Global Vital Signs Monitoring Market Size, Share, Trends & Growth Forecast Report By Product, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Vital Signs Monitoring Market Size

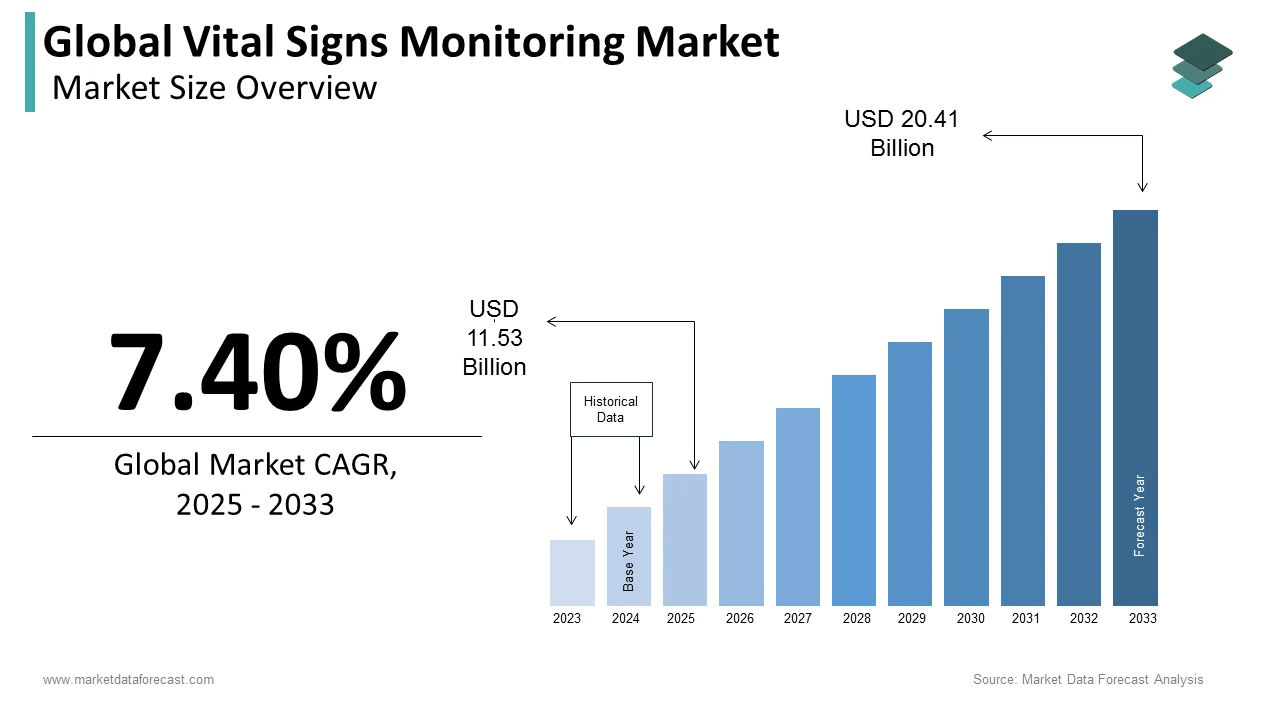

The size of the global vital signs monitoring market was worth USD 10.74 billion in 2024. The global market is anticipated to grow at a CAGR of 7.40% from 2025 to 2033 and be worth USD 20.41 billion by 2033 from USD 11.53 billion in 2025.

Vital sign devices accurately assess the patient's respiratory rate, blood pressure, temperature, and pulse. While giving treatment services, these devices are crucial in monitoring the patient's condition. These devices can also be used at home to monitor vital signs regularly. It is important to monitor critical patients at risk of complications on small changes, like patients with high/low B.P., diabetes patients, People with heart problems, and patients in the care of E.R. Therefore, these devices make sure to monitor any abnormal changes continually.

MARKET DRIVERS

Y-O-Y's growth in the prevalence of chronic diseases, growing R&D activities to develop better products, and YOY's growth of the home healthcare market worldwide are majorly propelling the vital global signs monitoring market.

Changes in lifestyles and food habits are also a factor for the increasing number of heart-related diseases, solely to propel the market's growth rate. The growing adoption of sedentary lifestyles and irregular physical activities are ascribed to fuel the market demand tremendously. In addition, rising awareness over the usage of home care settings is elevating the market's demand.

