Asia-Pacific Telemedicine Market Research Report - Segmented By Technology, Service, Application, Delivery Mode, End User & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From 2025 to 2033

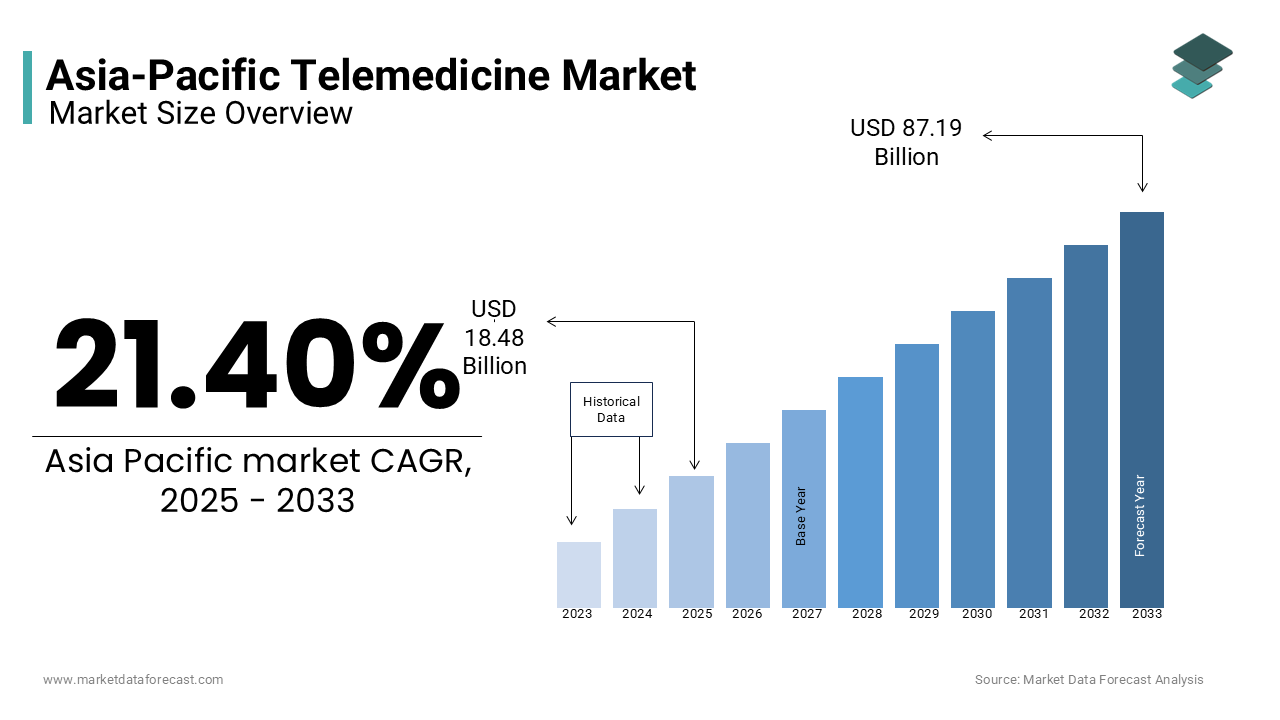

Asia-Pacific Telemedicine Market Size

The telemedicine market in the Asia-Pacific region is estimated to grow from USD 18.48 billion in 2025 to USD 87.19 billion by 2033, growing at a compound annual growth rate (CAGR) of 21.40% during the forecast period. The telemedicine market in the Asia-Pacific size was valued at USD 15.22 billion in 2024.

The Asia Pacific telemedicine market has emerged as a transformative force in healthcare delivery. It is driven by technological advancements and shifting patient preferences. Moreover, the increasing prevalence of chronic diseases has heightened demand for remote monitoring solutions.

MARKET DRIVERS

Rising Healthcare Accessibility Gaps

The widening gap in healthcare accessibility across rural and urban areas is a significant driver of the telemedicine market in the Asia Pacific. According to the Asian Development Bank, a large portion of the region’s population resides in rural areas with limited access to quality healthcare services. Telemedicine bridges this divide by enabling remote consultations, diagnostic support, and treatment plans. A study highlights that telemedicine adoption can reduce travel time for patients by up to 70%, making healthcare more accessible and affordable. This factor has led to increased government investments, such as Thailand’s Universal Health Coverage scheme, which integrates telehealth services to reach underserved populations.

