Global In-vitro Diagnostics (IVD) Market Size, Share, Trends and Growth Forecast Report - Segmented By Product (Instruments, Reagents and Kits and Software), IVD Technology (Clinical Chemistry, Hematology, Immunoassays, Coagulation and Hemostasis, Molecular Diagnostics, Microbiology and Other IVD technologies), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2024 to 2029)

Global In-vitro Diagnostics (IVD) Market Size (2024 to 2029)

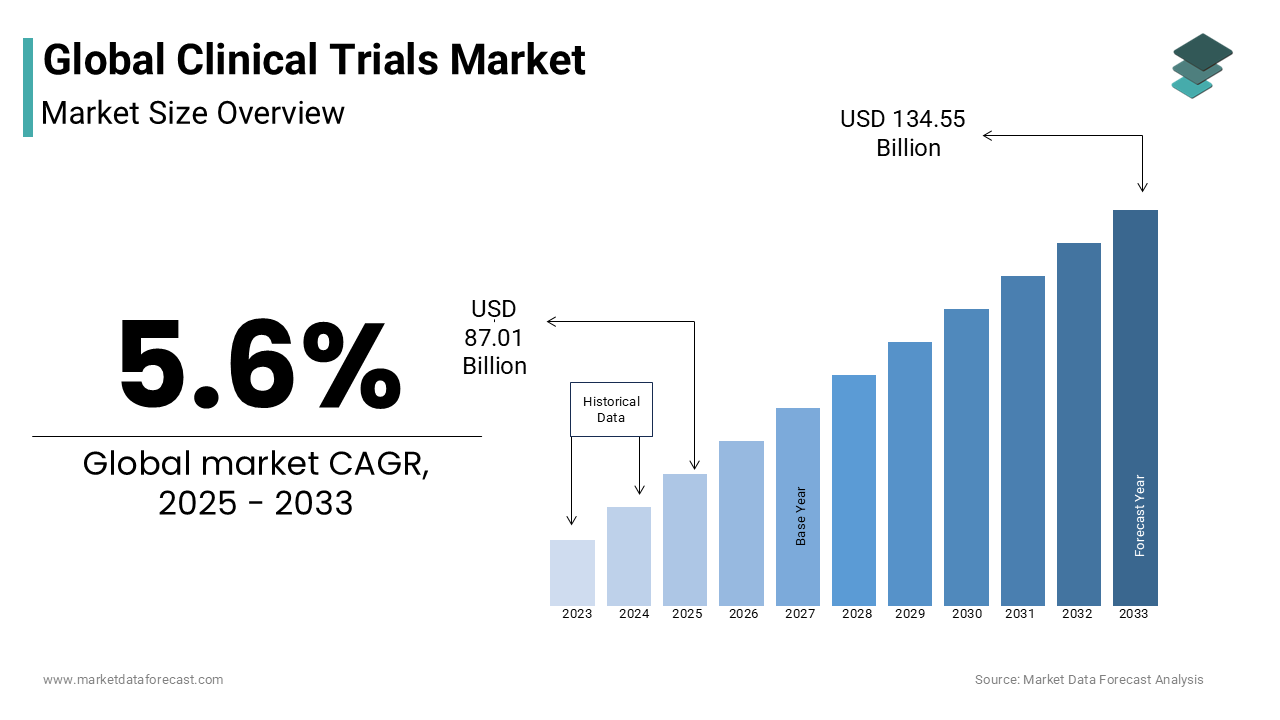

The global in-vitro diagnostics (IVD) market size is estimated to be USD 82.40 billion in 2024. The global IVD market is further forecasted to grow to USD 108.20 billion by 2029 at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2029.

Current Scenario of the Global In-vitro Diagnostics (IVD) Market

The demand for in-vitro diagnostics (IVD) is on the rise and is expected to accelerate during the forecast period. Factors such as the growing patient population suffering from chronic and infectious diseases, technological advancements, and an increasing aging population are fuelling the need for IVD worldwide. Regions such as North America, Europe and Asia-Pacific have been experiencing substantial demand for IVD products and services and account for the majority of the global IVD market share. The market participants have been adopting strategies such as innovating products with enhanced capabilities, entering new markets through partnerships and acquisitions, and increasing the number of awareness campaigns among healthcare professionals and consumers to increase their market share and strengthen their position in the global market. In addition to these, the key market participants have been exploring strategies such as customization, cost-effectiveness, and focus on personalized healthcare to address the increasing clinical needs and expand access to IVD technologies. Regions such as North America and Europe have been putting increased focus on precision medicine and preventive healthcare, which are resulting in the increased demand for IVD.

MARKET DRIVERS

The rapid adoption of personalized medicine is one of the major factors propelling the global in-vitro diagnostics (IVD) market growth.

