Global Cardiac Surgery Devices Market Size, Share, Trends & Growth Forecast Report By Product Type(Cardiopulmonary Bypass Equipment, Beating Heart Surgery Systems, Perfusion Disposables and Cardiac Ablation Devices), Application, Age Group and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Cardiac Surgery Devices Market Size

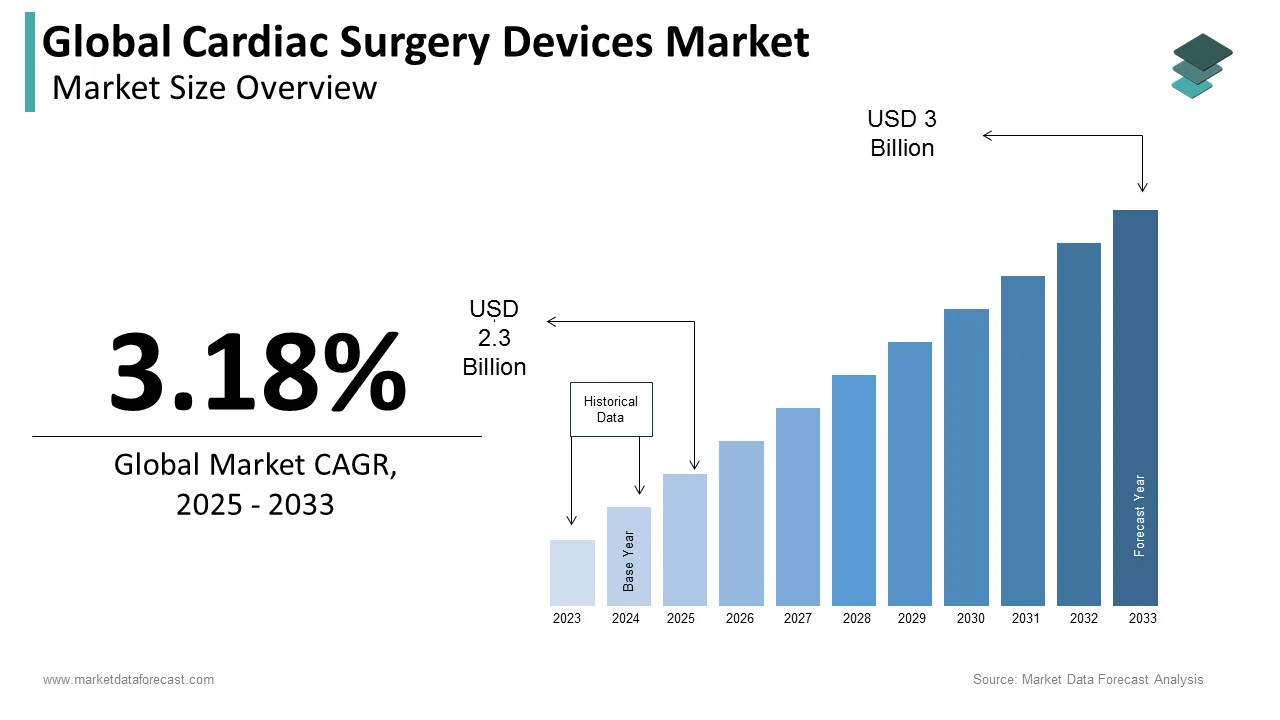

The global cardiac surgery devices market was valued at USD 2.23 billion in 2024. The global market is projected to grow from USD 2.3 billion in 2025 to reach USD 3 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of 3.18% during the forecast period 2025-2033.

The most common heart surgery in adults is coronary artery bypass grafting (CABG) or heart bypass surgery, a minimally invasive heart surgery since it makes only small incisions on the right side of the chest, reaching the heart between the ribs, unlike cutting through the breastbone in open heart surgery. Minimally invasive heart surgery is also performed to treat various other heart conditions. For instance, cardiac surgery is often needed if a plaque build-up blocks blood flow through a coronary artery, causes heart failure, dilated or diseased blood vessels like the aorta, faulty heart valves, and abnormal heart rhythms.

