Global Ventilator Market Size, Share, Trends & Growth Forecast Report By Type of Interface (Invasive and Non-invasive), End-users (Hospitals And Clinics, Ambulances, Home Care and Emergency Medical Services), Mobility (Intensive Care and Portable Ventilators) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Ventilator Market Size

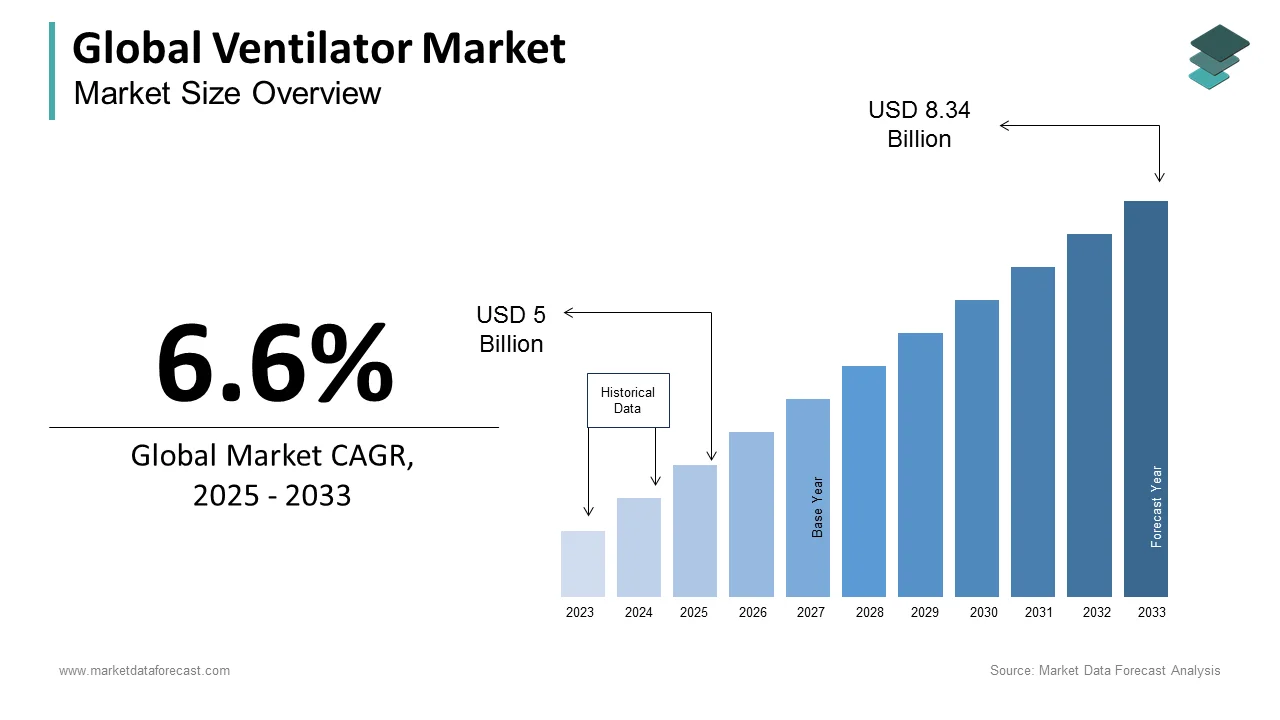

The size of the global ventilator market was worth USD 4.69 billion in 2024. The global market is anticipated to grow at a CAGR of 6.6% from 2025 to 2033 and be worth USD 8.34 billion by 2033 from USD 5 billion in 2025.

MARKET DRIVERS

Growth Driven by Respiratory Diseases & Aging Population

The increasing prevalence of respiratory diseases and the growing aging population worldwide are key drivers propelling the growth of the global ventilator market. The burden of respiratory diseases is rising due to various causes, such as smoking, obesity, and behavioral changes. Also, lung and respiratory disorders, such as chronic obstructive pulmonary disease (COPD) and bronchial asthma, consistently need ventilators as they cause postoperative problems among patients. The increasing incidence of these target indications raises the affected patient's hospital admission and readmitted rates as they may need regular ventilation assistance. Besides, with an uptick in the aging population, there has been a corresponding increase in cardiovascular disease, stroke, and diabetes. The need for prompt medical attention distinguishes these cases.

Critical Care & Technological Advancements

An increase in critical care unit cases is a major factor accelerating the ventilator market growth. The ventilation system gives artificial or mechanical respiration to a patient suffering from some chronic condition. Also, growing people's discretionary incomes and their ability to pay more for specialized healthcare systems have facilitated the development and upgrading of healthcare infrastructure and treatment facilities. As a result, it also brings momentum to the market. Technological developments, growing healthcare costs, and an increasing number of intensive care beds in developing markets also drive the development of the global ventilator industry. The industry is similarly influenced by a high rate of premature births, rising demand for medical care in the senior community, and government efforts to improve the development of ventilators. However, the shortage of qualified healthcare personnel, the lack of consistent terminology for various ventilation types, and the high costs associated would significantly restrict business development.

Technological advancements in ventilators are boosting the growth rate of the global market.

Technological advancements in microprocessor-controlled ventilation, integrated with the challenge of new ventilation types, have created a multidisciplinary healthcare team with a range of ways to transform critically ill ventilation treatment for patients. Advanced ventilators are ready for all specifications and have multiple checks and balances. Patient-specific parameters such as air pressure, air volume, and flow rate, and general parameters such as air leakage, mechanical loss, power failure, battery replacement, oxygen tanks, and remote control are fitted with sensors and monitors.

