Global Supply Chain Analytics Market Size, Share, Trends, & Growth Forecast Report – Segmented By Solution (Logistics Analytics, Manufacturing Analytics, Planning & Procurement, Sales & Operations Analytics, Visualization & Reporting), Service (Professional, Support & Maintenance), Deployment Mode (Cloud, On-premises), Enterprises Size (Large Enterprises, SMEs), End-use (Retail & Consumer goods, Healthcare, Manufacturing, Transportation, Aerospace & Defense, High Technology Products, Others), & Region - Industry Forecast From 2024 to 2032

Global Supply Chain Analytics Market Size (2024 to 2032)

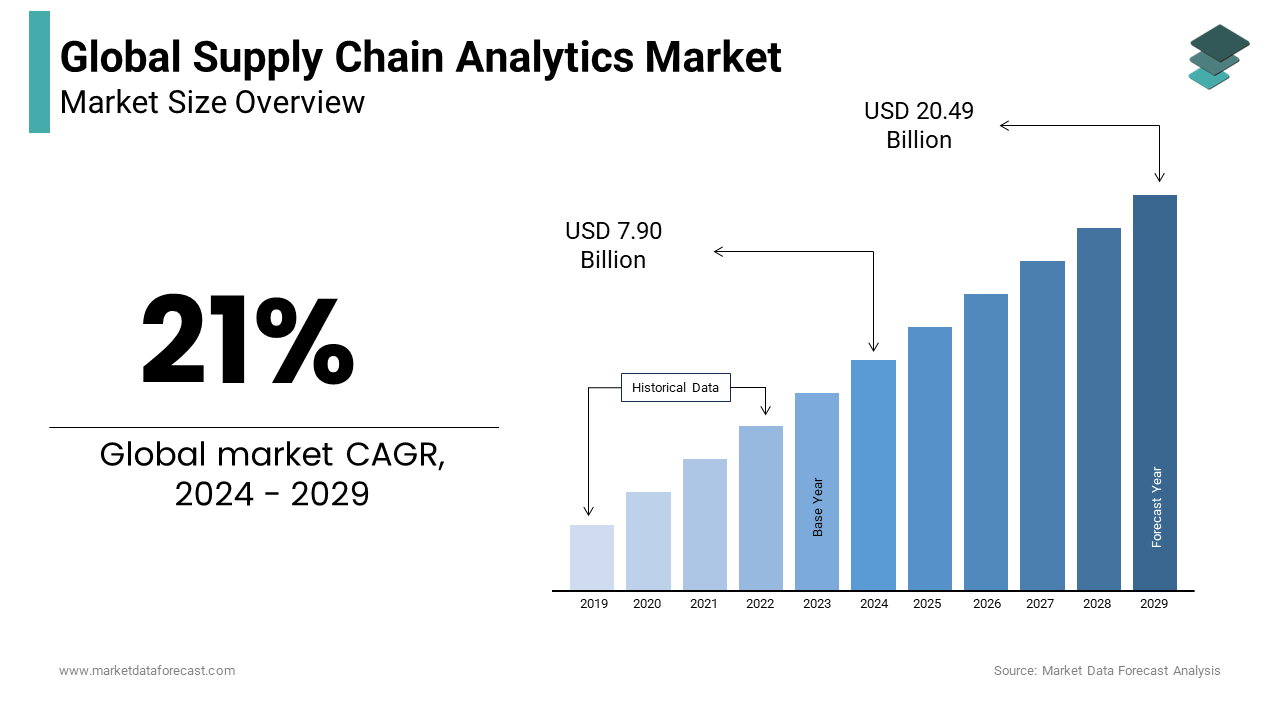

The global supply chain analytics market was valued at USD 6.53 billion in 2023. The global market is predicted at USD 7.90 billion in 2024. The market size is expected to grow at a CAGR of 21% during the forecast period, reaching USD 36.30 by the end of 2032.

Supply chain analytics enables organizations to gain a broader perspective of supply chain activities, effectively managing any issues affecting the business’s profitability or sustainability. Mobile-based solutions enable businesses to monitor inefficient supplier networks, elevated warehousing costs, and inaccurate forecasts, among other issues. In addition, analytics solutions play a crucial role in analyzing business operations, which can enhance inventory management and reduce costs that may hinder the market growth. A recent increase in the adoption of mobile-based solutions is anticipated to generate opportunities for market demand.

