Global Clinical Trials Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report By Phase (Phase I Trials, Phase II Trials and Phase III Trials), Design (Interventional Trials, Observational Trials and Expanded Access Trials), Indication & Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis from 2024 to 2033

Global Clinical Trials Market Size

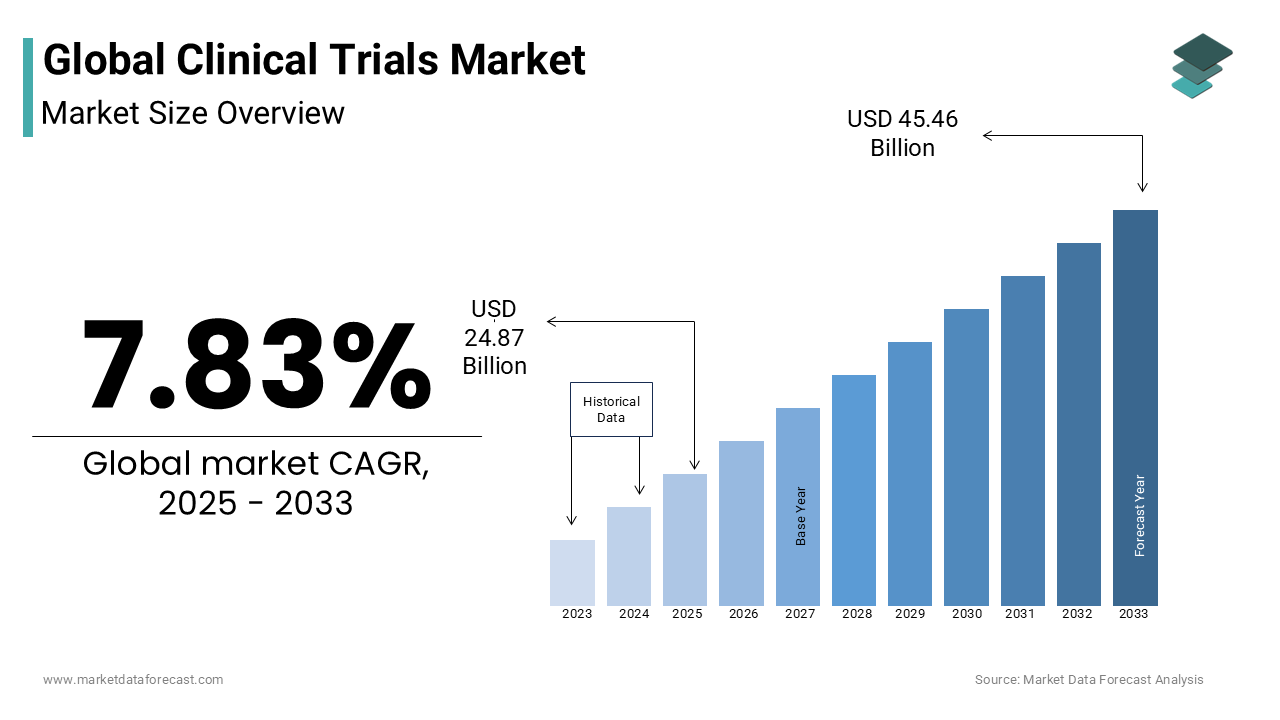

As per our report, the global clinical trials market size will grow to USD 45.46 billion by 2033 from USD 24.87 billion in 2025 and it is expected to witness a CAGR of 7.83% during the forecast period from 2025 to 2033. The global clinical trials market was valued at USD 23.06 billion in 2024.

Clinical trials are rigorously structured research studies conducted on human participants to evaluate the safety, efficacy, and potential side effects of medical interventions such as new drugs, therapies, and medical devices. These trials serve as the backbone of modern medicine, guiding regulatory approvals and shaping clinical guidelines. According to the National Institutes of Health (NIH), clinical trials involve the prospective assignment of participants to specific interventions to assess their impact on biomedical and health-related outcomes. This process ensures that only scientifically validated treatments reach the market by enhancing patient safety and therapeutic advancements. A Financial Times analysis revealed that Europe’s share in global commercial drug trials fell from 22% in 2013 to 12% in 2023, whereas China’s increased to 18%. This trend highlights the growing preference for streamlined regulatory processes in regions like the U.S. and China.

