Asia Pacific Clinical Trial Management System Market Size, Share, Trends & Growth Forecast Report By Delivery Mode (Web-based CTMS, On-premise CTMS, Cloud-based CTMS), By Component (Software, Hardware, Services), By End User (Pharmaceuticals, CROs, Others), By Type of System (Site-based Licensed, Enterprise-based, Licensed Enterprise-based), and Country (India, China, Japan, South Korea, Australia, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Clinical Trial Management System Market Size

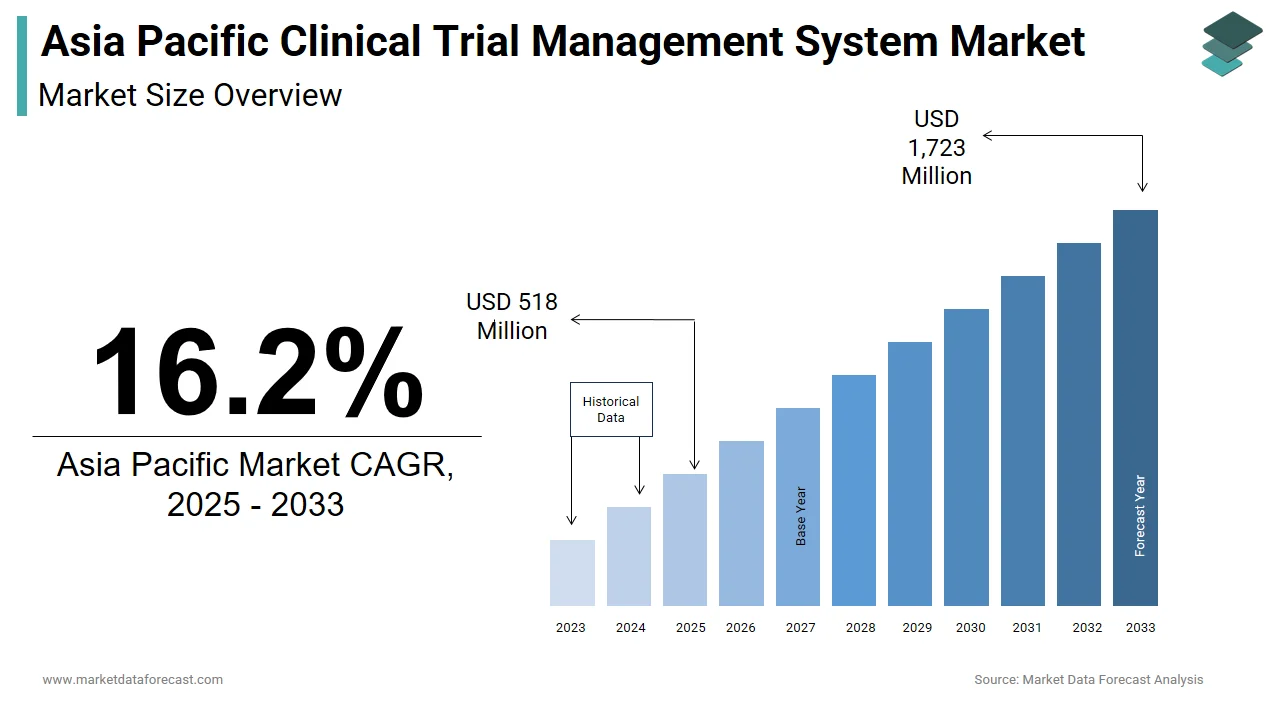

The size of the Asia Pacific clinical trial management system market was worth USD 446 million in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 16.2% from 2025 to 2033 and be worth USD 1,723 million by 2033 from USD 518 million in 2025.

The Asia Pacific clinical trial management system (CTMS) market refers to the adoption and implementation of digital platforms designed to streamline the planning, execution, monitoring, and reporting of clinical trials. These systems play a crucial role in managing patient data, regulatory compliance, investigator communication, budget tracking, and trial timelines—ensuring efficiency and adherence to global standards in pharmaceutical and biotech research.

