Global Solid State Battery Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Thin Film Battery, Portable Battery), Capacity (Below 20mAh, 20mAh-500mAh, Above 500mAh), Application (Consumer & Portable Electronics, Electric Vehicles, Energy Harvesting, Wearable & Medical Devices, Others) & Region - Industry Forecast From 2024 to 2032

Global Solid State Battery Market Size (2024 to 2032)

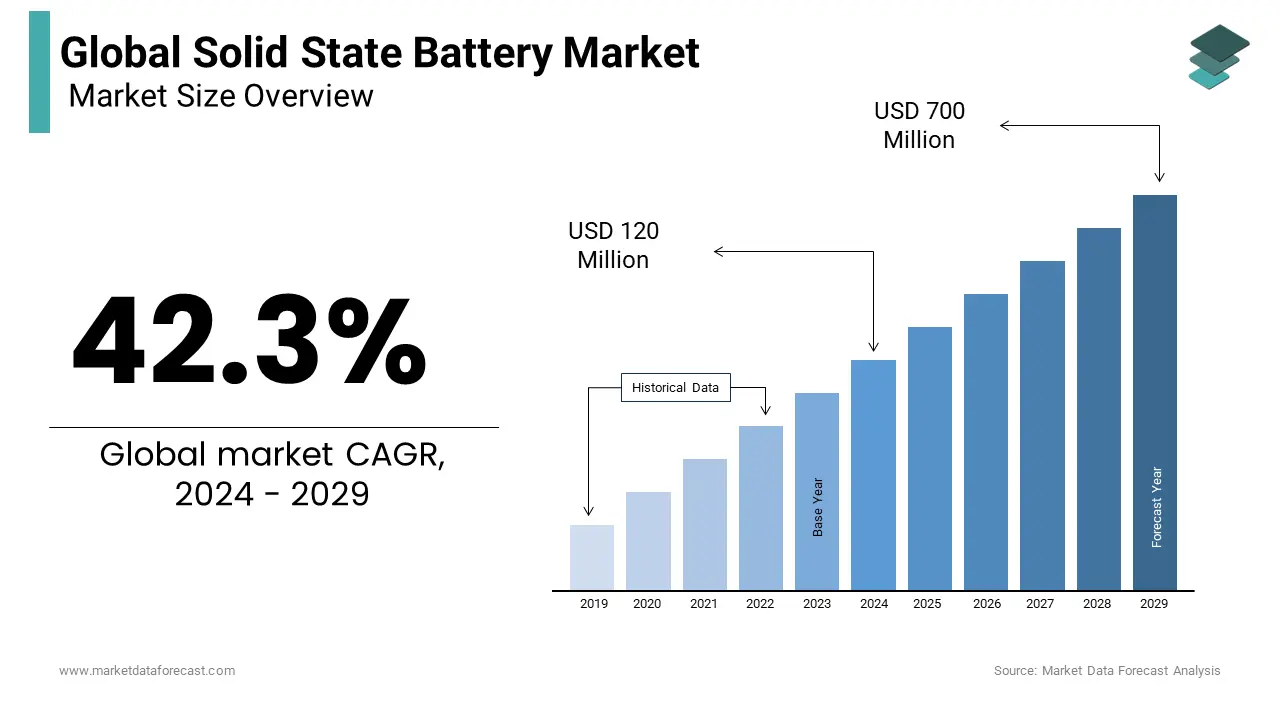

The size of the global solid state battery market was valued at USD 84.33 million in 2023, registering a CAGR of 42.3% during the forecast period 2024-2032 to reach USD 2,017.53 million by 2032 from USD 120 million in 2024.

Current Scenario of the Global Solid State Battery Market

The solid-state battery is safer than the traditional liquid electrolytes and has a longer life span. Solid-state batteries are manufactured to achieve higher energy storage capacity. The use of these batteries completely eliminates the risk of thermal runaway with increasing thermal stability. The design of the state solid battery involves a unique three-dimensional copper foam that reduces thermal leakage accidents and elevates the fast-charging speed. Ongoing research and development activities focus on improving safety features with innovative technology. In the present world, the need for solid-state batteries is very high to sustain the growing prevalence of safety, energy density, and fast charging capabilities. The transparency in using eco-friendly compositions shall drive the need to adopt this in wide applications. The potential to use solid-state batteries has grown rapidly in recent years. Solid-state batteries play a crucial role in the performance of electric vehicles and hybrids. The new technology in manufacturing electric vehicles is adding fuel to the growth rate of the market.

MARKET DRIVERS

The rising prominence of electric and hybrid vehicles is certainly one of the major factors that will help the solid state battery market grow.

