Global Antiseptics and Disinfectants Market Size, Share, Trends & Growth Forecast Report By Type (Alcohol and Aldehyde, Phenols and Derivatives, Biguanides and Amides, Quaternary Ammonium Compounds, Iodine Compounds and Others), End User (Domestic User and Institutional User) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Antiseptics and Disinfectants Market Size

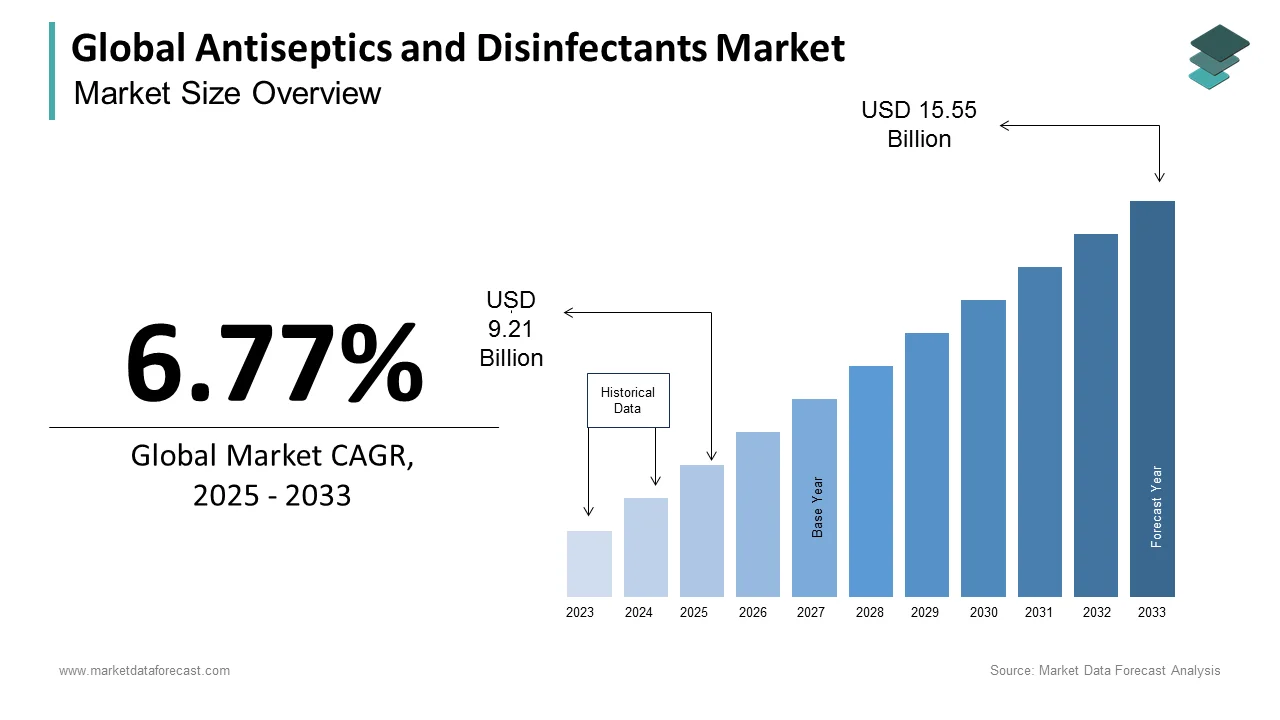

The size of the global antiseptics and disinfectants market was worth USD 8.63 billion in 2024. The global market is anticipated to grow at a CAGR of 6.77% from 2025 to 2033 and be worth USD 15.55 billion by 2033 from USD 9.21 billion in 2025.

Antiseptics and disinfectants are widely used in hospitals, clinics, and houses. They kill microorganisms, whereas antiseptics are used on living bodies and disinfectants on non-living surfaces. Antiseptic is a chemical substance that kills pathogens and harmful microorganisms in or on the human body's surface tissue. They mainly act by dissolving cell membranes and protein denaturation, causing dehydration of the cells due to evaporation. For instance, Chloroxylenol is a chlorinated phenolic antiseptic primarily active against gram-positive bacteria and is used in lubricating cream for vaginal examination.

On the other hand, disinfectants are chemicals used to kill pathogenic microorganisms in or on objects' surfaces. The disinfectant's main course of action includes the disruption of cell membranes and the cell's denaturation of proteins and enzymes. These chemical agents are effective against vegetative gram-positive and gram-negative bacteria, mycobacteria, and viruses. For instance, Lysol, a phenol compound, is used as a general disinfectant for domestic or hospital use, like disinfection of floors, bathrooms, washbasins, and organic waste such as sputum, feces, urine, etc.

MARKET DRIVERS

The rise in life-threatening infectious diseases such as COVID-19 globally propels the antiseptics and disinfectants market.