MARKET DRIVERS

Surge in Clinical Research Activities Across Emerging Markets

One of the primary drivers fueling the growth of the Asia Pacific clinical trial management system (CTMS) market is the rapid expansion of clinical research activities in emerging economies such as India, China, and Southeast Asian nations. These regions are becoming preferred destinations for global pharmaceutical and biotechnology firms seeking cost-effective yet high-quality environments for conducting clinical trials. According to the Indian Society for Clinical Research, India alone accounted for over 150 new clinical trial applications in 2023, a 25% increase compared to the previous year. The country's diverse patient pool, lower operational costs, and improving regulatory environment have attracted numerous multinational companies to establish research collaborations with local CROs and academic institutions. As these trials grow in complexity and volume, the demand for efficient CTMS platforms has intensified, enabling stakeholders to manage data integrity, protocol adherence, and multi-site coordination effectively.

Increasing Adoption of Cloud-Based and AI-Integrated CTMS Platforms

Another key driver of the Asia Pacific clinical trial management system (CTMS) market is the growing preference for cloud-based and AI-integrated platforms that enhance data accessibility, real-time monitoring, and decision-making capabilities. Traditional on-premise systems are being replaced by scalable, secure, and interoperable digital solutions that allow seamless collaboration among investigators, sponsors, and regulatory bodies. In Singapore, where digital transformation in healthcare is highly prioritized, government-backed initiatives like Smart Health Nation have accelerated the integration of artificial intelligence into clinical workflows. South Korean pharmaceutical firms are also leveraging AI-driven analytics within CTMS tools to predict patient enrollment trends, monitor adverse events, and optimize trial design.

MARKET RESTRAINTS

High Implementation Costs and Complexity of Integration

A major restraint affecting the widespread adoption of clinical trial management systems (CTMS) in the Asia Pacific region is the high implementation cost and complexity associated with integrating these platforms into existing clinical research workflows. For smaller pharmaceutical companies and contract research organizations (CROs), deploying a fully functional CTMS can require significant financial investment, especially when considering licensing fees, infrastructure upgrades, and ongoing maintenance. In developing markets such as Vietnam, Indonesia, and the Philippines, where research budgets are often limited, many organizations continue to rely on manual or semi-digital processes due to affordability constraints. Also, integrating CTMS with other critical systems such as electronic data capture (EDC), laboratory information management systems (LIMS), and enterprise resource planning (ERP) can be technically challenging.

Data Security Concerns and Regulatory Compliance Challenges

Data security concerns and regulatory compliance challenges pose a significant barrier to the growth of the Asia Pacific clinical trial management system (CTMS) market. Given the sensitive nature of patient data and the increasing reliance on digital platforms for trial management, ensuring data integrity and cybersecurity remains a top priority for research organizations and regulators alike. Countries like India and Thailand have introduced stricter data protection laws in recent years, requiring clinical trial sponsors to comply with stringent data localization and encryption standards. In China, the Cyberspace Administration mandates strict oversight of health data exports, complicating cross-border clinical trial collaborations. Furthermore, varying regulatory landscapes across the region complicate system standardization efforts.

MARKET OPPORTUNITIES

Expansion of Contract Research Organizations (CROs) in the Asia Pacific Region

The rapid expansion of contract research organizations (CROs) in the Asia Pacific region presents a significant opportunity for the clinical trial management system (CTMS) market. As pharmaceutical and biotech firms increasingly outsource clinical trial operations to reduce costs and accelerate timelines, CROs have emerged as pivotal players in drug development ecosystems across China, India, South Korea, and Southeast Asia. In India, the Association of Clinical Research Organizations (ACRO) reported that more than 300 CROs are now actively engaged in Phase I through Phase IV studies, each requiring sophisticated CTMS tools for trial coordination, subject tracking, and regulatory submissions. China has also witnessed a surge in CRO-led research activities, driven by government incentives and streamlined approval pathways under the National Medical Products Administration.

Growing Demand for Decentralized and Virtual Clinical Trials

The increasing adoption of decentralized and virtual clinical trials presents a transformative opportunity for the Asia Pacific clinical trial management system (CTMS) market. As the industry shifts toward patient-centric models enabled by digital health technologies, there is a growing need for integrated CTMS platforms capable of managing remote data collection, telemedicine interactions, wearable device integration, and electronic consent processes. According to McKinsey & Company, the number of decentralized clinical trials launched in the Asia Pacific region increased in 2023 compared to the previous year. In Japan, where digital health adoption is well-established, leading pharmaceutical firms have partnered with tech companies to develop hybrid trial models that leverage mobile apps and home health visits to improve patient recruitment and retention.