MARKET DRIVERS

Increased Pharmaceutical Research and Development (R&D) Expenditure

The clinical trials market is significantly propelled by heightened investments in pharmaceutical R&D. The Congressional Budget Office reports that inflation-adjusted R&D spending by pharmaceutical companies surged from $38 billion in 2000 to $83 billion in 2018, reflecting a robust commitment to developing innovative therapies. This substantial financial dedication underscores the industry's focus on discovering novel treatments, thereby necessitating extensive clinical trials to assess safety and efficacy. Consequently, the surge in R&D expenditure directly fuels the demand for clinical trials by facilitating the introduction of new medical interventions to the market.

Advancements in Real-World Evidence (RWE) Utilization

The integration of Real-World Evidence into clinical research has emerged as a pivotal driver in the clinical trials market. This growth is propelled by favorable government regulations and a shift towards value-based care. The adoption of RWE enhances the design and execution of clinical trials by providing insights from real-world patient data, thereby improving trial efficiency and supporting regulatory decision-making. This trend underscores the increasing reliance on comprehensive data to inform clinical research and healthcare strategies. Government agencies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have endorsed RWE integration to enhance drug approval processes and post-market surveillance. The FDA's 21st Century Cures Act encourages the use of RWE to support regulatory decisions, reinforcing its role in clinical trials.

MARKET RESTRAINTS

High Failure Rates in Clinical Drug Development

The clinical trials market faces significant challenges due to the high attrition rates in drug development. Despite rigorous preclinical testing, approximately 90% of clinical drug development fails, as highlighted in a study published in the National Center for Biotechnology Information. This high failure rate underscores the inherent difficulties in translating laboratory findings into safe and effective therapies for humans. The substantial investment of time and resources into trials that do not yield marketable products poses a considerable financial risk for pharmaceutical companies by potentially deterring investment in innovative treatments.

Challenges in Patient Recruitment and Retention

Recruiting and retaining participants for clinical trials remain formidable obstacles. The National Institutes of Health (NIH) reports that over 80% of clinical trials in the United States fail to meet their enrollment timelines, which leads to delays and increased costs. Factors contributing to this issue include stringent eligibility criteria, patient concerns about safety and logistical challenges such as travel requirements. These recruitment difficulties can compromise the statistical power of studies, which can limit the generalizability of findings and ultimately hinder the timely development of new medical interventions.

MARKET OPPORTUNITIES

Adoption of Decentralized Clinical Trials (DCTs)

The increasing implementation of Decentralized Clinical Trials (DCTs) presents a significant opportunity in the clinical trials market. DCTs utilize digital health technologies to conduct trials remotely, enhancing patient accessibility and engagement. The U.S. Food and Drug Administration (FDA) has recognized the potential of DCTs to improve trial efficiency and participant diversity. A report by the National Center for Biotechnology Information (NCBI) indicates that DCTs can reduce trial timelines by up to 30%, leading to substantial cost savings. The COVID-19 pandemic has further accelerated the adoption of DCTs, with a notable increase in their implementation to overcome traditional trial limitations.

Expansion into Emerging Markets

The clinical trials market is experiencing growth through expansion into emerging economies. A study published in the National Center for Biotechnology Information (NCBI) highlights that the average annual growth rate of clinical trials from 2005 to 2012 was 30% in Asia and 12% in Latin America and the Caribbean. This trend is driven by factors such as lower operational costs, diverse patient populations, and supportive regulatory environments in these regions. The globalization of clinical research into these emerging markets offers opportunities for cost-effective trials and access to a broader participant base.

