Global CDMO Market Size, Share, Trends & Growth Forecast Report By Service (CMO and CRO) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global CDMO Market Size

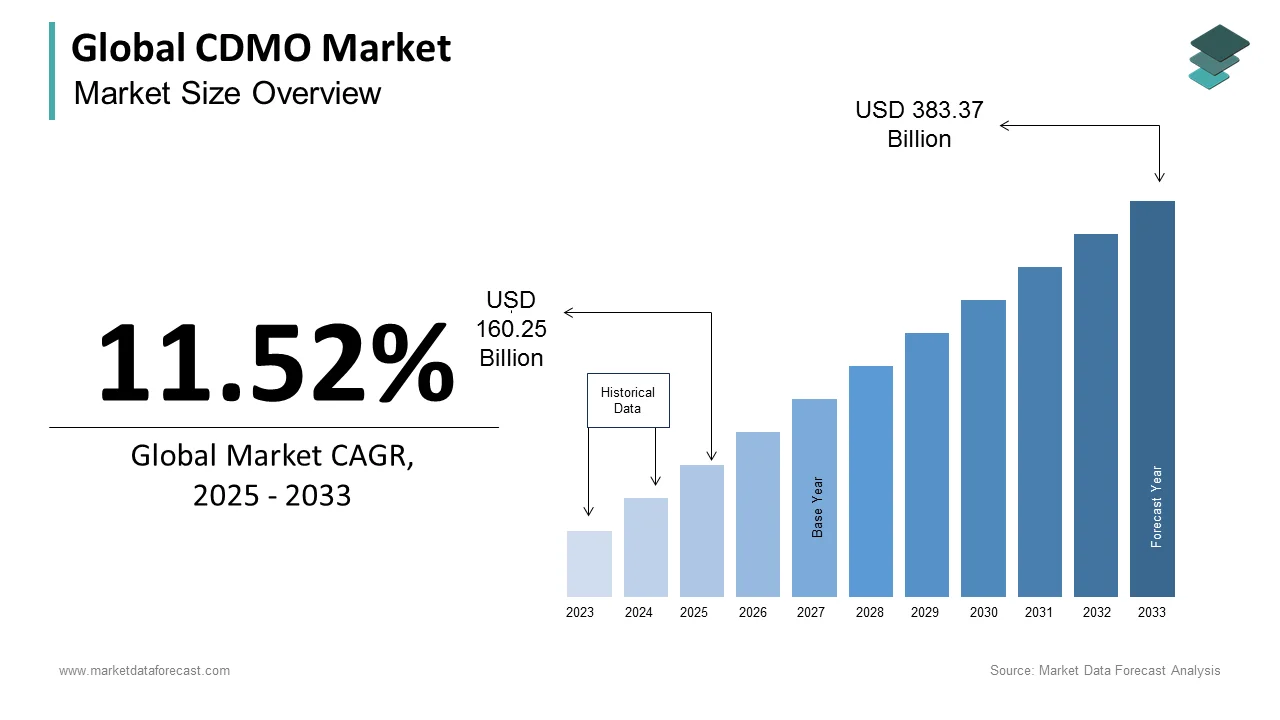

The size of the global CDMO market was worth USD 143.70 billion in 2024. The global market is anticipated to grow at a CAGR of 11.52% from 2025 to 2033 and be worth USD 383.37 billion by 2033 from USD 160.25 billion in 2025.

The complexity of the manufacturing process, the requirements, and the lack of in-house drug manufacturing capabilities of many pharmaceutical companies are pushing them towards CDMOs. Additionally, CDMOs ensure all the manufacturing process steps from formulation, analytic services, bending, coating, converting, packaging, serialization, and shipment. Every step of the process is taken care of by the company. The CDMOs allow for faster FDA approvals, clinical trials, API production, and commercial maximizations. Furthermore, the continuous mergers and acquisitions of the CDMOs with small pharma and biotech companies and firms, along with life-science companies to increase their reach and regional expansion, are leading the market to grow. In addition, the increase in investments, research, and developments in the field leads to market growth. For instance, cordenpharma announced the strategic acquisition of €3.7 million in October 2017.

MARKET DRIVERS

The growing patient population with chronic diseases and the rising need for pharmaceuticals are expected to drive CDMO market growth.

Due to the growing population and the increasingly sedentary lifestyle, there is a rise in the number of chronic diseases around the world. In addition, the ever-increasing geriatric population worldwide is increasing the need for better pharmaceutical needs, and the simplification of the drug manufacturing process by the CDMOs is boosting the market for these companies. The demand for biologics and rising non-communicable diseases are propelling the market growth.