Surge in Chronic Disease Prevalence

The rising incidence of chronic diseases is another key driver propelling the telemedicine market forward. Telemedicine platforms equipped with wearable devices and remote monitoring tools are increasingly being adopted to address this challenge. For instance, in Japan, the use of telehealth for managing hypertension and diabetes has grown since 2020. Additionally, telemedicine reduces hospital readmission rates, making it a cost-effective solution for managing chronic conditions.

MARKET RESTRAINTS

Limited Internet Penetration in Rural Areas

One of the primary restraints of the telemedicine market in the Asia Pacific is the limited internet connectivity in rural and remote regions. According to the International Telecommunication Union (ITU), a significant portion of the population in South Asia lacks reliable internet access, hindering the adoption of telehealth services. This digital divide creates challenges in delivering real-time consultations and remote monitoring, particularly for elderly patients who rely heavily on these services.

Regulatory and Reimbursement Challenges

Another significant restraint is the lack of standardized regulations and reimbursement policies for telemedicine services. According to Deloitte, over 60% of healthcare providers in the region face difficulties in securing reimbursements for virtual consultations due to inconsistent policies. Additionally, regulatory fragmentation across countries complicates cross-border telehealth initiatives. This uncertainty not only affects revenue models but also slows down market growth, as organizations remain cautious about investing in unregulated environments.

MARKET OPPORTUNITIES

Integration with Emerging Technologies

The integration of telemedicine with emerging technologies like artificial intelligence (AI) and the Internet of Medical Things (IoMT) presents immense opportunities for market expansion. For instance, in South Korea, AI-powered chatbots are being used to triage patients and provide preliminary diagnoses, reducing consultation times by 40%, as per the Korea Health Industry Development Institute. Similarly, IoMT devices, such as wearable health trackers, are gaining traction in Singapore, where a significant portion of patients prefer remote monitoring for chronic conditions. These innovations not only enhance the efficiency of telemedicine platforms but also attract tech-savvy consumers.

Expansion into Untapped Markets

Emerging economies like Myanmar and Cambodia offer untapped opportunities for telemedicine vendors. These markets represent fertile ground for expanding telemedicine services and addressing unmet healthcare needs.

MARKET CHALLENGES

Resistance to Digital Transformation

A significant challenge facing the telemedicine market in the Asia Pacific is resistance to digital transformation among both healthcare providers and patients. This resistance is further compounded by patient skepticism, particularly among older adults who prefer traditional in-person consultations. Without addressing these barriers, the widespread adoption of telemedicine remains constrained, limiting its ability to revolutionize healthcare delivery.

Data Privacy and Security Concerns

Data privacy and security concerns pose another major challenge for the telemedicine market. For example, in Australia, the Office of the Australian Information Commissioner reported a 35% increase in healthcare-related cyberattacks in 2022, highlighting vulnerabilities in telemedicine platforms. Patients’ reluctance to share personal health data online further exacerbates the issue, as noted by the Asia-Pacific Economic Cooperation (APEC).

SEGMENTAL ANALYSIS

By Type Insights

The Tele hospitals segment dominated the Asia Pacific telemedicine market by holding a 45.5% share in 2024. This position in the market is due to their role in providing advanced medical services to underserved areas, particularly in rural regions. One key driver is the increasing prevalence of chronic diseases requiring continuous monitoring. According to the World Health Organization (WHO), a significant percentage of deaths in the region are attributed to chronic conditions, creating demand for specialized remote care. Another factor is government support; as per the Ministry of Health in Japan, public funding has enabled tele hospitals to expand services to nearly 30% of rural districts, bridging healthcare accessibility gaps.

The mHealth is the fastest-growing segment, with a CAGR of 28.7%. This is fueled by rising smartphone penetration and the proliferation of health apps. A report by Deloitte highlights that over 70% of urban populations in Southeast Asia use smartphones, driving demand for mobile-based healthcare solutions. Also, the integration of AI-powered diagnostics into mHealth platforms enhances efficiency. These factors position mHealth as a transformative force in the telemedicine landscape.

By Component Insights

The software segment accounted for 50.4% of the Asia Pacific telemedicine market in 2024. This dominance is driven by the need for robust platforms to facilitate virtual consultations and remote monitoring. For instance, in Australia, telehealth software like Coviu supports over 1 million consultations annually, ensuring seamless integration with existing systems. Another factor is the rise of cloud-based solutions, enhancing scalability and accessibility.

