Global Agricultural Grow Lights Market Size, Share, Trends, And Growth Forecasts Report – Segmented By Technology (HID , Florescent, LED, Induction and Plasma), Installation (New and Retrofit), Applications (Performance Partial Spectrum, And Full Spectrum), Application (Indoor Farming, Commercial Greenhouse, Vertical Farming Research), And Region (North America, Latin America, Asia Pacific, Europe, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Agricultural Grow Lights Market Size

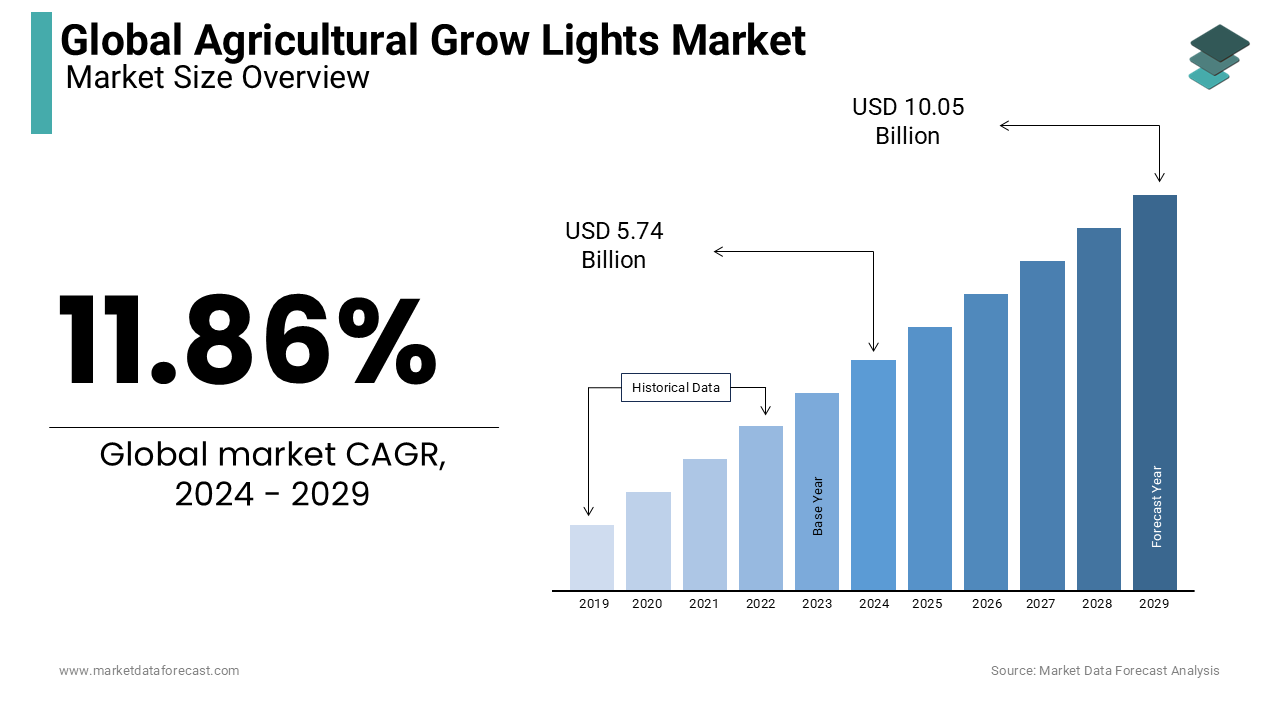

The global agricultural grow lights market was valued at USD 5.74 billion in 2024 and is anticipated to reach USD 6.42 billion in 2025 from USD 15.74 billion by 2033, growing at a CAGR of 11.86% from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL AGRICULTURE GROW LIGHTS MARKET

LED grow lights are more efficient and powerful than older generation high-pressure sodium and metal halide bulb grow lights.

They lower the electricity bill and produce less heat. Less heat allows for putting the light closer to plants so they do not get burned. The quality of light is better for growing with LED specialized grow lights. These specialized grow lights provide homogeneous light distribution. Light distribution at precisely the right wavelengths is made possible. LED light sources offer light distribution for good photosynthetic response. Vendors are able to stimulate plant growth. Flora series LEDs provide accelerated photosynthesis and energy savings.

