Global Aftermarket Parts in Construction Industry Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report – Segmented By Type (Cooling Systems, Accessories, Electrical Systems, Fuel Systems, and Others), Applications (Heavy Earthmoving, Light Earthmoving, Lifting and Material Handling, Drilling and Trenching, Trucking and Hauling), And Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2024 to 2029

Global Aftermarket Parts in Construction Industry Market Size (2024 to 2029)

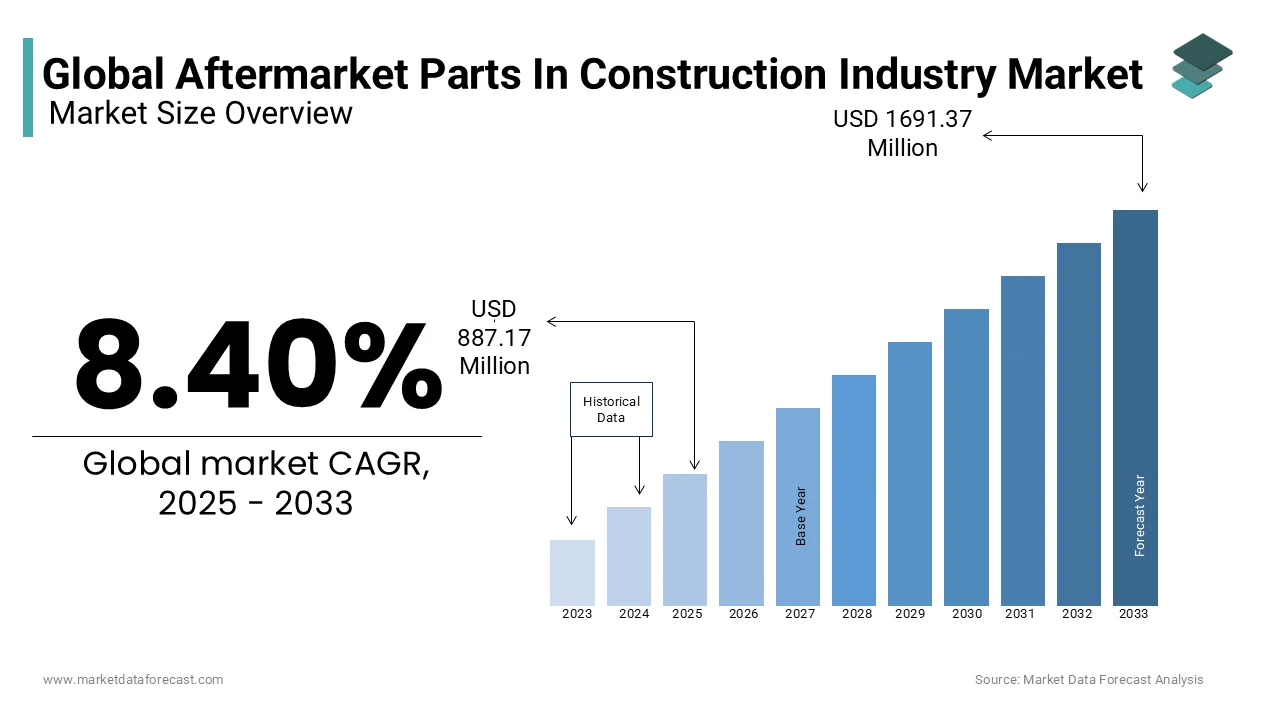

The global aftermarket parts in the construction industry market size is expected to reach USD 818.19 million in 2024 and reach USD 1,225.82 million by 2029, growing at a CAGR of 8.40% from 2024 to 2029.

CURRENT SCENARIO OF THE GLOBAL PARTS IN THE CONSTRUCTION INDUSTRY MARKET

The construction industry is a booming global market. This industry has seen significant growth, especially in developing countries, as the improving economy in these regions boosts the market.

The continuation of the development process, especially in developing countries, will result in significant growth of this industry in the coming years. The growth of this industry has also seen a similar increase in the sale of spare parts for the construction industry. These parts are installed in a variety of applications and range from fuel systems to engine components.

The growing heavy machinery market will be the main driver of this industry in the future due to the growing demand for earthmoving equipment. The trend to incorporate additional accessories into cranes for specific applications, such as manufacturing, forestry, oil and gas, and transportation, offers positive prospects for market growth. Cranes are experiencing rapid demand in these verticals due to higher efficiency and better operating performance compared to conventional construction tools. The flexibility these machines offer to connect additional drives, motors, and axles is one of the main factors driving the proliferation of aftermarket parts in the construction industry market.

