North America In-Vitro Diagnostics (IVD) Market Size, Share, Trends & Growth Forecast Report By Product (Instruments, Reagents and Kits, Software), Technology, Application & Country (United States, Canada, Mexico & Rest of North America), Industry Analysis From 2025 to 2033

North America In-Vitro Diagnostics (IVD) Market Size

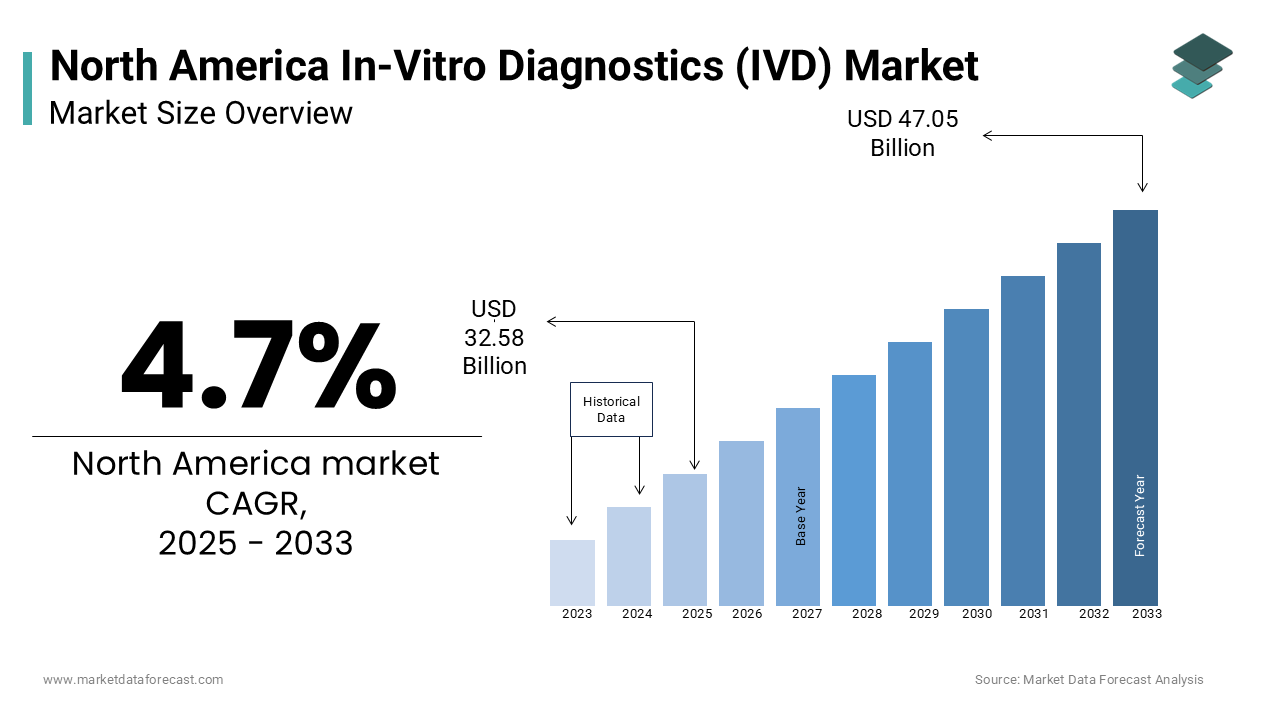

The size of the North American in-vitro diagnostics market was valued at USD 31.12 billion in 2024. The North American market is estimated to exhibit a CAGR of 4.7% from 2025 to 2033 and be worth USD 47.05 billion by 2033 from USD 32.58 billion in 2025.

MARKET DRIVERS

The rising prevalence for early diagnosis of diseases, increasing incidences of infectious and chronic diseases, and adopting point-of-care testing devices for accurate results in very little time are majorly driving the growth of the North American In-Vitro Diagnostics Market. In addition, the trend towards personalized medicines, the rise in the investments in hospitals and clinics by government and non-government organizations, and growth in the scale of diagnostic centers, along with the increasing flow of patients, are expected to fuel the North American IVD market.

Adopting the latest technologies and launching innovative products favoring the end-users in the medical sector certainly create growth opportunities for the market. Along with this, rising awareness over the availability of different treatment procedures for various diseases among individuals and ongoing research on the development of new devices in concern towards people's safety and adequate support from the private sectors through investments are lavishing the market's demand in North America.

MARKET RESTRAINTS

However, the high installation and maintenance cost of the equipment used in the diagnostic centers is quietly restricting the demand of the in-vitro diagnostics market in North America. Lack of standardization is one more factor hindering the growth rate of the market. In addition, the absence of skilled people to operate the devices more accurately and analyze the reports has remained challenging for the market players. Frequent changes in economic strategies may also negatively impact the market's growth rate in North America.

REGIONAL ANALYSIS

North America was the largest regional segment of IVD globally and held 37.3% of the global IVD market share in 2024, owing to the growing prevalence of chronic diseases such as cancer and respiratory diseases.

Within North America, the United States is the largest market for in-vitro diagnostics, while Canada is estimated to be the fastest-growing with a healthy CAGR. The United States has the largest In-Vitro diagnostics market in the world. Continuous awareness and product innovations are the factors behind the leading market. In the United States, section 210 of the Federal Food, Drug, and Cosmetic Act says that diagnostics products are medical devices and biological product subjects. The use of point-of-care (POC) diagnostics and the high occurrence of chronic diseases, heart diseases, asthma, diabetes, and COVID-19 in 2020 are majorly boosting the IVD market growth in the U.S. These diseases are responsible for the high mortality rate in the United States. The use of in-vitro diagnostics is feasible for managing chronic conditions. Furthermore, advances in DNA sequencing, growing demand for diagnostic devices, customer healthcare spending, and government funds will increase the growth of the U.S. in-vitro diagnostics market in the forecast period.

KEY MARKET PLAYERS

Companies holding the majority of the shares in the North American IVD Market profiled in the report are Abbott Laboratories, Johnson and Johnson, Siemens Healthcare, Becton Dickinson, Roche Diagnostic, Beckman Coulter Inc., Biomérieux, Ortho Clinical Diagnostics, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation & Thermo Fisher Scientific, Inc.

MARKET SEGMENTATION

This research report on the North American in-vitro diagnostics (IVD) market is segmented and sub-segmented into the following categories.

By Product

- Instruments

- Reagents and Kits

- Software

By Technology

- Clinical Chemistry

- Hematology

- Immunoassays

- Coagulation and Hemostasis

- Molecular Diagnostics

- Microbiology

- Other IVD technologies

By Application

- Diabetes

- Infectious Diseases

- Oncology/Cancer

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- HIV

By Country

- The United States

- Canada

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com