Recently, people’s understanding of the benefits of personalized medicine has improved significantly. Personalized medicine offers improved patient outcomes compared to traditional treatments as these are developed based on the genetic markup of individuals. For instance, in a survey conducted by the Personalized Medicine Coalition, an estimated 74% of Americans agreed that personalized medicine providers have better patient outcomes compared to traditional medicine. IVD plays an important role in the development of personalized medicine by providing diagnostic information required to identify specific biomarkers, genetic mutations or other characteristics that play a role in treatment decisions. According to a study by the JAMA network, personalized medicine delivers 41% better results compared to traditional treatments.

The growing patient population suffering from chronic diseases and infectious diseases worldwide fuels the growth rate of the IVD market.

The patient population suffering from chronic diseases such as cancer, diabetes, CVDs and others, as well as infectious diseases such as HIV, hepatitis and others, is growing rapidly worldwide and this is resulting in the increasing usage of IVD products that can aid in the diagnosis and monitoring of these conditions. The adoption of sedentary lifestyle changes leads to an increase in chronic diseases. As a result, growing incidences of chronic and infectious diseases are majorly fuelling the market's growth rate. As per the estimates published by the World Health Organization (WHO), the population diagnosed with chronic diseases is growing significantly worldwide with each passing year and deaths from chronic diseases account for almost 74% of overall deaths worldwide. IVD testing is often used in the diagnostic procedures of chronic diseases. CDC says 6 in 10 people in the U.S. suffer from at least one chronic disease.

The growing aging population globally favors the global in-vitro diagnostics (IVD) market growth.

According to the World Health Organization, the number of people over 65 is estimated to reach 1.5 billion by 2050. Diseases such as Cancer, Alzheimer's, Arthritis, and others maintain a robust correlation with aging. In the treatment procedures, the laboratories use immunoassay-based tests aggressively, which is expected to drive the growth of the in-vitro diagnostics market. Increasing demand to provide appropriate treatment services is leveling up the growth rate of the IVD market.

The prevalence of automatic IVD systems in hospitals and laboratories is likely to boost the global in-vitro diagnostics market growth.

IVD systems are extremely useful in diagnosing diseases as a patient and aids in ensuring proper treatment procedures. The emergence of advanced technologies in healthcare hit laboratories, where the demand for automatic systems is growing steadily and fueling the growth rate of the IVD market. In addition, the rising prevalence of user-friendly devices in laboratories and increasing awareness towards OTC (over-the-counter) devices are promoting the IVD market growth.

Furthermore, the growing number of technological advancements such as next-generation sequencing (NGS), digital PCR, and microarrays, increasing healthcare expenditure in developing countries, rising demand for POC testing and the growing number of approvals from the regulatory bodies for the IVD products are favouring the growth rate of the in-vitro diagnostics market. Factors such as the rising adoption of companion diagnostics, growing emphasis on early disease detection and prevention, increasing demand for molecular diagnostics, an increasing number of improvements in the healthcare infrastructure in developing countries and growing demand for home healthcare are also contributing to the growth rate of the IVD market.

MARKET RESTRAINTS

The shortage of skilled persons to perform these procedures effectively due to fewer training programs and the fluctuations in the prices of final products used in the laboratories slightly hamper the global in-vitro diagnostics market. Furthermore, the government's rules and regulations for approving newly launched products and the lack of standardization, other attributes declining the growth, are other challenging factors for the global in-vitro diagnostics (IVD) market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2029 |

|

Segments Covered |

By By Product, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Abbott Laboratories, Johnson and Johnson, Siemens Healthcare, Becton Dickinson, Roche Diagnostics, Beckman Coulter Inc., Biomérieux, Ortho Clinical Diagnostics, Inc., Bio-Rad Laboratories Danaher Corporation, Sysmex Corporation, and Thermo Fisher Scientific, Inc. |

SEGMENTAL ANALYSIS

Global In-vitro Diagnostics (IVD) Market Analysis By Product

The reagents and kits segment accounted for 41.8% of the global in-vitro diagnostics (IVD) market share in 2023 and is estimated to showcase a promising CAGR during the forecast period. The growing prevalence of chronic and infectious diseases is majorly driving segmental growth. In addition, the development of new technologies such as molecular diagnostics and POC testing, and the increasing aging population worldwide boost the growth rate of the segment. People are much more likely to be diagnosed with chronic diseases. They require frequent diagnostic testing, resulting in the growing usage of reagents and kits and contributing to segmental growth. Furthermore, the growing funding and support from governmental and non-governmental organizations for the research and development of new diagnostic tests further drive segmental growth.

