Asia Pacific Biologics Market Size, Share, Trends & Growth Forecast Report By Source, Product, Biologics Manufacturing Type, Disease Category, and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Biologics Market Size

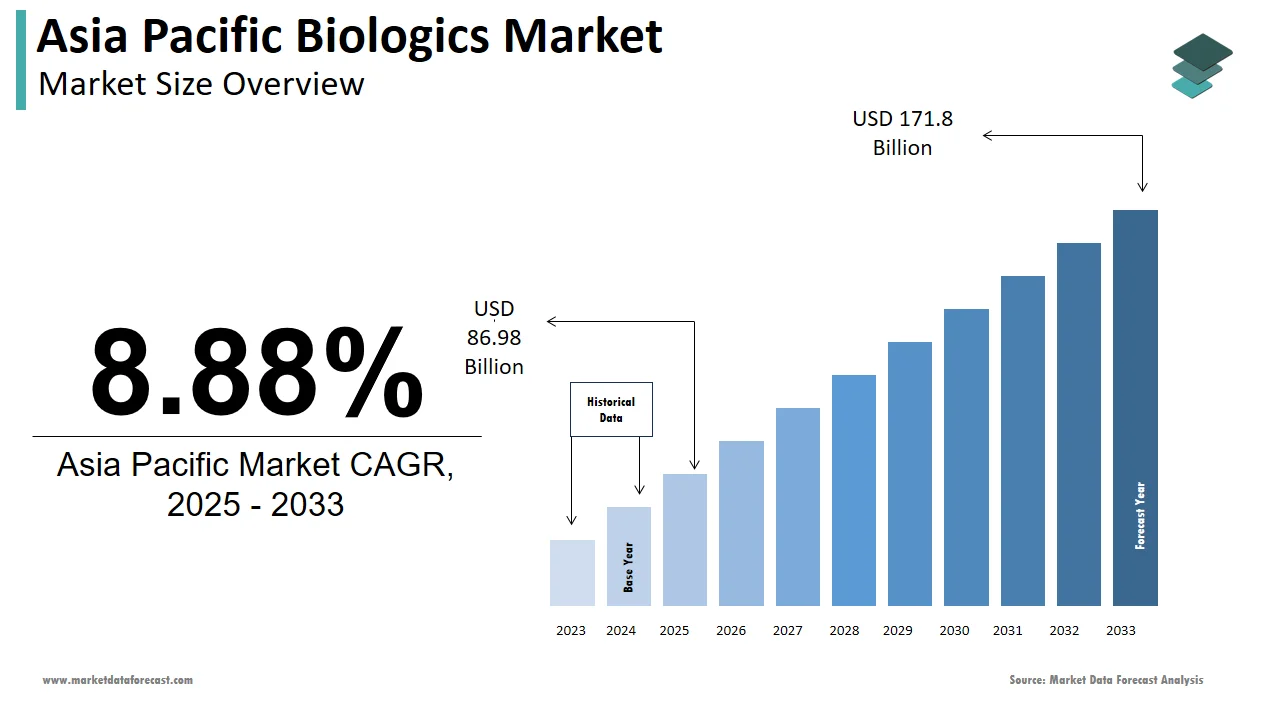

The size of the Asia Pacific biologics market was valued at USD 79.89 billion in 2024. This market is expected to grow at a CAGR of 8.88% from 2025 to 2033 and be worth USD 171.8 billion by 2033 from USD 86.98 billion in 2025.

MARKET DRIVERS

The market's growth is majorly driven by the factors such as increasing demand for innovative therapies, Y-O-Y rise in the prevalence of chronic diseases in this region, and drastic changes in people's social behavior. An increase in population and changes in social behavior are projected to propel market growth. Moreover, the biopharmaceutical contract manufacturing market is developing majorly due to the accelerating demand for biologics and growing outsourcing by the pharmaceutical companies in developing companies such as China and India in the Asia Pacific region. On the other hand, increasing capital investment from critical players and growing population is most likely to propel the market growth. Furthermore, robust advancements in research and development activities and emerging markets are expected to increase the growth of the biologics market.

MARKET RESTRAINTS

The Asia Pacific market is facing some growth challenges. Such as the stringent regulatory process for biologics; moreover, the biologics process requires high capital investments, which cannot be affordable in emerging countries such as India, considered the growth decline factor. The primary concern factors such as biologics drugs are highly complex and require control and maintenance throughout the development and production process; these factors are expected to restrain the market growth. In the biologics process, development and quality control procedures involve colossal capital investment at the initial state process.

COUNTRY LEVEL ANALYSIS

Among these countries, China accounted for the majority market share in the Asia Pacific region in 2022, and it is estimated to continue the dominating trend during the forecast period. The Chinese biologics market size is expected to grow at a CAGR of 9.5% during the forecast period. The presence of significant biologics teams in China, which consequently produces high demand for biologics, influences the market expansion. As per the World Health Organization, it is estimated that many new cancer cases will be reported during the forecast period.

On the other hand, the Indian biologics market is one of the fastest-growing regions in the Asia Pacific biologics market. Increasing consciousness regarding health among the people in this region and rapidly growing population is boosting the biologics market.

The Biologics market in Japan has held the largest market share over the forecast period. Japan is contributing to the Asia Pacific region's growth. Market growth is attributed to ceaseless expansion in the product portfolio with a growing demand for biologics and a rising prevalence of chronic diseases.

The Australian biologics market witnessed significant growth over the forecast period because of incessant investments in biologics and developments in cellular and gene therapies.

New Zealand had moderate growth in the biologics market over the forecast period, and it is expected to increase during the forecast period. The market players in New Zealand are focussing on strategic initiatives to gain significant market growth of biologics.

KEY MARKET PLAYERS

Companies such as Johnson & Johnson (J&J), F Hoffmann-La Roche, Bristol-Myers Squibb, GlaxoSmithKline, AbbVie, Amgen, Sanofi, Eli Lilly, and Company, Merck & Co., and Pfizer Inc. are playing a dominating role in the Asia Pacific biologics market.

MARKET SEGMENTATION

This Asia Pacific biologics market research report is segmented and sub-segmented into the following categories.

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense, RNAi, & Molecular Therapy

- Others

By Biologics Manufacturing

- Outsourced

- In-house

By Disease Category

- Oncology

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]