Asia-Pacific Craft Beer Market Size, Share, Trends & Growth Forecast Report By Product Type, Distribution Channel, Age Group, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific Craft Beer Market Size

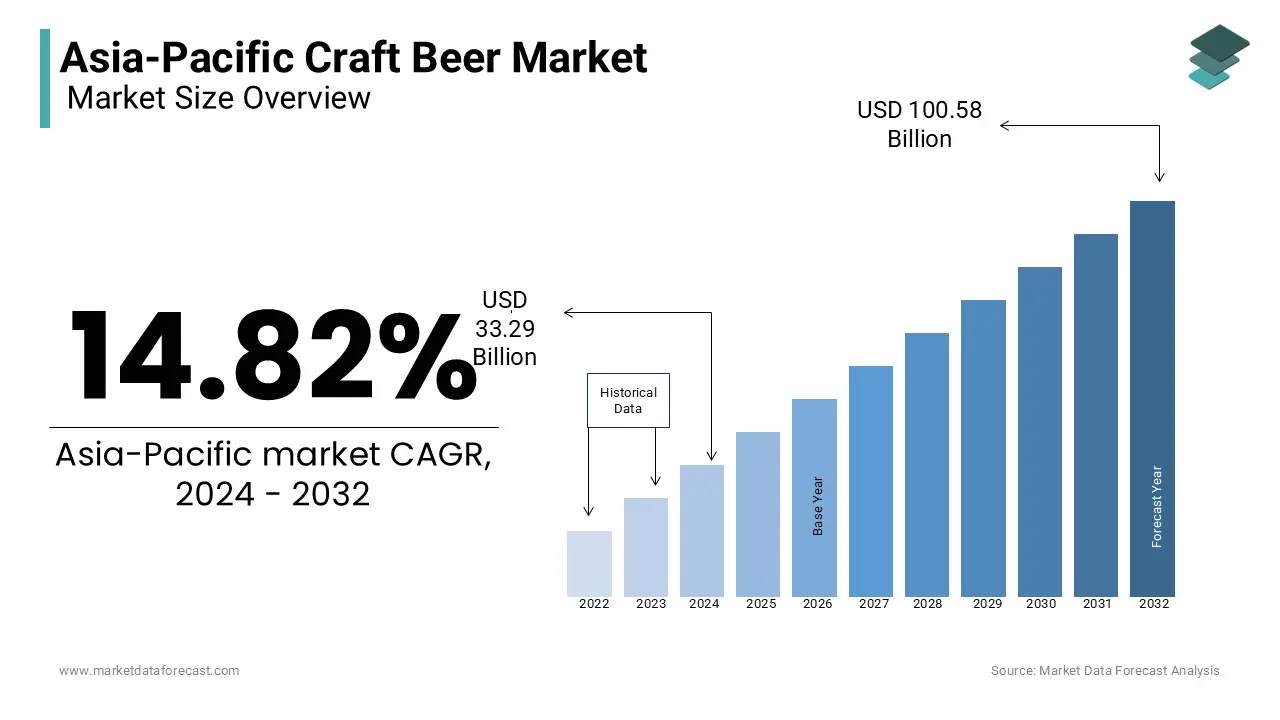

The craft beer market size in the Asia-Pacific region was valued at USD 33.29 billion in 2024. The Asia-Pacific market size is anticipated to grow at a CAGR of 14.82% from 2025 to 2033 and be worth USD 115.46 billion by 2033 from USD 38.22 billion in 2025.

Craft beer is typically produced by small and independent breweries and emphasizes primarily on quality, unique flavors, and innovative brewing techniques to set it apart from mass-produced beers. The craft beer market in Asia-Pacific is witnessing significant growth as consumers increasingly seek diverse and personalized drinking experiences. China, Japan, and Australia lead the craft beer market in the Asia-Pacific region and the growth of the market is supported by a rising number of microbreweries and brewpubs. According to the Brewers Association of China, the number of craft breweries in the country surpassed 2,000 in 2022. Similarly, the craft beer sector in Japan has seen a 7% annual growth rate, as reported by the Japan Brewers Association. According to the Australian Craft Brewers Association, craft beer accounted for 15% of the total beer market in Australia by value in 2022.