On the other hand, the instruments segment had 36.1% of the global market share in 2023 and is another lucrative segment and is estimated to witness 8.88% CAGR during the forecast period. The growing demand for automated instruments that can perform diagnostic tests quickly and accurately is one of the key factors propelling segmental growth. The growing number of technological advancements and increasing healthcare spending are fuelling the need for advanced diagnostic instruments and devices, which is expected to result in the segment's growth during the forecast period.

Global In-vitro Diagnostics (IVD) Market Analysis By Technology

The clinical chemistry segment held 26.8% of the global in-vitro diagnostics (IVD) market in 2023. The growing chronic disease patient population primarily drives segmental growth. People suffering from chronic diseases such as diabetes, cardiovascular disease, and kidney disease often require regular monitoring of various biomarkers and chemicals in the blood and use clinical chemistry tests. The rising aging population worldwide is another major factor fuelling the segment’s growth rate. People who are aged are much more likely to get diagnosed with chronic diseases and require regular monitoring of health, including the functioning of kidney and liver and electrolyte levels, to which clinical chemistry tests are used.

The molecular diagnostics segment is predicted to hold a substantial share of the global IVD market in 2023 and is expected to register a notable CAGR during the forecast period. The growing patient population suffering from infectious diseases, genetic diseases, and cancer drives the segmental growth. In addition, the growing adoption of personalized medicine, rising efforts from key market participants on the development of advanced sequencing and amplification technologies, and the rising adoption of molecular diagnostics by clinical laboratories and hospitals fuel the growth rate of the segment. Furthermore, growing healthcare expenditure and an increasing number of government initiatives to promote early diagnosis and disease prevention contribute to the growth rate of the segment.

The immunoassay segment is expected to witness a CAGR of 9.66% during the forecast period.

Global In-vitro Diagnostics (IVD) Market Analysis By Application

The oncology/cancer segment is expected to have the fastest of 9.04% CAGR in the worldwide in-vitro diagnostics (IVD) market during the forecast period. Factors such as the growing cancer patient population and increasing demand for personalized medicine and targeted therapies majorly drive segmental growth. In addition, growing government funding for cancer research, increasing awareness regarding early cancer detection among people, and increasing number of technological developments in the advanced molecular diagnostic tests for cancer boost the growth rate of the segment.

The infectious diseases segment accounted for 24.7% of the worldwide IVD market share in 2023 and is expected to grow at a notable CAGR during the forecast period owing to the rising incidence of infectious diseases such as multi-drug resistant infections. The growing demand for early diagnosis and treatment and an increasing number of advancements in diagnostic technologies further accelerate the growth rate of the segment.

REGIONAL ANALYSIS

North America was the largest regional segment in the worldwide market and accounted for 37% of the share of the global market in 2023. During the forecast period, the North American IVD market is also expected to register a promising CAGR owing to the increasing prevalence of chronic diseases such as cancer and respiratory diseases. The presence of well-established healthcare infrastructure, high healthcare expenditure and increasing demand for early and accurate diagnosis fuel the growth rate of the IVD market in North America. Furthermore, the growing adoption of personalized medicine by the North American population and the increasing usage of POC diagnostics favor the growth of the North American market. The presence of major international market participants such as Roche Diagnostics, Abbott Laboratories, and Thermo Fisher Scientific in the North American region is a big plus to the North American regional market growth. The U.S. IVD market had the largest share of the North American market in 2023, followed by Canada. During the forecast period, the U.S. is expected to continue to dominate the North American market and Canada is predicted to grow at a healthy CAGR.

Europe is a potential regional market for in-vitro diagnostics worldwide and is expected to grow at a notable CAGR during the forecast period. The growth of the European in-vitro diagnostics market is driven by the presence of sophisticated healthcare infrastructure, the increasing aging population and the rising demand for POC testing devices. The growing number of initiatives from the European governments for disease prevention, rising awareness among people regarding the benefits of early disease detection and favorable reimbursement policies further boost the growth rate of the European market. The rising adoption of healthcare IT and digital health technologies and the favorable regulatory environment for IVD products and services in the European region further support the growth rate of the European market. The German IVD market held the largest share of the European market in 2023 and is expected to showcase a promising CAGR during the forecast period. On the other hand, the UK and France are predicted to control the largest share of the European market during the forecast period.

The APAC market is the most lucrative regional market globally and is predicted to register the highest CAGR during the forecast period. The growth of the APAC in-vitro diagnostics market is attributed to the increasing chronic disease patient population, a growing number of improvements in the healthcare infrastructure in the APAC countries, rising demand for POC diagnostics and the growing number of initiatives from the governments of APAC countries to promote the healthcare access and affordability fuels the IVD market growth in APAC.

