Global Structural Heart Devices Market Size, Share, Trends & Growth Forecast Report By Product, Procedure, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Structural Heart Devices Market Size

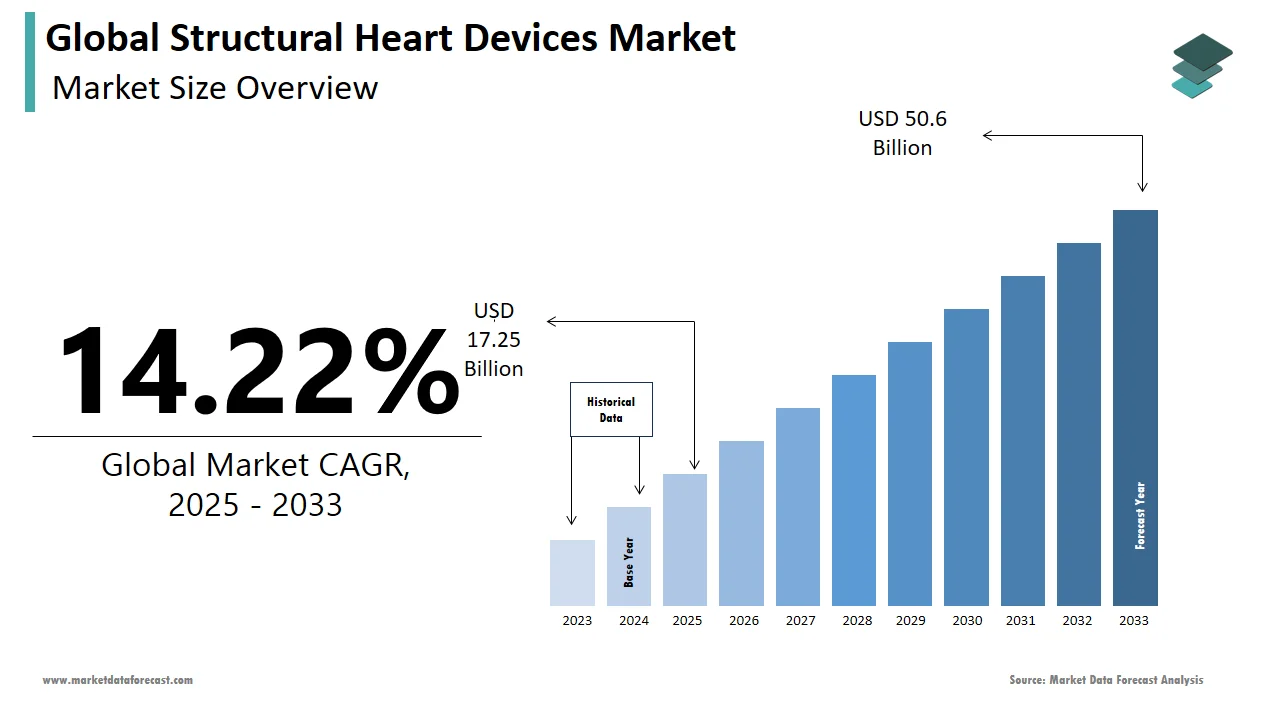

The global structural heart devices market was worth US$ 15.1 billion in 2024 and is anticipated to reach a valuation of US$ 50.6 billion by 2033 from US$ 17.25 billion in 2025, and it is predicted to register a CAGR of 14.22% during the forecast period 2025-2033.

Structural heart disease is a non-coronary abnormality of the heart which doesn't involve blood vessels. Instead, they are acquired through wear and tear due to infection or present at birth (congenital). Structural heart devices are those devices that are used to reshape and tighten the annuloplasty rings or heart valve balloon obturators around the heart if the heart is enlarged or has a leaky valve.

MARKET DRIVERS

Increased incidence of structural heart diseases such as aortic stenosis and mitral regurgitation is one of the key factors propelling the structural heart devices market.

Approximately 250,000 patients are diagnosed, on average, with mitral valve disease annually, according to the Center for Structural Heart Disease at Henry Ford Hospital. Therefore, the rise in the number of patients suffering from structural heart diseases, including congenital disease in newborns, and the demand for fast and long-lasting procedures has increased the demand for structural heart devices. In addition, the growing focus of key players on structural heart device R&D activities, favorable reimbursement scenarios, and growing demand for minimally invasive surgeries are further promoting the growth rate of the structural heart devices market.

Technological Advancements in the structural heart devices market to further augment the market growth.

Advanced technologies mean developing innovative repair devices like obturators, annuloplasty rings, advanced tissue heart valves for structural heart repair and replacement, and many more such procedures; improved treatments to improve quality of life and increase the expectancy of life are likely to augment the market growth. The use of recently developed new tissue valves and mechanical heart valves are being widely used across the globe to treat structural heart defects, which also provides increased longevity, thereby raising the living standards of the people.The rise in approvals for various structural transcatheter cardiac products, various types of valvular degenerative heart disease, and growing demand for minimally invasive procedures like structural heart surgeries over traditional open-heart surgery, which includes Mitral and aortic valve replacement procedures are widely being used by cardiologists to treat structural heart disease.

MARKET RESTRAINTS

Risks associated with the procedures; high costs associated with the surgeries are the major factors hampering the growth of the structural heart devices market. In addition, the market's main limitations are the strict government regulations, the inaccessibility of cardiac surgeries, the low adoption rate of technologically advanced structural heart devices in emerging economies, and the lack of qualified personnel. Also, there are many risks associated with devices like stroke, failure, and other complications after the mitral valve replacement procedure, along with low utilization of the latest devices since they are more expensive than the traditional ones, further restraining the growth of the market.

