Global Medical Device Testing Market Size, Share, Trends & Growth Forecast Report By Services, Sourcing Type, Device Class and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Medical Device Testing Market Size

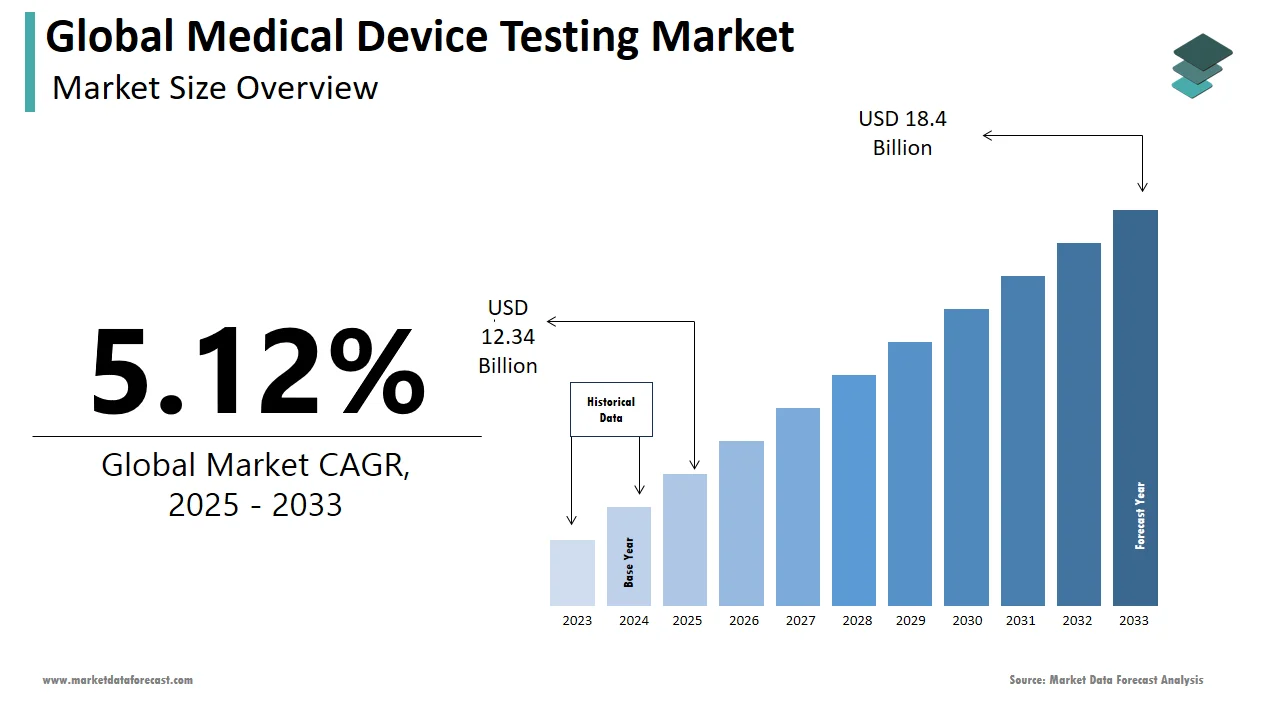

The size of the global medical device testing market was worth USD 11.74 billion in 2024. The global market is anticipated to grow at a CAGR of 5.12% from 2025 to 2033 and be worth USD 18.4 billion by 2033 from USD 12.34 billion in 2025.

MARKET DRIVERS

Increasing technical advancements, the growing need for verification and validation of medical devices, and the rise in in-vitro tests are primarily accelerating the growth of the global medical device testing market.

Verification and validation are essential methods in the healthcare sector. Verification is one of the important phases in developing a product. It is used to verify whether the product has been developed based on given requirements and validation checks whether the intended use has been met. Thus, usability specifics are fulfilled. Design, process, and software verification and validation are the methods of verification and validation for medical devices. Medical devices use smaller, more significant, and more advanced designs. This makes the validation and verification process more critical. The importance of this test is better repeatability, less rework and redesign, faster market time, fewer mistakes, improved competitiveness, and lower production costs.