MARKET CHALLENGES

Fragmented Regulatory Landscapes Across Asia Pacific Countries

One of the most pressing challenges facing the Asia Pacific clinical trial management system (CTMS) market is the presence of fragmented and inconsistent regulatory frameworks across different countries. Each nation within the region has its own regulatory authority—such as the Central Drugs Standard Control Organization (CDSCO) in India, the National Medical Products Administration (NMPA) in China, and the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan—each imposing unique requirements for clinical trial conduct, data submission, and electronic record-keeping.

According to the Asia-Pacific Economic Cooperation (APEC) Life Sciences Innovation Forum, the lack of harmonized Good Clinical Practice (GCP) guidelines creates significant complexities for multinational sponsors and CTMS providers attempting to deploy standardized digital solutions across multiple jurisdictions. Moreover, regulatory authorities in certain countries mandate data localization policies, restricting the transfer of clinical trial data across borders.

Shortage of Skilled Professionals and Limited Digital Literacy in Clinical Operations

Another significant challenge impeding the growth of the Asia Pacific clinical trial management system (CTMS) market is the shortage of skilled professionals and limited digital literacy among clinical research teams. Effective utilization of CTMS platforms requires expertise in data management, regulatory compliance, and software integration—competencies that are still relatively scarce in many parts of the region. In India, despite having a large workforce in the pharmaceutical sector, only a fraction of clinical monitors and site coordinators possess hands-on experience with advanced CTMS modules such as risk-based monitoring dashboards or automated trial alerts. In rural and semi-urban areas of countries like Indonesia and the Philippines, digital literacy gaps are even more pronounced.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Delivery Mode, Component, End User, Type of System, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Bioclinica, Bio-Optronics Inc., DATATRAK International Inc., ERT Clinical, IBM, Medidata Solutions Inc., MedNet Solutions, Inc., Oracle, Parexel International Corporation, and ArisGlobal |