In addition, the expansion of the pharmaceutical industry in emerging markets, growing R&D spending by pharmaceutical companies, shorter drug development timelines, rising need for flexible manufacturing capabilities and reduction in overall development and manufacturing costs contribute to the CDMO market growth. Technological advancements in pharmaceutical manufacturing, rising emphasis on personalized medicine, growing demand for innovative drug delivery systems, an increasing number of partnerships and collaborations between CDMOs and pharmaceutical companies and stringent regulatory requirements for drug approval support the growth of the CDMO market.

Furthermore, the rising focus on quality and safety standards, an increasing number of small and mid-sized pharmaceutical companies, growing demand for gene and cell therapy and growing outsourcing of clinical trials favor the growth rate of the CDMO market.

MARKET RESTRAINTS

The market is expected to be hindered by small-scale CDMOs that lack the state-of-art equipment needed to provide quality drug manufacturing services along with the stringent regulations of the drug, small molecules, and biologics approvals by the government, especially in developing economies, and the pricing challenges that small scale companies may face. Limited funding is another key roadblock to the growth rate of the CDMO market. Furthermore, the scarcity of skilled workforce and competition from low-cost countries such as India and China inhibit the growth rate of the CDMO market.

MARKET OPPORTUNITIES

The rising prominence of launching various pharmaceutical products that meet quality standards according to government regulations is posing new opportunities for the CDMO market. The well-versed strategies to develop a vaccine or drug are highly important to meet the appropriate standards of safety and quality that can be easily fulfilled with the help of these organizations. The companies can develop the process with the already existing facilities, which eventually reduces the total time taken to develop a new drug. From drug development to drug manufacturing, a CDMO can provide comprehensive services for the pharmaceutical industry, which greatly influences the growth rate of the CDMO market.

The demand to launch innovative drugs in very little time to fight against various pandemic-like situations with huge support from the government will eventually enhance the growth opportunities for the CDMO market. The emergence of COVID-19 has taught me what the threats look like. World Health Organization scrutinized various factors that can help fight these toughest situations, which are believed to positively impact the development or launch of innovative drugs that can save the lives of many people. The periodic updates from the WHO to promote the safety of the people through valid healthcare services are attributed to leveraging the growth rate of the market.

In 2024, WHO announced its plan to design and help decision-makers through telemedicine services, which are accurate and can reach out to many customers at critical points. European countries are majorly stepping towards innovative solutions in reshaping healthcare solutions with cost-effective and making treatment services available even in remote areas through telemedicine. Digitalization in the healthcare industry is certainly bringing new opportunities for the CDMO market.

MARKET CHALLENGES

Disruptions in the supply chain and a shortage of professional workers can lead to a slow production rate, which may impede the scale of the project’s expectations. The high importance of selecting the right CDMO partner for proper process and development is degrading the growth rate of the market. The selection of the wrong CDMO can cause serious regulatory complications for the government authorities, where the total investment may go in vain. In addition, the rising concern over data breaches and insecurity over an organization's confidential information may also act as challenging attributes for the market to grow. Penetration of various organizations without proper expertise valuations in many countries brings a negative impact on healthcare services, and this can hinder the growth rate of the CDMO market. Also, the rising cost of treatment procedures that are not affordable by the common people can also be a factor that challenges the market key players to bring out new strategies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Service and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Metrics, AMRI, Famar, WuXi AppTech, Asymchem, Porton, Lonza, Catalent, Patheon, Siegfried, Recipharm, Strides Shasun, and Piramal, and Others. |

SEGMENTAL ANALYSIS

By Service Insights

The active pharmaceutical manufacturing services segment accounted for the largest share of the global CDMO market in 2023 and is anticipated to record a significant share during the forecast period. The increasing number of biological APIs in the pipeline stage and expanding usage of API biologics in various medicines are boosting segment growth.

The production of solid dosage forms, injectables, and other items falls under the finished product manufacturing segment's further classification. After API manufacturing, the finished products segment had the second-largest share. Due to the rising demand for injectables and preference for injectable delivery systems like prefilled syringes and autoinjectors for administering biologics and biosimilars, the injectables segment in the finished product manufacturing segment is predicted to experience significant growth during the forecast period.

Discovery, preclinical, clinical, and laboratory services comprise the clinical research organization (CRO) category. The CRO segment is expected to be dominated by clinical trial services throughout the forecast period. The increased demand for efficient treatments and the growing number of goods under development are related to this. The need for clinical trial services is also projected to increase due to rising R&D spending and expanding cooperation among top pharmaceutical companies to outsource clinical trials, which will further boost the growth of the CDMO market. During the forecast period, a moderate increase in the packaging segment is anticipated.

