Asia Pacific Compression Garments And Stockings Market Research Report - Segmented By Product Type(Compression garments, Compression stockings), Application, End-user & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Compression Garments and Stocking Market Size

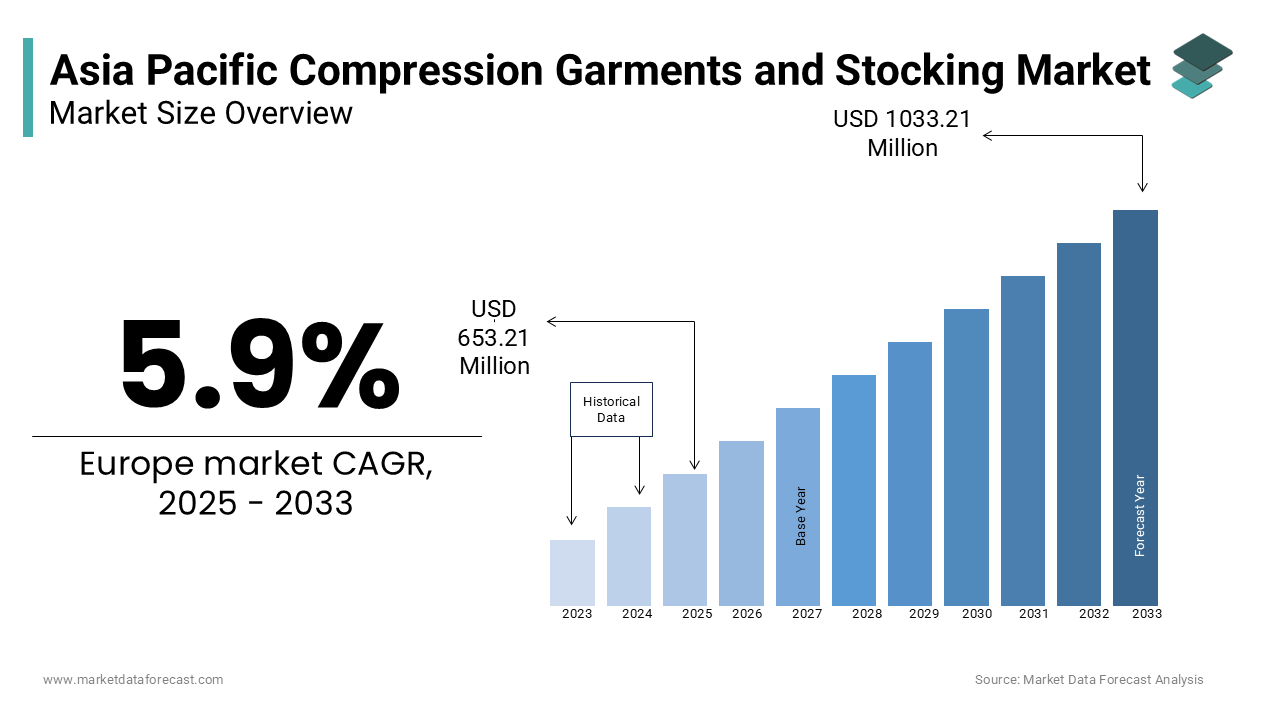

The Compression Garments and Stockings Market Size in the Asia Pacific is valued at USD 616.82 million in 2024 and is projected to grow at a CAGR of 5.9% to reach USD 1033.21 million by 2033 from 653.21 million in 2025 during the forecast period 2025 to 2033.

The availability of a large target patient population and the increased incidence of sports injuries and accidents are the primary drivers of this market's growth. In addition, compression therapy devices are designed for patients with lifestyle-related disorders and vascular diseases such as obesity, diabetes, lymphedema, DVT, and varicose veins.

The growing senior population is considered a significant factor was supporting market expansion because older adults are more sensitive to numerous health issues. In addition, patients' desire to adopt various treatment modalities, including compression therapy, is being driven by these considerations.

Compression garments and stockings market growth is accelerated by an increase in the incidence of multiple chronic diseases, rise in the occurrences of varicose veins and lymphedema , an increase in the rate of orthopedic operations, and the prominence of compression garments.

Furthermore, rising public awareness of the benefits of compression garments and stockings, increased health consciousness, increased investment, and increased healthcare spending all help the compression garments and stockings market. Immobility, past deep vein thrombosis, pregnancy, obesity, and varicose veins are all factors that contribute to the development of lymphatic and venous problems.

Lymphatic problems are also caused by chronic venous insufficiency, breast cancer, and operations. As a result, the market expansion is likely to be fueled by the rising frequency of chronic disorders and growing awareness of innovative therapies such as compression garments and other devices.

Poor patient compliance with compression garments and a lack of widely approved standards for compression products are expected to limit the market's growth throughout the forecast period. Furthermore, the high cost of compression garments and stockings and tight production requirements and regulations are expected to stifle the compression garments and stockings market. In addition, alternative therapies and design restrictions are projected to provide difficulties to the compression garments and stockings market soon.

REGIONAL ANALYSIS

Geographically, the Asia Pacific Compression garments and stockings market is expected to provide considerable potential possibilities for compression therapy market competitors.

The India Compression garments and stockings market is expected to reach a decent CAGR due to increasing disposable income levels and raising awareness among physicians, surgeons, & patients about the latest treatment options available for various orthopedic and vascular disorders.

The China Compression garments and stockings market is predicted to grow dramatically in the coming years due to the rising patient population, increasing the prevalence of target diseases in the region.

Compression garments and stockings are becoming more popular among athletes and gymnasts because they give a good fit, absorb sweat, and prevent injuries during an event or sport. This aspect is driving up demand for compression garments and stockings.

Furthermore, innovations in fabric technology and garment designs and a growing awareness of physical fitness are driving the region's compression garments and stockings market forward.

KEY MARKET PLAYERS

The top Companies leading the Asia Pacific Compression Garments and Stockings Market Profiled in the Report are 2XU Pty. Ltd, 3M, BSN Medical, Santemol Group Medical, Leonisa, Inc., Medical Z, Medi GmbH & Co KG, Nouvelle, Inc.,

MARKET SEGMENTATION

This research report on the Asia Pacific Compression Garments and Stockings Market has been segmented and sub-segmented into the following categories

By Product

- Compression garments

- Compression stockings

By Application

- Varicose veins

- Wound care

- Burns

- Oncology

By End User

- Hospitals

- ASC's

- Clinics

- Online sales

- Healthcare

By Country:

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]