Global Surface Disinfectant Market Size, Share, Trends & Growth Forecast Report By Formulation (Wipe, Liquid and Spray), Type (Quaternary Ammonium Compounds, Phenol, Chlorhexidine Gluconate, Alcohol and Aldehyde), Application, End-User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Surface Disinfectant Market Size

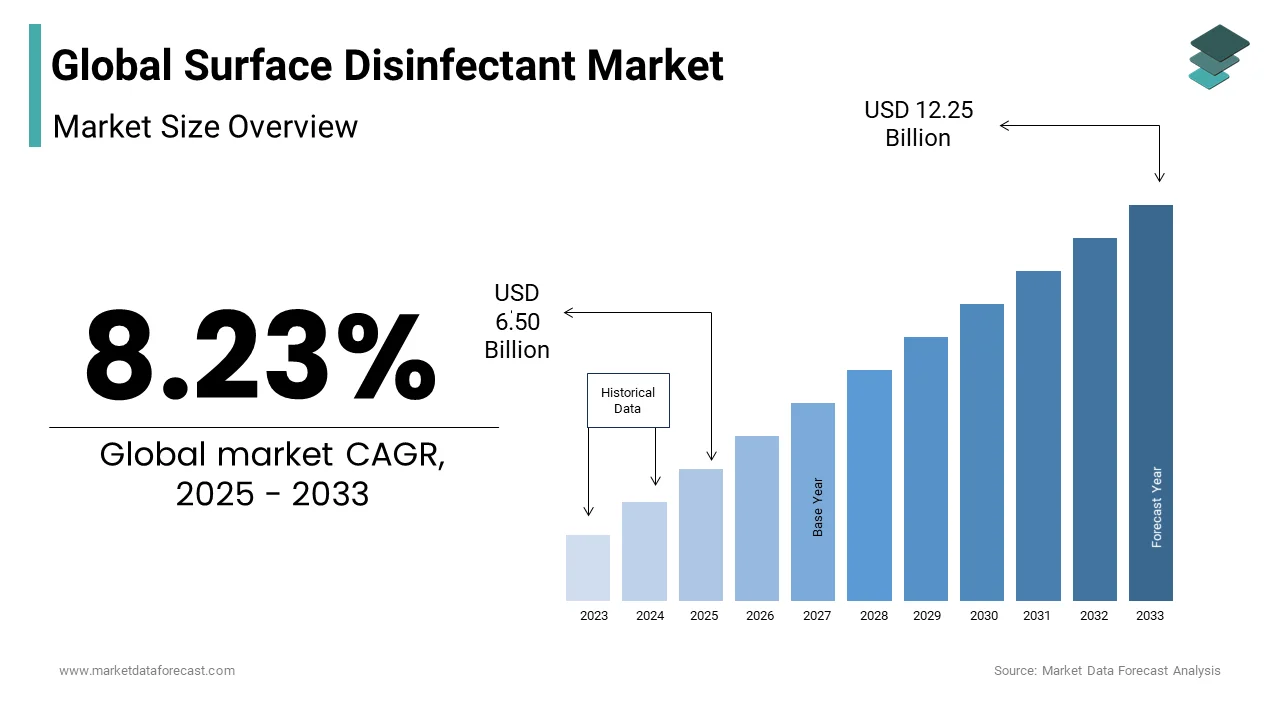

The global Surface Disinfectant Market was valued at USD 6.01 Billion in 2024 and is expected to reach USD 12.25 Billion by 2033 from USD 6.50 Billion in 2025, growing at a CAGR of 8.23 % during the forecast period.

Surface disinfectant chemicals are used to kill or destroy microorganisms. These chemical agents are more effective than sanitizers because they crush all bacteria. These are different from antibiotics, which fight microorganisms within the body. Usually, surface disinfectants are used in hospitals, clinics, the kitchen, and other places to avoid spreading infections.

