Global Solar Encapsulant Market Research Report - Segmentation by Material (Ethylene Vinyl Acetate, Polyvinyl Butyral, Polydimethylsiloxane, Ionomer and Others), Technology (Monocrystalline Silicon and Thin Film), Application (Automotive, Construction, Electronics and Others) and Region - Industry Forecast 2024 to 2032.

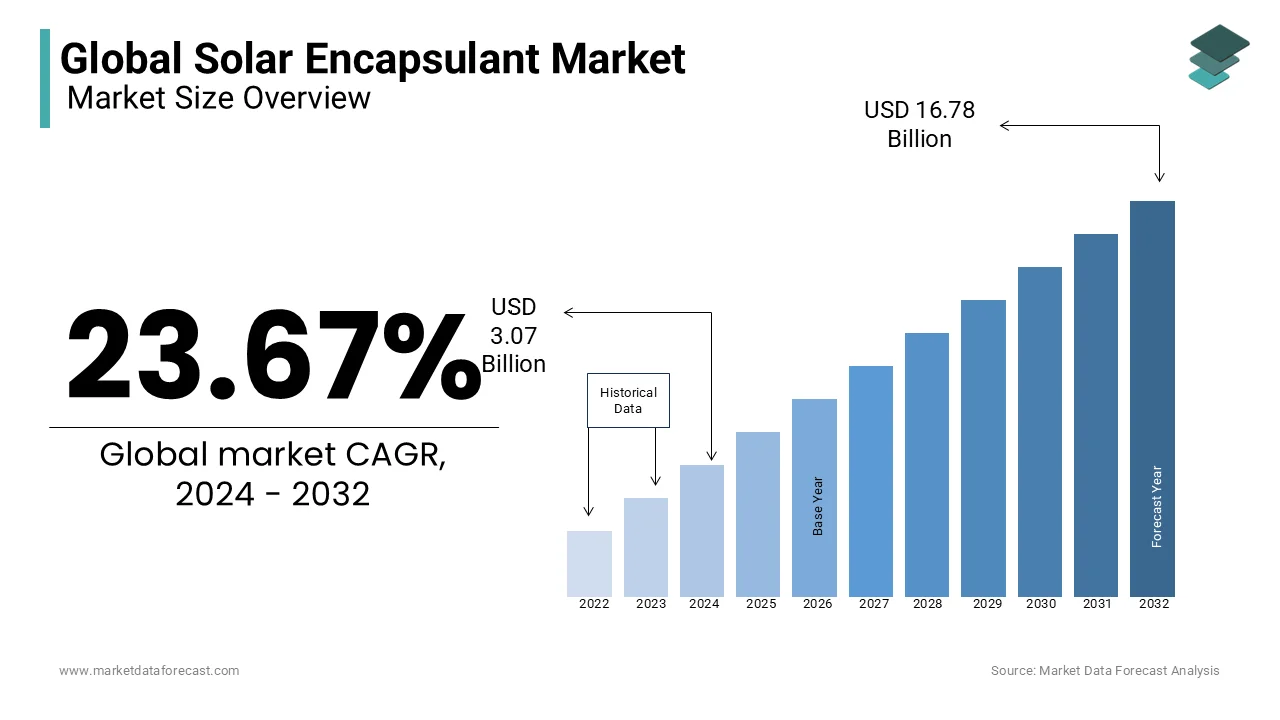

Solar Encapsulant Market Size (2024-2032):

The size of the global solar encapsulant market was worth US$ 2.48 Billion in 2023. The global market is anticipated to grow at a CAGR of 23.67% from 2024 to 2032 and be worth US$ 16.78 billion by 2032 from US$ 3.07 billion in 2024.

Current Scenario of the Global Solar Encapsulant Market

Solar encapsulations are products utilized in Photovoltaic (PV) solar modules to supply incredible durability and protection against corrosion and delamination. Materials such as ethylene-vinyl acetate (EVA), non-ethylene vinyl acetate, and UV-curable resins are used to laminate solar cells and protect them from shock and vibration. The growth in the demand for solar energy becomes the generation of a powerful growth of the encapsulation of the solar system. In addition, the demand for photovoltaic installations in the south will be increased due to assistance programs on the only energy market, as well as the demand for alternative energy sources. This trend is anticipated to create a lucrative growth opportunity for the solar encapsulant market. In addition, excellent mechanical properties and chimneys, such as durability and thermal resistance, have increased the demand for materials for encapsulation alone with applications for different residential, non-residential, and utility sectors.

