy, the cell therapy segment is expected to hold the major share of the global regenerative medicine market during the forecast period owing to the increasing usage of regenerative medicine in clinical studies for the development of cell-based therapies and ongoing clinical trials. An increasing number of investments and funding by governmental and non-governmental organizations in favor of cell therapies are favoring segmental growth. Furthermore, the rising adoption of personalized medicine, the increasing number of advancements in stem cell research and the growing patient count suffering from chronic diseases are propelling the segmental growth.

The gene therapies segment is estimated to account for a considerable share of the global market during the forecast period. An increasing number of advancements in gene therapy technologies, the growing patient population suffering from genetic diseases, increasing awareness among healthcare professionals regarding the benefits of gene therapies and a favorable regulatory environment for gene therapy products are fuelling the segmental growth.

The tissue engineering segment is predicted to register a healthy CAGR during the forecast period owing to the shortage of transplantable organs and the increasing adoption of personalized treatment procedures such as tissue engineering.

By Application Insights

Based on application, the orthopedic & musculoskeletal spine segment is predicted to account for the major share of the global regenerative medicine market during the forecast period. The growing patient population suffering from musculoskeletal disorders and injuries such as osteoarthritis and fractures is one of the key factors propelling the growth of the segment. In addition, the increasing adoption of minimally invasive surgeries, technological advancements in stem cell therapy, and the growing geriatric population are contributing to the growth rate of the segment. Furthermore, growing investments in product R&D is forecasted to boost the growth of the segment.

The oncology segment is predicted to capture a substantial share of the global regenerative medicine market during the forecast period. The rising prevalence of cancer and increasing usage of regenerative medicine in treating cancer patients to stimulate the immune system to fight cancer and repair damaged tissue caused by chemotherapy and radiation therapy are accelerating segmental growth. The growing demand for effective and safe cancer treatments and the increasing need for personalized and targeted therapies for cancer treatment are further hiking the growth rate of the segment.

The cardiovascular segment is estimated to witness a healthy CAGR during the forecast period in the worldwide market. The growing patient population suffering from cardiovascular diseases and the potential of regenerative medicine to repair damaged cardiac tissue are supporting the growth rate of the segment.

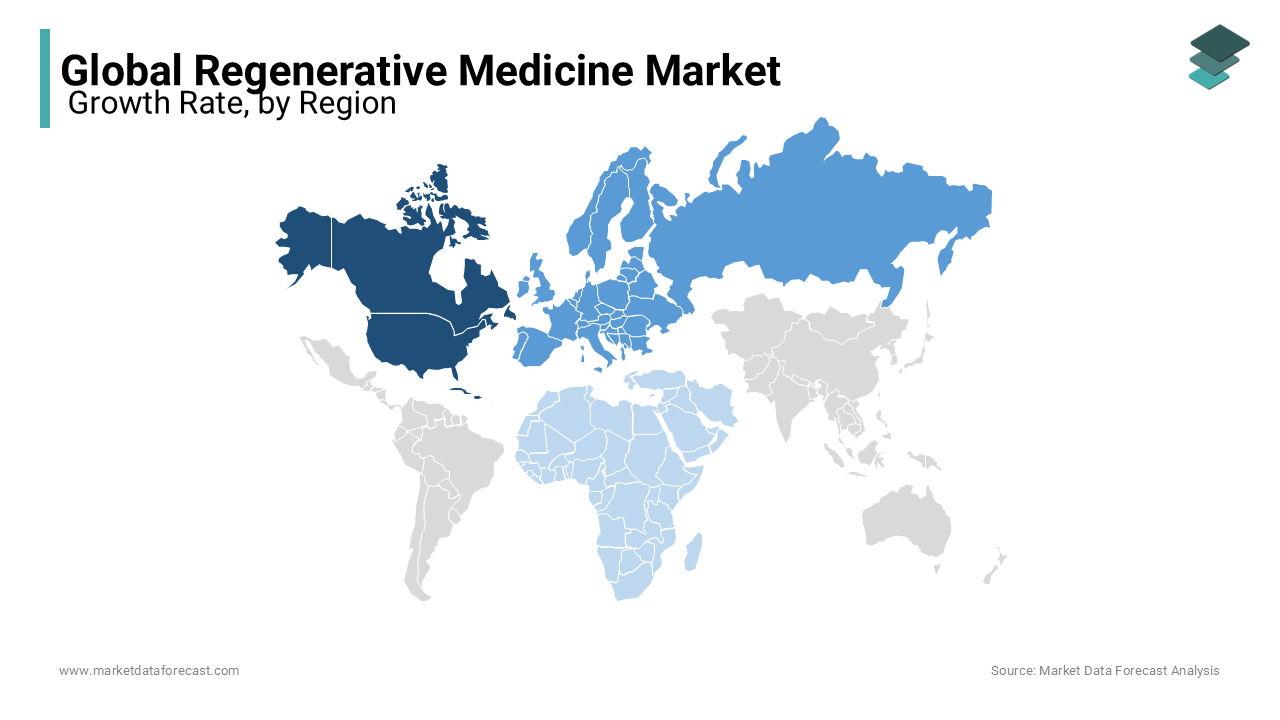

REGIONAL ANALYSIS

Geographically, the North American regenerative medicine market occupied the largest share of the global market in 2024 and the regional domination is anticipated to continue in the worldwide market during the forecast period. The growing number of research institutes and rising efforts from market participants for the development of novel therapeutics primarily drive the North American regional market. The U.S. market accounted for the most significant share of the North American market in 2024 and is estimated to account for the leading share during the forecast period in North America due to the growing healthcare infrastructure and favorable reimbursement policies. In addition, the growing prevalence of chronic diseases in the U.S is further boosting the growth rate of the U.S. market. On the other hand, the Canadian market is projected to showcase healthy growth during the forecast period.