The increasing prevalence of washing hands frequently to kill germs is anticipated to fuel market growth. Ongoing research on developing new products with advanced technology and the growing scale of hospitals and clinics with the spread of COVID-19 are favoring the growth of the global market. According to the Centers for Disease Control and Prevention (CDC), 1 out of 25 people suffers from healthcare-associated infections yearly.

Rising cases of HAIs due to lack of sanitation and prevention are expected to drive the global antiseptics and disinfectants market growth.

Growing efforts to reduce HAI cases and raise awareness of home and personal hygiene are a big plus to the market growth. Increasing awareness, particularly in developing economies like Asia, the Middle East, Africa, and Latin America, is expected to boost the market quickly. In addition, suitable reprocessing of medical devices and endoscopes is necessary because the infection can be spread from one patient to the next as these devices come into close contact with the skin and body. Furthermore, approaches are necessary for hospitals to maintain good hygiene and sanitation, reducing the risk of HAIs. This trend is expected to fuel market growth for antiseptics and disinfectants throughout the forecast period.

The extensive use of antiseptic and disinfection products has contributed to the emergence of microbial resistance, notably antibiotic cross-resistance. In hospitals and other healthcare facilities, antiseptics and disinfectants are frequently utilized for topical and challenging surface applications since they are crucial in preventing nosocomial infections and infection control procedures. These products contain many active biocides, many of which have been used for hundreds of years, such as alcohols, phenols, iodine, and chlorine. Factors such as an increasing percentage of hospitals and advanced healthcare facilities worldwide and the rising trend of health clubs and fitness centers are expected to drive the antiseptics and disinfectants market. Moreover, the young generation's keen interest in preventing the flu and bacterial and viral infections will probably increase the demand for antiseptics and disinfectants.

MARKET RESTRAINTS

The lack of complete knowledge of the use of these products and fluctuations in the availability of different chemical agents hinder antiseptics and disinfectants market growth. Strict rules and regulations by government officials regarding public safety when approving new products also impede market growth. Some disinfectants are also high risk when used regularly, limiting the need for this market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By End User, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

3M Company, Abc Compounding, Advanced Sterilization Products, American Biotech Labs, Angelini Pharma Inc., Becton, Dickinson, And Company, Bio-Cide International Inc., Cardinal Health, Nufarm Limited, Carefusion Corp, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