It is a known fact the sales of electric vehicles and hybrids are surging at a random rate across the world. According to the latest reports, around 14 million new electric cars were registered globally, 95% of which were registered in China, Europe, and the US. The number of electric car sales increased by 35% in 2023 compared to 2022. Solid state batteries play a crucial role in electric vehicles with their effective features like long-lasting battery life and enhancing thermal stability. Irrespective of the ongoing demand for solid-state batteries in the automotive industry, the wide applications of these batteries are gaining attention in the healthcare industry. The launch of high technological equipment in healthcare is a boom in the healthcare industry. Mobile healthcare systems and wireless healthcare monitoring systems are becoming highly popular in treating chronic diseases. All these devices are manufactured with the help of solid-state batteries, which allows the devices to have more flexibility in design and form factor. Devices like pacemakers and a few wearable devices are promptly made up of solid-state batteries to supply low power with higher energy densities. A growing number of cardiac diseases is substantially leveling up the need for the implantation of pacemakers everywhere. More than 7,00,000 pacemakers are implanted every year across the world. The number itself showcases the gradually increasing demand for the need to produce a high number of pacemakers with technological advancements. These statistics are likely to enhance the growth rate of the market.

MARKET RESTRAINTS

The cost to manufacture solid-state batteries is very high, which is limiting the growth rate of the solid state battery market.

The major reason for the higher cost is the complex nature of manufacturing these batteries when compared with traditional lithium batteries. Manufacturing solid-state batteries that are both iconically conductive and stable requires power equipment that costs a lot. Small and medium-scale industries could not afford this equipment to manufacture the batteries, which merely impeded the market’s growth rate. Only skilled personnel can manufacture these solid-state batteries, and a lack of people who have experience also hinders the market’s share. Stringent rules and regulations by the government to approve innovative products, especially in the healthcare industry, in favor of public safety, account for hampering the share of the market.

MARKET OPPORTUNITIES

Ongoing research and development activities in various industries to expand their product portfolio are inclined to showcase huge growth opportunities for the solid state battery market in the foreseen years. Government support through funds for developing solid-state batteries is to leverage the growth rate of the solid state battery market during the forecast period. Solid state batteries are overcoming the challenges faced by traditional batteries where the potential benefits incurred in providing a power source for electric vehicles. The growing need for highly efficient electric vehicles is ascribed to boost the growth opportunities for the solid-state battery. Companies are focusing on launching high-quality electric vehicles by overcoming all the challenges and issues with traditional vehicles to boost the solid state battery market share. Collaborations of the topmost companies to develop solid-state batteries are likely to propel the growth rate of the market. Automotive companies like Toyota and Idemitsu Kosan 2023 announced partnership strategies to develop new solid-state batteries to enhance the performance of electric vehicles. The need to meet the untapped potential requirements in manufacturing EVs, especially through solid-state batteries, is prompting the growth rate of the market.

MARKET CHALLENGES

The major challenge for the market key players is the slow progress in enhancing the development of solid-state batteries with high efficiency in overcoming interfacial resistance, stress cracking, and maintaining mechanical & chemical stability. Another factor that is hampering the growth rate of the solid state battery market is the fast charging and discharging scenario in the electrode/electrolyte interface. Negative effects on the environment are a new concern for companies that want to develop solid-state batteries according to the government’s standards. Companies focusing on advancing traditional batteries to lower the cost of the final products are also among the factors that are declining the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

42.3% |

|

Segments Covered |

By Type, Capacity, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BrightVolt Inc., Cymbet Corporation, Solid Power Inc., Toyota Motor Corporation, Excellatron Solid State LLC, Robert Bosch GmbH, Altair Nanotechnologies, Quantumscape Corporation, Apple Inc., Dyson Ltd., and Others. |

SEGMENTAL ANALYSIS

Global Solid State Battery Market Analysis By Type

The thin film battery segment is leading with the dominant share of the solid state battery market, whereas the portable battery segment has gained huge traction in the past few years. Increasing demand from the automotive industry to launch new features in the EVs to attract a huge number of customers is likely to promote the growth rate of the market. The portable solid state battery market is inclined to have huge growth opportunities in the coming years. The rising prevalence of electric and hybrid car manufacturing, according to customers' preference for lightweight vehicles, is extending the growth rate of this segment.

Global Solid State Battery Market Analysis By Capacity

The 20mAh-500mAh segment is gearing up to grab huge opportunities concerning the market growth during the forecast period. The prominence of wearable devices is surging, and the need for the usage of thin film batteries with wireless sensors is anticipated to show growth opportunities for the 20mAh-500mAh segment growth. The above 500mAh segment is inclined to have the highest share of the market, with increasing support from the government through investments to reduce greenhouse gas emissions by creating awareness among the public to shift towards electric or hybrid vehicles in the coming years.