Impact Of Covid-19 On The Structural Heart Devices Market

The outbreak began early in March 2020 and continued for over a year. Lockdowns and quarantines have been the result of the coronavirus outbreak. Many businesses have suffered losses due to restrictions. The unemployment rate rose due to the unexpected increase in the number of patients and the severe shortage of hospital resources, such as oxygen cylinders, deteriorating the financial situation. The COVID-19 pandemic has positively impacted the structural heart devices market. Even though the pandemic has affected healthcare, disrupting healthcare facilities, the demand for various cardiovascular devices, including structural heart devices, has significantly increased due to the increased risk of infection in cardiovascular patients. In addition, the research done during the pandemic suggested the effectiveness of drugs increased the demand for structural heart devices used for patient survival.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.22% |

|

Segments Covered |

By Product, Procedure, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic PLC, Braile Biomedica, St. Jude Medical, Inc., Medical Technology Est., Micro Interventional Devices, Inc., Boston Scientific Corporation, Liva Nova PLC, Edwards Lifesciences Corporation, Cryolife, Inc., Jena Valve Technology, Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on product type, the heart valve segment is expected to dominate the structural heart devices market during the forecast period owing to its minimally invasive surgical nature and increased cardiovascular diseases. Therefore, a TAVR is being used more nowadays because the procedure is minimally invasive, doesn't require open heart surgery, and needs only a tiny incision in the skin. In addition, it replaces a defective aortic valve in the heart with an animal-derived aortic valve.The annuloplasty rings segment is also anticipated to register a healthy CAGR owing to their allowance for a large cooptation surface, which is essential for long-lasting repair. In addition, it restores the annular dimensions of the vessel and the leaflets closer together and stabilizes the ring.

By Procedure Insights

Based on the procedure, the replacement procedures segment is anticipated to hold a significant market share during the forecast period since only by replacing a valve in place of diseased heart valves the problems of stenosis and regurgitation are solved. In addition, they act as gates to allow blood to flow into the heart, thus making the heart work again. On the other hand, the repair procedures, like heart valve surgery, are also expected to grow in the market. However, unlike just replacing the valves, a surgeon repairs diseased heart valves in a typical heart valve surgery, including open-heart surgery.

By End-User Insights

Based on the end-user, the hospital systems segment is estimated to register the largest share of the market during the forecast period because of the creation of structural cardiac programs for new patient attraction, showing that they are innovative since the historically solid and complex cardiac surgery programs are not as sustainable as they appear to be. The ASC, on the other hand, are proving to be gaining patients' satisfaction with the outcome of the surgery, low cost, and quality of care they receive and impressed with the way the facility is run, which is why the ambulatory surgical centers are also expected to grow over the forecast period.

REGIONAL ANALYSIS

Geographically, the North American region led the market in 2024 and is also expected to dominate the structural heart devices market during the forecast period owing to increased healthcare spending, rising preference for minimally invasive procedures, growing geriatric population, increased research and development, increasing rate of endovascular procedures, and a growing prevalence of heart disease. The recent data in July 2024 from the Centers for Disease Control and Prevention (CDC) showed approximately 20.1 million adults over the age of 20 with coronary arteries. Additionally, according to CDC data, nearly 805,000 people in the US suffer a heart attack each year. Therefore, the high-risk cardiovascular disease in the population makes it mandatory to develop more structural heart devices used for treatment.

Asia-Pacific is expected to witness the highest growth rate due to increased awareness of heart disease, improved screening programs, medical care, and improved access to health care.

In the region of Europe, there is a high prevalence of aortic stenosis, therefore, highlighting the growing need for structural devices to treat the disorder, thereby leading to the growth of the market, along with the increasing prevalence of valvular heart disease (VHD) and development of new techniques to repair and replace heart defects.

The rapid adoption of structural heart devices increased the focus of structural heart device vendors, and the rising incidence of aortic stenosis is presumed to contribute to the growth of this market in Latin America, the Middle East, and Africa. Furthermore, by improving healthcare infrastructure, the need for structural heart disease treatment devices has increased due to the lack of healthcare facilities. Therefore, increasing disposable income introduction of new major key players in the market is expected to drive further growth.

KEY MARKET PLAYERS

Medtronic PLC, Braile Biomedica, St. Jude Medical, Inc., Medical Technology Est., Micro Interventional Devices, Inc., Boston Scientific Corporation, Liva Nova PLC, Edwards Lifesciences Corporation, Cryolife, Inc., Jena Valve Technology, Inc. are a few of the notable companies operating in the global structural heart devices market profiled in this report.

RECENT MARKET HAPPENINGS

- In September 2022, Abbott released data from five presentations that demonstrated the benefits of its minimally invasive devices in treating various structural heart conditions, altering doctors' approaches to patient care, and reducing the need for more complex surgery.

- In September 2022, a global leader in health technology, Royal Philips, showcased its latest cardiology innovations and solutions to enhance efficiency and clinical confidence to improve patient outcomes in Transcatheter Cardiovascular Therapeutics.

MARKET SEGMENTATION

This research report on the global structural heart devices market has been segmented and sub-segmented based on the product, procedure, end-user, and region.

By Product

- Heart Valve

- Transcatheter Heart Valve

- Mechanical Heart Valve

- Surgical Heart Valve

- Annuloplasty rings

- Occlusion Devices

By Procedure

- Replacement Procedures

- Repair Procedures

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Cardiac Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global medical tourism market going to be worth by 2033?

As per our research report, the global structural heart devices market size is estimated to be worth USD 50.6 billion by 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com