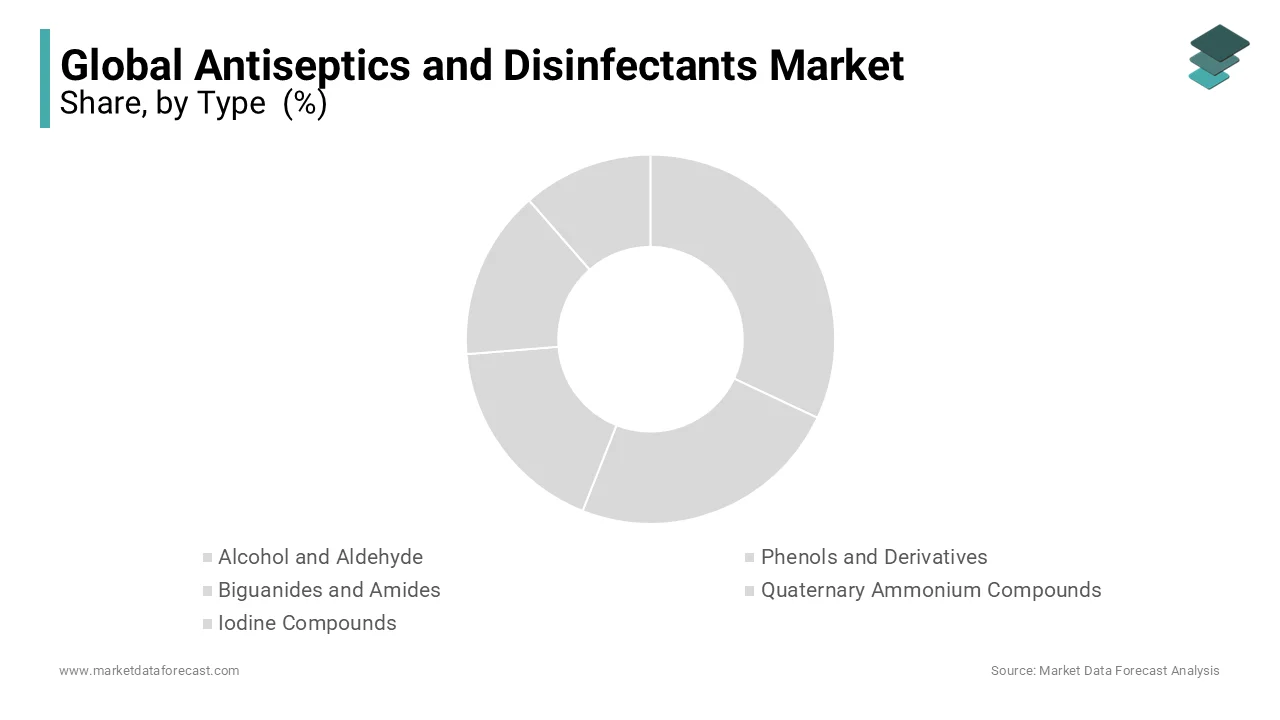

The quaternary ammonium compounds segment had the highest global market share in 2024. The alcohol and aldehydes segment accounted for a promising market share in 2024. The impact of COVID-19 is making this segment grow enormously. In addition, the rising demand for sanitizing the isolation wards and other places frequently is a significant factor driving the segment's growth. Alcohols are widely used as a disinfectant, antiseptic, and antidote. Through its application on the skin, the person's skin can be disinfected before a needle and surgery.

The phenols and derivatives segment had a substantial market share in 2024, following the alcohol and aldehydes segments. Phenol is an antiseptic and disinfectant used as an active ingredient against fungi and viruses, quite slowly effective against spores, and also to disinfect the skin and relieve itching. However, the increasing prevalence of maintaining hygiene conditions at houses, offices, and others is fueling the segment's growth rate.

The biguanides and amides segment is expected to have a significant growth rate in the coming years. Chlorhexidine is the most popular biguanide antiseptic due to its potency of antimicrobial activity against Gram-positive and Gram-negative bacteria, which is ineffective against spores.

By End-User Insights

The institutional user segment had the most significant share of the global antiseptics and disinfectants market in 2024. Increasing research and development activities in institutes to develop innovative products is one factor favoring this segment's growth.

The domestic user segment is expected to grow at a healthy growth rate during the forecast period. Increasing usage of antiseptics and disinfectants in hospitals, clinics, and other places to control the spread of infectious diseases is accelerating the market's growth rate.