The increasing adoption of the latest devices at hospitals and clinics is expected to favor the global vital signs monitoring market. Launching innovative devices like digital blood pressure monitoring devices, pulse oximeters, and others favoring the end-users is also propelling the market's demand. Besides, government initiative steps Escalating expenditure on healthcare associated with the rising disposable income in both developed and developing countries is likely to fuel the growth rate of the vital signs monitoring market. In addition, people prefer home care settings to hospitals due to its convenience factor significantly impacting the market's growth rate. Therefore, innovations in vital signs monitoring devices and the shortage of healthcare professionals are to support growth.

Factors such as improvement in the healthcare infrastructure, changes in the healthcare settings, and increasing funds by the government are outraging the vital signs monitoring the market's growth. There is a critical nursing shortage in the U.S. According to the Bureau of Labor Statistics, there will be a shortage of at least 1 million nurses nationwide by 2024. Even now, the estimated 3 million U.S. nurses are insufficient to effectively staff clinics, elder living facilities, emergency rooms, and surgical centers. Therefore, the unmet requirement for professionals can be covered with the help of vital sign monitors. Additionally, introducing various types of monitors, body-worn, ingestible, non-contact, etc., is helping the market's growth.

MARKET RESTRAINTS

Fluctuations in the prices of the device due to less production rate are slowly degrading the growth rate of the global vital signs monitoring market.

Along with this, people in rural areas are less aware of the devices available, which hinders the vital signs monitoring market demand. In low and middle-income economic countries, the demand for these devices is deficient due to a lack of knowledge, which hampers the market's growth. In addition, the lack of reimbursement policies in underdeveloped countries is also restraining the market's growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, G.E. Healthcare, Masimo, Omron Healthcare, Contec Medical Systems Co. Ltd, A&D Company Ltd., Nonin Medical Inc., SunTech Medical, Inc. |

SEGMENTAL ANALYSIS

By Product Insights

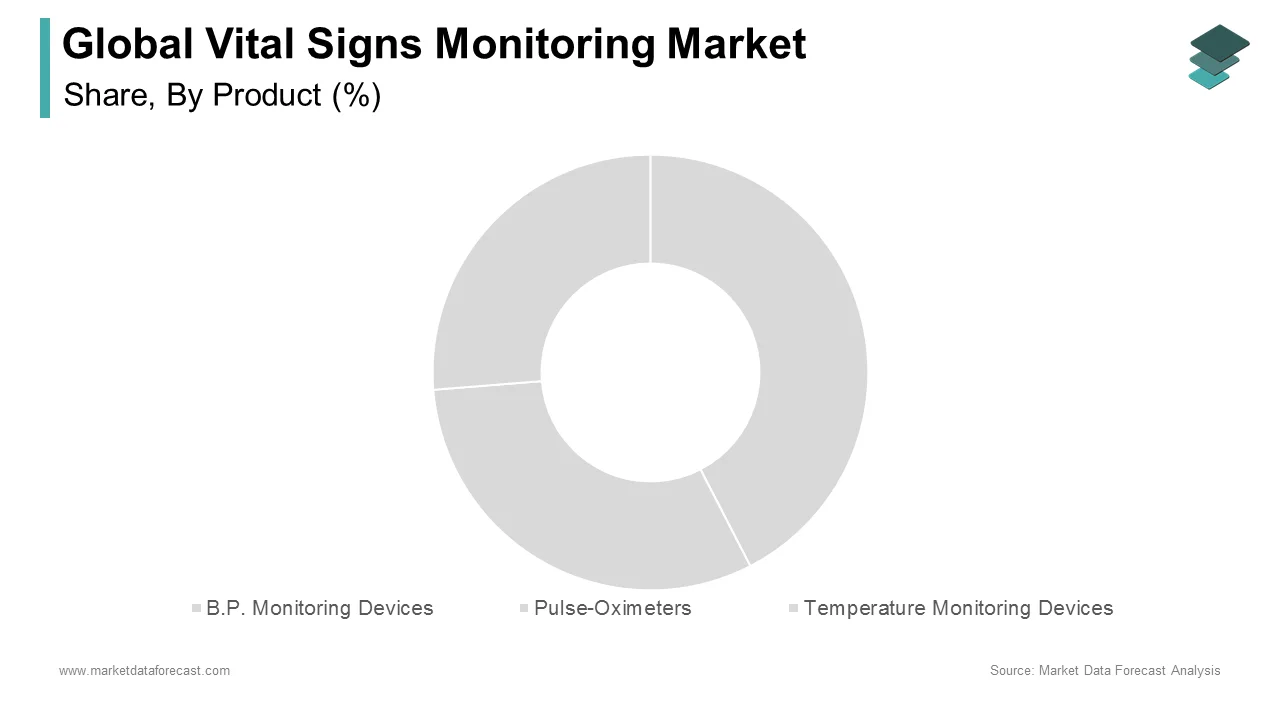

Based on the product, the B.P. monitoring devices segment was the market leader in 2024 and is predicted to continue dominating the forecast period. Y-O-Y growth in the prevalence of hypertension directly reflects the growth of the B.P. monitoring devices market. B.P. monitors are essential for measuring and preventing any severe heart conditions caused by high or low BP.

