Yellow Pea Protein Market segmented by Nature (Conventional and Organic), by Product Type (Protein Isolates, Textured Protein, Protein Concentrates, and Hydrolyzed Proteins), By End-Use (Animal Feed, Food Processing, Sports Nutrition, Infant Nutrition, Nutraceuticals, Cosmetics & Personal Care) by Processing Type (Wet Processing and Dry Processing) and by Regional Analysis (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast (2023 – 2028

Yellow Pea Protein Market Size, Share, Growth (2023-2028)

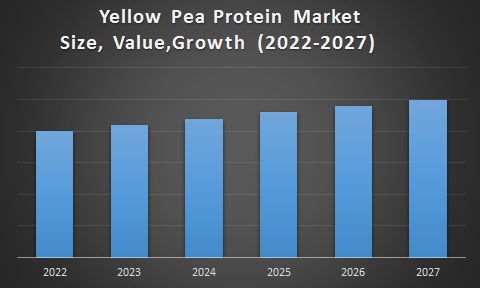

yellow pea protein market is expected to reach USD 3 billion by 2023, with a CAGR of 5.1% between 2022 and 2028.

Yellow Pea Protein Market Overview:

Yellow pea protein is a supplement derived primarily from yellow peas and is increasingly used in the food and beverage industry to increase the shakes and shakes' protein content. Over the past decade, new food trends, including preforms, clean labels, vegan, and chemical-free, have emerged at a steady pace around the world. Yellow pea protein is used in pet food due to its high nutritional properties. Yellow pea protein is low in fat and high in crude fiber. This factor is an important ingredient in reducing calorie content for weight control and low-fat pet food.

Yellow Pea Protein Market Drivers:

The demand for yellow pea protein will increase as demand for vegan substitutes increases in the food and beverage industry and an increased awareness of the benefits of natural ingredients. Due to its neutral taste and combined texture, yellow pea protein is currently used to process high-quality, easily digestible meat substitutes. The demand for sulfur pea protein in the beverage industry is expected to increase over the forecast period as the propensity to use plant raw materials increases. This investment is mainly made in yellow pea protein, starch, and protein in the food and beverage industry. Leading companies operating in the vegetable raw materials market, such as A&B Ingredients and Roquette Freres, are expected to increase total peat protein production and recognize the beverage industry's demand. The remarkable trend-driven growth for organic ingredients in the beverage industry is expected to further fuel the yellow pea protein market's growth. Plant foods have gained rapid popularity over the past decade, and as a result, the demand for plant protein continues to rise. Other factors that can help the yellow pea protein market's growth include optimal shelf life, easy to add properties, stable price, nutrient content, and sustainability. Today, yellow pea protein is increasingly being used to make vegan burgers, protein powder shakes, plant-based milk, and more. As environmental problems and reports of animal cruelty increase, modern consumers increasingly avoid consuming meat-based products. As consumers continue to seek alternative protein sources, food manufacturers are increasingly focusing on adding yellow pea protein products to their product portfolios to attract more consumers. Several prominent food manufacturers, such as Warburtons, said the company is adding yellow pea protein to its existing product range. In addition, yellow pea protein is not an allergen and has a higher ecological index compared to other alternatives, which is why it is increasingly emerging as an excellent source of protein. Over the past three to four years, the amount of products containing yellow pea protein has doubled in many regions of the world, and that amount is likely to increase further in the coming years. Because consumers prefer healthy and nutritious food, they pay attention to the ingredients and ingredients that are used in their food. Yellow pea protein helps control blood sugar, control weight, and maintain cholesterol levels.

Yellow pea protein is rich in antioxidants like flavonoids and phenolic compounds and anti-inflammatory compounds that support vascular health. Working women are moving towards the concept as fast as working out and working out with their new strong skin. As more consumers are encouraged to exercise, beauty brands are now focusing on creating products that help them achieve their health and fitness goals. As a result, cosmetic and personal experts suggest using plant proteins to thrive in supplements and beauty products. Due to its health benefits and nutritional properties, the use of yellow pea protein by food manufacturers is increasing in the most consumed foods, such as bakeries, confectionery, ice cream and desserts, sauces, soups, and snacks. The trend for plant-based proteins originated in the food and beverage industry due to its functional benefits and an increasing number of consumers migrating to vegan and flexible diets. Manufacturers are trying to find a variety of protein additives in their food products to take advantage of a variety of opportunities in untapped markets. There are some cases related to pea allergies, but they are negligible compared to the top eight allergens. Therefore, manufacturers of yellow pea protein will have a significant opportunity for yellow pea protein to replace the top eight allergens in the future.

