Global Renal Biomarkers Market Size, Share, Trends & Growth Forecast Report By Diagnostic Technique (Chemiluminescent Enzyme Immunoassay, Colourimetric Assay, Enzyme-Linked Immunosorbent Assay, Liquid Chromatography-Mass Spectrometry and Particle-Enhanced Turbidimetric Immunoassay), Type (Up-Regulated Proteins, Interleukin 18, Kidney injury molecule 1, Neutrophil gelatinase-associated lipocalin, Functional Biomarker, Serum Creatinine, Serum Cystatin C and Urine Albumin) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Renal Biomarkers Market Size

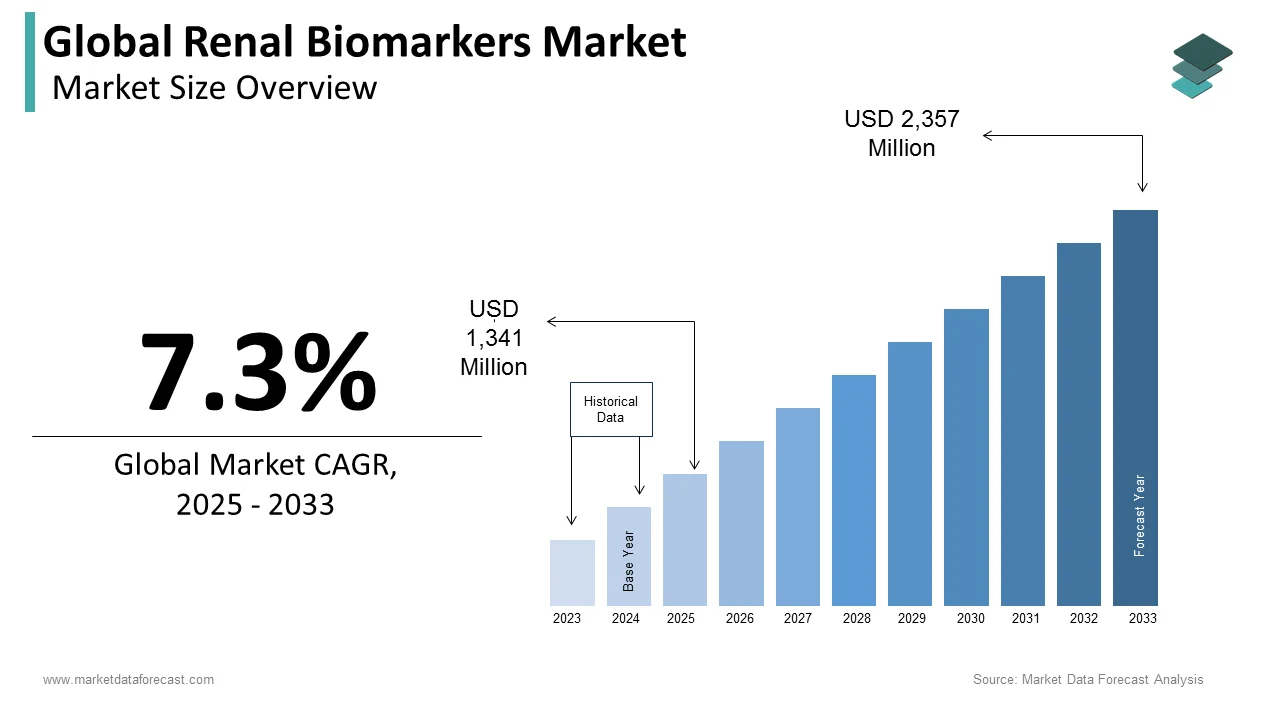

The global renal biomarkers market size was valued at USD 1,250 million in 2024. The global market size is expected to reach USD 2,357 million by 2033 from USD 1,341 million in 2025, growing at a CAGR of 7.3% from 2025 to 2033.

A biomarker is a characteristic that is objectively measured and evaluated as an indicator of normal biological processes pathogenic process responses to a therapeutic intervention. Renal biomarker consists of serum creatinine (SCR), blood urea nitrogen (BUN), urinary albumin/protein, and volume excretion.

