Global Active Implantable Medical Devices Market Size, Share, Trends & Growth Forecast Report By Product and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Active Implantable Medical Devices Market Size

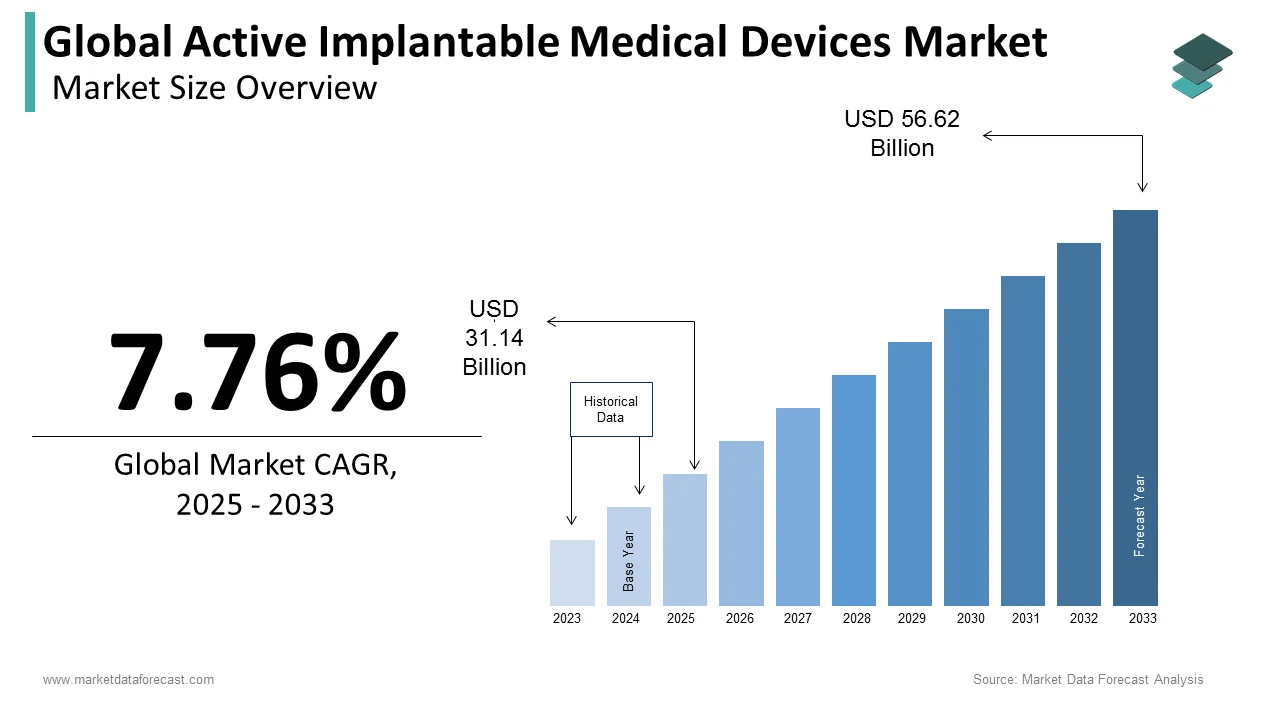

The size of the global active implantable medical devices market was worth USD 28.90 billion in 2024. The global market is anticipated to grow at a CAGR of 7.76% from 2025 to 2033 and be worth USD 56.62 billion by 2033 from USD 31.14 billion in 2025.

Active implantable medical devices are widely utilized in the medical field for diagnostic and therapeutic purposes, and they are implanted totally or partially in the human body. The device will be implanted in the patient's body and remain there forever. Heart rhythms can be controlled, hypertension can be monitored, functional electrical stimulation of nerves can be provided, glaucoma sensors can be used, and bladder and cranial pressure may be monitored. Many wireless medical devices communicate with receivers in the area that are connected to landlines, cellular networks, or high-speed internet access. Cardiovascular devices, Parkinson's disease, epilepsy, spasticity, and individuals with hearing or vision impairment are among the diseases for which active implanted medical devices are used.

MARKET DRIVERS

The rising incidence of cardiovascular diseases, increasing aging population, and rising adoption of technological developments primarily drive the global active implantable medical devices market growth.

The growing elderly population is one of the major factors in the globally active implantable medical devices market growth. According to the World Health Organization (WHO), the number of people over 65 is supposed to increase from 524 million in 2010 to about 1.5 billion in 2050. By 2050, the global age group over 80 will have 379 million, expected to be 5.5 times the 65 million in 2000. Age is associated with a gradual decline in functional reserve in multiple organ systems, including the heart, brain, and ears. Therefore, it is not surprising that elderly patients use imbalanced medical resources. About 92% of the elderly have at least one chronic illness, and 77% of the elderly have at least two chronic diseases.

Additionally, the emergence of innovative implantable products with enhanced performance and effortless operative procedures is expected to support the market's growth rate during the forecast period. Favorable government policies will likely offer several opportunities to the new and well-established manufacturers in the market. The rising prevalence of cardiovascular diseases and increasing demand for active implantable devices, especially in developing countries, is another promising factor in helping the market reach new heights in growth. Furthermore, an increasing number of medical research activities to create advanced and ergonomically enhanced technologies due to an expanding number of various diseases offer lucrative growth opportunities and push the limits of the global active implantable medical devices market.