Medical device testing is the most used in vitro diagnostics (IVD). It tests on samples such as blood or tissue taken from the human body. It can detect various diseases and monitor a person's overall health to help cure, treat, or prevent diseases. In-vitro tests are used in various disease detections, such as HIV infections, malaria, and hepatitis. The increasing prevalence of such diseases rapidly results in the growing demand for in-vitro tests and various medical devices.

Technological advancements such as IoT and AI in various devices are key growth factors for the global medical device testing market. Key companies are focusing on manufacturing these advanced products. Innovation and advanced medical devices help for the accurate result of disease diagnosing inventions in medical devices and also provide the cost-effectiveness of technology-based therapeutic tools during disease treatment. Various governmental bodies and healthcare providers also support medical research centers. In 2021, PaxeraHealth announced that it had launched an AI-based imagining platform in the U.S.

Increasing need for verification and validation for medical devices, an increased adaption of various portable medical devices and wearable medical devices, increasing healthcare expenditure, wearable devices, developments in the field of drug-device combination, integration of mobile and medical devices, personalized medicine, stringent government rules and standards across medical devices and medical device technologies are the major driving factors for the growth of medical device testing market in coming years.

MARKET RESTRAINTS

Increasing the cost, taking a long time to manufacture products, and high competition in medical devices are the restraining factors for the medical device testing market growth. In addition, the lack of testing facilities, changing regulations and standard rules, and lack of skilled professionals for testing medical devices are challenging the growth of the medical device testing market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.12% |

|

Segments Covered |

By Services, Sourcing Type, Device Class, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Toxikon, Inc., Intertek Group plc, Pace Analytical Services, Charles River Laboratories International, Inc., American Preclinical Services LLC, North American Science Associates, Inc., Sterigenics International LLC, Eurofins Scientific, WuXi AppTec Group, Bureau Veritas, TÜV SÜD, Elements Material Technology, and Envigo, and Others. |

SEGMENTAL ANALYSIS

By Service Type Insights

Based on the service type, the resting service segment had the largest share of the global medical device testing market in 2024. There is an increasing demand for testing services in medical devices due to increased demand for products, increasing awareness among consumers, and high-quality products. Testing services verify that the products meet the required quality and safety standards. Testing services help manufacturers improve the marketability of their medical devices and lower costs in the pre-production phase. Certifications certify that the manufacturers of the medical products have followed the standards and quality and safety rules during the production process.

By Sourcing Type Insights

Based on the sourcing type, the outsourced segment led the market for medical device testing worldwide in 2024. Large international companies are focusing on increasingly outsourcing medical device testing services to help reduce overall testing costs. In addition, outsourcing TIC services are growing to third-party vendors if the testing requires the implementation of complex technologies.

By Device Class Insights

Based on the device class, the class III segment is forecasted to register the largest share in the global medical device testing market during the forecast period. Classifying medical devices are essential due to the presence of potential risks associated with medical devices. In addition, class III medical devices are used to support human life. For example, heart valve replacements, pacemakers, and pulse generators are class III medical devices.