Supply chain analytics also improves a company’s ability to make decisions concerning incorporating technology, organizational infrastructure, strategic relationships, and enterprise resource management. In addition, supply chain analytics solutions promote strategic decision-making and assist businesses in enhancing their market position, maximizing their return on investment, and accelerating their development by applying the acquired knowledge. The software for supply chain analytics facilitates collaboration and access to diverse data sources while delivering comprehensive insights. These benefits enable a company to improve its response time by expecting alterations to its production schedule and process.

MARKET DRIVERS

Rising Adoption of Big Data Technologies- Due to the proliferation of the IoT, social media and multimedia organizations are perpetually amassing a prodigious amount of information; Traditional business data is expanding at a rate ten times slower than data generated by algorithms and humans. In addition, it is anticipated that by 2027, devices that collect, analyze and exchange this data will be worth approximately USD 41 billion. As a result, numerous businesses and individuals have adopted big data analytics in response to the rising demand for storing, processing, and analyzing massive amounts of structured and unstructured datasets. Hence, adopting big data technology is surging the supply chain analytics market growth.

MARKET RESTRAINTS

Increasing cyber threats threaten supply chain analytics solutions to be used- As big data grows in all business sectors, companies are analyzing data sets to make strategic decisions. But data scientists all over the world worry about errors in data sets. In addition, organizations may be worried about unethical behavior and the rise of cyber threats, which could somewhat slow the adoption of supply chain analytics solutions. Even though integrating technology into supply chain processes seems good, business leaders still worry about security and data breaches. If a data set has mistakes, contradictory information, or no longer accurate information, it could hurt the company’s efforts to build strong supply chain analytics projects. This is one of the major restraining factors that has been threatening the supply chain analytics market for quite some time now.

MARKET OPPORTUNITIES

Increasing use of supply chain analytics on the cloud- Organizations are more likely to use cloud-based solutions because the supply chain ecosystem is getting more complicated, and more people want data to be analyzed in real-time. Cloud-based data analytics solutions mostly track and evaluate all supply chain activities across the forward and backward supply chain ecosystems. In addition, the advantages of the cloud over other supply chain management systems providers, such as its low cost, flexibility, ease of use and integration, planning and ability to grow, are also attracting them and opening doors for future opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

21% |

|

Segments Covered |

By Solution, Services, Deployment Mode, Enterprise Size, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

SAP SE, Oracle, IBM, SAS Institute, Software AG, Micro Strategy, Tableau, Qlik, TIBCO, Cloudera, Logility, and others. |

SEGMENTAL ANALYSIS

Global Supply Chain Analytics Market Analysis By Solution

In 2022, the sales and operation analytics segment dominated over 25% of the global market share. The need to optimize resource utilization and the cost is a significant factor contributing to the growth rate of this segment. The client benefits from adaptable and cost-effective supply chain analytics that is adaptable to dynamic requirements. This is anticipated to contribute to the segment’s growth during the forecast period.

Global Supply Chain Analytics Market Analysis By Services

Based on the type of service segment, professional services will have over 60% of the market share in 2022. So that data doesn’t get lost or stolen, professional services must make sure that the new systems are compatible with the systems already in place in many departments and integrate the new systems with the old ones. This helps the segment grow. Demand for professional services to analyze and store important data and for professional help with new technologies is growing. Thus, the professional services segment is anticipated to grow at the highest CAGR over the forecast period.

Global Supply Chain Analytics Market Analysis By Deployment Mode

Based on deployment type, the cloud segment held the largest market share in 2022. The proliferation of technology has led to the widespread adoption of IoT devices, which has increased OEM customers’ reliance on cloud-based problems. Cloud deployment increases an organization’s adaptability and enables the mass customization of products and services. The industry favors big data analytics solutions owing to their advantages in data security and risk assessment. The aggressive deployment of supply chain analytics solutions on cloud-based platforms is a consequence of increased mobility and the simplicity of using cloud services.