MARKET RESTRAINTS

Issues related to using such devices, such as those related to device failure and network security, may hinder market growth soon. In addition, the high cost and adverse compensation policies of implantable medical devices are vital challenges and limit the adoption of active implantable medical device solutions in the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Medtronic PLC, Abbott Laboratories, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, LivaNova, Cochlear Limited, MED-EL, Sonova Holding AG, William Demant Holding A/S, and Nurotron Biotechnology Co. Ltd. |

SEGMENTAL ANALYSIS

Global Active Implantable Medical Devices Market Analysis By Product

The cardioverter defibrillators segment held the largest share in 2024. This is due to increased cardiovascular diseases and high compliance with technologically advanced products.

Another segment that plays a pivotal role in the growth of the global active implantable medical devices market is transvenous implantable cardioverter defibrillators. Over the sub-segments of this type, single-chamber implantable cardioverter defibrillators dominate, followed by subcutaneous implantable cardioverter defibrillators.

The neurostimulators market witnessed the highest growth rate during the forecast period. The demand for neurostimulators, profound brain stimulators, is growing significantly across the globe. In addition, an increase in the prevalence of chronic pain, such as neuropathic pain, pain due to diabetes, arthritis, anxiety, and suffering from an injury, has significantly increased the demand for neurostimulators.

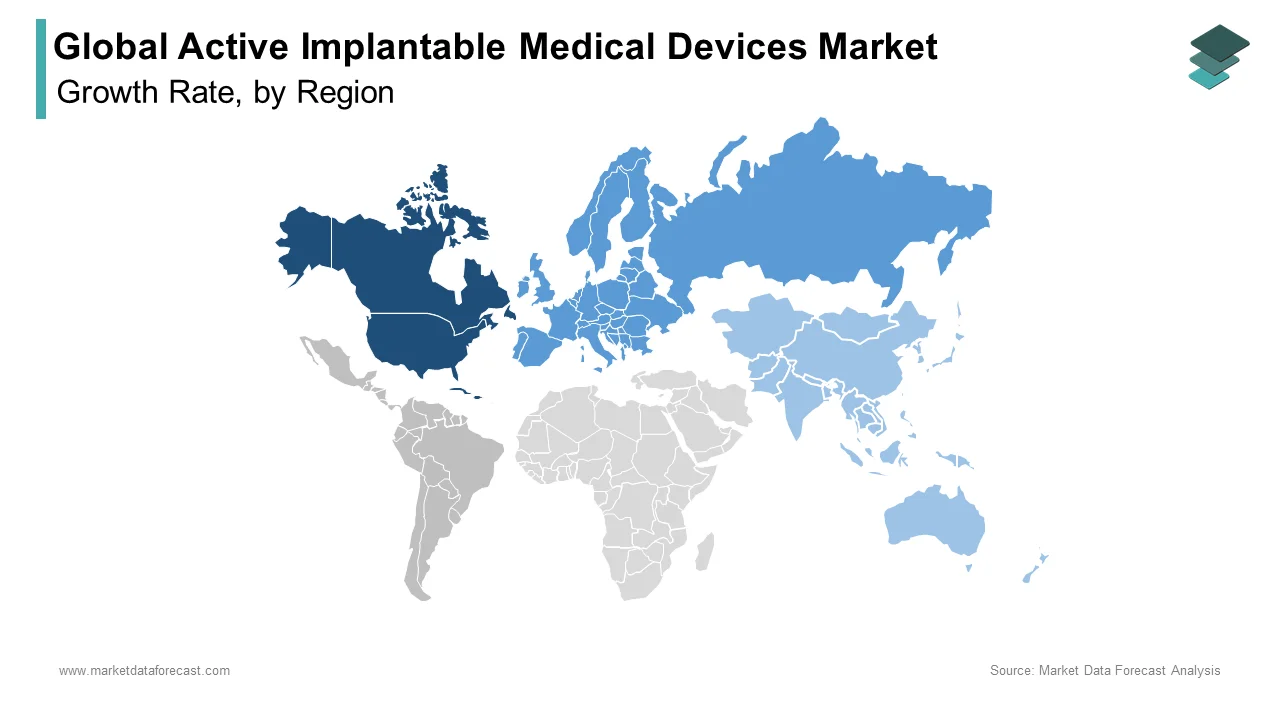

REGIONAL ANALYSIS

North America dominated the market for active implantable devices worldwide in 2024 and is predicted to continue its domination in the global market during the forecast period.