Hardware is the fastest expanding component, with a CAGR of 23.5%. This expansion is influenced by advancements in wearable devices and IoT-enabled equipment. According to the International Data Corporation (IDC), shipments of wearable health trackers in the region grew in 2022, with countries like South Korea leading adoption. For example, Samsung’s Galaxy Watch series integrates real-time health monitoring features, attracting over 5 million users. Further, rural healthcare facilities are increasingly adopting portable diagnostic tools, as noted by the Asian Development Bank, which states that hardware investments can improve service delivery.

By Application Insights

Telecardiology held a 30.3% share of the Asia Pacific telemedicine market in 2024. This prominence is driven by the high prevalence of cardiovascular diseases in the region. According to the World Heart Federation, cardiovascular diseases account for a significant portion of all deaths in the Asia Pacific, necessitating remote monitoring and timely interventions. Another contributing factor is the integration of AI-powered diagnostic tools, which enhance accuracy and efficiency.

Telepsychiatry is the fastest-growing service segment, with a CAGR of 32.3%. This growth is supported by rising mental health awareness and the stigma associated with traditional psychiatric care. According to the WHO, over 150 million people in the region suffer from mental health disorders, creating demand for accessible and discreet solutions. Additionally, government initiatives, such as India’s National Mental Health Programme, promote telepsychiatry adoption, as highlighted by the Ministry of Health. These factors position telepsychiatry as a vital tool for addressing unmet mental health needs.

By Delivery Mode Insights

The segment of on-premise delivery commanded the Asia Pacific telemedicine market by accounting for 60.5% of the share in 2024. This dominance is driven by data sovereignty concerns and the need for control over sensitive patient information. For instance, in China, the Cybersecurity Law mandates that all healthcare data must be stored locally, prompting hospitals to invest in on-premise infrastructure. Another factor is customization, as noted by Deloitte, which states that a significant number of large enterprises prioritize tailored solutions to meet operational needs.

Cloud-based delivery is the fastest advancing segment, with a CAGR of 27.8%. This growth is fueled by the scalability and cost-effectiveness of cloud platforms. Additionally, the rise of hybrid work models has amplified demand, as noted by a study that reports a major increase in cloud-based telemedicine usage post-pandemic.

REGIONAL ANALYSIS

India is a pivotal player in the Asia Pacific telemedicine market by contributing 20.4% to the regional share in 2024. The country’s leading position is driven by its vast population and significant healthcare accessibility gaps. The Ministry of Health reports that significant portions of rural areas lack access to quality healthcare, creating immense demand for telemedicine. Initiatives like Ayushman Bharat Digital Mission have further propelled adoption, enabling over 100 million digital health records. Additionally, private players like Practo have expanded services, conducting millions of teleconsultations annually. These efforts position India as a leader in democratizing healthcare through technology.

China holds a 25.2% share of the Asia Pacific telemedicine market. The country’s dominance is driven by its aging population and rising chronic disease burden. Government initiatives, such as the Healthy China 2030 plan, promote telemedicine adoption, with platforms like Ping An Good Doctor serving over 300 million users. Also, advancements in 5G technology have enhanced telemedicine capabilities, as highlighted by Huawei, which reports a 40% improvement in service delivery speeds.

Japan contributes notably to the regional telemedicine market. The country’s place in the market is driven by its aging population and stringent healthcare regulations. Additionally, partnerships with tech giants like Sony have led to innovations in remote diagnostics, positioning Japan as a hub for advanced telemedicine solutions.

Australia and New Zealand collectively hold 10.6% of the market share. This is supported by robust IT infrastructure and strong regulatory frameworks. The National Broadband Network plays a crucial role in enabling telehealth services and reaching rural populations. Additionally, government funding has bolstered innovation, with New Zealand investing substantially in telehealth infrastructure, as noted by the Ministry of Business, Innovation, and Employment.

Singapore accounts for a smaller portion of the market share. The country’s growth is propelled by its Smart Nation initiative and advanced healthcare ecosystem. Also, collaborations with global players like IBM have enhanced AI-driven diagnostics, improving patient outcomes.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a promising role in the Asia Pacific telemedicine market profiled in this report are AMD Global Telemedicine, CISCO Systems, Inc., Medtronic, Inc., GE Healthcare, Honeywell Lifesciences, Philips Healthcare, McKesson Corp, Aerotel Medical Systems, CardioComm, Cerner Corporation, Apollo Hospitals (India) and Neosoft (China).