The European regenerative medicine market was the second-largest regional market globally in 2024, and it is estimated to showcase a notable CAGR during the forecast period. The growing funding by the governments of European countries in favor of regenerative medicine, increasing research and development activities, and growing patient count suffering from chronic diseases in Europe are propelling the European regenerative medicine market growth. The growing number of partnerships and collaborations between research institutions, pharmaceutical companies, and biotech companies is another notable attribute boosting the growth rate of the European market. During the forecast period, the German regenerative medicine market is predicted to hold the major share of the European market owing to the presence of several companies that operate with regenerative medicine and research institutes. The sophisticated healthcare infrastructure in Germany is further favoring the German market growth.

The APAC regenerative medicine market is predicted to register the highest CAGR during the forecast period. The APAC region is the fastest regional market in the worldwide market. China accounted for the leading share of the APAC market in 2024 and is anticipated to continue the same trend throughout the forecast period. The Chinese government approved several human embryonic stem cell measures to encourage researchers to explore these cells' clinical potential in China. On the other hand, the Indian regenerative medicine market is anticipated to witness a healthy CAGR during the forecast period owing to the growing geriatric population and increasing adoption of a sedentary lifestyle by the Indian population.

The Latin American regenerative medicine market is expected to grow at a notable CAGR during the forecast period owing to the increasing number of initiatives by Latin American countries to promote regenerative medicine. Brazil held the major share of the Latin American market in 2024 and is expected to grow at a healthy CAGR during the forecast period. The growth of the Brazilian market is driven by the presence of a well-established healthcare infrastructure and an increasing number of funding programs and initiatives by the Brazilian government to promote the usage of regenerative medicine. Mexico is another notable regional market for regenerative medicine in Latin America.

The regenerative medicine market in MEA is predicted to register a healthy CAGR during the forecast period. Saudi Arabia is one of the promising markets for regenerative medicine in the Middle East and Africa. Other than Saudi Arabia, MEA countries such as United Arab Emirates (UAE), Qatar, and Egypt are predicted to occupy the major share of the MEA market during the forecast period.

KEY MARKET PLAYERS

Companies leading the global regenerative medicine market profiled in the report are Vertex Pharmaceuticals Incorporated (U.S.), Acelity L.P. Inc. (U.S.), Celgene Corporation (U.S.), StemCells, Inc. (U.S.), Organogenesis Inc. (U.S.), NuVasive, Inc. (U.S.), Vericel Corporation (Genzyme) (U.S.), Japan Tissue Engineering Co., Ltd. (Japan), Cytori Therapeutics Inc. (U.S.), Advantagene, Inc. (U.S.) and Mesoblast Ltd. (Australia).

RECENT HAPPENINGS IN THIS MARKET

- In January 2018, Medeor Therapeutics was awarded USD 18.8 million from the California Institute for Regenerative Medicine.

- In January 2018, RepliCel Life Sciences Inc. partnered with the private firm, China-based Yofoto Health Industry Co. Ltd, for regenerative Medicine.

- In 2018, an agreement was made between SanBio group and Hitachi Chemical Advanced Therapeutics Solutions, LLC, to develop contract manufacturing of regenerative medicines.

- In September 2018, a deal was announced by Essential Biologics LLC with Blood Centers of America to support research and product development for cell therapy.

MARKET SEGMENTATION

This research report has segmented and sub-segmented the global regenerative medicine market into the following categories.

By Product

- Cell-Based Products

- Autologous

- Allogeneic

- Acellular Products

By Therapy

- Cell Therapy

- Gene Therapy

- Tissue Engineering

- Immunotherapy

By Application

- Orthopedic & Musculoskeletal Spine

- Dermatology

- Cardiovascular

- Central Nervous System

- Oncology

- Diabetes

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global regenerative medicine market going to be worth by 2033?

As per our research report, the global regenerative medicine market is estimated to be worth USD 211.09 billion by 2033.

Which segment by product type led the regenerative medicine market in 2024

Based on the product type, the cell-based products segment led the regenerative medicine market in 2024.

Does this report include the impact of COVID-19 on the regenerative medicine market?

Yes, in this report, the COVID-19 impact on the global regenerative medicine market is included.

Which are the significant companies operating in the regenerative medicine market?

Companies playing a key role in the global regenerative medicine market are Vertex Pharmaceuticals Incorporated (U.S.), Acelity L.P. Inc. (U.S.), Celgene Corporation (U.S.), StemCells, Inc. (U.S.), Organogenesis Inc. (U.S.), NuVasive, Inc. (U.S.), Vericel Corporation (Genzyme) (U.S.), Japan Tissue Engineering Co., Ltd. (Japan), Cytori Therapeutics Inc. (U.S.), Advantagene, Inc. (U.S.) and Mesoblast Ltd. (Australia).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com