SEGMENTAL ANALYSIS

By Delivery Mode Insights

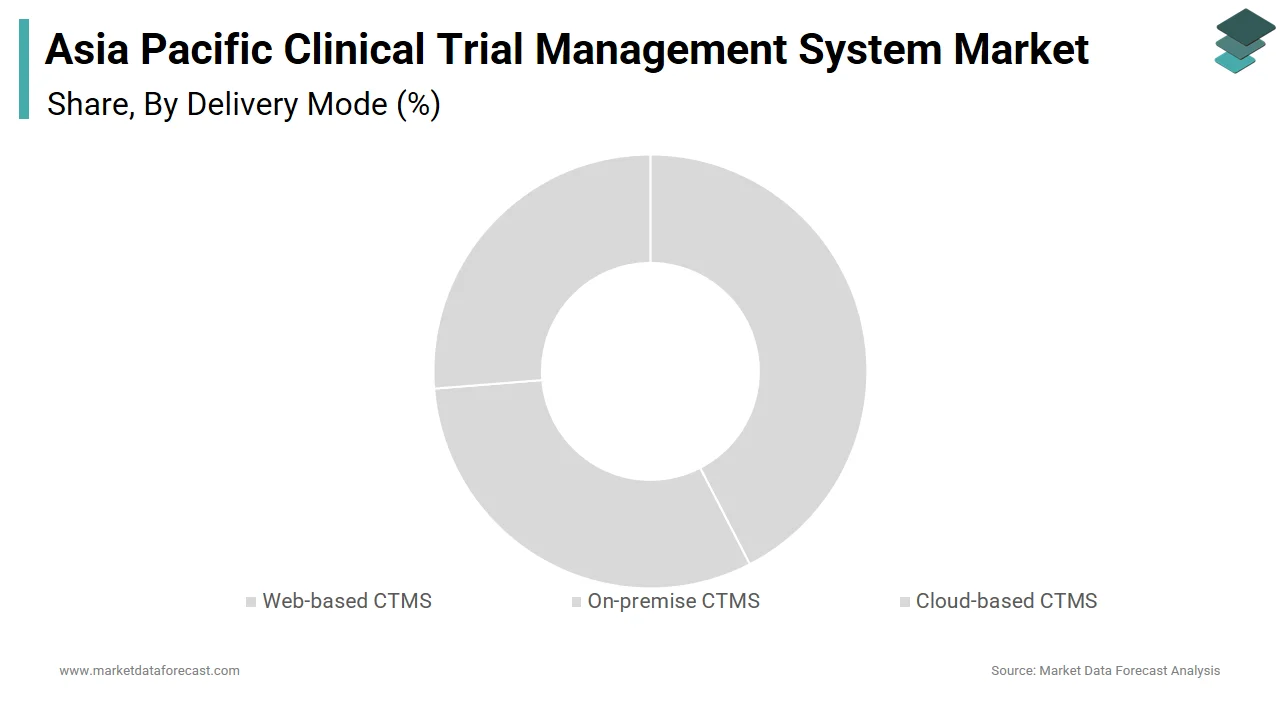

The web-based clinical trial management system (CTMS) segment held the largest share of the Asia Pacific market by accounting for a 42.3% in 2024. This dominance is primarily due to its accessibility, ease of deployment, and compatibility with multi-site clinical trials that span across different countries. In South Korea, where digital health infrastructure is highly developed, government-backed initiatives have encouraged research institutions to adopt web-enabled CTMS tools to streamline regulatory submissions and improve collaboration. Moreover, web-based systems do not require significant upfront investment in hardware or server maintenance, making them particularly attractive to small and mid-sized research organizations.

Also, the cloud-based clinical trial management systems are emerging as the fastest-growing segment in the Asia Pacific market, projected to expand at a CAGR of 15.8%. This surge is driven by the rising demand for scalable, secure, and interoperable digital platforms that support decentralized and hybrid clinical trial models. Apart from these, government policies promoting digital health transformation are accelerating adoption.

By Component Insights

The software component had the largest share of the Asia Pacific clinical trial management system (CTMS) market i.e. 58% in 2024. This is due to the core role software plays in enabling end-to-end trial coordination, including patient recruitment, protocol adherence, adverse event tracking, and regulatory reporting. India has also seen rapid software uptake, particularly among mid-sized CROs expanding their global client base. Furthermore, the proliferation of AI-enhanced analytics within CTMS software has improved predictive modeling, site selection, and risk-based monitoring capabilities.

The services segment is the fastest-growing in the Asia Pacific clinical trial management system (CTMS) market, projected to expand at a CAGR of 14.6%. This growth is attributed to the increasing demand for implementation support, training, consulting, and managed services that ensure optimal utilization of CTMS platforms. In Australia, where regulatory complexity is high, specialized CTMS consulting firms have emerged to assist sponsors in aligning their digital strategies with Therapeutic Goods Administration (TGA) requirements.

By End User Insights

The pharmaceutical sector had the largest share of the Asia Pacific clinical trial management system (CTMS) market, contributing approximately 47% in 2024. This is driven by the increasing number of drug development programs being conducted across the region, particularly in China, Japan, and South Korea, where regulatory reforms and government incentives have spurred innovation. Similarly, in Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) has introduced fast-track approval pathways for innovative therapies, necessitating streamlined CTMS usage to meet accelerated timelines. In India, major pharmaceutical companies such as Dr. Reddy’s Laboratories and Sun Pharma have invested heavily in digital trial management solutions to support both domestic and international clinical studies.

The clinical research organizations (CROs) are the swiftest expanding segment in the Asia Pacific clinical trial management system (CTMS) market, projected to expand at a CAGR of 16.3% through 2033. This is fueled by the increasing outsourcing of clinical trial operations by global pharmaceutical companies seeking cost-effective yet high-quality research environments. In India, the Association of Clinical Research Organizations (ACRO) reported that more than 300 CROs are actively engaged in Phase I through Phase IV studies, with a majority investing in modern CTMS solutions to support global clients.

By Type of System Insights

The enterprise-based clinical trial management system (CTMS) segment had the biggest share of the Asia Pacific market, accounting for a 45.8% in 2024. This is primarily due to the increasing preference for centralized, scalable solutions that support large-scale, multi-country clinical trials conducted by pharmaceutical companies and contract research organizations (CROs). In Japan, leading pharmaceutical firms like Takeda and Eisai have adopted enterprise-wide CTMS solutions to streamline trial operations across multiple therapeutic areas and geographic locations. In South Korea, where digital transformation in healthcare is advancing rapidly, major CROs such as Macrogen Clinical Laboratory and Clinigen have deployed enterprise-based CTMS to manage complex oncology and rare disease trials.