MARKET CHALLENGES

Regulatory Complexity and Variability

The clinical trials market faces significant challenges due to complex and variable regulatory frameworks across different countries. Conducting multi-country clinical trials often involves navigating diverse regulatory requirements, which can lead to delays and increased costs. A paper published by the National Center for Biotechnology Information (NCBI) discusses the regulatory challenges associated with conducting multi-country clinical trials in resource-limited settings by highlighting issues such as varying ethical standards and approval processes. These complexities can deter sponsors from engaging in international trials, limiting the global applicability of research findings.

Economic Constraints in Clinical Research

Financial challenges significantly impact the clinical trials market, particularly in resource-limited settings. A discussion paper from the National Center for Biotechnology Information (NCBI) highlights that the economic crisis in clinical research is driven by the inability to transform the business model for research as core informatics technology evolves. This financial strain can lead to reduced funding for trials, limiting the scope and scale of research initiatives. Additionally, economic constraints can affect the ability to attract and retain skilled researchers, further hindering the progress of clinical trials.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Phase, Design, Indication, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Challenges, Opportunities, Restraints; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

Chiltern, Omnicare, PPD, Parexel, Kendle International Inc., Quintiles, ICON Plc, and Charles River. |

SEGMENTAL ANALYSIS

By Phase Insights

The Phase III trials dominated the market by holding 53.13% of global market share in 2024. The domination of phase III trials segment is attributed to the comprehensive nature of Phase III trials, which involve extensive participant groups to confirm efficacy, monitor side effects, and compare the intervention to standard treatments. The substantial scale and complexity of these trials necessitate significant investment, with median costs exceeding $19 million per study. Additionally, about 35% of Phase III trials are outsourced, a figure expected to rise as more investigational drugs progress to advanced stages. These factors underscore the critical role of Phase III trials in validating new treatments before regulatory approval.

On the other hand, the phase II trials segment is projected to experience considerable growth in the coming years. These trials focus on evaluating the efficacy and optimal dosing of interventions in patient populations by serving as a pivotal step before large-scale Phase III trials. The U.S. Food and Drug Administration (FDA) estimates that approximately 33% of investigational drugs are in Phase II trials by highlighting the substantial activity within this segment. The increasing emphasis on personalized medicine and targeted therapies contributes to the expansion of Phase II trials, as researchers aim to identify specific patient groups that may benefit from novel treatments. This trend reflects a strategic shift towards more efficient and effective drug development processes.

By Design Insights

The interventional trials segment led the market by accounting for 77.8% of the global market share in 2024 due to their structured methodology, where participants receive specific interventions to assess health outcomes. These trials involve assigning participants to specific interventions to evaluate health outcomes, which serves as the primary method for determining the efficacy and safety of new treatments. Their structured design and controlled settings yield robust data essential for regulatory approvals and clinical decision-making. The National Institute on Aging emphasizes that such trials are the main avenue for assessing new medical interventions' safety and effectiveness in humans.

On the other hand, the expanded access trials segment is projected to experience significant growth by registering a CAGR of 5.7% during the forecast period owing to the rising demand for investigational therapies among patients with serious or life-threatening conditions lacking alternative treatments. Regulatory frameworks, such as those established by the U.S. Food and Drug Administration (FDA), facilitate expanded access, reflecting a commitment to providing early access to promising therapies. The growing awareness and implementation of these programs highlight their importance in addressing unmet medical needs and enhancing patient care.

By Indication Insights

The oncology segment held the dominant position in the global market by capturing 26.4% of the global market share in 2024. According to the World Health Organization (WHO), cancer is a leading cause of death worldwide, accounting for nearly 10 million deaths in 2020. This significant burden has led to substantial investments in oncology research, resulting in a large number of clinical trials focused on developing new cancer therapies. The complexity and diversity of cancer types necessitate extensive clinical research, contributing to the prominence of the oncology segment in the clinical trials market.