MARKET DRIVERS

Growing Consumer Preference for Premium and Artisanal Beverages

The increasing preference for premium, artisanal beverages is a key driver of the Asia-Pacific craft beer market. Consumers in the region, particularly millennials and urban professionals, are seeking unique flavors and high-quality brews. According to the Japan Brewers Association, the craft beer market in Japan has grown by 7% annually as consumers move away from mass-produced beers. In China, the Brewers Association of China reports that demand for premium beer increased by 12% between 2020 and 2022. This trend is also visible in Australia, where craft beer accounts for 15% of the total beer market value. This rising preference for authenticity and innovation is propelling market growth.

Expanding Number of Microbreweries and Brewpubs

The surge in the number of microbreweries and brewpubs across the Asia-Pacific region is significantly driving the craft beer market. Countries such as China, India, and Australia have witnessed a steady rise in small-scale brewing establishments. The Australian Craft Brewers Association highlights that the number of breweries in Australia grew by over 11% in 2022. Similarly, India’s Ministry of Commerce and Industry reports that new microbrewery openings have surged in urban centers, catering to younger demographics. These establishments not only offer locally brewed, innovative products but also provide consumers with immersive experiences, fostering loyalty and increasing craft beer consumption in the region.

MARKET RESTRAINTS

High Production Costs and Limited Economies of Scale

The Asia-Pacific craft beer market faces challenges from high production costs, which impact profitability, particularly for small-scale breweries. Craft beer production involves premium ingredients, specialized brewing equipment, and labor-intensive processes that are costlier than mass-produced beer. According to the Australian Bureau of Statistics, craft beer production costs are approximately 30% higher than traditional beer production. Additionally, smaller breweries often lack economies of scale, leading to higher per-unit costs. In markets like India, where raw materials such as hops and malt are often imported, currency fluctuations further escalate expenses. These cost constraints limit the competitiveness of craft breweries against large-scale beer manufacturers.

Stringent Alcohol Regulations and Taxation Policies

Regulatory barriers and high taxation on alcoholic beverages restrain the growth of the Asia-Pacific craft beer market. Many countries in the region impose heavy excise duties and licensing fees on breweries, making it difficult for small and medium-sized enterprises to thrive. In India, the Goods and Services Tax on beer is as high as 40%, as reported by the Ministry of Finance. Similarly, Japan enforces strict alcohol advertising and distribution laws, complicating market access for new entrants. These stringent regulations increase operational costs and limit market penetration, particularly in regions with complex alcohol policies, thereby hindering the growth potential of craft beer producers.

MARKET OPPORTUNITIES

Rising Demand for Low-Alcohol and Health-Oriented Beers

The increasing focus on health-conscious lifestyles presents a significant opportunity for the Asia-Pacific craft beer market. Consumers are shifting toward low-alcohol and functional beverages that align with wellness trends. According to the Australian Bureau of Statistics, sales of low-alcohol beer in Australia grew by 9% annually between 2020 and 2022, driven by health-conscious millennials. In Japan, the Ministry of Health highlights a growing preference for beverages with reduced calories and natural ingredients, fostering demand for lighter craft beer options. This trend enables craft brewers to diversify their offerings with innovative, health-oriented products, attracting a broader consumer base.

Expansion of Export Opportunities

The global appeal of Asia-Pacific craft beer offers a lucrative export opportunity for regional brewers. Unique flavors, local ingredients, and innovative brewing methods position these products as premium offerings in international markets. For instance, the China Council for the Promotion of International Trade reports that craft beer exports from China increased by 15% in 2022, reflecting strong demand from North America and Europe. Similarly, Australia’s Department of Agriculture emphasizes the growing interest in Australian craft beer, particularly in the U.S. and Asian markets. This export potential allows brewers to expand revenue streams and strengthen their global presence while showcasing the brewing expertise of the Asia-Pacific region.

MARKET CHALLENGES

Supply Chain Disruptions and Ingredient Shortages

The Asia-Pacific craft beer market faces significant challenges due to supply chain disruptions and ingredient shortages. Essential raw materials like hops and barley, often imported, are subject to fluctuating availability and rising costs. The Australian Department of Agriculture notes that adverse climate events in key barley-producing regions caused a 15% reduction in supply in 2022. Similarly, the Ministry of Commerce in China highlights that rising shipping costs and delays have disrupted the import of premium hops, which is critical for craft beer production. These supply chain constraints increase operational costs, reduce production capacity, and hinder the ability of smaller breweries to meet growing demand.