REGIONAL ANALYSIS

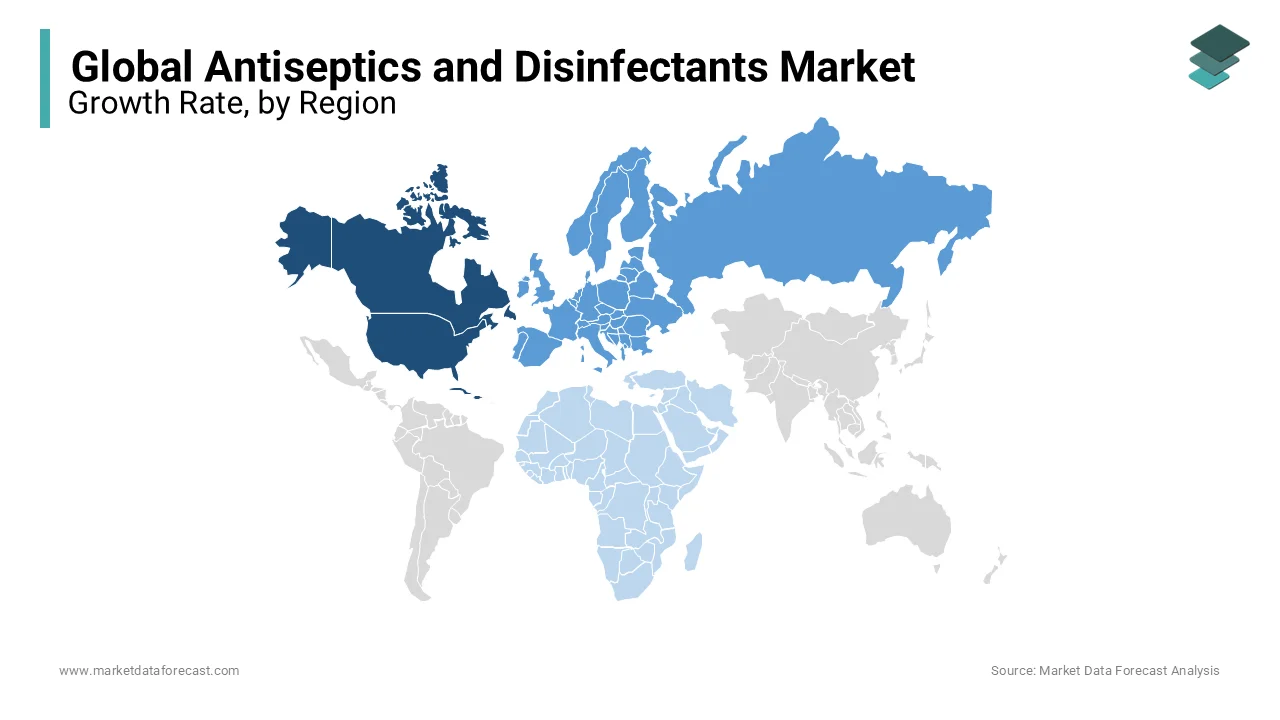

The North American antiseptics and disinfectants market was the leader in the global market in 2024. However, it is expected to witness moderate growth within the forecast period due to the market's saturation on antiseptics and disinfectants in the U.S. and Mexico. Therefore, it is expected to harm the antiseptic and disinfectant market over the years. However, the demand for antiseptics and disinfectants has increased in the past few years due to the rising awareness of the nutritional benefits of antiseptics and disinfectants. In addition, major companies in the US are expanding their vegetable production capacities to keep up with the growing demand for imports in the US market. Therefore, it is expected to fuel the market growth of the antiseptic and disinfectant market. Besides, a high literacy rate coupled with the increasing number of healthcare and business centers is likely to contribute to the growth of the antiseptic and disinfectant market.

The European antiseptics and disinfectants market accounts for a significant share of the global antiseptic and disinfectant market. The region is expected to grow due to rising healthcare expenditure in Norway, Denmark, and other European countries. In addition, in the last decade, there has been a marked increase in the domestic use of antiseptic and disinfectant in this region due to increasing awareness about pandemic diseases such as spreading flu and viral infections.

The Asia Pacific antiseptics and disinfectants market is expected to witness the highest CAGR during the forecast period due to the widespread popularity of Ayurveda in this region. In addition, the growing medical sector and literacy rates, mainly in China, India, Indonesia, and Thailand, drive this region's antiseptic and disinfectant market. Besides, raising awareness towards personal care and maintaining hygiene in India's emerging economies is expected to augment the market growth of antiseptics and the disinfectant market in this region shortly.

The Latin American antiseptics and disinfectants market is expected to grow at a healthy CAGR during the forecast period.

The antiseptics and disinfectants market in the Middle East and Africa is anticipated to showcase a moderate CAGR in the coming years.

KEY MARKET PLAYERS

Companies like 3M Company, Abc Compounding, Advanced Sterilization Products, American Biotech Labs, Angelini Pharma Inc., Becton, Dickinson, And Company, Bio-Cide International Inc., Cardinal Health, Nufarm Limited, and Carefusion Corp dominate the global antiseptics and disinfectants market.

MARKET RECENT HAPPENINGS

- In November 2022, two antiseptic solutions, a solution with an aqueous solution of 10% chlorhexidine and a 4% aqueous solution of chlorhexidine, commonly used by surgeons before fracture surgery resulted in being equally effective in preventing post-surgical infections, whose research had been done by researchers from University of Maryland School of Medicine, on more than 1,600 patients with open fractures.

- In Nov 2022, according to a recent study by Environmental Toxicology and Chemistry researchers, chemicals used in antiseptics like BAC, BZT, and PCMX were evaluated to pose no adverse ecological effects and instead had high margins of safety.

- In Nov 2022, according to the researchers of BMJ, the antiseptic drug hippuric methenamine was found to be as effective as antibiotics for the treatment of urinary tract infections in women, which could further reduce the global burden of antibiotic resistance by stopping the growth of certain bacteria through the sterilization of urine.

- In June 2018, Johnson & Johnson reported the Fortive Corporation's binding offer to purchase its Advanced Sterilization Products (ASP), a subsidiary of Ethicon, Inc. It will allow the company to broaden its sterilization product range and help increase its customer base worldwide.

MARKET SEGMENTATION

This research report on the global antiseptics and disinfectants market has been segmented and sub-segmented based on type, end-user, and region.

By Type

- Alcohol and Aldehyde

- Phenols and Derivatives

- Biguanides and Amides

- Quaternary Ammonium Compounds

- Iodine Compounds

- Others

By End-User

- Domestic User

- Institutional User

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What was the size of the global antiseptics and disinfectants market in 2024?

The global antiseptics and disinfectants market size was valued at USD 8.63 billion in 2024.

Which region is growing the fastest in the global antiseptics and disinfectants market?

Geographically, the APAC regional market is anticipated to grow the fastest in the global market during the forecast period.

Which region accounted for the largest share by type in the antiseptics and disinfectants market in 2024?

Based on type, the alcohol and aldehydes segment led the market in 2024.

What are some of the promising players in the antiseptics and disinfectants market?

3M Company, Abc Compounding, Advanced Sterilization Products, American Biotech Labs, Angelini Pharma Inc., Becton, Dickinson, And Company, Bio-Cide International Inc., Cardinal Health, Nufarm Limited, and Carefusion Corp are a few of the major players in the antiseptics and disinfectants market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]