Surface disinfectants can play a major role in preventing the spread of infections. It is highly important to use disinfectants to clean specific objects or surfaces in order to prevent the risk of pathogens. The importance of the use of disinfectants with the rising concern over the spread of various viral infections globally. The emergence of COVID-19 raised awareness of the importance of sanitation and maintaining hygienic surfaces. According to the World Health Organization (WHO), more than 4.6 Billion people in the world gave priority to sanitation services in 2022. Also, the report stated that around 1.4 million people across the globe die due to a lack of proper hygiene conditions that spread various infectious diseases. According to the National Library of Medicine reports, government officials in the US are giving topmost priority to cleaning hospital room surfaces, which is the most important step to prevent healthcare-acquired infections. HAIs are solely responsible for causing at least 75000 deaths only in the US annually. Most HAI infections can be controlled by proper sanitation using surface disinfectants. Focusing on environmental cleaning procedures, which is a bit of a challenging task due to the complexity of cleaning surfaces, is set to create huge growth opportunities for the surface disinfectants market in the coming years.

MARKET DRIVERS

The growing prevalence of HAIs and other infectious diseases is primarily boosting the surface disinfectant market growth. The increasing geriatric population, the implementation of stringent regulations, and the growing healthcare sector are propelling the global surface disinfectants market growth. The recent COVID-19 pandemic increased the usage of surface disinfectants worldwide, thus contributing to market growth. The prevalence of killing microorganisms to prevent the spread of infections is a major driving factor for market growth. Furthermore, increasing incidences of chronic diseases and a rise in patient flow in hospitals, as well as increased awareness programs by the government and non-government organizations to promote the awareness of hygiene to control infectious diseases, are driving the surface disinfectants market. In addition, favorable government initiatives on disinfection and sterilization due to rising incidents of human-transmitted diseases and other infections are key factors driving the demand for surface disinfectants.

The growing patient population suffering from chronic diseases worldwide is further fuelling the growth of the surface disinfectants market. The number of patients admitted to hospitals suffering from chronic diseases is significantly growing worldwide. Therefore, hospitals must be disinfected frequently to keep patients safe from acquiring any infectious disease. People suffering from diseases such as cancer, diabetes, and heart-related problems are more prone to the infections around them. Moreover, increasing surgery for this treatment increases the chance of spreading the virus or infection through the instrument used. This may lead to sickness in the healthcare provider and workers working in the environment. As a result, this surface disinfectant is used to clean the floor and surgical equipment to reduce the further spread of infection. Considering all these factors, the surface disinfectant market has demand during the forecast period.

Furthermore, factors such as increasing awareness about the role of disinfection, growing demand for home disinfectants due to increasing focus on child health and rising disposable income, the emergence of diseases like influenza, chikungunya, and Ebola, and growing economies of the counties across the world are likely to offer lucrative opportunities for the growth of the surface disinfectant market during the forecast period. The increasing production of new surface disinfectants has recently also driven the market forward. Key players are manufacturing different surface disinfectants for different areas based on the level of infection spread. They also focus on the concentration level of the disinfectant to reduce any further side effects caused by using surface disinfectant for an extended period.

MARKET RESTRAINTS

The competition from alternative disinfection methods is one of the major restraints to the surface disinfectant market. The stringent regulatory environment for surface disinfectant products makes it complex for new products to enter the market, hampering the market expansion and limiting the market’s growth rate. Issues associated with the shortages of raw materials and poor availability of surface disinfectant products in underdeveloped countries are further impeding market growth. Lack of standardization in disinfection protocols, high costs of disinfection products and equipment, and limited understanding of disinfection efficacy and mechanisms further negatively impact the market growth. Resistance of microorganisms to disinfectants and side effects associated with using surface disinfectants are estimated to inhibit the market’s growth rate. In addition, poor awareness regarding the significance of surface disinfectant products among people and healthcare providers in some countries is negatively affecting the market growth. Lack of investment in research and development for new and innovative disinfectant technologies is another major impediment to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Formulation, Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M Company (U.S.), Procter & Gamble (U.S.), and Reckitt Benckiser Group plc. (U.K.), The Clorox Company (U.S.), Sealed Air Corporation (U.S.), Steris Corporation (U.S.), Cantel Medical Corporation (U.S.), Johnson & Johnson (U.S.), and Ecolab (U.S.). |