Intense Market Competition

Intense competition within the Asia-Pacific craft beer market poses a challenge for smaller breweries striving to establish a foothold. The rapid proliferation of microbreweries in countries like Australia, China, and Japan has created a crowded market, making it difficult for new entrants to differentiate themselves. According to the Australian Craft Brewers Association, the number of breweries increased by 11% in 2022, heightening competition for shelf space and consumer attention. Furthermore, the dominance of large beer manufacturers with craft-style product lines adds to the competitive pressure. This crowded landscape forces smaller players to invest heavily in marketing and innovation, increasing their operational costs and reducing profit margins.

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The on-trade segment accounted for a substantial share of the regional market in 2023. The on-trade segment mainly comprises restaurants, coffee shops, bars, clubs, and hotels. Consumers, with the availability of brewpubs, tasting rooms, and tiki bars, are experiencing a more comfortable experience in the on-trade segment, and this factor results in a surge in millennial demand for pubs and bars, resulting in the growth of the on-trade segment in the Asia-Pacific craft beer market.

By Age Group Insights

The 21–35 years segment is projected to hold the leading share of the Asia-Pacific market during the forecast period. In general, the millennial population, that is, people belonging to the age group 21–35 years, are the main consumers of craft beer in this area. Also, several brewing companies focus on developing products that attract this age group. Therefore, it can be concluded that the rise in the number of millennials will create promising opportunities for the expansion of the Asia Pacific craft beer market.

REGIONAL ANALYSIS

China accounted for the leading share of the Asia-Pacific craft beer market in 2023. The domination of China in the Asia-Pacific market is primarily attributed to its large population, growing middle class, and increasing preference for premium beverages. According to the Brewers Association of China, the country had over 2,000 craft breweries by 2022. Rising disposable incomes and urbanization have bolstered demand, with craft beer consumption growing by 12% annually. Major cities like Shanghai and Beijing serve as hubs for craft beer culture, hosting festivals and promoting local brands. This growth underscores China’s role as a major contributor to the region’s craft beer industry, attracting both local and international brewers.

Australia is anticipated to account for a notable share of the Asia-Pacific craft beer market over the forecast period. Australia is known for its innovative brewing techniques and high-quality products. As per the reports of the Australian Craft Brewers Association, craft beer accounts for 15% of the country’s total beer market value. The rise of microbreweries, particularly in regions like Victoria and New South Wales, has fueled market growth. Additionally, consumer preferences for locally sourced and sustainable products have driven demand. Australia’s export-oriented strategies further expand its market reach, with growing interest in Australian craft beer from Asia and North America, cementing its position as a regional leader in the regional market.

Japan stands out in the Asia-Pacific craft beer market for its emphasis on quality and unique flavor profiles. The Japan Brewers Association notes a 7% annual growth in craft beer sales, with breweries innovating using traditional ingredients like matcha and yuzu. Japan’s long-standing beer culture and premiumization trends have bolstered demand for artisanal brews. The country’s regulatory changes, such as relaxed production laws for small breweries, have facilitated the sector’s growth. Additionally, craft beer festivals and a focus on exports to international markets enhance Japan’s reputation as a leading force in the Asia-Pacific craft beer market.

KEY MARKET PLAYERS

Companies playing a major role in the Asia-Pacific craft beer market include Anheuser-Busch In Bev, Heineken NV, The Boston Beer Company Inc., D.G. Yuengling & Son Inc., Sam Adams, Constellation Brands, Sierra Nevada, The Gambrinus Company, Chimay Beers and Cheeses and Stone & Wood Brewing Co.

RECENT HAPPENINGS IN THIS MARKET

- In February 2017, Heineken N.V. declared the acquisition of Brazil Kirin Holding S.A, which is one of the biggest brew makers.

- In May 2017, Anheuser-Busch InBev gained North Carolina-based Wicked Weed Brewing, which is attributable to expanding the production of honey bees.

MARKET SEGMENTATION

This research report on the Asia-Pacific craft beer market has been segmented and sub-segmented based on the following categories.

By Product Type

- Ale

- Lagers

By Distribution Channel

- On-Trade

- Off-Trade

By Age Group

- 21–35 Years

- 40–54 Years

- 55 Years and Above

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com