Yellow Pea Protein Market Restraints:

Compared to other alternatives such as beans, lentils, and chickpeas, the high price of yellow pea protein is expected to hamper market growth, mainly in Asian countries. The protein content of lentils, beans, and chickpeas is almost 1.2% lower than that of peas. However, many manufacturers are opting for low-cost alternative products. The cost of yellow pea protein is having a great impact on the growth of the market in Asian countries. The increasing adoption of broccoli, chickpea, quinoa, and lentil proteins has significantly hampered the yellow pea protein market's growth. Additionally, the health factors associated with yellow pea protein are nearly identical to other alternatives. Therefore, manufacturers prefer to opt for other alternatives to yellow pea protein. However, as the demand for protein-rich additives is increasing rapidly, the demand for yellow pea protein in supplements is expected to show significant growth.

REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022-2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023-2028 |

|

CAGR |

5.1% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill Inc., Roquette Frères, DuPont de Nemours Inc., Kerry Group PLC, Glanbia plc, The Scoular Company, Shandong Jianyuan Group, Cosucra Groupe Warcoing SA, Bata Food., Axiom Foods, Burcon NutraScience Corporation, Puris Proteins LLC and The Green Lab LLC. |

Yellow Pea Protein Market Segmentation Analysis:

The Yellow Pea Protein market is segmented on the basis of Nature as conventional and organic. The organic yellow pea protein market is expected to grow at a CAGR of 7.1% during the forecast period. Traditional yellow pea protein is expected to dominate the market with a 93% market share by 2030.

The Yellow Pea Protein market is segmented into isolated

-

protein

-

textured protein

-

concentrated protein

-

hydrolyzed protein

In terms of end-use,

-

Animal Feed

-

Food Processing

-

Sports Nutrition

-

Infant Nutrition

-

Nutraceuticals

-

Cosmetics

The food processing sector dominates in 2020 with a 50% market share and is expected to grow at a CAGR of 5.6% over the forecast period. Sports nutrition and nutraceuticals are expected to have a market share of ~ 26% and ~ 18% in 2020. Depending on the type of processing, the Yellow Pea Protein market is segmented into wet processing and dry processing. Dry machining leads the market with a 68% market share in 2020, while wet machining is growing at a CAGR of 6.8% over the forecast period.

Impact of COVID 19 on the Yellow Pea Protein Market:

The ongoing COVID-19 pandemic is expected to have a minor impact on the overall growth of the global Yellow Pea Protein market during the evaluation period. Plant-based proteins, including sulfur pea protein, are gaining significant traction during the pandemic as more consumers turn their backs on meat products in the Asia Pacific for fear of becoming infected with the novel coronavirus. However, strict blockades in various countries and trade and shipping restrictions are some of the key factors expected to negatively impact the offline sale of pea protein products. With increasing health and environmental concerns, the Covid-19 outbreaks are creating a broader population migrating from animal proteins to alternative proteins like yellow pea protein.

Yellow Pea Protein market Regional Analysis:

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East and Africa

North America leads the yellow pea protein market and is expected to dominate during the forecast period. Animal welfare in North America is increasing as the vegan, and lean population in North America grows. There is a growing awareness of health and wellness in North America. Demand for yellow pea protein is increasing among vegetarians and health-conscious consumers in North America. North America is expected to grow 6.2% during the forecast period. The Asia Pacific region is expected to be the fastest-growing regional market during the forecast period due to increased consumption of nutrient-enriched functional foods. The Asia Pacific is expected to show the highest growth rate of 8.4% by 2026. China is the largest exporter of yellow pea protein here as the government focuses on reducing meat consumption and increasing consumption. Of vegetable protein or other alternative proteins.

Yellow Pea Protein market Key Players

-

Cargill Inc

-

Roquette Frères

-

DuPont de Nemours Inc.

-

Kerry Group PLC

-

Glanbia plc

-

The Scoular Company

-

Shandong Jianyuan Group

-

Cosucra Groupe Warcoing SA

-

Bata Food

-

Axiom Foods

-

Burcon NutraScience Corporation

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]