Asia Pacific Antiseptics and Disinfectants Market Size, Share, Trends & Growth Forecast Report By Type, End User and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From (2025 to 2033)

Asia Pacific Antiseptics and Disinfectants Market Size

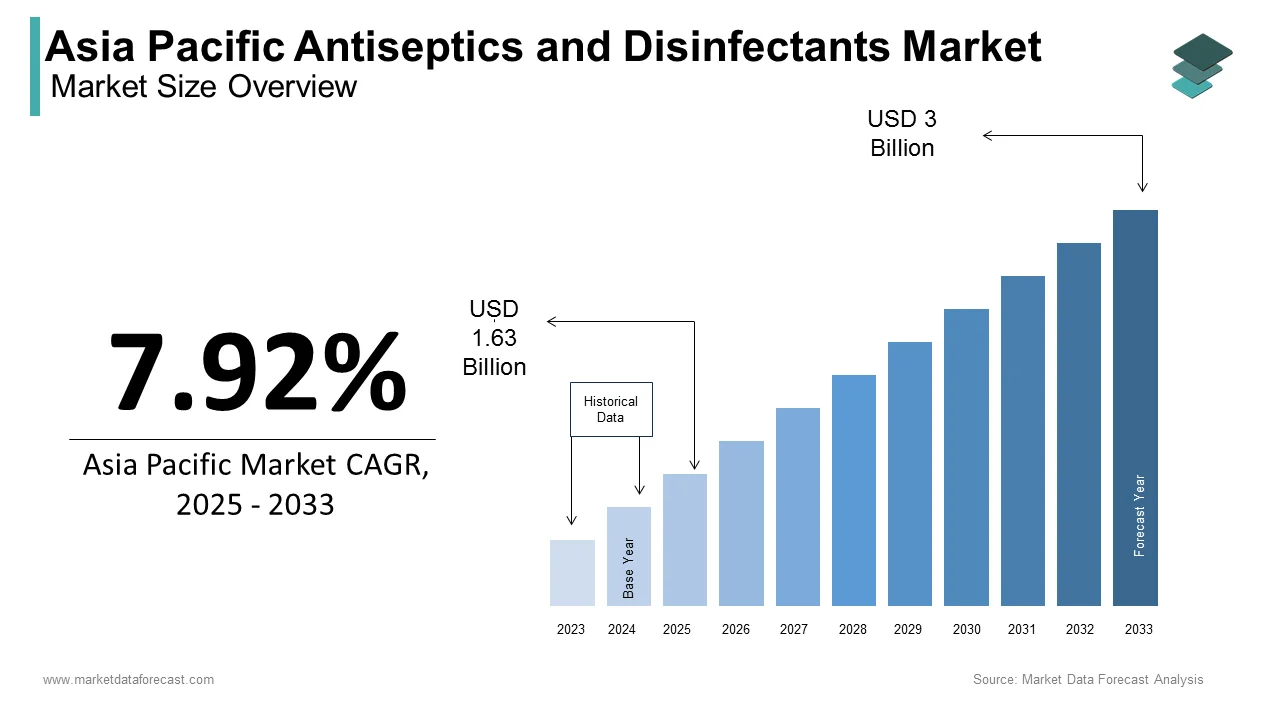

The size of the Asia Pacific antiseptics and disinfectants market was valued at USD 1.51 billion in 2024. This market is expected to grow at a CAGR of 7.92% from 2025 to 2033 and be worth USD 3 billion by 2033 from USD 1.63 billion in 2025

MARKET DRIVERS

Growing Demand for Antiseptics & Disinfectants

The rise in the number of surgeries and the growing demand for antiseptics & disinfectants are fueling the market's growth. Also, changes in government policies in favor of the poor people, especially during the COVID-19 outbreak, elevate the demand of the market.

Increasing the scale of hospitals and clinics across the region, the rising flow of patients, the rising prevalence of surgical treatment procedures, and the need to keep the instruments sterile to prevent bacteria's growth are the primary growth driving factors to the Asia Pacific Surface Disinfectants Market. Furthermore, increasing support from government organizations through funds and creating awareness through campaigns broadens the growth rate of the market in the Asia Pacific.

Awareness Towards Microbe Prevention in Medical Devices

Awareness towards the prevention of microbe growth in medical devices through antiseptics and disinfectants, rising focus to improve healthcare services in hospitals and clinics to promote the wellbeing of the patient is straight propelling the growth rate of the antiseptics and disinfectants market in this region.

MARKET RESTRAINTS

Lack of Skilled Staff in Rural Areas

Fluctuations in the production rate of these products in manufacturing companies are slowly impeding the market demand. The dearth of skilled staff in keeping surgical instruments more hygienic in rural areas is challenging for market growth. Rapid changes in the government's economic strategies are also limiting the growth rate of the antiseptics and disinfectants market in the Asia Pacific. Lack of standardization also hinders market demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-user, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

3M Company, Abc Compounding, Advanced Sterilization Products, American Biotech Labs, Angelini Pharma Inc., Becton, Dickinson And Company, Bio-Cide International Inc., Cardinal Health and Carefusion Corp., and Others. |

SEGMENTAL ANALYSIS

By End-User Insights

REGIONAL ANALYSIS

The Asia Pacific has the largest population compared to the other geographies, and the safety concerns among all people are offering a high growth rate to this region.

The Indian antiseptics and disinfectants market is playing the leading role in the APAC market. Creating awareness through campaigns and digital media is lucratively lavishing the demand of the market. The growing geriatric population is an additional factor prompting the growth rate of the market in this country.

Following India, China is ruling with prominent shares of the market. Increasing demand to improve the healthcare infrastructure is majorly fuelling the growth rate of the market. Escalating expenditure on healthcare is prompting the growth rate of the market in this country.

The antiseptics and disinfectants market has great opportunities in Japan. Growing disposable income in urban areas is one of the factors anticipated to accelerate the market's demand. The rise in the incidences of various health disorders is propelling the growth rate of this market.

In the antiseptics and disinfectants market in Australia, the rise in the number of research and development institutes is a key factor elevating the demand of the antiseptics and disinfectants market. The growing prevalence of sanitizing properly in hospitals due to the spread of COVID-19 is escalating the market demand.

In South Korea, the demand for antiseptics and disinfectants is expected to have the highest growth rate in 2020-2025. The rising scale of healthcare centers is greatly influencing the demand of the market. A rise in awareness over the use of antiseptics and disinfectants is leveling this market's demand.

KEY MARKET PLAYERS

Promising companies in the Asia Pacific antiseptics and disinfectants market profiled in this report are 3M Company, Abc Compounding, Advanced Sterilization Products, American Biotech Labs, Angelini Pharma Inc., Becton, Dickinson And Company, Bio-Cide International Inc., Cardinal Health and Carefusion Corp., and Others.

MARKET SEGMENTATION

This research report on the Asia Pacific antiseptics and disinfectants market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Alcohol and Aldehyde

- Phenols and Derivatives

- Biguanides and Amides

- Quaternary Ammonium Compounds

- Iodine Compounds

- Others

By End-User

- Domestic User

- Institutional User

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com