SEGMENTAL ANALYSIS

By Formulation Insights

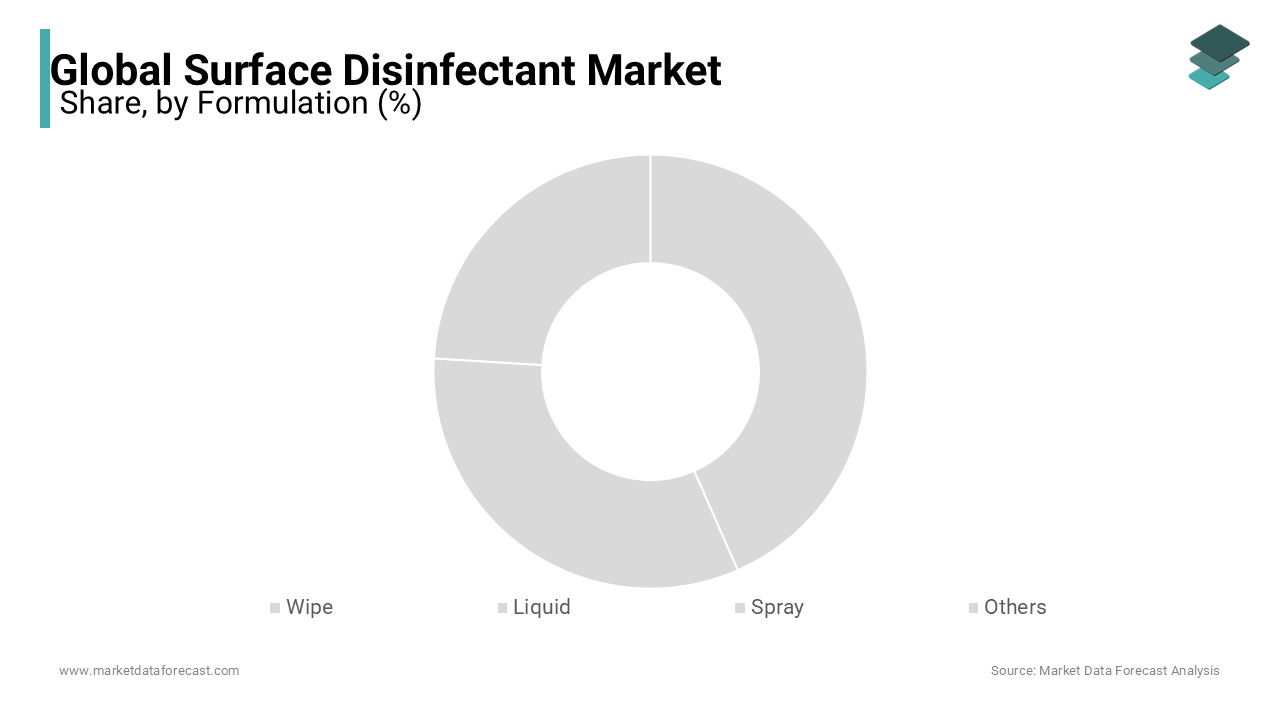

The liquid segment held the major share of the global surface disinfectant market in 2024 and the segment’s dominance is expected to continue during the forecast period. Liquid products are easy to use, have wide availability, and are versatile in application. Due to this, most people prefer using these products, which is one of the significant factors propelling segmental growth. In addition, the rising demand for liquid-based surface disinfectant products from industries such as healthcare facilities, food and beverage processing plants, households, and public places is another major factor boosting segmental growth. The segment's growth is further driven by the increasing need to maintain hygiene by spraying disinfectants in public places.

The wipe segment occupied a substantial share of the worldwide market in 2024 and is expected to grow at a notable CAGR during the forecast period. These products are convenient to use and can be cleaned and disinfected on small or hard-to-reach surfaces using these products. The adoption of these products has been increasing gradually over the last few years, and the trend is estimated to continue further in the coming years.

On the other hand, the spray segment is forecasted to witness a healthy CAGR during the forecast period. This is because the adoption of these products is growing significantly in industries and households, which is majorly driving the segment’s growth rate.

By Type Insights

Based on type, the alcohol segment captured the largest share of the global surface disinfectant market in 2024 and the domination of the segment is likely to continue during the forecast period. The segment's growth is driven by the growing adoption of alcohol-based surface disinfectants, as these products are believed to be effective in killing a wide range of microorganisms, including bacteria, viruses, and fungi. In addition, the growing usage of alcohol-based surface disinfectants in various industries, such as healthcare facilities, households, and public places, is further propelling the segment’s growth rate.