Also, licensed enterprise-based clinical trial management systems are the fastest-growing segment in the Asia Pacific market, projected to expand at a CAGR of 14.9%. This progress is caused by the increasing demand for customizable, secure, and locally adaptable CTMS solutions that balance the scalability of enterprise systems with the flexibility of licensing arrangements. In China, government regulations mandating data localization have prompted several foreign pharmaceutical companies to deploy licensed enterprise-based CTMS platforms within local data centers.

COUNTRY LEVEL ANALYSIS

China held the largest share of the Asia Pacific clinical trial management system (CTMS) market by accounting for a 28.5% in 2024. The country's growth is attributed to its aggressive investments in biopharmaceutical research, rapid expansion of domestic and international clinical trials, and supportive government policies aimed at accelerating drug approvals. Companies like WuXi AppTec, Hengrui Medicine, and CSPC Pharmaceutical Group have expanded their clinical research capabilities, integrating enterprise-based CTMS platforms to support complex multi-center studies.

Japan market is supported by its advanced biotech infrastructure, mature pharmaceutical industry, and strong academic-industry collaborations. The country has long been a leader in regenerative medicine and precision therapeutics, fostering a conducive environment for cutting-edge clinical research. Institutions like Kyoto University and Osaka University have pioneered induced pluripotent stem cell (iPSC) technologies that are now being integrated into early-phase clinical testing workflows. Government agencies such as the Pharmaceuticals and Medical Devices Agency (PMDA) have implemented fast-track approval pathways for innovative biologics, encouraging greater investment in digital trial management.

South Korea is seeing rapid growth driven by biotech clusters and is driven by its strong focus on biotech innovation and strategic investments in research infrastructure. The country has established itself as a regional leader in monoclonal antibody production and gene therapy research, supported by a cluster of world-class biopharma companies and research institutes. Companies like Samsung Biologics and Celltrion have expanded their upstream development capabilities, incorporating automated CTMS tools to improve trial efficiency and compliance.

India is an emerging powerhouse in the field. The country’s growth is primarily driven by its cost-effective R&D infrastructure, strong scientific talent pool, and increasing participation in global biopharma partnerships. Companies like Syngene, Piramal Pharma Solutions, and Biocon have expanded their digital trial management capabilities to serve international clients, particularly in oncology and metabolic disorders. Government initiatives such as the Biotechnology Industry Research Assistance Council (BIRAC) have facilitated technology transfer and incubation for early-stage biotech ventures.

Australia holds a smaller share of the Asia Pacific CTMS market and is supported by its well-developed healthcare system, strong regulatory framework, and focus on translational research. The country maintains some of the highest clinical and data governance standards in the region, ensuring safe and effective deployment of digital trial management solutions. Universities such as Monash and the University of Melbourne are actively engaged in digital health research, providing a strong foundation for future applications in decentralized and virtual trial models. This strategic positioning reinforces Australia’s role as a key contributor to the regional market.

KEY MARKET PLAYERS

Companies like Bioclinica, Bio-Optronics Inc., DATATRAK International Inc., ERT Clinical, IBM, Medidata Solutions Inc., MedNet Solutions, Inc., Oracle, Parexel International Corporation, and ArisGlobal are playing a leading role in the Asia Pacific CTMS market.

TOP LEADING PLAYERS IN THE MARKET

Oracle Health Sciences (Medidata Solutions)

Oracle, through its acquisition of Medidata Solutions, plays a leading role in the global and regional clinical trial management system (CTMS) market. In the Asia Pacific region, Oracle offers integrated digital platforms that support end-to-end clinical trial operations—from protocol design to regulatory submission. The company's presence is strengthened by its cloud-based solutions that facilitate collaboration between sponsors, CROs, and research sites across multiple countries. Oracle continues to invest in AI-driven analytics and interoperability features tailored for the evolving needs of clinical research stakeholders in the region.

Veeva Systems Inc.

Veeva has emerged as a key player in the Asia Pacific CTMS landscape by offering scalable, cloud-native solutions tailored for life sciences companies. Its Vault CTMS platform provides modular capabilities that streamline trial planning, execution, and compliance with global standards. In the Asia Pacific, Veeva has focused on expanding its customer base among mid-sized pharmaceutical firms and CROs seeking agile and user-friendly systems. The company’s commitment to continuous innovation and integration with other clinical data ecosystems positions it as a strong competitor in the rapidly growing digital clinical trial environment.