Global Supply Chain Analytics Market Analysis By Enterprise Size

By enterprise size, the large enterprise's segment holds the largest share of the supply chain analytics market, the reason being the growing demand for strong monitoring solutions and automation capabilities for the allocation of resources and making strategic decisions in big corporations. The need for a supply chain analytics market is likely to be driven by the lack of an internal network architecture for data storage.

Global Supply Chain Analytics Market Analysis By End Use

In 2022, the manufacturing sector held the largest market share of the supply chain analytics market. Supply chain analytics can aid in performance enhancement because they provide access to real-time data across the entire value chain and reflect changes made to any region or process throughout the organization in real-time. Increasing customer demand and the need to ensure product availability and on-time delivery are also driving the need for supply chain efficiency enhancements.

REGIONAL ANALYSIS

In 2022, more than 35% of the world’s market was in North America, making the region holder of the biggest market shares. Because business processes in North America are getting more complicated, more attention is being paid to how operational data is shown visually. This lets businesses quickly evaluate the state of their supply chain based on data which helps them make better strategic decisions.

Asia Pacific is following North America in holding the shares of the market owing to a rise in the number of industries with the growing investments from the government.

KEY PLAYERS IN THE GLOBAL SUPPLY CHAIN ANALYTICS MARKET

- SAP SE

- Oracle

- IBM

- SAS Institute

- Software AG

- Micro Strategy

- Tableau

- Qlik

- TIBCO

- Cloudera

- Logility, and others.

RECENT HAPPENINGS IN THE GLOBAL SUPPLY CHAIN ANALYTICS MARKET

- In January 2023, the partnership between project44 and SAS will bring together the largest global real-time transportation data repository and the most intelligent supply chain planning tools. This will make E2E global supply chains more accurate and easier to see.

- In November 2022, IBM released IBM Business Analytics to help companies deal with problems that came up out of the blue.

- In October 2022, Oracle and Well Span Health announced that they would work together to improve business visibility and make operations run more smoothly.

- In May 2021, Software AG and SAP made their partnership in the field of digital supply chains even bigger by letting SAP’s S/4HANA cloud use its Trend Miner analytics software.

- In February 2021, Software AG and SAP announced their partnership to make supply chain management data easier to see. This will help improve the quality of products.

DETAILED SEGMENTATION OF THE GLOBAL SUPPLY CHAIN ANALYTICS MARKET INCLUDED IN THIS REPORT

This research report on the global supply chain analytics market has been segmented and sub-segmented based on the solution, services, deployment mode, enterprise size, end-use, and region.

By Solution

- Logistics Analytics

- Manufacturing Analytics

- Planning & Procurement

- Sales & Operations Analytics

- Visualization & Reporting

By Services

- Professional

- Support & Maintenance

By Deployment Mode

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- SMEs

By End Use

- Retail & Consumer goods

- Healthcare

- Manufacturing

- Transportation

- Aerospace & Defense

- High Technology Products

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Frequently Asked Questions

What are the key drivers of growth in the supply chain analytics market?

Key drivers include the increasing need for demand forecasting, inventory management, and real-time data insights. Additionally, advancements in big data, artificial intelligence (AI), and machine learning (ML) technologies significantly contribute to market growth.

What are the main challenges faced by the global supply chain analytics market?

Major challenges include data privacy concerns, high implementation costs, and the complexity of integrating analytics solutions with existing systems. Additionally, a shortage of skilled professionals in data analytics poses a significant hurdle.

What role does artificial intelligence (AI) play in supply chain analytics?

AI plays a crucial role in enhancing supply chain analytics by enabling advanced predictive analytics, improving decision-making processes, automating routine tasks, and providing deeper insights through machine learning algorithms. AI helps in identifying patterns and anomalies that are not easily detectable through traditional methods.

How are emerging technologies like blockchain and IoT influencing the supply chain analytics market?

Emerging technologies like blockchain and the Internet of Things (IoT) are revolutionizing supply chain analytics by providing greater transparency, traceability, and efficiency. Blockchain ensures secure and immutable transaction records, while IoT devices provide real-time data from various points in the supply chain, enhancing overall visibility and decision-making capabilities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]