REGIONAL ANALYSIS

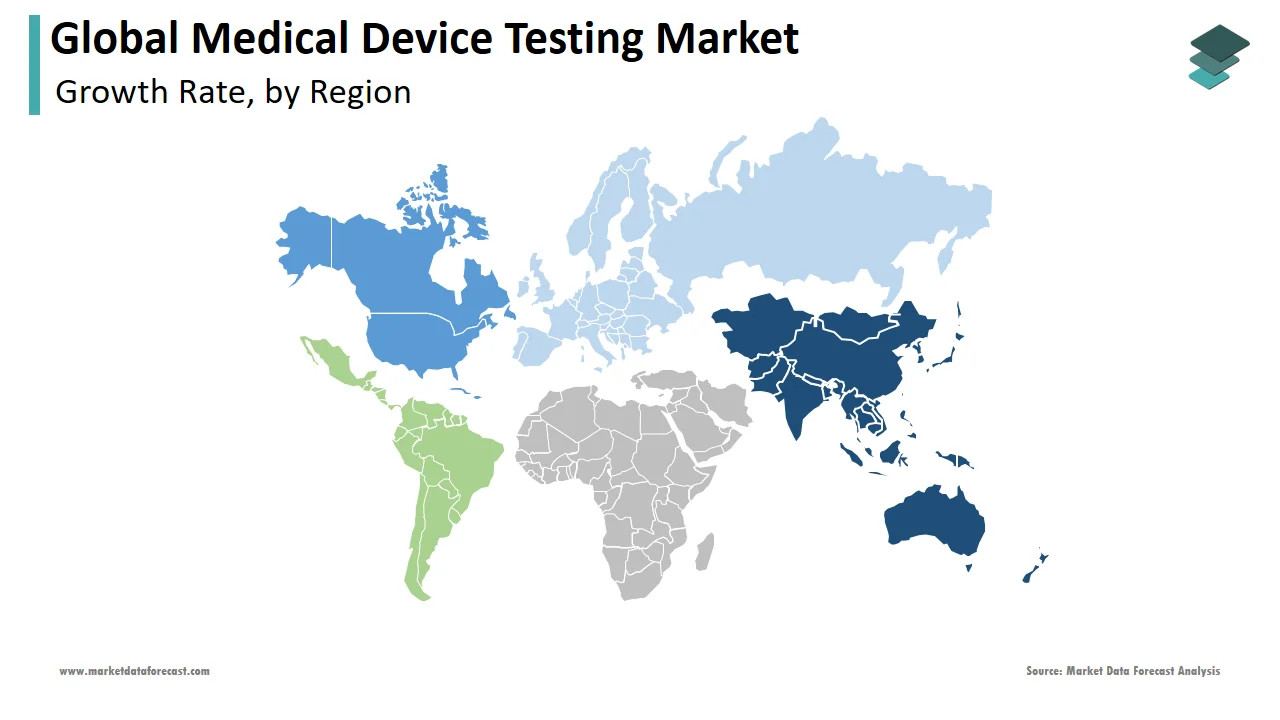

Geographically, the Asia-Pacific region dominated the medical device testing market in 2024 due to rising consumer awareness, increasing disposable income, and advancements in the healthcare infrastructure in China and Japan. In addition, there is growing awareness regarding healthcare devices in India after the pandemic, especially after the pandemic has forced the government to invest in research and development of new portable and accurate equipment.

On the other hand, North America was so close to the Asia-Pacific accounting for the same amount of the share occupied by the Asia-Pacific region in the global market in 2024. The dominance of the North American region can be credited to increased awareness among users about the safety and security of medical devices in the US and the growing adoption of advanced devices. In addition, stringent regulatory bodies such as the FDA are fuelling market growth. According to the Centre for Medicare & Medicaid Services, the United States spent USD 3.6 trillion on healthcare in 2018. Healthcare expenditure accounted for 17.7 percent of the GDP of the country. Increasing demand for medical device testing services in this region and approval of many medical devices may promote market expansion. All these factors have fuelled the market in the North American region.

KEY MARKET PLAYERS

Toxikon, Inc., Intertek Group plc, Pace Analytical Services, Charles River Laboratories International, Inc., American Preclinical Services LLC, North American Science Associates, Inc., Sterigenics International LLC, Eurofins Scientific, WuXi AppTec Group, Bureau Veritas, TÜV SÜD, Elements Material Technology, and Envigo are a few of the notable players in the global medical device testing market profiled in this report.

RECENT MARKET DEVELOPMENTS

- In 2020, Intertek announced the expansion of its personal protective equipment services to include precertification testing of N95 Respirator Precertification Testing by the National Institute for Occupational Safety and Health.

- In 2022, TUV SUD announced the expansion of its Medical & Health Services facilities in New Brighton, Minnesota.

MARKET SEGMENTATION

This research report on the global medical device testing market has been segmented and sub-segmented based on services, sourcing type, device class & region.

By Service Type

- Testing Services

- Inspection Services

- Certification Services

By Sourcing Type

- In-house

- Outsourced

By Device Class

- Class I

- Class II

- Class III

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the global medical device testing market?

By 2033, the size of the global medical device testing market is estimated to be worth USD 18.4 billion.

Which segment by service type is expected to dominated the market?

By services type, the testing segment is expected to lead the global medical device testing market in the coming years.

Which region is expected to dominate the medical device testing market?

Between 2025 to 2033, as per our research report, the APAC region is predicted to dominate the medical device testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com