The renal biomarker market is growing rapidly. This can be attributed to the rising cases of other chronic illnesses like high blood pressure and diabetes. This has a direct connection with the kidney disease. Another factor contributing to the market growth is the weakening immunity of the younger generation caused by the increased consumption of convenience and fast foods, irregular eating habits due to busy lifestyles and climate change effects.

According to the United States Renal Data System 2022 Annual Data Report, COVID-19 prevalence significantly increased in patients with kidney disease. It stated that by the end of June 2021, over 10 percent of chronic kidney disease, 13 percent of kidney transplants and 20 percent of dialysis-receiving patients got infected with the coronavirus. Besides this, race, gender and geographical location also play a major role like women, non-Hispanic black adults and elderly people. Hence, the renal biomarker market is expected to expand in the forecast period.

MARKET DRIVERS

Advancements in Genetics and Rising Kidney Disease Cases Fuel Market Growth

The growing advancements in genetics and rising incidence of kidney and renal diseases are primarily fuelling the renal biomarkers market growth. Acute kidney injury (AKI) and chronic kidney disease (CKD) substantially increase morbidity and mortality. Some researchers are going into the laboratories to develop a procedure to diagnose acute kidney injury and chronic kidney diseases with surrogate marker GFR, such as serum creatinine (SCr). The growing demand for innovative techniques in the medical sector is driving the need of the market. The government organization is working towards the development in the field of renal biomarkers as there is a tremendous demand for the non-invasive biomarker process. Increasing scale research centers are also propelling the growth rate of the market.

Growing Disease Prevalence and Advancements in Renal Biomarkers

Y-O-Y growth in the occurrence of cardiovascular diseases, chronic kidney diseases, and diabetes are significantly contributing to the development of the renal biomarkers market. Increasing R & D activities and rising diagnostic applications of biomarkers are further anticipated to further flourish the renal biomarkers market. Contract Research Organizations (CROs) are increasing in huge numbers, which is estimated to favor the market's growth rate. The development rate of chronic kidney diseases among children increases, which is anticipated to impel the market demand. In 2018, according to the European Renal Association- European Dialysis and Transplant Association data, more than 850 million people were diagnosed with kidney disease. The vast number of patients affected with a different form of kidney disease is rising, which is leading to the improvement of new renal biomarkers that are expected to bolster the market growth.

MARKET RESTRAINTS

Challenges in Accuracy and Detection of Renal Biomarkers

The current biomarkers are not specific and cannot work at a particular target as they cannot detect some of the diseases. There is no adequate or proper way to detect acute and chronic kidney diseases, which is estimated to hinder the renal biomarkers market growth. Furthermore, an inappropriate way to identify acute and chronic kidney diseases is one major factor in limiting the market growth. Inadequate reimbursement policies impede market demand. Usage of irregular and imperfect standard quality is predicted to hinder the renal biomarkers market growth in Europe. Hurdles associated with regulatory bodies are likely to restrict the market. The vast amount required for drug discovery, development, and establishment is obstructing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.3% |

|

Segments Covered |

By Diagnostic Technique, Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

bbott Diagnostics, F. Hoffmann-La Roche AG, Beckman Coulter Inc., Astute Medical Inc., Siemens Healthcare Diagnostics Inc., Thermo Fisher Scientific Inc., Alere Inc., bioMérieux SA, and Randox Laboratories Ltd., and Others. |

SEGMENTAL ANALYSIS

By Diagnostic Technique Insights

The enzyme-linked immunosorbent assay segment led the renal biomarkers market in 2024. It accounts for 44.3 percent of the global market share and this domination is expected to continue during the forecast period owing to the rising demand for quality healthcare services. Also, this is a popular option for renal biomarker analysis because it provides greater sensitivity and specificity for identification in biological samples. In addition, its adaptability and credibility further strengthen its dominant position in the market by meeting the diagnostic demands of both researchers and medical practitioners. Furthermore, the growing incidence of chronic diseases and increased emphasis on early diagnosis of diseases are other factors influencing the growth of the segment. There is a major surge in cancer, diabetes and cardiovascular patients in recent times. It is due to this escalating pattern the demand for ELISA has shot up.