Parexel International Corporation

Parexel is a prominent global contract research organization with a strong footprint in the Asia Pacific clinical trial management system market. The company provides proprietary CTMS tools alongside full-service clinical development offerings. Parexel supports pharmaceutical and biotech clients in managing complex trials with real-time monitoring, risk-based quality management, and centralized reporting. With deep expertise in regulatory landscapes across the region, Parexel enhances local adoption of advanced CTMS platforms, particularly in Japan, South Korea, and India, where clinical research activity is expanding rapidly.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by leading players in the Asia Pacific clinical trial management system (CTMS) market is technology innovation and platform modernization , where companies continuously develop cloud-native, AI-integrated, and interoperable solutions to enhance trial efficiency and compliance. Another crucial approach is strategic partnerships and collaborations , wherein vendors work closely with academic institutions, CROs, and regulatory bodies to align product development with regional clinical trial workflows. Lastly, market localization and customer support expansion is a key tactic, with firms investing in on-the-ground technical teams, multilingual interfaces, and training programs to meet the specific needs of diverse healthcare ecosystems across the Asia Pacific.

COMPETITION OVERVIEW

The competition in the Asia Pacific clinical trial management system (CTMS) market is marked by a dynamic mix of global technology leaders and emerging regional players striving to capture a larger share of a fast-evolving industry. Established multinational corporations dominate due to their comprehensive software portfolios, deep R&D capabilities, and well-established distribution networks. These companies are investing heavily in next-generation technologies such as artificial intelligence, machine learning, and decentralized trial support tools to maintain technological superiority and accelerate client project timelines. At the same time, domestic firms are gaining momentum by offering cost-effective solutions, localized deployment models, and agile service delivery tailored to the unique requirements of biopharma developers in the region. As the demand for digital transformation in clinical research grows—fueled by increasing outsourcing trends, regulatory reforms, and the rise of virtual trials—the intensity of competition is rising not only in terms of pricing but also in innovation, scalability, and strategic positioning. Additionally, shifting regulatory expectations and increasing collaboration between academia and industry further shape the competitive environment, requiring all participants to adapt quickly to sustain growth and relevance.

RECENT MARKET DEVELOPMENTS

- In January 2023, Oracle Health Sciences launched a dedicated clinical trial innovation center in Singapore aimed at accelerating the adoption of AI-powered CTMS tools and enhancing support for regional pharmaceutical and biotech firms.

- In August 2023, Veeva Systems expanded its regional office in Tokyo, introducing localized implementation specialists to improve customer engagement and support for Japanese pharmaceutical companies adopting Vault CTMS.

- In March 2024, Parexel International entered into a strategic partnership with a leading Indian CRO to co-develop customized CTMS modules tailored for biosimilar and oncology-focused clinical trials.

- In October 2023, IQVIA launched a new digital trial enablement program in Australia, integrating its CTMS with wearable device data and remote patient monitoring tools to support decentralized clinical studies.

- In May 2024, Wipro GE Healthcare announced the launch of an AI-enhanced clinical trial analytics suite designed specifically for Southeast Asian markets, improving site performance tracking and risk-based monitoring capabilities.

MARKET SEGMENTATION

This Asia Pacific clinical trial management system market research report is segmented and sub-segmented into the following categories.

By Delivery Mode

- Web-based CTMS

- On-premise CTMS

- Cloud-based CTMS

By Component

- Software

- Hardware

- Services

By End User

- Pharmaceuticals

- Clinical Research Organization (CRO)

- Other End Users

By Type of System

- Site-based Licensed

- Enterprise-based

- Licensed Enterprise-based

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What factors are driving the Asia Pacific CTMS market?

The Asia Pacific CTMS market is driven by a rising number of clinical trials, government support, increased R&D in pharma and biotech, and growing demand for efficient trial data management.

2. What challenges does the Asia Pacific CTMS market face?

The Asia Pacific CTMS market faces challenges like high installation and maintenance costs, need for advanced infrastructure, and difficulties in managing frequent data and regulatory changes.

3. What opportunities exist in the Asia Pacific CTMS market?

Opportunities in the Asia Pacific CTMS market include technological advancements, IT-pharma collaborations, digital transformation, and expanding clinical research in India, China, and Australia.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com