On the other hand, the quaternary ammonium compounds segment held a considerable share of the global market in 2024 and is predicted to continue showcasing a healthy CAGR throughout the forecast period. The growing use of these compounds in disinfectants for healthcare facilities and food processing industries primarily drives segmental growth.

The phenol segment is another lucrative segment anticipated to perform well during the forecast period owing to growing awareness through government initiatives, even in rural areas. In addition, chlorhexidine Gluconate, alcohol, and aldehyde will grow in the coming years.

By Application Insights

Based on application, the in-house segment is predicted to hold a major share of the global surface disinfectant market during the forecast period owing to the growing awareness among people regarding the significance of having a clean and hygienic environment to limit the spread of infections. In addition, the growing incidence of infectious diseases is another notable factor contributing to the segment's growth rate.

On the other hand, the instrument segment is estimated to witness a healthy CAGR in the coming years. Factors such as the growing demand for surface disinfection products in healthcare facilities and research laboratories, the increasing patient population suffering from HAI, and increasing awareness of infection control and prevention are boosting segmental growth.

By End-User Insights

The hospital segment is estimated to occupy the leading share of the global surface disinfectant market during the forecast period. The segment's growth is driven by the growing number of patients visiting hospitals, the increasing number of government initiatives to improve hospital infrastructure in developing countries, rising investments from private organizations to maintain a hygienic hospital environment, and increasing healthcare expenditure.

During the forecast period, the laboratories segment is predicted to showcase a healthy CAGR in the coming years.