MARKET DRIVERS

The emergence of thin-film solar cell technology is a major driver in the global Solar Encapsulant market. Thin-film solar cell technology costs less than crystalline silicon solar technology. The use of this technology makes bulk production of solar cells economical. In addition, the growing demand for photovoltaic modules is a key driver of the Solar Encapsulant market.

Research and development of solar cell technology are anticipated to create lucrative opportunities in the global Solar Encapsulant market. Research into solar cell technology has resulted in the development of third-generation photovoltaic cells that have the potential to exceed current limits of efficiency and performance. The increase in government subsidies and market support programs has increased the demand for solar power as an alternative and efficient solution to reduce carbon emissions. In addition, the demand for the installation of photovoltaic cells on roofs is increasing.

MARKET RESTRAINTS

The degradation of solar encapsulating material is a major factor hampering the Solar Encapsulant market.

Exposure of encapsulating materials such as ethylene-vinyl acetate and polyolefin elastomer to moisture and corrosion results in the deterioration of solar encapsulating materials. The yellow browning of ethylene-vinyl acetate copolymer (EVA) encapsulants used in photovoltaic modules has caused significant power losses. Additionally, weather-degraded EVA films resulted in decreased UV absorption. This is anticipated to hamper the potential growth opportunities for the solar encapsulant market.

IMPACT OF COVID-19 ON THE GLOBAL SOLAR ENCAPSULANT MARKET

The return of the global solar market to double-digit growth rates in 2019 marked a positive trajectory for the sector. But in 2021, the coronavirus pandemic has not left the solar energy industry. This year, new solar grid connections are anticipated to drop for the first time in many years. It is now of the utmost importance that governments do not ignore renewable energy and solar energy when developing economic stimulus packages. If the world is serious about meeting the climate goals of the Paris Agreement, not only do solar deployments need to regain their recent growth but also the rate of installation of solar energy, the cheapest power generation technology and more versatile, should increase much faster short and medium term. This year a global survey conducted in April by the Global Solar Council into the impacts of COVID-19 on solar energy: more than 71% of solar companies surveyed reported a drop in orders, of which 6 in 10 said orders had been reduced by up to 50%, and 3 in 10 saw a decrease from 50% to 90% (see page 63). The effect of the pandemic on installation rates varies across countries and segments, largely depending on the severity of countries' suffering from coronavirus and the response of governments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

23.67% |

|

Segments Covered |

By Material, Technology, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bridgestone, Dai Nippon Printing Co. Ltd, E.I. Dupont De Nemours & Co., First Solar Gmbh, Isovoltaic Ag, Mitsubishi Plastics Inc, and Others. |

SEGMENTAL ANALYSIS

Solar Encapsulant Market Analysis By Material

The market can be divided into ethylene vinyl acetate, polyvinyl butyral, polydimethylsiloxane, ionomer, and others. Other segments include thermoplastic polyurethane and polyolefin. The ethylene-vinyl acetate segment has experienced significant growth in recent years due to its increased application in laminating photovoltaic cells.

Solar Encapsulant Market Analysis By Technology

The Solar Encapsulant market can be segmented into monocrystalline silicon solar technology and thin-film solar technology. The thin-film solar technology segment can be further subdivided into cadmium telluride, copper selenide, indium, gallium, and amorphous silicon. The monocrystalline silicon solar technology segment had a dominant market share in 2017 due to its advantages, such as higher efficiency and lower power consumption compared to other technologies.

Solar Encapsulant Market Analysis By Application

The Solar Encapsulant market is segregated into automotive, construction, electronics, and others. The construction segment accounted for a significant share of the market in 2017 due to the rising call for roof panel systems in the construction industry.

