Global Sustainable Aviation Fuel Market Research Report - Segmentation By Fuel Type (Bio fuel, Hydrogen Fuel and Power to Liquid Fuel), By Platform (Commercial aviation, Military aviation, Business & general aviation and Unmanned aerial vehicle), By Blending Capacity (Below 30%, 30% to 50% and above 50%) and Region – Industry Forecast 2024 to 2032.

Global Sustainable Aviation Fuel Market Size (2024-2032):

The global sustainable aviation fuel market was worth US$ 1.2 billion in 2023 and is anticipated to reach a valuation of US$ 40.88 billion by 2032 from US$ 1.78 billion in 2024 and is predicted to register a CAGR of 48% during 2024-2032.

Current Scenario of the Global Sustainable Aviation Fuel Market

Sustainable aviation fuel is a specific type of gasoline that is designed to be used in planes while also increasing their efficiency. Sustainable aviation fuels are made from renewable resources and have a chemistry that is quite comparable to traditional fossil jet fuels. Increased use of sustainable aviation fuels reduces carbon emissions when compared to regular jet fuel because it replaces the fuel's lifespan. to create a sustainable environment and meet severe regulatory limits on emissions, the aviation industry is leaning toward reducing carbon footprints.

MARKET GROWTH

Aviation fuel usage is expected to rise as the aviation sector expands and worldwide trade expands. As a result, the demand for sustainable aviation fuel will increase dramatically in the future to attain a sustainable environment.

MARKET DRIVERS

Airlines transported 15.20 billion passengers in 2023, according to figures supplied by the International Civil Aviation Organization (ICAO). Furthermore, by 2040, the number of airline passengers is predicted to exceed 10.0 billion, necessitating the purchase of additional planes to convey people from point A to point B. This in turn increases the size of the aircraft fleet and the frequency of flights, which necessitates efficient fuels and, boosts the worldwide sustainable aviation fuel market.

Sustainable aviation fuel is a greener alternative to fossil fuel, reducing greenhouse gas emissions by up to 80% throughout the fuel's lifecycle when compared to regular fossil jet fuel. As a result, airlines can reduce their environmental impact. The gasoline burns cleanly without Sulphur, oxygen, or aromatics and has a higher energy content, reducing dangerous particle Sox and Nox emissions.

Using sustainable aviation fuel is an excellent method to demonstrate to stakeholders and customers your company's commitment to sustainability. Your airline can support a cleaner future for aviation and the earth by aggressively championing the use of sustainable aviation fuels.

Consumers are increasingly looking for more environmentally friendly solutions in their life, with the aviation industry aiming to cut CO2 emissions in half by 2050 compared to 2005 levels. Giving your clients the option of using sustainable aviation fuel – for example, by establishing a scheme where they can purchase it at the same time as their flights – can only be a good thing.

Cumulatively, all these factors are contributing to the expansion of the global sustainable aviation fuel market industry.

MARKET RESTRAINTS

The COVID-19 epidemic has had a negative impact on the worldwide economy. The installation of a lockdown, the suspension of domestic and international flights, and air travel limitations for non-essential travel have all had a negative influence on the long-term growth of the sustainable aviation fuel industry. Also, due to a limited workforce and a temporary halt in production activities to prevent the spread of coronavirus, new aircraft deliveries have been delayed, affecting the demand for sustainable aviation fuel.

A rise in crude oil prices has a greater impact on airlines, as an aircraft uses 14 litres of fuel per kilometre on average, resulting in higher operating costs. Thus, the rise in crude oil prices restricts market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

48% |

|

Segments Covered |

By Fuel Type, Platform, Blending Capacity, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Aemetis, Inc., Avfuel Corporation, Fulcrum Bioenergy, Gevo, Lanzatech, Neste, Preem AB, Sasol, SkyNRG, World Energy and Others. |

SEGMENTAL ANALYSIS

Sustainable Aviation Fuel Market Analysis By Fuel Type

The biofuel segment of the sustainable aviation fuel market will account for the biggest share during the projected period, based on fuel type. Biofuel's greatest promise lies in its ability to reduce GHG emissions in the aviation sector while also having a positive impact on climate change. A major driving force behind biofuel development and consumption has been the aviation sector's strong and ongoing commitment, as well as the active involvement of an increasing number of stakeholders, such as airlines and many aviation organizations, in developing biofuel through voluntary initiatives. Due to substantial advancements in technological approaches to commercializing the use of alternative jet fuel, biofuel production is likely to grow rapidly in the coming decade.

Sustainable Aviation Fuel Market Analysis By Platform

According to the platform, throughout the projected period, the commercial aviation segment of the sustainable aviation fuel market would account for the highest share. The increase in the aircraft fleet of emerging economies in the commercial aviation sectors can be linked to the growth of this market. The adoption of renewable jet fuel by numerous commercial airlines, commercial airports, and aircraft manufacturers around the world is propelling this area of the sustainable aviation fuel market forward.

Sustainable Aviation Fuel Market Analysis By Blending Capacity

The 30% to 50% category of the sustainable aviation fuel market is predicted to develop at the fastest CAGR over the forecast period, based on biofuel blending capacity. The modest mix capacity, drop-in facility in existing fuel systems, supply logistics infrastructure, and aircraft fleet enable the overall cost to be kept low while meeting the volume demands of commercial and military aviation.