The Pulse oximeters segment is next to the B.P. monitors segment, accounting for the market's dominating shares. However, increasing cardiovascular-related problems and the rising priority for pulse oximeters during the COVID-19 pandemic are outraging the growth rate of this segment. As a result, the fingertip segment among the pulse oximeters segment is estimated to grow 8.36% during the forecast period.

By End User Insights

Based on End Users, the Hospitals are gaining traction over the market shares among all based on the end-users. An increasing number of hospitals by the growing number of patients due to the spread of COVID-19 is accelerating the market demand. In addition, technological advancements in healthcare and the adoption of new product launches in hospitals are likely to promote the growth rate of this segment.

However, the home healthcare segment is expected to grow quickly during the forecast period. The sudden surge in the digitalization of the world and the population preferring at-home services rather than hospital care, and the rising awareness about remote and personal care are supporting the rise of the segments. Additionally, the rise of geriatric populations and critically ill patients who find it difficult to visit hospitals support this revenue for the segment.

REGIONAL ANALYSIS

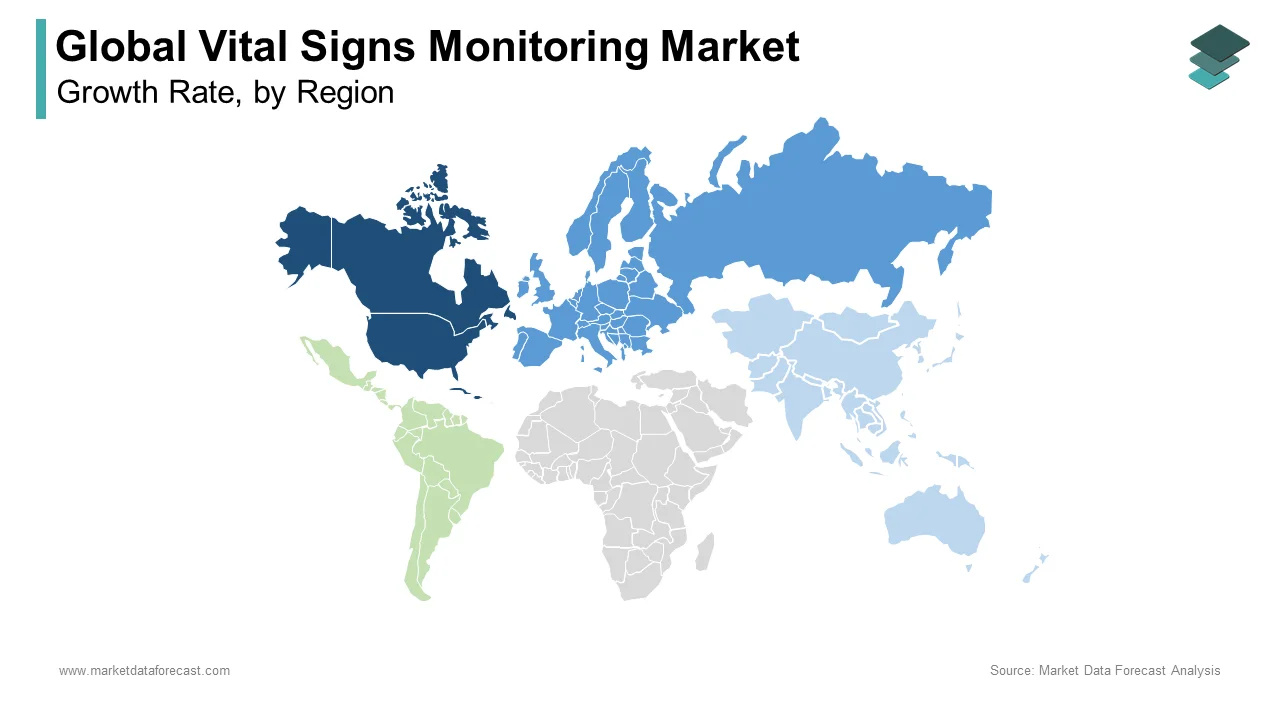

Geographically, North America is expected to hold the highest market shares due to increasing healthcare research and development activities. The presence of the key players and collaborations of the companies to introduce quality healthcare services positively impact the market's growth rate in this region. The United States is the major country dominating the market shares. According to the Population Reference Bureau, in the U.S., people aged above 60 years will be around 98 million by 2060.