Global Solid State Battery Market Analysis By Application

The wearable and Medical devices segment is ruling with the dominant share of the solid state battery market. The rising number of people using advanced wearable devices to maintain health and wellness by checking their vitals at regular intervals is surging the growth rate of this segment. The launch of innovative products in the healthcare industry with advanced technologies is also to fuel the growth opportunities for the market. The electric vehicles segment is set to hold the highest CAGR by the end of 2029. The surging production rate of electric vehicles, with the eventually increasing demand from users across the world in urban cities, is greatly influencing the growth rate of this segment.

REGIONAL ANALYSIS

North America was positioned as the most dominating player in the global market in 2023.

The domination of North America is primarily attributed to the presence of key automobile companies in this region. The prominence of launching high-quality features in electric and hybrid vehicles by improving battery stability is prompting the growth rate of the solid state battery market in this region. The US and Canada are the major countries contributing the highest share of the market. Rising disposable income, especially in urban areas, and the growing prevalence of owning highly advanced electric vehicles are major factors contributing to the highest share of the solid state battery market in the US. Increasing per capita income and focusing on launching innovative products with the latest technology are also ascribed to boost the solid-state battery market’s value in North America.

Europe is a notable regional segment in the worldwide market and is likely to account for a substantial share of the global market.

Following North America, Europe is inclined to have a substantial growth rate in the solid state battery market. European countries are strongly working towards the target ‘Zero Emission’ from vehicles. The UK government has already set a plan to reduce the impact on the environment by promoting only zero-emission vehicles. The government is setting up a strategy to lower carbon emissions by 2030. It is estimated that 80% of new cars and 70% of vans are likely to produce zero emissions, and by 2035, it will be 100% of vehicles that emit no harmful gases into the environment. These changes are set to rely on manufacturing electric cars with the utmost technological developments that bolster the solid state battery market’s growth rate in the UK.

Asia-Pacific is projected to grow at the fastest CAGR in the global market during the forecast period.

The Asia Pacific solid state battery market is expected to reach its highest CAGR by the end of the forecast period. Increasing population and rising investments in the expansion of the end-user industries, supported by both private and public organizations in emerging countries such as India and China, are accelerating the market's growth rate.

Latin America, the Middle East and Africa are expected to showcase a steady growth pace throughout the forecast period.

KEY PLAYERS IN THE GLOBAL SOLID STATE BATTERY MARKET

Companies playing a prominent role in the global solid state battery market include BrightVolt Inc., Cymbet Corporation, Solid Power Inc., Toyota Motor Corporation, Excellatron Solid State LLC, Robert Bosch GmbH, Altair Nanotechnologies, Quantumscape Corporation, Apple Inc., Dyson Ltd., and Others.

RECENT HAPPENINGS IN THE GLOBAL SOLID STATE BATTERY MARKET

- In 2024, Solid Power and SK On, a leading company in global electric vehicle battery manufacturing, agreed together to develop solid-state batteries that are expected to boost the technologies for commercialization. This agreement will allow SK On to use solid power technologies on ASSB cell design and pilot production processes during research and development activities.

- In 2024, Toyota Motor Corporation, largest company in carmaker released an update on its fast charges its solid-state battery plans. It is expecting that by 2027 or 2028, the company will be able to produce mass number of solid state batteries with high efficiency. The main aim is to roll out the next generation solid state batteries in next 3 years and to launch a battery that charges in very less time and has double vehicle range of capacity.

DETAILED SEGMENTATION OF THE GLOBAL SOLID STATE BATTERY MARKET INCLUDED IN THIS REPORT

This global solid state battery market research report has been segmented and sub-segmented based on type, capacity, application and region.

By Type

- Thin Film Battery

- Portable Battery

By Capacity

- Below 20mAh

- 20mAh-500mAh

- Above 500mAh

By Application

- Consumer & Portable Electronics

- Electric Vehicles

- Energy Harvesting

- Wearable & Medical Devices

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of growth in the solid-state battery market?

The key growth drivers include increased demand for electric vehicles (EVs), the need for higher energy density and safety in batteries, advancements in consumer electronics, and growing applications in renewable energy storage and medical devices.

What are the key challenges faced by the solid-state battery market?

The primary challenges include high manufacturing costs, scalability issues, limited commercialization, and technical difficulties in maintaining long battery life and performance under real-world conditions.

What role does government policy play in the solid-state battery market?

Government initiatives, such as subsidies for EVs, funding for advanced battery research, and stringent regulations on carbon emissions, are playing a significant role in accelerating the adoption and development of solid-state batteries.

What is the potential environmental impact of solid-state batteries?

Solid-state batteries are considered more environmentally friendly due to their reduced reliance on hazardous materials and potential for longer life cycles, which decrease battery waste. Additionally, their development supports the transition to cleaner energy systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com