Global Transplant Diagnostics Market Size, Share, Trends & Growth Forecast Report By Technology, Product, Application, Type, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Transplant Diagnostics Market Size

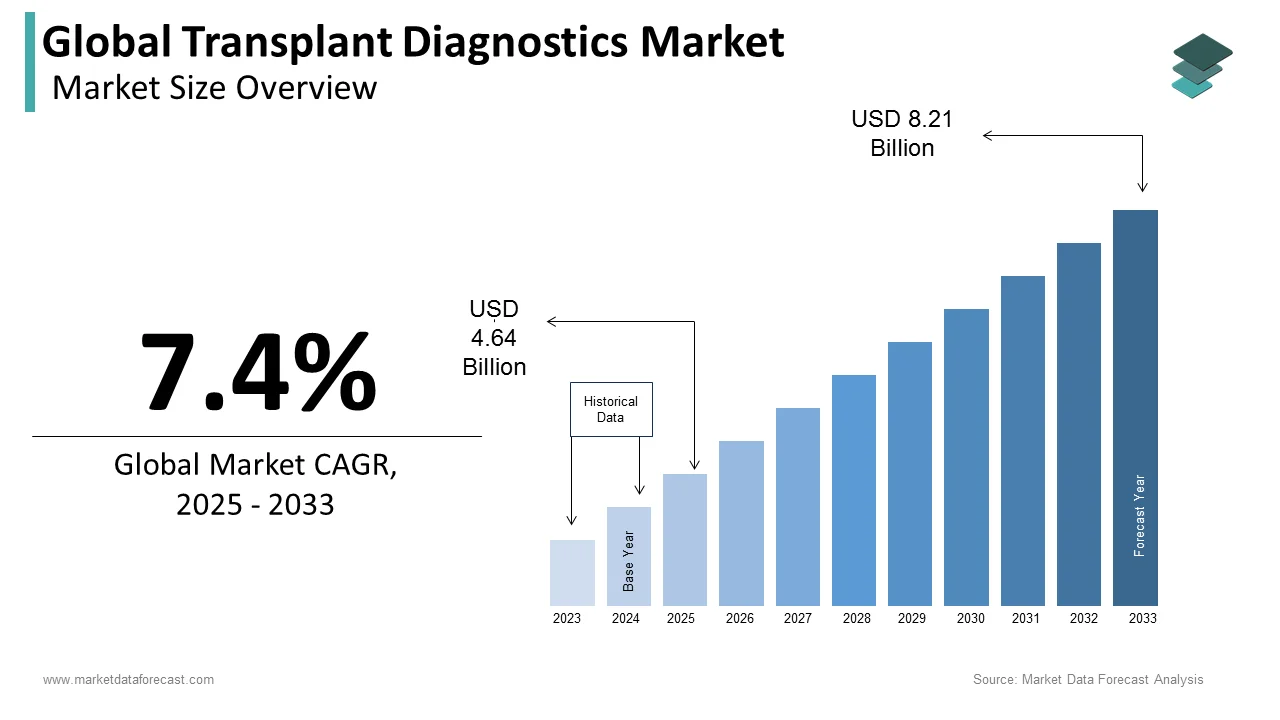

The global transplant diagnostics market was valued at USD 4.32 billion in 2024. The global market is projected to grow from USD 4.64 billion in 2025 to reach USD 8.21 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7.4% during the forecast period 2025-2033.

MARKET DRIVERS

YOY growth in the number of organ transplants with the requirement of individuals affected with terminal has a growth effect on the global transplant diagnostics market.