Cardiovascular surgical devices are the medical equipment that helps in cardiac surgical treatments with efficient and economic measures. In addition, these medical devices have been developed to assist sophisticated technologies for parents with chronic cardiovascular infections. According to the report published by the World Health Organization (WHO), it is estimated that cardiovascular disorders witnessed around 17.7 million or 31% of global deaths in 2015. The cardiovascular and thoracic instruments used as cardiac surgery devices are dissecting scissors, vascular scissors and forceps, micro-scissors and forceps, bulldog forceps, diathermy forceps, arterial forceps and ligation forceps, vascular forceps, micro-needle holders and sutures.

MARKET DRIVERS

Technical advancements in these devices, such as robotic heart surgery, are driving the cardiac surgery devices market.

Robotic heart surgery is a minimally invasive heart surgery done through minimal cuts in the chest using robot-controlled tools, and tiny instruments, without cutting through the breastbone surgeons. One of the main advantages of robotic heart surgery is a lesser risk than open heart surgery without cutting the sternum, eliminating many complications of open heart surgery. This is referred to as da Vinci surgery, the robot manufacturer's name.

Vascular malfunctions in the geriatric population, the growing incidence of obesity, and the availability of devices that offer effective therapeutic cures with minimum risk propel the cardiac surgery devices market growth.

In addition, the subsequent increase in surgical procedures and the increasing prevalence of cardiac conditions are expected to boost the market growth. Moreover, increasing investment and funding by the government and various private organizations to improve infrastructure facilities in the healthcare sector is propelling the market growth of the cardiac surgical devices market over the forecast years. In many cases, heart problems do not always require surgery but might need the use of cardiac surgical devices, and also treatment is done through medications and lifestyle changes. Other minimally invasive surgeries include Pacemaker or Implantable Cardioverter Defibrillator (ICD) Insertion, Coronary Artery Bypass Surgery (CABG), Heart Transplantation, Cardiac Device Insertion ventricular assist (VAD), Heart Valve Repair or Replacement, Aneurysm Repair Maze Surgery, and total artificial heart (TAH).

The increasing adoption of CEC due to its ability to conserve blood loss during surgery is gaining more attraction, and this factor is foreseen to propel the market growth.

Generally, the role of CEC is to Clear the heart by draining all the blood using venous cannulas, keeping the blood oxygenated, stopping the lungs with oxygenators, adjusting chemical and electrolyte content through a tank, and the temperature with a heat exchanger machine, and also deliver it to the patient through the use of arterial cannulas. It not only provides the means to ensure the conservation of blood loss but also returns it to the patient via cardiotomy vents, administers cardioplegia, prevents distension of the heart during surgery via cardiac vents, provides safety accessories like safety nets and airways rescue, and provide myocardial protection, which is all achieved through a closed circuit driven by pumps and connected by tubes.

MARKET RESTRAINTS

Due to most of the surgeries being major ones, they often have risks despite being successful, like infection, tissue damage to the heart, kidneys, liver, and lungs, bleeding, reactions to anesthesia, stroke, or even death, as identified by The National Heart, Lung, and Blood Institute. The risk could even be higher if the patient had already been suffering from other diseases like peripheral arterial disease, diabetes, and kidney or lung disease. However, stringent government regulations associated with medical devices and high-cost expenditure for medical devices are projected to diminish the cardiac surgery devices market's market growth. In addition, adopting alternative surgical methods and inadequate medical payments impede market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.18% |

|

Segments Covered |

By Product, Type, Application, Age Group, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Trinity Biotech, Abiomed, Inc., Cardinal Health, C. R. Bard, Inc., MedWaves Incorporated, CyberHeart Incorporated, and Transmedics, Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The perfusion disposables are anticipated to have recorded the largest market share during the forecast period. The role of a perfusionist is crucial since it temporarily takes over the heart's work in case a patient undergoes a procedure that disrupts the normal functioning of the heart since the heart is primarily responsible for pumping fluids throughout the body, providing vital nutrients and oxygenation to different organs. Thus, infusion by a cardiopulmonary bypass machine is necessary during heart surgeries to continue pumping blood, allowing the surgeons to operate on the heart. In addition, the increasing aging population and the rising prevalence of chronic diseases are expected to drive the disposable perfusion segment.