By Type Insights

The functional biomarker segment is expected to hold the largest share of the market during the forecast period and is observed to have a CAGR value of 6.94% for renal biomarkers. The factors driving the segment demand are the increasing chronic kidney diseases (CKD) and awareness of serum creatinine biomarkers by private and public sectors. In addition, the growing prevalence of diabetic nephropathy and other related diseases is also fuelling the market share of the segment. For instance, one in seven adults in the United States is affected by CKD which is around 37 million people. Non-Hispanic black people and individuals aged 65 or older have a high incidence rate. Moreover, according to research, it is projected that there will be approximately 7.61 million CKD patients by 2033. However, the issues in reimbursement and regulation can hinder the segment’s expansion.

By End-User Insights

The diagnostic labs are considered to have the largest market share. Diagnostic labs account for 34.9% in terms of value over the forecast period. Whereas, the Outpatient clinic's segment is expected to register a CAGR value of a 7.2% share of renal biomarkers growth. This due to the growing economy in both developed and developing countries. Apart from this, the frequently used renal biomarkers in diagnostic laboratories are blood urea nitrogen (BUN), serum creatinine, urine albumin/protein, and glomerular filtration rate (GFR). Additionally, recent studies have detected new potential renal biomarkers which comprise kidney injury molecule 1 (KIM-1), cystatin C and neutrophil gelatinase-associated lipocalin (NGAL). So, these developments can increase earlier detection and more accurate diagnosis of kidney disease and ultimately surge the market value of diagnostic labs.

REGIONAL ANALYSIS

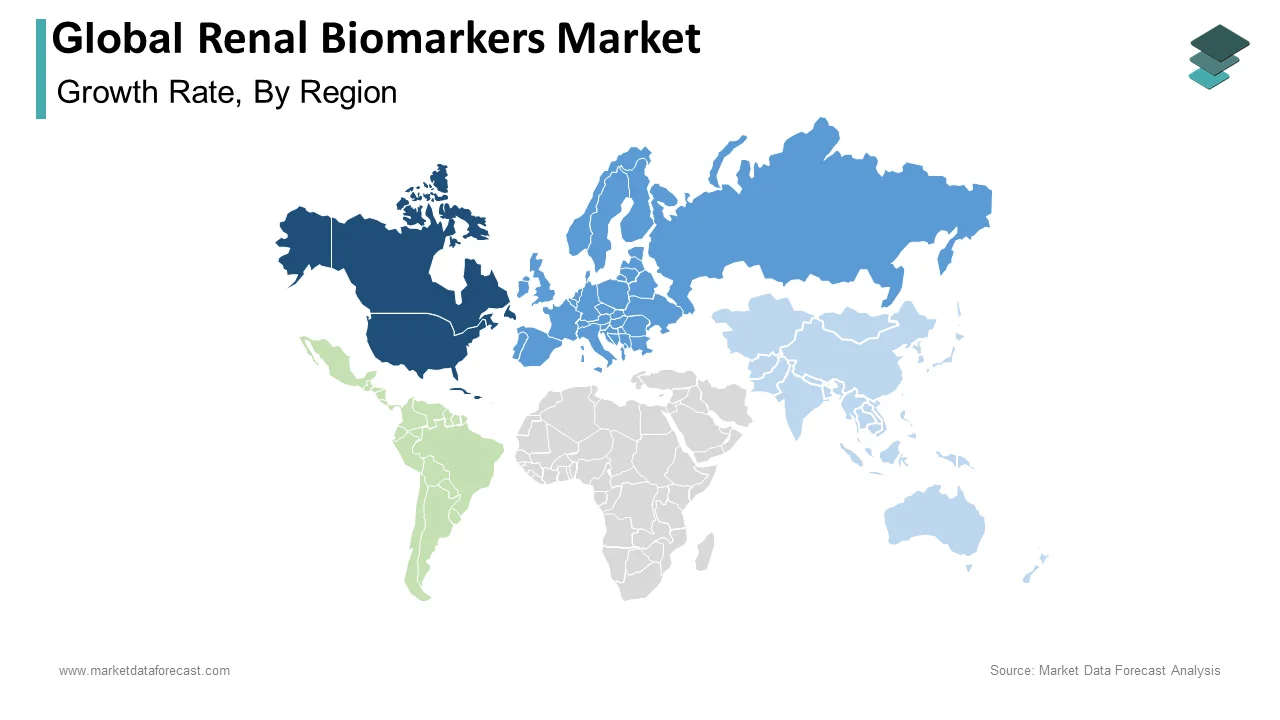

The North American region occupied most of the share in the global renal biomarkers market in 2024. The area has contributed 32% of the U.S. share owing to the escalating expenditure on healthcare, strong economic growth, and receiving novel diagnostic methods. The U.S. holds the highest shares of the market and is continuing the same growth rate during the period.