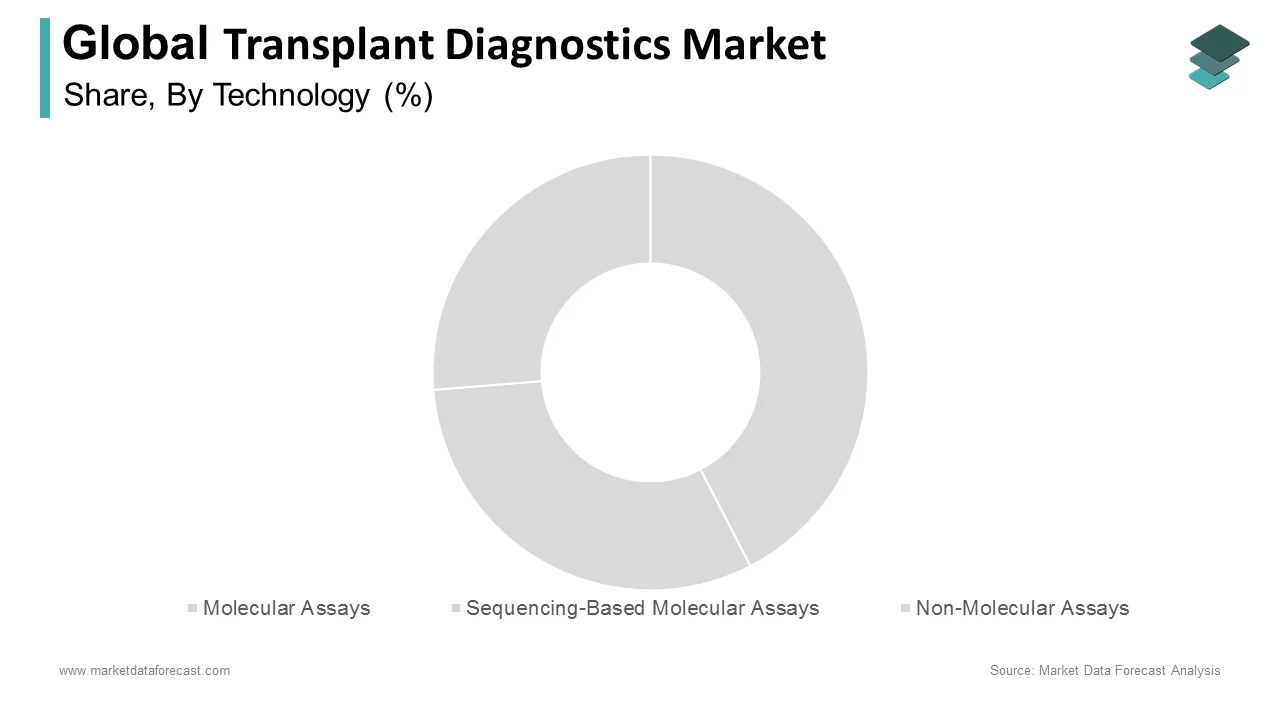

As per the statistics published by OrganDonor.gov, more than 40000+ transplants happened in 2021. An estimated 90483 patients were on the waiting list for a kidney transplant in 2021, of which only 24670 were performed. The increasing adoption of transplant diagnostic techniques in related research studies and an expanding number of organ transplantation procedures propel market growth. An increasing number of substantial organ transplantation procedures, government regulation to augment organ donation in various healthcare markets, and rising number of chronic diseases and disorders, increasing demand for infectious disease diagnosis and tissue typing in cases of donor-recipient cross-matching, a growing number of organ transplantation procedures drive the market for transplant diagnostic market. Molecular assays have the largest market share, expected to be the fastest-growing segment during the forecast period due to their better sensitivity, specificity, and high resolving power.

Furthermore, the global transplant diagnostics market is likely to grow further with the increasing elderly population, a growing number of soft tissues, solid and stem cell-based transplantation, increasing prevalence of chronic diseases, growing robot-assisted laboratory automation of diagnostic procedures, and human leukocyte antigen (HLA) typing. Technological advances that are coming up to enhance transplant procedures are anticipated to favor market growth. Also, increased public and private investment in developing innovative human leukocyte antigen (HLA) test products and increased use of HLA typing products in clinical diagnostics have improved and continued the healthcare infrastructure in developing countries. Reducing the average cost of gene sequencing and expanding the base on which to install PCR and NGS equipment will drive the growth of the global transplant diagnostics market in the future.

MARKET RESTRAINTS

However, high costs involved with PCR and NGS instruments, limited medical reimbursement for transplantation procedures, and a massive gap between organ donation and transplantation have been responsible are hampering the growth rate of the transplant diagnostics market. In addition, the transplant diagnostics market growth can be negatively impacted by strict regulatory policies, slow approval processes, inadequate organ transplant reimbursement policies, and social and ethical conflicts worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Technology, Transplant Type, Application, End-user, Product, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CareDx, Pacific Biosciences of California, Illumina, Thermo Fischer Scientific, GenDx, and Immucor. |

SEGMENTAL ANALYSIS

By Technology Insights

Based on technology, the molecular assay technology segment is expected to grow at a healthy CAGR during the forecast period. This is because doctors prefer molecular assays over non-molecular assays. Furthermore, serologic detection preferences for HLA typing are gradually shifting due to its advantages, such as accuracy, efficacy, and low risk. Currently, the field of PCR-based assays has the largest market share for various applications.

However, the sequencing-based molecular assay segment is anticipated to showcase healthy during the forecast period.