Factors such as preterm birth, rapid growth in population, rising lung diseases, and an increased number of ICU beds are promoting the ventilator market growth worldwide. The growth in chronic illness among children and the diseases related to hearts and lungs due to lifestyle changes have also increased the demand for ventilators. The growth in the number of home therapists has also led to an increase in demand for ventilators. Countries like India, China, and Brazil have led a rise in the need for ventilators in these countries. These countries have increased their healthcare budgets, and there is a significant share of the development of ventilators in these budgets.

MARKET RESTRAINTS

Unfavorable reimbursement scenarios in case ventilators are limiting the growth of the global market.

The ventilators are very complex to use, and only trained professionals should be allowed to use them; due to the lack of such professionals worldwide, ventilators are restricted. Physicians have also shown a lack of transition to ventilators, which can be challenging. Ventilator costs are high worldwide, making them inaccessible to the poor, thus limited in reach. The improper functioning of alarms, inappropriate heating or humidification of the inspired gas, and improper ventilation cycle are minor complications during ventilation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type Of Interface, End-Users, Mobility, And Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Philips, Resmed, Medtronic, Becton, Dickinson and Company, Getinge, Dräger, Smiths Group, Hamilton Medical, G.E. Healthcare, Fisher & Paykel, Air Liquide, Asahi Kasei, and Allied Healthcare Products, and Others. |

SEGMENTAL ANALYSIS

By Type of Interface Insights

The invasive segment led the ventilator market in 2024 and is expected to register a prominent CAGR during the forecast period. Mechanical ventilation is termed Invasive Ventilation. Invasive ventilatory support is provided via either an endotracheal tube or a tracheostomy tube. Wide applications in respiratory diseases, neurological diseases, and sleeping disorders are the primary factors supporting the growth of the invasive ventilation segment.

The non-invasive ventilation segment accounted for a considerable share of the worldwide market in 2024 and is predicted to witness a healthy CAGR during the forecast period. Non-invasive ventilation is the one where support is not provided via the endotracheal tube or tracheostomy tube. Non-invasive ventilation is breathing support through a face mask or nasal mask. Air pressure is administered depending on whether the person is breathing in or out. NIV is used due to the reason that it can avoid spreading the infection. It is second in market share and is expected to increase rapidly.

By End-users Insights

The hospitals and clinics segment occupied the major share of the worldwide market in 2024 and is predicted to continue to be the dominating segment in the global market throughout the forecast period. Hospitals and clinics are the largest end-users of ventilators because ventilators are expensive and difficult to procure. However, especially during COVID-19 times, hospitals have increased their inventory of ventilators to cure patients with severe conditions.

The home care segment is the second-largest ventilator market and is expected to register the highest CAGR. The increased awareness of ventilator technology among patients and doctors and increased healthcare budgets by personnel have driven this segment's growth.

Ambulances are the third largest but are expected to rise at a reasonable growth rate due to increased budgets for quality healthcare from private and public institutions.

Emergency medical services are also expected to have a reasonable growth rate due to increased emergency medical cases.

By Mobility Insights

The intensive-care segment is expected to hold the leading share of the global ventilator market during the forecast period. Intensive-care ventilators have the largest market share and are expected to increase as more hospitals and other healthcare institutions are built.

Although they are second in market share, portable ventilators are expected to have a promising CAGR. Portable ventilators are used in cases where ambulances and home care are needed.

REGIONAL ANALYSIS

North American had the largest share in the global ventilator market in 2024, as the quality of health facilities is much better than in other countries. The hospitals are more advanced, and the significant players in the ventilator market see massive potential and invest more in research and development.

Europe had the second-largest share worldwide in 2024, as the government allocated a fair share for the healthcare industry in its budget. Increased smoking, a rising population, and high healthcare expenditure drive market growth.

Asia-Pacific had the third-largest share in the global market in 2024. It is expected to grow at a reasonable rate due to the increase in population in China and India. Also, the healthcare budgets and facilities are significantly less compared to the North American and European markets.

The Latin American market is anticipated to grow at a steady CAGR during the forecast period.

The MEA market is estimated to grow at a moderate share of the worldwide market in the coming years.

KEY MARKET PARTICIPANTS

Companies such as Philips, Resmed, Medtronic, Becton, Dickinson and Company, Getinge, Dräger, Smiths Group, Hamilton Medical, G.E. Healthcare, Fisher & Paykel, Air Liquide, Asahi Kasei, and Allied Healthcare Products are expected to account for the majority of the global ventilators market share during the forecast period.

RECENT HAPPENINGS IN THE MARKET

- The U.S. government has promised Uzbekistan more ventilators to fight covid19.

- G.M. and Ford have wrapped up their temporary ventilator production and are moving toward the auto business.

- Companies like Mahindra have also started ventilator production to cater to the rising demand during this pandemic.

- In Apr 2020, a Bengaluru-based startup launched a portable ventilator for coronavirus patients.

MARKET SEGMENTATION

This market research report on the global ventilator market has been segmented and sub-segmented based on the type of interface, end-users, mobility, and region.

By Type of Interface

- Invasive ventilation

- Non-Invasive ventilation

By End-users

- Hospitals and clinics

- Ambulances

- Home care

- Emergency Medical Services

By Mobility

- Intensive care

- Portable ventilators

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which segment by end-user led the global ventilator market in 2023?

Based on the mobility, the intensive care ventilators segment led the global ventilators market in 2023 and is projected to continue showing dominance throughout the forecast period.

Which segment by mobility is expected to grow the fastest in the global ventilator market?

The global ventilator market size is predicted to be USD 8.34 billion in 2033.

Which are the key market participants in the global ventilators market?

Philips, Resmed, Medtronic, Becton, Dickinson and Company, Getinge, Dräger, Smiths Group, Hamilton Medical, GE Healthcare, Fisher & Paykel, Air Liquide, Asahi Kasei, and Allied Healthcare Products are some of the leading manufacturers of ventilators in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com