Latin America had a considerable share of the worldwide market in 2023 and is expected to grow at a healthy CAGR during the forecast period. The growing adoption of healthcare IT and increasing usage of telemedicine and remote patient monitoring boost the IVD market in Latin America. In Latin America, the IVD market in Brazil was growing consistently and is forecasted to witness a CAGR of 4.98% during the forecast period. Followed by Brazil, the Mexican IVD market is estimated to register a healthy growth rate during the forecast period.

The Middle East and Africa IVD market will have a slight inclination in the growth rate in the coming years. UAE led this regional market in the recent past, and the UAE market was worth USD 430 million in 2023 and is estimated to grow at a CAGR of 5.32% during the forecast period.

KEY PLAYERS IN THE IVD MARKET

Abbott Laboratories, Johnson and Johnson, Siemens Healthcare, Becton Dickinson, Roche Diagnostics, and Beckman Coulter Inc. are a few of the dominating companies in the global IVD market. Other companies that account for a significant share of the IVD market are Biomérieux, Ortho Clinical Diagnostics, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, and Thermo Fisher Scientific, Inc.

RECENT HAPPENINGS IN THE GLOBAL IVD MARKET

Product Launches

- In April 2019, to fight against cancer, Sophia Genetics took a step forward in announcing the CE-IVD marking of its Solid Tumor Solution (STS). This application can detect solid tumors like lung, colorectal, skin, and brain cancers.

- In April 2019, Altona Diagnostics GmbH announced the launch of the Altostar Molecular Diagnostic workflow. It is a CE-marked device with several benefits, such as flexibility and efficiency in testing infectious diseases.

- In November 2018, the first automated in vitro diagnostic (IVD) named Roche launched VENTANA pan-TRK (EPR17341) Assay. This launch is beneficial in laboratories for detecting tropomyosin receptor kinase (TRK) proteins in cancer.

- In July 2018, Namsa announced the Launch of IVD development services through integrated laboratory testing. This company is to put complete efforts into manufacturing capable devices in favor of the end-users.

- In December 2018, Genesig Real-Time PCR Epstein-Barr Virus (EBV) Kit and Genesig Real-Time PCR BK virus (BKV) Kit were launched by Novacyt. These two kits are under the name CE-IVD mark molecular diagnostic kits. These kits accurately diagnose the disease and are easily handled in real-time applications.

- In July 2018, Surmodics, Inc. introduced Matrix Guard Diluent; this move helped their shares eventually propel. The kit is to reduce false-positive results while performing tests using IVD.

Product Approvals

- In July 2019, the Abbott IVD system had clearance from the FDA for screening blood and plasma donations. This system has additional automatic features that can run up to 3 hours without human effort. In addition, it can do 600 tests per hour.

- In March 2019, the Instrumentation Laboratory (IL) received approval from U.S. Food and Drug Administration for the innovative product GEM Premier ChemSTAT in vitro diagnostic (IVD) analyzer. It is developed with intelligent quality management and is broadly used in point-of-care testing, primarily in hospital Emergency Departments and clinical laboratories.

Collaborations/Partnerships

- In August 2019, Sysmex, a leading company supporting IVD instruments, agreed with JVCKENWOOD Corporation to manufacture IVD biodevices. As a result, these companies will better use micro and nanofabrication technology in developing useful IVD devices.

- In November 2019, Lexent Bio partnered with Illumina, Inc. to develop a next-generation sequencing IVD kit to diagnose cancer. This product is to promote companies' portfolios to the next level.

DETAILED SEGMENTATION OF THE GLOBAL IN-VITRO DIAGNOSTICS (IVD) MARKET INCLUDED IN THIS REPORT

This research report on the global in-vitro diagnostics (IVD) market has been segmented and sub-segmented based on the product, technology, application, and region.

By Product

- Instruments

- Reagents and Kits

- Software

By Technology

- Clinical Chemistry

- Hematology

- Immunoassays

- Coagulation and Hemostasis

- Molecular Diagnostics

- Microbiology

- Other IVD technologies

By Application

- Diabetes

- Infectious Diseases

- Oncology/Cancer

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- HIV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Which segment by product is predicted to lead the IVD market in the coming years?

Geographically, the North American region dominated the in-vitro diagnostics market in 2023.

Which segment by application is estimated to dominate in the global IVD market in the coming years?

Based on the application, the cancer segment is growing at a rapid pace and is forecasted to showcase domination over the other segments in the global IVD market from 2024 to 2029.

Which region led the global IVD market in 2023?

The global in-vitro diagnostics (IVD) market size is estimated to grow by USD 102.51 billion by 2028.

Which are the key market participants in the global IVD market?

Based on the product, the reagents and kits segment is expected to lead in the global in-vitro diagnostics market from 2024 to 2029.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]