The cardiovascular (CVS) segment is anticipated to experience the fastest growth in the global clinical trials market during the forecast period. The increasing prevalence of cardiovascular diseases, which are the leading cause of death globally, has intensified the need for innovative treatments. According to the World Health Organization, cardiovascular diseases account for an estimated 17.9 million deaths per year. This escalating health concern has spurred a surge in clinical trials aimed at developing novel cardiovascular therapies. Advancements in medical technology and a deeper understanding of cardiovascular pathophysiology are further propelling research in this area are leading to a higher CAGR for cardiovascular-related clinical trials compared to other indications.

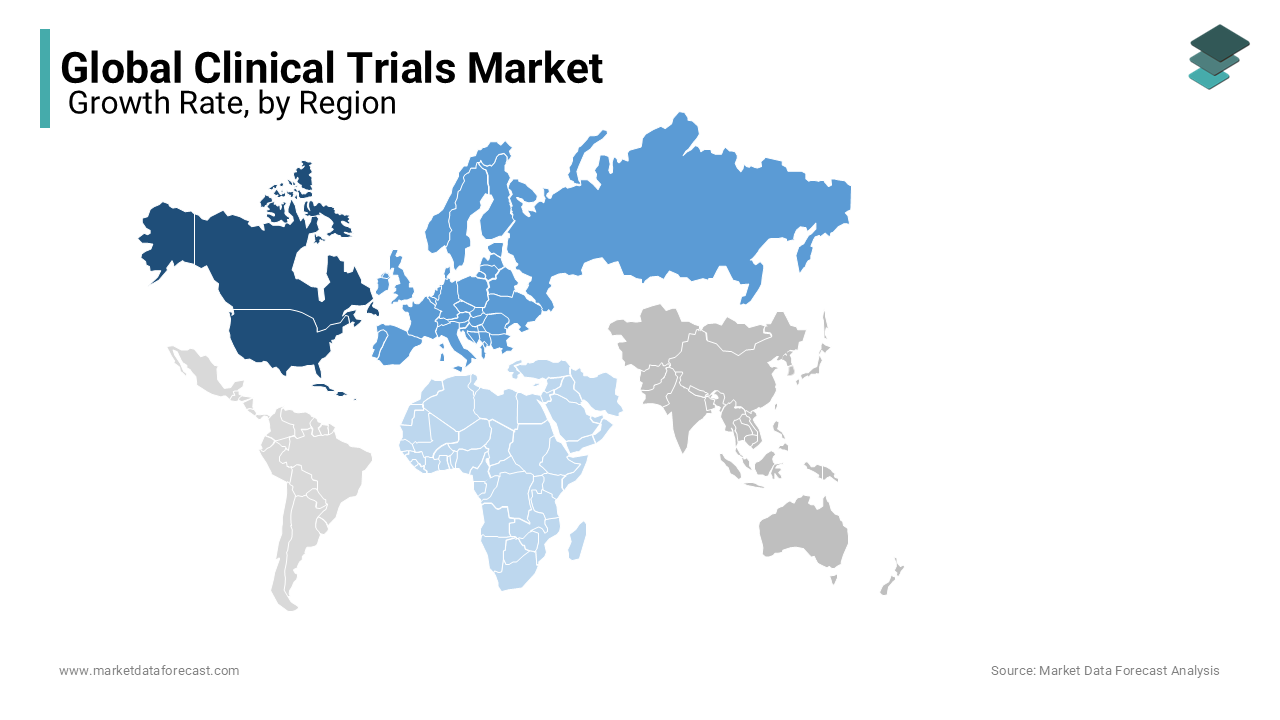

REGIONAL ANALYSIS

North America dominated the clinical trials market and captured 27% of the global market share in 2024. The United States dominates due to its advanced healthcare infrastructure, large pharmaceutical sector and the Food and Drug Administration (FDA)'s streamlined regulatory framework. In 2023, the U.S. alone conducted over 40% of all industry-sponsored clinical trials with its global leadership. The region benefits from high R&D spending with the National Institutes of Health (NIH) investing over $45 billion annually in medical research. These factors collectively make North America the largest and most established hub for clinical trials worldwide.