The rise in the geriatric population and the surge in neurological diseases drive North America's active implantable medical devices market. The United States is leading the North American market in market share. The rise in cardiovascular vascular diseases and the accessibility to technological advancements drive the United States market. For instance, according to the American College of Cardiology, in 2017, more than 800,000 members were dead from cardiovascular disease (CVD) only in the United States. Moreover, for every 40 seconds, an American will die from CVD, and coronary heart diseases (CHD) like stroke and heart failure account for most CVD deaths. American Heart Association (AHA) estimates that about 5.7 million adults suffer from congestive heart failure in the United States. Moreover, the rise in innovative and technologically advanced products boosts the United States market. Further, Canada is predominantly increasing with the rising healthcare expenditure in this region. These factors led the North American Active Implantable Medical Devices Market during the forecast period.

Europe is the second-largest market in terms of market share. The Europe Active Implantable Medical Devices Market is valued at USD 5.13 billion in 2020. This value is assumed to reach USD 7.49 billion by 2025 to get a 7.86% CAGR during the forecast period. The rise in the older people population and a constant surge in cardiovascular and neurological diseases propel market growth. According to the European Heart Network, over 3.9 million people die from cardiovascular disease (CVD) yearly in Europe, and over 1.8 million deaths in the European Union (EU). Germany and the United Kingdom are the major contributors to the European market. The UK's active implantable medical devices market has witnessed robust growth during the forecast period, and the massive availability of advanced technologies in Germany is boosting the market. France is assumed to have a significant growth rate in the market in the future years.

The Asia-Pacific region is expected to grow at the highest CAGR. The Asia-Pacific market was valued at USD 4.28 billion in 2020 and is expected to reach USD 6.43 billion by 2025 at a CAGR of 8.45% during the forecast period. The rise in healthcare spending and the healthcare reforms for infrastructural development are driving the market. Countries like China and India have huge geriatric populations, and the healthcare infrastructure in these countries is developing every year, thus showing immense healthcare market potential. In addition, the less strict regulations attract pharmaceutical companies to invest in China and India. These factors will boost the Asia Pacific Active Implantable Medical Devices Market in the upcoming years.

KEY PLAYERS IN THE GLOBAL ACTIVE IMPLANTABLE DEVICES MARKET

Notable companies operating in the global active implantable medical devices market profiled in this report are Medtronic PLC, Abbott Laboratories, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, LivaNova, Cochlear Limited, MED-EL, Sonova Holding AG, William Demant Holding A/S, and Nurotron Biotechnology Co. Ltd.

RECENT HAPPENINGS IN THE MARKET

- In May 2019, Medtronic PLC developed the Attain Stability Quad MRI SureScan for active fixation of left heart lead, which has been paired with pacemakers and defibrillators associated with Medtronic’s quadripolar cardiac resynchronization therapy. The device is to attain stability and precision in lead placement, and the product has been approved by the FDA (Food and drug administration in the U.S).

- In Aug 2019, Boston Scientific Corporation completed the acquisition of BTG Plc, a company that offers a variety of products in streams of specialty pharmaceuticals, cardiovascular, and cancer treatment procedures. The strategic collaboration will enable the Boston Scientific Corporation to provide advanced technologies and improve the infrastructure to support professionals treating severe diseases across the world.

- In Dec 2019, Impulse Dynamics Company developed a device called the Optimizer smart system, which applies to CCM therapy. The FDA has approved the product for treating cardiac dysfunctions in patients. The company has been funded by crucial investors such as Amzek Health Investors, Minth Holdings Ltd, Acom Biosciences, etc.

DETAILED SEGMENTATION OF THE GLOBAL ACTIVE IMPLANTABLE MEDICAL DEVICES MARKET INCLUDED IN THIS REPORT.

This research report on the global active implantable medical devices market has been segmented and sub-segmented based on the product and region.

By Product

- Implantable Cardioverter Defibrillators

- Transvenous Implantable Cardioverter Defibrillators

- Biventricular Implantable Cardioverter Defibrillators (ICDs)/Cardiac Resynchronization Therapy Defibrillators (CRT-Ds)

- Dual-Chamber Implantable Cardioverter Defibrillators

- Single-Chamber Implantable Cardioverter Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillator

- Transvenous Implantable Cardioverter Defibrillators

- Implantable Cardiac Pacemakers

- Ventricular Assist Devices

- Implantable Heart Monitors/Insertable Loop Recorders

- Neurostimulators

- Spinal Cord Stimulators

- Deep Brain Stimulators

- Sacral Nerve Stimulators

- Vagus Nerve Stimulators

- Gastric Electrical Stimulators

- Implantable Hearing Devices

- Active Hearing Implants

- Passive Hearing Implants

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the CAGR of the active implantable medical devices market?

The global active implantable medical devices market is expected to grow at a CAGR of 7.76% from 2025 to 2033.

What is driving the growth of the active implantable medical devices market?

The growing aging population, rising prevalence of chronic diseases, technological advancements in medical devices, and growing demand for minimally invasive surgeries majorly drive the growth of the active implantable medical devices market.

Which geographical regions are leading the active implantable medical devices market?

Currently, North America and Europe are leading the active implantable medical devices market, followed by Asia-Pacific and the rest of the world.

What are some of the key players in the active implantable medical devices market?

Abbott Laboratories, Boston Scientific Corporation, Cochlear Limited, Medtronic plc, and St. Jude Medical, Inc. are some of the major participants of the active implantable medical devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com