By Product Insights

The consumables segment accounted for the leading share of the transplant diagnostics market in 2024, closely followed by the reagents segment.

On the other hand, the software and services segment is anticipated to register a promising CAGR during the forecast period.

By Application Insights

Based on application, the diagnostics segment is expected to command the leading share in the global transplant diagnostics market during the forecast period due to the growing number of transplants due to rising cases of chronic conditions and traumatic incidents.

However, the research segment is also expected to grow significantly due to rising laboratories and biopharmaceuticals involvement in developing new procedures and better treatment types for transplant surgeries, promoting the segment growth.

By Transplant Type Insights

Based on the transplant type, the kidney transplant segment is anticipated to hold the most dominant share of the market during the forecast period. This is because kidneys are the most common organs that face problems as the body gets older, and the kidneys are also quickly affected by bad lifestyles and food habits, pushing the segment's growth. In addition, the kidneys are also easier to donate as a person can generally live with one normal functioning kidney.

However, the liver and heart transplant segments are expected to grow significantly during the forecast period as they are the second most needed transplant organs. The growing rates of alcohol abuse and cardiovascular diseases through the forecast period are also responsible for the growing requirement for these organs.

By End-User Insights

The laboratories segment is expected to hold a major share of the transplant diagnostics market during the forecast period due to the rising cases of organ transplantation and business outsourcing by biopharmaceutical companies toward individual laboratories. Additionally, the advancement in resources, research, and infrastructure for laboratories supports the market's growth.

However, the hospital segment is also expected to show promising growth during the forecast period due to the large influx of patients in the healthcare sectors, advanced infrastructure, and top-class surgeons' availability to perform transplants.