REGIONAL ANALYSIS

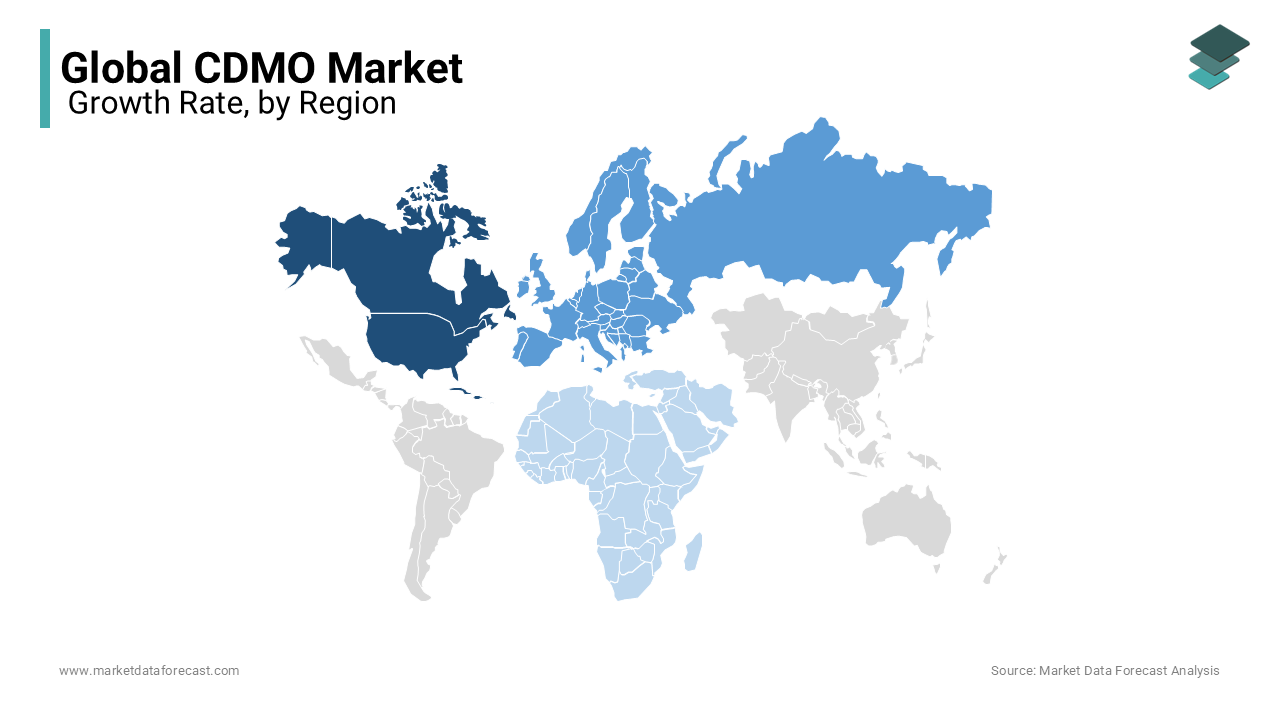

Geographically, North America accounted for the largest share of the global CDMO market in 2024 and is anticipated to continue leading worldwide throughout the forecast period.

The advanced healthcare sector availability, long-standing CDMO, and favorable reimbursement policies are boosting market growth. In addition, expanding partnerships between pharmaceutical firms and CDMOs providing a wide range of services are to blame for the region's leading market share globally. The largest drug market in the world, with over half of all R&D spending in the biotechnology and pharmaceutical industries, is the United States. As a result, CMOs is a crucial player in this industry and has invested in new infrastructure and technology to support a variety of outsourcing units. The U.S. led the CDMO market in North America in 2022 and is anticipated to continue to dominate throughout the forecast period. Factors such as the growing demand for advanced pharmaceutical products and therapies due to the rising prevalence of chronic diseases and an aging population majorly propel the U.S. market growth. In addition, the growth of the U.S. market is also driven by factors such as the increasing preference from the pharmaceutical and biopharmaceutical companies to use CDMO services due to the benefits associated such as cost reduction and increased efficiency of drug development, rising number of strategic partnerships between CDMOs and pharmaceutical companies, advancements in technology and manufacturing processes and rising focus on R&D activities by pharmaceutical companies. Canada is another lucrative regional market in North America for CDMO services and is predicted to register a healthy CAGR during the forecast period.