Ongoing R&D activities and technological developments aimed at reducing wear and tear on construction equipment can harm the industry. The high initial purchase cost associated with cranes fuels customer demand for fail-safe machines with minimal maintenance costs. In response to demand, crane manufacturers are focusing on integrating sensor technologies into machines to reduce downtime, which is impacting the proliferation of aftermarket products. Additionally, the high installation and maintenance costs associated with aftermarket products pose a challenge to the growth of the industry.

MARKET DRIVERS

The demand for the aftermarket parts is growing especially in constructional activities. The growing number of construction activities in both developed and emerging countries is ascribed in prompting the growth rate of the aftermarket parts in construction industry market. Most of the aftermarket parts are affordable and can be customizable according to the preference.

Increasing government support through subsidies is greatly influencing the growth rate of the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

CAGR |

8.40% |

|

Segments Covered |

By Application, Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Boundary, NTN Global, Union Tractor, Hitachi, Rammer, Intracoparts, Volvo, DSM, and Others. |

SEGMENTAL ANALYSIS

Global Aftermarket Parts in Construction Industry Market By Application

Heavy equipment is essential for construction jobs of almost any size, from home construction to large-scale commercial and civil projects.

Earthmoving equipment covers a wide range of machines that can excavate and level soil and rocks, as well as other jobs. Earth-moving machines and other heavy equipment not only speed up earth movement but also handle demolition and construction. Many types of heavy construction machinery are designed for multiple functions, making them indispensable on construction sites.

Global Aftermarket Parts in Construction Industry Market By Type

It may be necessary to cool buildings in hot climates or where there are significant thermal gains (such as solar gain, people, and equipment). This cooling is sometimes called comfort cooling. Cooling may also be necessary for refrigeration or for some industrial processes. The electrical systems in these buildings begin with a step-down transformer provided by the utility company and located within or in close proximity to the building. The transformer reduces standard line potential to two dual voltage systems, which are then passed through main breakers and electricity meters to record subscriber usage.

REGIONAL ANALYSIS

The increasing development of infrastructure in the APAC region will boost the aftermarket parts in the construction industry. Improving the economies of South America, especially Brazil, will also lead to a growing market. The increasing use of vehicles in the construction industry has led to a growing market for aftermarket parts in this industry.

KEY PLAYERS IN THE GLOBAL MARKET

Boundary, NTN Global, Union Tractor, Hitachi, Rammer, Intracoparts, Volvo, DSM. Some of the major key players involved in the aftermarket parts in the construction industry market. Some of the major key players are involved in this market.

RECENT HAPPENINGS IN THIS MARKET

- Tata Hitachi launched the EX215LC Quarry, a machine designed to perform in tough quarry applications.

- CLAAS, one of the world's leading manufacturers of agricultural machinery, will once again be present at Bauma Munich with its own stand.

- Deere & Company reported a net income of $ 722 million for the fourth quarter that ended November 3, 2019, or $ 2.27 per share, compared to a net income of $ 785 million, or $ 2.42 per share, for the quarter that ended November October 28, 2018.

- With the proposed Bharat Stage (BS) Term-IV emissions standards, the domestic tractor industry expects a further increase of 25% to 30% in the cost of ownership of equipment over 50 hp, said experts from the industry at a recent virtual summit on the agricultural equipment sector organized by ETAuto.com.

DETAILED SEGMENTATION OF THE GLOBAL AFTERMARKET PARTS IN THE CONSTRUCTION INCLUDED IN THIS REPORT

This research report on the global aftermarket parts in the construction industry market has been segmented & sub-segmented into the following categories.

By Application

- Heavy Earthmoving

- Light Earthmoving

- Lifting & Material Handling

- Drilling & Trenching

- Trucking & Hauling

By Type

- Cooling Systems

- Accessories

- Electrical Systems

- Fuel Systems

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the expected market size and market value of the global Aftermarket Parts in Construction Industry Market?

The global aftermarket parts in the construction industry market is estimated to reach a valuation of US$ 1130.84 billion by 2028 and is predicted to register a CAGR of 8.40% from 2023 to 2028.

Which regions contribute the most to the global market share of Aftermarket Parts in Construction Industry Market?

Asia Pacific and South America are the leading contributors to the global market share of autonomous tractors, accounting for approximately X% collectively.

What are the notable trends in Asia-Pacific's Aftermarket Parts in Construction Industry Market?

The trend to incorporate additional accessories into cranes for specific applications, such as manufacturing, forestry, oil and gas, and transportation, offers positive prospects for market growth.

which is the leading region in the global Aftermarket Parts in Construction Industry Market?

Asia Pacific is the leading region in this market.

who is the key market players involved in this market?

Boundary, NTN Global, Union Tractor, Hitachi, Rammer, Intracoparts, Volvo, DSM. Some of the major key players involved in the aftermarket parts in the construction industry market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]