MARKET DRIVERS

Grow lights, especially LEDs, are used extensively in farming-related applications due to the advantages they offer, such as high reliability, low power consumption, and spectral intensity.

The increasing commercial greenhouse and vertical farming practices, which require the use of different grow lights, are driving the growth of the overall grow lights market. Factors such as the constantly growing demand for food coupled with the depletion of land for farming are further going to aid the market growth.

Moreover, plant factories that allow the growing of vegetables indoors all year round use LED lights that minimize power consumption. It artificially creates the environment necessary for plants to grow by controlling the amount of culture solution, air, and light from light-emitting diodes. Because the amount of light, temperature, humidity, and carbon dioxide concentration levels can be optimized without being affected by the weather, not only is the growth rate better than those grown in open fields, but even the yield is at least ten times higher.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.86% |

|

Segments Covered |

By Technology, Type of Installation, Spectrums, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Royal Philips, General Electric Company, Osram Licht AG, Gavita Holland B.V., LumiGrow, Inc., Heliospectra AB, Transcend Lighting Inc., Iwasaki Electric Co., Ltd., Illumitex Inc., Hortilux Schreder B.V. and Sunlight Supply Inc and Others. |

SEGMENTAL ANALYSIS

Global Agricultural Grow Lights Market By Technology

Traditional lighting technologies such as high-intensity discharge (HID) and fluorescent lighting are quite popular among commercial growers as well as hobbyists. Even though LED grow light is a new technology, it is proving to be far more effective than other lighting technologies. Though LED grow lights are expensive, their long-term benefits in terms of energy efficiency make them an ideal option for indoor plant cultivation.

Global Agricultural Grow Lights Market By Type of Installation

The market for retrofit installations is likely to hold a larger market share during the forecast period. Retrofitting is defined as the removal of an existing grow light and installing a new one, either of the same lighting technology or of different lighting technology. New installations are generally characterized by the expansion of existing facilities or the setting up of a new facility, such as a new greenhouse or a vertical farm.

REGIONAL ANALYSIS

Europe was the leading market for grow lights. Within Europe, the Netherlands is a leading exporter of horticultural produce, grown within its numerous automated commercial greenhouses. Due to the extensive use of grow lights, vertical farming is also gaining popularity in Europe. The rising population in Europe is a major driver for the increasing need to practice indoor horticulture in this region. Moreover, the severe cold in winter and insufficient sunlight in parts of Europe mandate indoor growing with the help of artificial lighting. North America was the second major market for grow lights in 2020. The emergence of vertical farms and the booming market for cannabis cultivation are further driving the demand for grow lights in this region. Asia Pacific is expected to register the highest CAGR in the coming years. In places like Japan, where there is a deficiency in the environment, plant factories have continued to thrive with the use of LED grow lights in large warehouse-type entities that provide food for the general public and for people who need specialized nutrition.

KEY MARKET PLAYERS

The market is dominated by companies like Royal Philips, General Electric Company, Osram Licht AG, Gavita Holland B.V., LumiGrow, Inc., Heliospectra AB, Transcend Lighting Inc., Iwasaki Electric Co., Ltd., Illumitex Inc., Hortilux Schreder B.V. and Sunlight Supply Inc.

MARKET SEGMENTATION

This research report on the global agriculture grow lights market is segmented and sub-segmented based on Technology, Type of Installation, spectrum, Application, and Region.

By Technology

- HID

- Fluorescent

- LED

- Induction

- and Plasma

By Type of Installation

- New and Retrofit

By Spectrums

- Performance Partial Spectrum

- Full Spectrum.

By Application

- Indoor Farming

- Commercial Greenhouse

- Vertical Farming, Research

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global agriculture market?

The current market size global agricultural grow lights market was valued at USD 6.42 billion in 2025

Who are the market players that are dominating the global agriculture market?

The market is dominated by companies like Royal Philips, General Electric Company, Osram Licht AG, Gavita Holland B.V., LumiGrow, Inc., Heliospectra AB, Transcend Lighting Inc., Iwasaki Electric Co., Ltd., Illumitex Inc., Hortilux Schreder B.V. and Sunlight Supply Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com