Europe is next in leading with the dominant shares of the market. Constant economic growth and high investments in the healthcare sector are elevating the demand in the market.

Asia Pacific is growing faster and will hit the highest CAGR in the near future. The rising scale of hospitals and increasing awareness of pulse oximeters and temperature monitoring devices at home are likely to fuel the market's demand. In addition, the increasing geriatric population and trend towards fitness activities are also ascribed to leverage the growth rate of the vital signs monitoring market in Asia Pacific.

KEY MARKET PARTICIPANTS

Some of the notable companies playing a promising role in the global vital signs monitoring market profiled in this report are Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, G.E. Healthcare, Masimo, Omron Healthcare, Contec Medical Systems Co. Ltd, A&D Company Ltd., Nonin Medical Inc., SunTech Medical, Inc.

RECENT MARKET HAPPENINGS

- In November 2022, The FDA-cleared, patented pulse oximetry (SpO2) sensor chipset and integrated processing technology from BioIntelliSense, Inc. were made available. It accurately measures blood oxygen levels during movement and activity and across the full spectrum of skin pigmentations, from very light to very dark. A company that provides clinical intelligence and continuous health monitoring is called BioIntelliSense, Inc. The provision of clinically precise SpO2 readings across a range of patient demographics has reached a critical milestone, which may help to increase healthcare fairness. Sotera, a digital health firm focused on identifying early indicators of patient deterioration, will attend the AMIA Annual Symposium from November 5 to 9, 2022. The digital health startup will discuss its many projects to enhance patient data collecting and lessen clinical responsibilities through improved workflow efficiencies at booth 416 during the forthcoming event.

- In October 2022, To increase the number of technologies offered in the United States through its collaboration with Medtronic, BioIntelliSense purchased the clinical intelligence and triage system AlertWatch. The collaboration with BioIntelliSense, based in Golden, Colorado, will significantly broaden the application and usage of our top-notch clinical decision support system. In addition to reducing hospital stays and expenses, workflow automation benefits also help physicians and nurses by providing highly actionable information that prioritizes individualized patient care.

- In October 2022, The WatchTower Vital Signs Report app was introduced by SentinelOne in the Singularity Marketplace. This new reporting feature simplifies the process of getting cyber insurance coverage by providing firms with an accurate profile of their cybersecurity posture and controls. In addition, the software offers a real-time "inside-out" perspective of an enterprise's cybersecurity health for cyber insurers, improving policy accessibility and lowering underwriting risk. An independent cybersecurity platform provider is SentinelOne.

MARKET SEGMENTATION

This research report on the global Vital Signs Monitoring market has been segmented and sub-segmented based on product, end-users, and region.

By Product

- B.P. Monitoring Devices

- Aneroid B.P. Monitors

- Automated B.P. Monitors

- Pulse-Oximeters

- Tabletop/Bedside Pulse-Oximeters

- Fingertip

- Handheld

- Wrist-Worn

- Pediatric Pulse-Oximeters

- Temperature Monitoring Devices

- Mercury-Filled Thermometers

- Digital Thermometers

- Infrared Thermometers

- Temperature Strips

By End User

- Hospitals

- Physician's Office

- Home Healthcare

- Ambulatory Centers

- Emergency Care Centers

- Other Healthcare Settings

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global vital signs monitoring market going to be worth by 2033?

As per our research report, the global vital signs monitoring market size is estimated to grow to USD 20.41 billion by 2033.

Which segment by product is projected to lead the vital signs monitoring market?

Based on the product, the BP monitoring devices segment is projected to dominate the vital signs monitoring market from 2025 to 2033.

Which region held the largest share of the vital signs monitoring market in 2024?

Based on the region, the North American market led the vital signs monitoring market in 2024.

Who are the major players operating in the vital signs monitoring market?

Clean Cells, Charles River Laboratories International Inc, Danaher Corporation, Merck KGaA, Parker Hannifin, and Read Source Technologies are the key market players in the vital signs monitoring market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com