Asia-Pacific is the fastest-growing region in the global clinical trials market during the forecast period due to lower operational costs, a vast patient population, and improved regulatory policies. China and Japan are at the forefront, with China surpassing the U.S. in new clinical trial registrations in 2022. The World Health Organization (WHO) reports that the Western Pacific region registered 23,250 trials in 2023 by indicating a surge in research activity.

Europe clinical drug trials market is deemed to have the significant growth opportunities in the next foreseen years. Germany and the UK are leading clinical trial locations, but the European Medicines Agency (EMA) is working on regulatory reforms to attract more studies. Despite the decline, Europe is expected to maintain steady trial activity in niche therapeutic areas such as rare diseases and gene therapies.

Latin America's clinical trials market is expanding due to a diverse genetic pool, lower costs, and increasing regulatory harmonization with global standards. Brazil and Mexico are the top destinations, with Brazil conducting 43% of the region’s total trials in 2023. Clinical research in Latin America is projected to grow at a CAGR of 6.5% from 2025 to 2033 which is ascribed to grow by government investments in healthcare and an increasing burden of chronic diseases.

The Middle East and Africa (MEA) region currently holds a small but growing share of the clinical trials market. Countries like Saudi Arabia, the UAE, and South Africa are leading, with Saudi Arabia launching initiatives to become a regional hub for pharmaceutical research. The market is expected to expand as regulatory frameworks improve and multinational pharmaceutical companies invest in local trials. The region’s growth is driven by an increasing prevalence of infectious diseases, cancer, and cardiovascular conditions by necessitating more diverse clinical research.

KEY MARKET PLAYERS

Chiltern, Omnicare, PPD, Parexel, Kendle International Inc., Quintiles, ICON Plc, and Charles River are some noteworthy companies that dominate the global clinical trials market.

The global clinical trials market is highly competitive, driven by the increasing demand for innovative drugs, biologics, and medical devices. The market is dominated by contract research organizations (CROs), pharmaceutical companies, and biotechnology firms that compete based on service offerings, technological capabilities, global reach, and regulatory expertise. Key players such as Parexel, ICON Plc, and Charles River Laboratories maintain their competitive advantage through strategic acquisitions, collaborations, and investments in advanced technologies like artificial intelligence (AI) and machine learning (ML).

The rising complexity of clinical trials, coupled with stringent regulatory requirements, has led to intense competition among CROs to offer cost-effective and efficient trial management solutions. Companies are also focusing on decentralizing clinical trials, enhancing patient recruitment strategies, and leveraging real-world data to streamline operations.

Emerging markets, particularly in Asia-Pacific, have become hotspots for clinical trials due to lower operational costs and a diverse patient population, intensifying competition among global and regional players. Additionally, mergers and acquisitions play a crucial role in market consolidation, with major firms acquiring smaller CROs to expand their service portfolios.

Top 3 Players in the market

Parexel is a leading CRO offering a comprehensive range of services, including clinical trial management, data management, medical writing, biostatistics, pharmacovigilance, and regulatory consulting. With a presence in over 51 countries and more than 18,900 employees, Parexel has been instrumental in the development of approximately 95% of the top 200 best-selling biopharmaceuticals. The company's global reach and extensive service offerings make it a key player in the clinical trials market.

ICON Plc is another major CRO that provides outsourced development and commercialization services to the pharmaceutical, biotechnology, and medical device industries. The company specializes in the strategic development, management, and analysis of programs that support clinical development. ICON's global presence and expertise in clinical trial management contribute significantly to the acceleration of drug development processes worldwide.

Charles River Laboratories offers essential products and services to assist pharmaceutical and biotechnology companies, government agencies, and leading academic institutions around the globe. Their services span each phase of the drug development pipeline, including preclinical and clinical laboratory services for the pharmaceutical, medical device, and biotechnology industries. Charles River's comprehensive support in early-stage research and clinical trials is vital for the efficient development of new therapies.