REGIONAL ANALYSIS

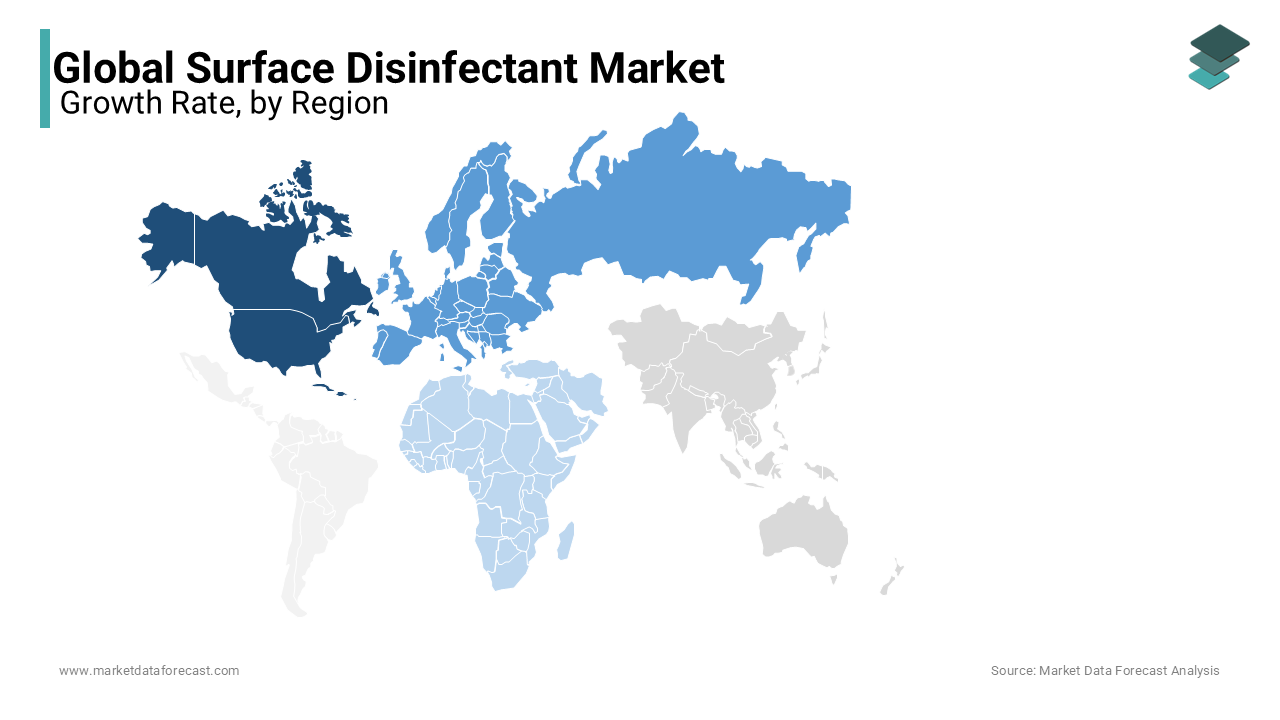

North America was the largest regional segment in the worldwide market in 2024, accounting for 40% of the global market share. The domination of the North American region in the global market is likely to continue during the forecast period. The growth of the North American Surface Disinfectant market is driven by the growing population suffering from infectious diseases and rising awareness among people and healthcare providers regarding the importance of infection control and prevention. In addition, stringent regulations given by North American countries for hygiene and safety in public places and healthcare facilities are propelling the North American market growth. In 2021, the U.S. occupied the major share of the North American surface disinfectant market, followed by Canada, and the same trend is predicted to continue throughout the forecast period.

Europe occupied a substantial share of the global market in 2024 and is expected to witness a notable CAGR during the forecast period. Factors such as increasing awareness among people regarding the impact of infectious diseases result in the increasing usage of surface disinfectants in the European region and contribute to regional market growth. In addition, the growing usage of disinfection products in European healthcare facilities promotes regional market growth.

Asia-Pacific is expected to register the highest CAGR worldwide among all the regions during the forecast period. The increasing population in the APAC countries, rapid urbanization, and increasing awareness among people regarding the importance of hygiene and infection prevention primarily drive the growth of the APAC market. During the forecast period, India and China are expected to hold the leading share of the APAC market.

Latin America held a considerable share of the worldwide surface disinfection market in 2024 and is predicted to grow at a healthy CAGR during the forecast period.

The market in the Middle East and Africa is estimated to showcase a moderate CAGR in the coming years.

KEY MARKET PLAYERS

The companies leading the global surface disinfectant market profiled in this report are 3M Company (U.S.), Procter & Gamble (U.S.), and Reckitt Benckiser Group plc. (U.K.), The Clorox Company (U.S.), Sealed Air Corporation (U.S.), Steris Corporation (U.S.), Cantel Medical Corporation (U.S.), Johnson & Johnson (U.S.), and Ecolab (U.S.). Some leading companies invest heavily in research and development activities to develop new products to maximize their market share.

RECENT HAPPENINGS IN THE MARKET

- In February 2020, Procter & Gamble (P&G) launched Microban 24, which protects surfaces for 24 hours by killing 99.9% of germs. As sanitizing is a significant part of controlling the transmission of diseases like COVID-19, this product receives a positive response from customers.

- In October 2019, 3M acquired Acelity, Inc. with a $6.7 Billion cash transaction. This acquisition brings out innovative healthcare solutions where patients can have a better experience.

- In December 2018, Ecolab Inc. acquired Holchem Group Limited, a leading company in hygiene and cleaning products. This acquisition is anticipated to strengthen the portfolio of the companies in the market.

- In July 2017, 3M Company launched a 3M Curos Stopper disinfecting cap product. The role of this cap is to protect the instrument port from getting contaminated.

- In June 2017, Clorax Company launched bleach germicidal wipes and hydrogen peroxide cleaner disinfectants.

MARKET SEGMENTATION

This research report on the global surface disinfectant market has been segmented and sub-segmented based on formulation, type, application, end-user, and region.

By Formulation

- Wipe

- Liquid

- Spray

By Type

- Quaternary Ammonium Compounds

- Phenol

- Chlorhexidine Gluconate

- Alcohol

- Aldehyde

By Application

- In-house

- Instrument

By End-User

- Hospitals

- Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What was the market size for surface disinfectants across the world in 2024?

The global surface disinfectant market size was worth USD 6.01 billion in 2024.

Which region had the largest share of the global surface disinfectant market in 2024?

Geographically, the North American region accounted for the major share of the global market in 2024, which is 35.6%

Which region is the most attractive regional market in the global market?

The North American regional market is estimated to be continued as the most attractive regional market worldwide during the forecast period.

Who are the major players in the surface disinfectant market?

3M, Procter & Gamble, Reckitt Benckiser Group PLC, Ecolab and Steris are currently dominating the surface disinfectant market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com