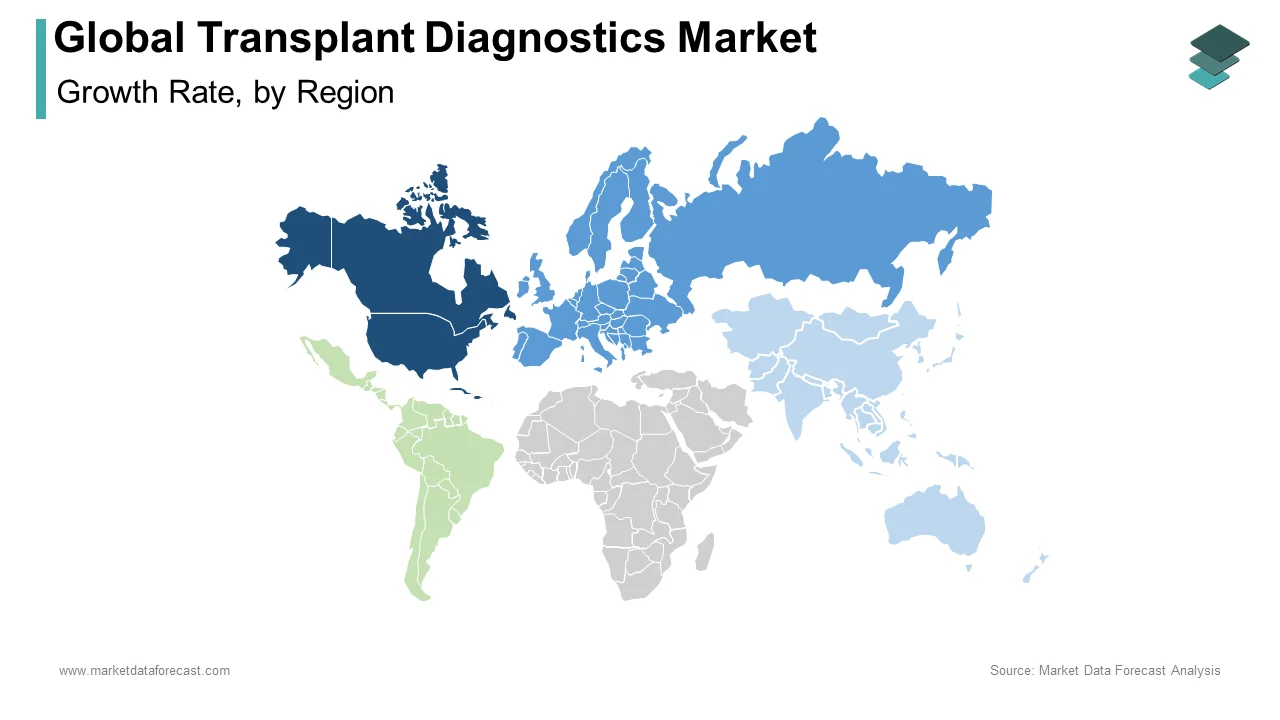

REGIONAL ANALYSIS

The North American transplant diagnostics market had the largest share in the global market based on the region in 2024, where the Asia-Pacific region is expected to collect high revenues for the transplant diagnostic market shortly. Regionally, North America is expected to have the largest share in transplant diagnostics and is projected to dominate the market over the forecast period. The growth of the North American market is primarily driven by the well-established healthcare system, increasing adoption of technological developments in transplant diagnostics, and the rising number of organ transplant surgeries being performed in North America. The U.S. transplant diagnostics market holds the largest share in the North American market due to the availability of skilled surgeons and the acquisition of advanced techniques and diagnostic tools. However, Canada is expected to witness the highest growth rate over the forecast period.

The transplant diagnostics market in Europe is expected to showcase promising growth and stands as the second-largest regional market worldwide. The growth of the European market is attributed to the growing donor population, the increasing number of transplant procedures, and the presence of favorable government laws. During the forecast period, the UK is expected to hold a major share of the European market.

At the same time, the transplant diagnostics market in Asia-Pacific is expected to have the fastest CAGR in the global market during the forecast period. China and India are growing rapidly in the APAC region. The growing patient population majorly drives the market growth in these countries, consistent improvements in the healthcare infrastructure, growing public and private support to develop HLA, and the rising prevalence of chronic diseases. In addition, developing countries such as India and Singapore of this APAC region are medical tourism destinations.

The Latin American transplant diagnostics market is expected to have a stable CAGR in the global market during the forecast period owing to the growing adoption of transplant diagnostic techniques. Brazil in this region is expected to occupy the leading share in the Latin American region.

The MEA transplant diagnostics market had a small portion of the global market in 2024. The growing adoption of technological developments majorly drives the regional market. Moreover, the lack of poor reimbursement policies and poor awareness among people regarding organ donations restrain the market growth in this region.

KEY MARKET PARTICIPANTS

CareDx, Pacific Biosciences of California, Illumina, Thermo Fischer Scientific, GenDx, and Immucor are a few of the companies playing a vital role in the transplant diagnostics market.

RECENT MARKET DEVELOPMENTS

- In December 2022, after completing its phase 2 trial, REGiMMUNE's top candidate to prevent graft-versus-host disease following stem cell transplantation is now ready for a late-stage test.

- Natera Inc. announced it's joining with Thermos Fisher Scientific to market its diagnostic test for kidney transplants.

- GenDx develops and markets a comprehensive line of In Vitro Diagnostic (IVD) tests and services, analysis software, and education addition. In addition, the company works in Sequencing-Based Typing (SBT) for transplantation offering high-resolution HLA typing methods for Sanger and NGS techniques.

MARKET SEGMENTATION

This research report has segmented and sub-segmented the global transplant diagnostics market based on the technology, transplant type, application, end-user, product & region.

By Technology

- Molecular Assays

- PCR-Based Molecular Assays

- Real-Time PCR

- Sequence-Specific Primer-PCR

- Sequence-Specific Oligonucleotide-PCR

- Other PCR-Based Molecular Assays

- Sequencing-Based Molecular Assays

- Sanger Sequencing

- Next-Generation Sequencing

- Other Sequencing Molecular Assays

- Non-Molecular Assays

By Product

- Consumables

- Instrument

- Reagent

- Software & Services

By Application

- Diagnostic Applications

- Pre-Transplantation Diagnostics

- Infectious Disease Testing

- Histocompatibility Testing

- Blood Profiling

- Post-Transplantation Diagnostics

- Pre-Transplantation Diagnostics

- Research Applications

By Transplant Type

- Heart Transplant

- Kidney Transplant

- Liver Transplant

- Stem Cell Transplant

By End-User

- Labs

- Hospitals

- Transplant Centres

- Research Labs & Academic Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the transplant diagnostics market worldwide in 2024?

The global transplant diagnostics market size was worth USD 4.32 billion in 2024.

Which segment by technology had the leading share in the global transplant diagnostics market in 2024?

The molecular assay segment by technology dominated the market in 2024.

Which country had the leading share in the global transplant diagnostics market in 2024?

The market in the U.S. had the major share in the global transplant diagnostics market in 2024.

What are some of the notable players in the transplant diagnostics market?

CareDx, Pacific Biosciences of California, Illumina, Thermo Fischer Scientific, GenDx, and Immucor are some of the major players in the transplant diagnostics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]