Top strategies used by the key market participants

Strategic Partnerships and Collaborations

Collaborating with other organizations allows companies to expand their market reach, share resources, and accelerate innovation. For instance, partnerships between pharmaceutical firms and academic institutions can lead to breakthroughs in drug development by combining research expertise with practical application. Such alliances enhance brand visibility and credibility, facilitating access to new markets and customer bases.

Data-Driven Approaches

Implementing data-driven strategies enables companies to optimize various aspects of clinical trials, including patient recruitment, site selection, and monitoring. By analyzing electronic health records (EHRs) and other health data, organizations can identify suitable patient populations more efficiently, reducing trial durations and costs. This approach leads to better decision-making and improved trial outcomes.

Leveraging Artificial Intelligence and Machine Learning

Integrating AI and ML into clinical trial processes allows for the analysis of large datasets to identify patterns and predict outcomes. These technologies can streamline drug discovery, personalize treatment plans, and enhance patient stratification. For example, companies like CSL are utilizing AI to tackle serious diseases by developing more personalized treatments and accelerating drug development.

RECENT HAPPENINGS IN THE MARKET

- In August 2023, Parexel and Partex entered a strategic partnership to utilize Artificial Intelligence (AI) driven solutions in drug discovery and development for biopharmaceutical clients worldwide. The collaboration aimed to reduce risks associated with the assets in their respective portfolios.

- In August 2023, Novo Nordisk announced the acquisition of Inversago Pharma. This acquisition was part of Novo Nordisk’s strategic efforts to develop new therapies targeting individuals with obesity, diabetes, and other significant metabolic diseases.

- In December 2023, Thermo Fisher Scientific Inc. introduced CorEvidence, a cloud-based optimization of pharmacovigilance case processing and safety data management processes.

- In April 2022, Charles River Laboratories International Inc. disclosed its acquisition of Explora BioLabs Holdings, Inc., a leading provider of contract vivarium research services.

- The National Institute of Allergy and Infectious Diseases (NIAID), a division of the National Institutes of Health (NIH) of the United States, started an early-stage clinical trial in July 2022 to investigate an investigational vaccine to stave off Nipah virus infection.

- In May 2022, the International AIDS Vaccine Initiative and Moderna Inc. started a Phase I clinical trial of an mRNA vaccine antigen in South Africa.

MARKET SEGMENTATION

This research report on the global clinical trials market has been segmented based on phase, design, indication, and region.

By Phase

- Phase I Trials

- Phase II Trials

- Phase III Trials

By Design

- Interventional Trials

- Observational Trials

- Expanded Access Trials

By Indication

- Autoimmune

- Blood disorders

- Cancer

- Circulatory

- CNS

- Congenital

- CVS

- Dermatology

- Ear

- Gastrointestinal

- Genitourinary

- Infections

- Mental disorders

- Metabolic

- Musculoskeletal

- Nose

- Ophthalmology

By Region

- North America

- U.S

- Canada

- Europe

- U.K

- Germany

- France

- Spain

- Italy

- Asia Pacific

- India

- Japan

- China

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East & Africa

- Middle East

- Africa

Frequently Asked Questions

What is the expected market size of the clinical trials market worldwide?

The global clinical trials market size is expected to reach USD 45.46 billion by 2033.

what is the compound annual growth rate (%) of the global clinical trials market during the forecast period?

The clinical trials market size is forecasted to grow at a CAGR of 7.83% from 2025 to 2033.

Which region holds the biggest market share of the clinical trials?

North America region holds the biggest share of the global clinical trials market.

Who are the leading players in the clinical trials market?

Chiltern, Omnicare, PPD, Parexel, Kendle International Inc, Quintiles, ICON Plc, and Charles River are the companies that plays a crucial role in the global clinical trials market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]