Europe accounted for a substantial share of the worldwide market in 2023 and is expected to grow at a notable CAGR during the forecast period. Factors include the growing demand for outsourcing services in the pharmaceutical industry, rising emphasis on R&D activities by biopharmaceutical companies, favorable government initiatives and policies promoting the growth of CDMOs by the European countries and growing investments in the biopharmaceutical industry majorly propel the growth of the European CDMO market. Technological advancements and innovations in the biopharmaceutical industry, the growing prevalence of chronic diseases and the rising demand for personalized medicine further contribute to the growth rate of the European market. The growing number of contract manufacturing agreements and partnerships and the rising trend of Mergers and Acquisitions in the CDMO industry are anticipated to have a favorable impact on the growth of the European market during the forecast period. Switzerland, Germany and the UK accounted for the major share of the European market in 2022. Countries such as Ireland and Denmark are anticipated to account for a considerable share of the European market during the forecast period owing to the favorable regulatory environment, availability of skilled workforce and favorable initiatives by the governments.

The Asia Pacific is anticipated to grow at a higher CAGR during the forecast period. The regional market growth is driven owing to the improving healthcare sector and supportive government policies. On the other hand, the low manufacturing and R&D costs and highly qualified workforces strengthen the regional market growth. As a result, the firms are turning to research-based partnerships to grow drug discovery and manufacturing investments in Asia, in addition to utilizing the advantages of a site in Asia through internal investment. For example, one of China's fastest-growing pharmaceutical companies is Huapont, a professional maker of dermatology and anti-tuberculosis medications that relies primarily on R&D and market expansion. Due to their R&D and complicated manufacturing skills, CROs/CMOs can use their knowledge to meet the needs of big generic pharmaceutical and biotech firms.

Latin America captured a considerable share of the global CDMO market in 2023 and is estimated to grow at a steady CAGR during the forecast period. The growing investments from global pharmaceutical companies in the Latin American region due to lower labor and operational costs compared to other regions is one of the major factors driving the Latin American market growth. Rising demand for contract manufacturing services from local biotech and pharmaceutical companies in the Latin American region, the presence of favorable government initiatives and policies that promote the growth of the pharmaceutical and biotech industries in the Latin America region and increasing demand for generic drugs due to the increasing prevalence of chronic diseases further boost the growth rate of the Latin American market. Among the various countries of Latin America, Mexico is anticipated to lead the market during the forecast period. Factors such as the presence of a well-established pharmaceutical industry, increasing R&D investments, government initiatives to promote the growth of the pharmaceutical sector and a large pool of skilled workforce majorly drive the Mexican market. On the other hand, Brazil, Argentina, Colombia and Chile are expected to register healthy growth during the forecast period.

MEA occupied a moderate share of the global market in 2023 and is expected to register a healthy CAGR in the coming years.

KEY MARKET PLAYERS

Metrics, AMRI, Famar, WuXi AppTech, Asymchem, Porton, Lonza, Catalent, Patheon, Siegfried, Recipharm, Strides Shasun, and Piramal are a few of the notable players in the global CDMO market.

RECENT HAPPENINGS IN THIS MARKET

- In 2024, Farmar, a Pharmaceutical contract development and manufacturing organization (CDMO) was acquired by MidEuropa from Metric Capital Partners (MCP) and ECM partners. Farmar operates in more than 80 international markets and has a diversified blue-chip base of pharmaceutical companies. MidEuropa’s commitment to the focus on new entries in the healthcare industry and its support through various development processes can mostly be fulfilled with this acquisition. These companies are believed to strengthen relevance through their capabilities in the marketplace in the coming years.

- In 2024, Asymchem made a positive and strong impact at the CPHI Milan 2024 exhibition. The company forwarded with a dual exhibition strategy, which reaffirmed its stand out as a technological leader in the pharmaceutical industry. The company is firmly focused on advanced manufacturing, global reach, and streamlined services, which are robust to build trust among the clients.

MARKET SEGMENTATION

This research report on the global CDMO market has been segmented and sub-segmented based on the service and region.

By Service

- CMO

- Finished Product Manufacturing

- Injectables

- Solid Dosage Forms

- Others (Semisolids/Liquid, Powder)

- API Manufacturing

- Packaging

- Finished Product Manufacturing

- CRO

- Preclinic

- Clinic

- Laboratory Services

- Discovery

By Region

- North America

- Europe

- Asia-pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global CDMO valued in 2024?

The global CDMO market size was worth USD 143.7 billion in 2024.

Which region is growing the fastest in the global CDMO market?

The Asia-Pacific CDMO market is anticipated to be the fastest among all the regions in the global market.

Who are the major players in the CDMO market?

Companies playing a key role in the global CDMO market are Metrics, AMRI, Famar, WuXi AppTech, Asymchem, Porton, Lonza, Catalent, Patheon, Siegfried, Recipharm, Strides Shasun and Pirama.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]