The Asia Pacific telemedicine market is highly competitive, characterized by the presence of global leaders and regional innovators vying for dominance. Global giants like Teladoc Health and Ping An Good Doctor leverage their technological expertise and extensive networks to cater to large-scale enterprises. Meanwhile, regional players like Apollo Telehealth Services focus on affordability and accessibility to serve underserved communities. The competitive landscape is shaped by rapid advancements in AI, IoT, and cloud computing, which are integrated into telemedicine platforms to enhance efficiency. Strategic collaborations with governments and insurers further intensify competition, as firms aim to expand their reach. For instance, partnerships with local healthcare providers have become a focal point for gaining market traction. Additionally, regulatory alignment and data security measures are critical differentiators, ensuring compliance with stringent healthcare laws.

Top Players in the Asia Pacific Telemedicine Market

Apollo Telehealth Services

Apollo Telehealth Services is a pioneer in the Asia Pacific telemedicine market, offering comprehensive solutions like teleconsultations, remote diagnostics, and health monitoring. Additionally, the company launched its mobile app, Apollo 24/7, which provides virtual consultations and medication delivery, reaching over 10 million users. These initiatives underscore Apollo’s commitment to leveraging technology to expand access and improve healthcare outcomes.

Ping An Good Doctor

Ping An Good Doctor is a leading telemedicine provider in China, offering services like online consultations, prescription delivery, and wellness management. Furthermore, the company collaborated with Huawei to enhance its platform’s scalability using 5G technology, ensuring seamless service delivery. These innovations reflect Ping An’s focus on integrating advanced technologies to meet growing consumer demands.

Teladoc Health

Teladoc Health has established a strong presence in the Asia Pacific telemedicine market by offering virtual care solutions tailored to enterprise clients and healthcare providers. The company’s Chronic Care Management program supports patients with long-term conditions, improving adherence and outcomes. Additionally, the company launched a mental health platform, addressing the rising demand for telepsychiatry services.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific telemedicine market employ strategies like partnerships, technological innovation, and localization to strengthen their positions. Collaborations with governments and private entities enable companies to scale operations and reach underserved populations. For instance, partnerships with telecom providers ensure reliable connectivity for remote consultations. Technological innovation focuses on integrating AI, IoT, and 5G to enhance service delivery. Localization efforts include multilingual support and compliance with regional regulations. Acquisitions also play a critical role; acquiring niche telemedicine firms enhances capabilities. Lastly, investments in user-friendly platforms attract tech-savvy consumers, driving adoption rates higher.

RECENT MARKET DEVELOPMENTS

- In April 2023, Apollo Telehealth Services partnered with Microsoft to integrate AI-driven analytics into its platform, enhancing diagnostic precision and patient engagement.

- In July 2023, Ping An Good Doctor launched AI-powered chatbots for triaging patients, reducing consultation times by 30% and improving operational efficiency.

- In September 2022, Teladoc Health collaborated with AIA Group to expand its services across Southeast Asia, targeting over 30 million policyholders and strengthening its regional footprint.

- In January 2024, Practo, an Indian telemedicine provider, acquired Medifee, a healthcare aggregator, to enhance its service offerings and streamline appointment scheduling for users.

- In November 2023, Samsung partnered with South Korea’s Ministry of Health to deploy wearable devices for remote monitoring, benefiting over 5 million chronic disease patients and solidifying its position in the market.

MARKET SEGMENTATION

This research report on the Asia-Pacific telemedicine market has been segmented and sub-segmented into the following categories.

By Type

- Technology

- Hardware

- Software

- Telecommunications

- Service

- Remote Patient Monitoring

- Store-and-Forward

- Real-Time Interactive

By Application

- Tele-Cardiology

- Tele-Radiology

- Tele-Pathology

- Tele-Dermatology

- Tele-Neurology

- Emergency Care

- Home Health

- Others

By Delivery Mode

- Web-Based

- Cloud-Based

- Others

By End-Users

- Tele-Hospitals

- Tele-Homes

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia Pacific

Frequently Asked Questions

Which countries in APAC are leading the telemedicine market growth?

China and India are the largest markets, with Japan and South Korea also showing substantial growth.

What role does the COVID-19 pandemic play in the growth of telemedicine in APAC?

The pandemic accelerated telemedicine adoption as it became a safer way to access healthcare.

What factors are driving the growth of telemedicine in the APAC region?

The growing healthcare access, rising chronic diseases, and the adoption of digital technologies are majorly propelling the growth of the APAC telemedicine market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]