The cardiopulmonary bypass equipment market is estimated to play a notable role in the cardiac surgery devices market. Cardiopulmonary bypass equipment provides a bloodless field for heart surgery by incorporating an extracorporeal circuit. It helps the patient as a heart and lung support during the heart and lungs bypassing, draining venous blood into a reservoir where it is oxygenated and pumped back to the body.

By Application Insights

The CABG accounted for the largest market share in 2024, with the increasing incidence of diseases and the growing number of older adults. Furthermore, surgery to correct it is essential due to the crucial functions of a coronary artery supplying blood to the heart muscles. It involves taking a blood vessel from another part of the body for its attachment to the coronary artery using the graft.

The congenital heart failure segment is anticipated to hold a substantial share in the global market due to its most common cause, coronary artery disease, occurring due to high triglyceride and blood cholesterol levels, leading to a severe condition where the heart does not ideally pump blood.

By Age Group Insights

The adult segment is anticipated to dominate the global market over the forecast period, owing to the changed lifestyle of people, leading to increasing prevalence of coronary heart disease, increased sedentary lifestyle, and increased awareness of disease treatment and management, leading to the establishment of more medical infrastructure and development of the existing ones.

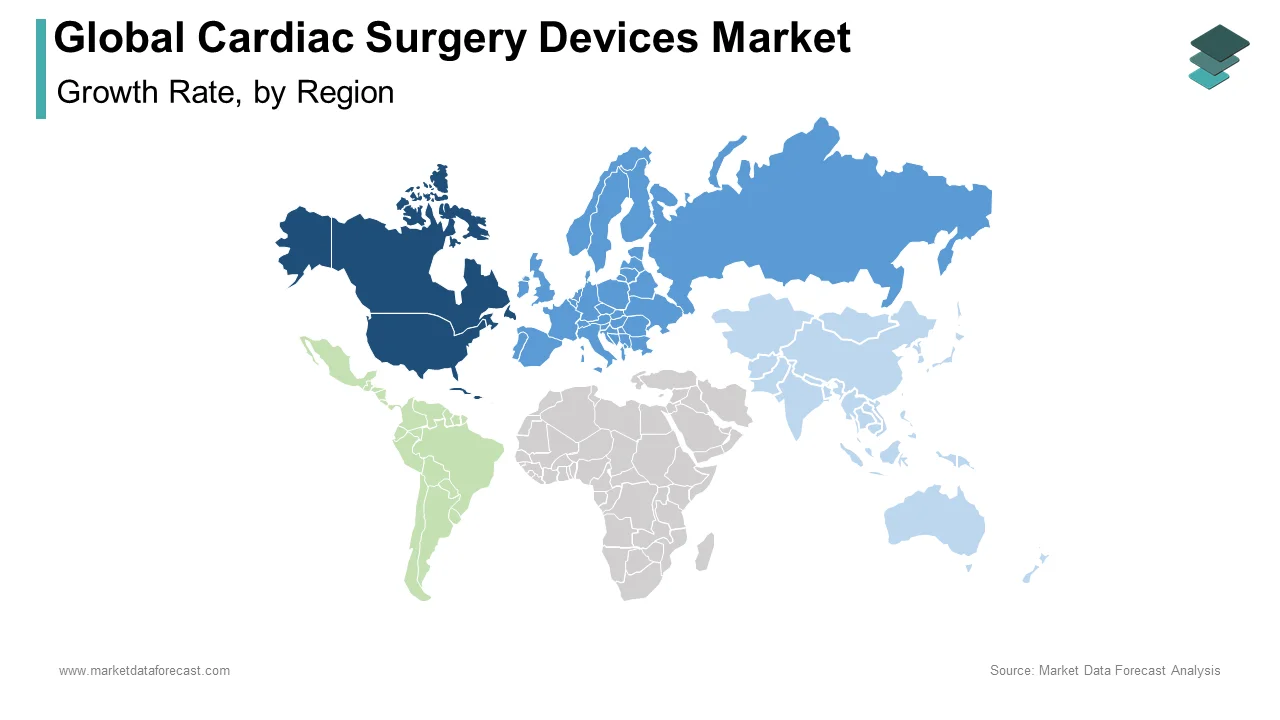

North America

REGIONAL ANALYSIS

Geographically, the cardiac surgery devices market in North America is one of the biggest regional markets worldwide. An increasing number of surgeries, well-established healthcare infrastructure facilities, and the prevalence of cardiac disease disorders propel cardiac surgical devices' market growth in this region.

The Europe cardiac surgery devices market accounted for a substantial share of the global market in 2024. It is expected to have a significant share with the influential growth factors due to increased cardiovascular diseases, heart surgeries, and ventricular assist devices driving the market growth in Europe.

The cardiac surgery devices market in the Asia Pacific is expected to have better growth with an increasing CAGR; the growth attributing factors such as reimbursement policies in emerging countries such as India and Japan and advancing surgical devices are expected to drive the cardiac surgical devices market.

The cardiac surgery devices market in Middle East & Africa is expected to grow better during the forecast period. Improving medical health facilities and investments by the government helps the market growth of the cardiac surgical devices market in this region.

KEY MARKET PLAYERS