The European market is expected to showcase promising growth for the growth of renal biomarkers during the analysis period. The increase in this region is expected to have a share of 21.1% of the market. The factors responsible for the growth are adopting the latest technology in the healthcare sector and the high expenditure capacity of the population. The UK is accounted to hold the top position with the largest share in the market. Quick launches and inventions of products to improve healthcare services and infrastructure are escalating the market demand. Notable growth in the elder people population leading to the increase of disease ailments expands the market portfolio. Germany, France, Italy, Spain, and the rest of Europe are projected to have considerable growth in the renal biomarkers market. Rapid advancements in genetics, which lead to the enhancement of upgraded renal biomarkers in treating patients with kidney disorders, are thriving in the market growth.

The Asia-Pacific market is expected to have the fastest growth rate over the analysis period. Soaring occurrences of renal diseases, growing older people population, and inadequate reimbursement policies are likely to hamper the growth of the renal biomarkers market. Countries like India and China are considered to provide a high range of opportunities for the renal biomarkers market.

The Latin American market is expected to have steady growth over the period owing to the adoption of advanced technology. Growing occurrences of diseases like high blood pressure and diabetes are some factors propelling the market's demand. Brazil is deemed to have enormous market opportunities with increasing support from private and public healthcare expenditure.

The Middle East & Africa region has a steady growth rate. The growing geriatric population, increasing diabetic population, rising awareness of acute and chronic kidney diseases, and increasing diagnostics and therapeutic procedures are significant factors for growth in this region. In this region, the South African market is soaring due to strong growth in healthcare and reimbursement programs from the government in developing countries.

KEY MARKET PLAYERS

Noteworthy companies playing a leading role in the global renal biomarkers market profiled in the report are Abbott Diagnostics, F. Hoffmann-La Roche AG, Beckman Coulter Inc., Astute Medical Inc., Siemens Healthcare Diagnostics Inc., Thermo Fisher Scientific Inc., Alere Inc., bioMérieux SA, and Randox Laboratories Ltd.

MARKET RECENT DEVELOPMENTS

- In January 2025, the University of Houston lab of Chandra Mohan invented the novel biomarkers for earlier diagnosis of lupus nephritis. It significantly enhances the diagnostic performance. The research findings provided a minimum six new urine biomarkers for active renal lupus. This is verified by the group of patients having different ethnic backgrounds.

- In November 2024, Chinese researchers announced the improved performance in detecting disease with urinary biomarkers against plasma biomarkers. Also, it is found that this is more effective than their serum correspondents. This is a simple and non-invasive way to collect Urine.

- In September 2024, a novel biomarker was identified in urine by researchers that can assist in early diagnostics of renal failure. They examined if urine levels of adenine can anticipate kidney infection or ailment in diabetic individuals and discovered that increased rates renal damage or failure is connected to greater levels of adenine. The study was conducted with more than 1200 diabetes and Weakened or damaged kidney patients.

MARKET SEGMENTATION

This market research report on the global renal biomarkers market has been segmented based on the diagnostic technique, type, end-user, and region.

By Diagnostic Technique

- Chemiluminescent Enzyme Immunoassay

- Colourimetric Assay

- Enzyme-Linked Immunosorbent Assay

- Liquid Chromatography-Mass Spectrometry

- Particle-Enhanced Turbidimetric Immunoassay

By Type

- Up-Regulated Proteins

- Interleukin 18

- Kidney injury molecule 1

- Neutrophil gelatinase-associated lipocalin

- Functional Biomarker

- Serum Creatinine

- Serum Cystatin C

- Urine Albumin

By End User

- Diagnostic Labs

- Hospitals

- Outpatient Clinics

- Research Centres

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com