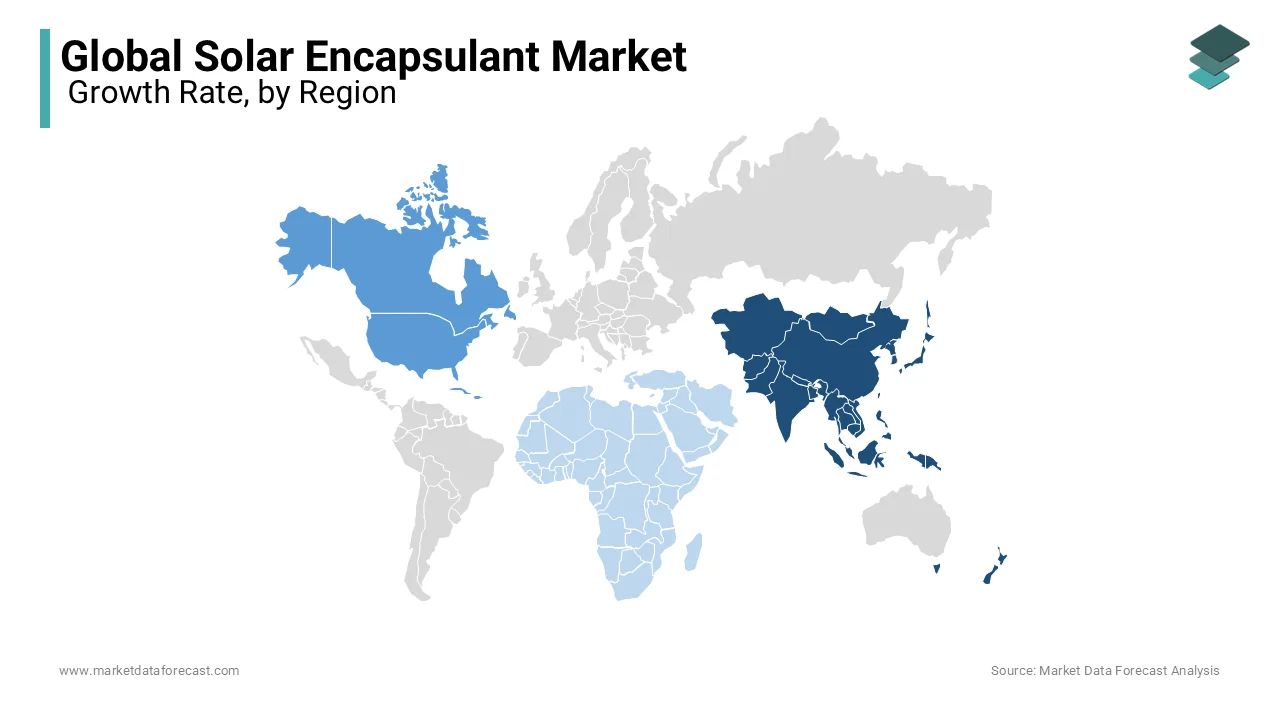

REGIONAL ANALYSIS

The Asia-Pacific Solar Encapsulant market is anticipated to grow at a rapid rate during the forecast period owing to the increase in solar module production capacity of major manufacturers in India and China. The significant increase in solar technology production in emerging economies such as India and China can be attributed to government subsidies and increased mergers and acquisitions by local manufacturers. In addition, China has dominated the solar encapsulant market in the Asia-Pacific because of the augmented production of inexpensive ethylene vinyl acetate films and their application in solar PV modules. North America and Europe are primarily focused on research to maximize solar power generation. The market in the Middle East and Africa is also increasing due to the elevated utilization of solar energy for power generation, agriculture, and architecture, which is supposed to increase the demand for solar encapsulants.

KEY PLAYERS IN THE GLOBAL ENCAPSULANT MARKET

Companies playing a prominent role in the global encapsulant market include Bridgestone, Dai Nippon Printing Co. Ltd, E.I. Dupont De Nemours & Co., First Solar Gmbh, Isovoltaic Ag, Mitsubishi Plastics Inc, and Others.

RECENT HAPPENINGS IN THE GLOBAL ENCAPSULANT MARKET

- In July 2016, Suzhou Zhongkang Power, a subsidiary of Jiangsu Akcome Science & Technology Co. Ltd., invested $ 149.97 million to build three photovoltaic power plants with a combined power generation capacity of 120 MW.

- In June 2017, RIPL launched five Bus Bar (BB) photovoltaic solar cells. These cells offer less resistance and improve the overall performance of the module. The launch aimed to expand the company's photovoltaic cell product line into the global market.

DETAILED SEGMENTATION OF THE GLOBAL ENCAPSULANT MARKET INCLUDED IN THIS REPORT

This research report on the global encapsulant market has been segmented and sub-segmented based on material, technology, application, and region.

By Material

- Ethylene Vinyl Acetate

- Polyvinyl Butyral

- Polydimethylsiloxane

- Ionomer

By Technology

- Monocrystalline Silicon

- Thin Film

By Application

- Automotive

- Construction

- Electronics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Solar Encapsulant Market growth rate during the projection period?

The Global Solar Encapsulant Market is expected to grow with a CAGR of 23.76% between 2024-2032.

2. What can be the total Solar Encapsulant Market value?

The Global Solar Encapsulant Market size is expected to reach a revised size of US$ 16.78 billion by 2032.

3. Name any three Solar Encapsulant Market key players?

Dai Nippon Printing Co. Ltd, E.I. Dupont De Nemours & Co., and First Solar Gmbh are the three Solar Encapsulant Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]