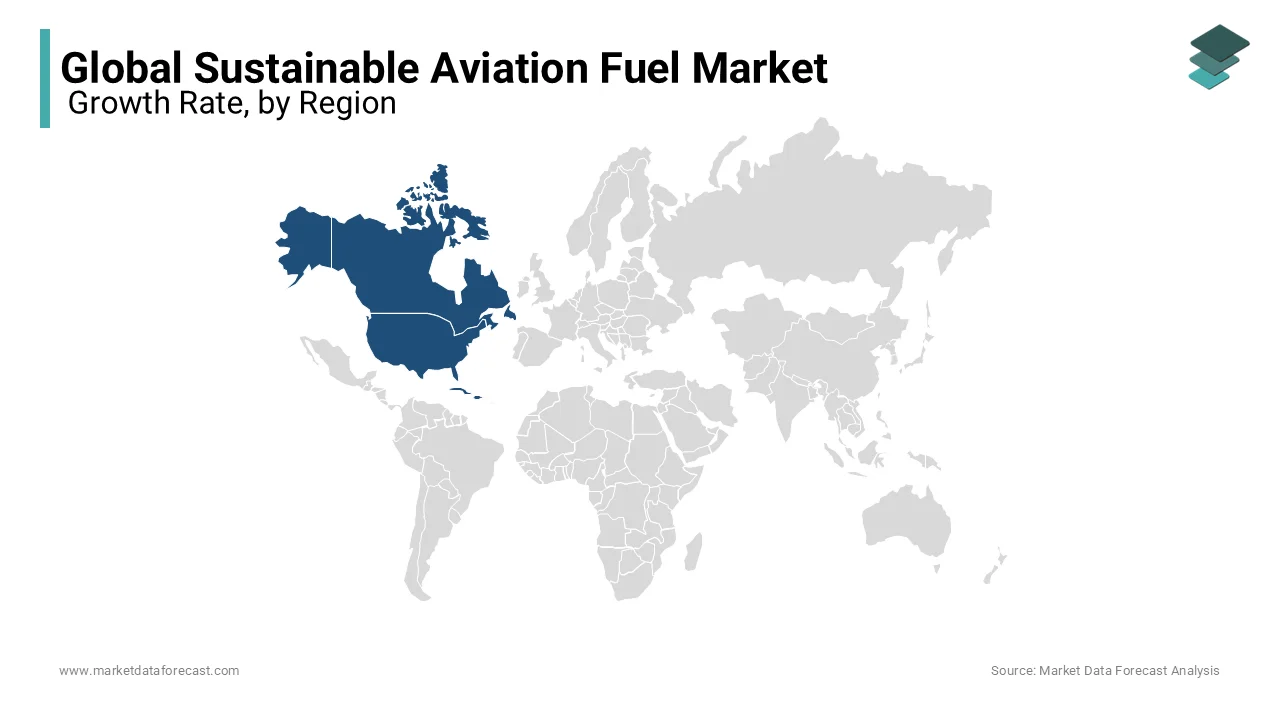

REGIONAL ANALYSIS

North America is thought to have the largest aircraft fleet and the highest number of passengers per year, resulting in a significant increase in aircraft emissions. The United States and Canada are focusing on numerous projects to use sustainable aviation fuel to meet the need for reduced carbon footprints owing to increased air traffic and air passengers. The North American market is considered to be one of the strongest demand centres for sustainable aviation fuel due to supportive legislation and measures to reduce aviation emissions. To achieve the goal of decarbonizing the aviation sector, switching to more energy-dense biofuel is expected to play a key role in reducing GHG concentrations across the region.

KEY PLAYERS IN THE GLOBAL SUSTAINABLE AVIATION FUEL MARKET

Companies playing a prominent role in the global sustainable aviation fuel market include Aemetis, Inc., Avfuel Corporation, Fulcrum Bioenergy, Gevo, Lanzatech, Neste, Preem AB, Sasol, SkyNRG, World Energy and Others.

RECENT HAPPENINGS IN THE GLOBAL SUSTAINABLE AVIATION FUEL MARKET

- Colonial, the major artery of the US' fuel supply from the south to the east coast announced it has added the ability to carry Sustainable Aviation Fuel and will accept customer nominations to ship the gasoline on its system. Shippers can now nominate jet fuel containing SAF for delivery from any Colonial origin point to any Colonial destination, including airports, via Colonial's 5,500-mile network.

- The United Kingdom is attempting to establish itself as a market leader in sustainable fuels. Its busiest airport, London Heathrow, is today the greatest consumer of SAF of any airport in the world. Following the implementation of a SAF incentive earlier this year, sustainable biofuels now account for 0.5 per cent of the airport's fuel supply.

DETAILED SEGMENTATION OF THE GLOBAL SUSTAINABLE AVIATION FUEL MARKET INCLUDED IN THIS REPORT

This research report on the global sustainable aviation fuel market has been segmented and sub-segmented based on fuel type, platform, blending capacity and region.

By Fuel Type

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

By Platform

- Commercial aviation

- Military aviation

- Business & general aviation

- Unmanned aerial vehicle

By Blending Capacity

- Below 30%

- 30% to 50%

- Above 50%

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the global sustainable aviation fuel market volume?

The sustainable aviation fuel market volume is huge, it generated revenue of US$ 1.78 billion in 2023 and is anticipated to reach a valuation of US$ 40.88 billion by 2032.

2. What is the expected market growth rate?

The market is expected to grow at a CAGR of 48% from 2024 to 2032.

3. Name any three sustainable aviation fuel market key players?

Aemetis, Inc., Avfuel Corporation, and Fulcrum Bioenergy are the three sustainable aviation fuel key players.

4. What is the major impacting factor in the global sustainable aviation fuel market?

Increase in aviation fuel usage and number of travelers are influencing elements in the worldwide sustainable aviation fuel market.

5. Which airport accounts for the highest use of sustainable aviation fuel?

London Heathrow airport situated in the United Kingdom is the leading consumer of SAF.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]