Some of the prominent companies leading the cardiac surgery devices market profiled in the report are Trinity Biotech, Abiomed, Inc., Cardinal Health, C. R. Bard, Inc., MedWaves Incorporated, CyberHeart Incorporated, and Transmedics, Inc., and Others.

RECENT MARKET DEVELOPMENTS

- In November 2022, a leading cardiac and vascular surgery provider, Artivion, Inc., made two investor conference announcements and hosted one-on-one meetings at the Canaccord Genuity MedTech, Diagnostics and Digital Health & Services Forum.

- In October 2022, CytoSorbents Corporation announced new data in CytoSorb to be used in various cardiac surgery indications due to the increase in infective endocarditis globally,

- In October 2022, PeriCor, a company co-founded by Mechanical Engineering Ph.D. student Justin Opfermann, invented the PeriPath device, which could be used for pediatric cardiac procedures, eliminating the need for invasive open chest surgery for the implantation of vital cardiac devices like pacemakers or defibrillators, which can even be inserted through a dime-sized incision.

- In October 2022, an interdisciplinary and multinational team of cardiologists, under the direction of the Department of Cardiology, successfully implanted the "DragonRing" in the first human being ever. By tightening the dilated ring, the DragonRing successfully treats functional mitral regurgitation, with a focus on the patient population whose atrial fibrillation is the primary cause of their mitral regurgitation.

MARKET SEGMENTATION

This research report on the global cardiac surgery devices market has been segmented and sub-segmented into the following categories.

By Product

- Cardiopulmonary Bypass Equipment

- Beating Heart Surgery Systems

- Perfusion Disposables

- Cardiac Ablation Devices

By Application

- Cardiac Arrhythmia

- CABG

- Coronary Heart Disease

- Congenital Heart Defects

- Congestive Heart Failure

By Age group

- New-born (0-30 days)

- Infant (31 days-1 years)

- Children (1-18 years)

- Adult (18+ years)

By Region

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global Cardiac Surgery Devices Market going to be worth by 2032?

As per our research report, the global Cardiac Surgery Devices Market size is projected to be USD 3 billion by 2033.

At What CAGR, the global Cardiac Surgery Devices Market is expected to grow from 2024 to 2032?

The global Cardiac Surgery Devices Market is estimated to grow at a CAGR of 3.18% from 2025 to 2033.

Which region will lead the Cardiac Surgery Devices Market in the future?

Geographically, the North American regional market dominated the Cardiac Surgery Devices Market in 2024.

Does this report include the impact of COVID-19 on the Cardiac Surgery Devices Market?

Yes, we have studied and included the COVID-19 impact on the global Cardiac Surgery Devices Market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com