Global CRO Services Market Size, Share, Trends & Growth Forecast Report By Type (Clinical Research Services, Early-Phase Development Services, Discovery Studies, Chemistry, Manufacturing, & Control (CMC), Preclinical Services, Laboratory Services, Bioanalytical Testing Services, Analytical Testing Services and Consulting Services), Therapeutic Area, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global CRO Services Market Size

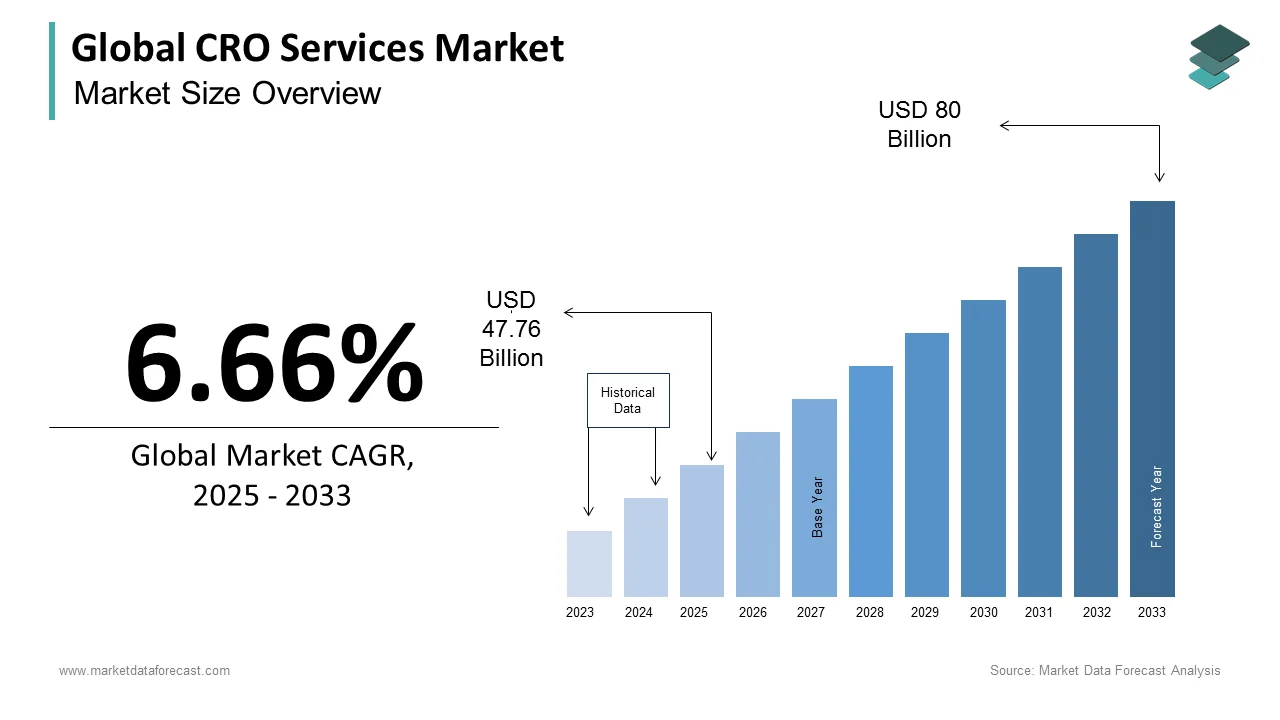

The size of the global CRO services market was worth USD 44.78 billion in 2024. The global market is anticipated to grow at a CAGR of 6.66% from 2025 to 2033 and be worth USD 80 billion by 2033 from USD 47.76 billion in 2025.

A CRO is a company that provides support to the pharmaceutical, biotechnology, and medical devices market in the form of research services outsourced on a contract basis. The services provided by CRO include clinical trials, pre-discovery research, CMS, post-marketing services, and laboratory services. CRO is now expanding its work by assisting companies through all stages of the development of drugs. There has been an increased advancement in technology used by CRO services, which has made the market more popular. The rapid globalization of important countries has helped the contract research organizations' services market build a place in this sector. Pharmaceutical Companies value the importance of cybersecurity and thus want to protect the data related to clinical trials, making the CRO services market less popular. Recently the Contract Research Organization (CRO) services have started to use wearable medical devices to make the process easier and more efficient. India and China will play a significant role in the market's growth.

MARKET DRIVERS

The growing number of clinical trials and R&D activities propel the CRO services market growth.

Recently, many governments worldwide have taken several initiatives in favor of contract organization services. Pharmaceutical companies are investing significantly in R&D activities, considering the potential in the coming years. The number of clinical trial activities is growing at a notable pace in various countries, which is expected to promote the growth rate of the CRO services market.

The growing aging population is anticipated to support the CRO services market's growth rate.

The European and APAC regions have been experiencing rapid growth in the aging population over the last few years. WHO says the aging population is growing aggressively worldwide, and one person in every six people is expected to be 60 years or over by 2030. The aging population is likely to be prone to various diseases. The pharmaceutical and medical device companies perform continuous R&D activities to develop innovative drugs and medical equipment to handle the growing treatment needs of aged people. Likewise, the increasing aging population worldwide is expected to result in the CRO services market growth in the coming years.

The rising patient count suffering from chronic diseases is expected to boost the CRO services market growth.

CDC says that six in every ten Americans suffer from at least one chronic disease in the United States. According to the data published by the World Health Organization (WHO), a considerable worldwide population suffers from chronic diseases. An estimated 41 million people die from chronic diseases each year. Companies that manufacture drugs and medical devices used in the treatment procedures for chronic diseases are increasingly outsourcing their early-phase clinical trials to reduce the expenses and workload, which is expected to result in the growth of the CRO services market.

An increased focus of CROs on providing effective solutions throughout the life cycle of drug discovery is favoring the market's growth rate. In addition, the growing adoption of technological developments such as big data continues to play an essential role in the CRO services market. Most importantly, wearable devices, a potentially disruptive technology, offer significant market opportunities. Recently, CROs have begun to utilize data from mobile medical wearable devices to improve data quality and test efficiency, providing lucrative opportunities for the participants of the CRO services market.

MARKET RESTRAINTS

The lack of qualified scientists and difficulties in assigning staff expertise for specific projects are majorly hampering the growth rate of the CRO services market.

Furthermore, the need for standardization for CRO services in some countries is expected to inhibit the overall market's growth rate. In addition, high costs associated with executing the CROs' operational costs are predicted to impact market growth negatively. Factors such as stringent regulatory requirements, data privacy, and security concerns are further projected to limit the growth rate of the global CRO services market in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Therapeutic Area, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech. |

SEGMENTAL ANALYSIS

By Type Insights

The clinical research services segment accounted for the largest share of the global CRO services market in 2024 and the segment's domination is likely to continue during the forecast period. The growing patient population suffering from chronic diseases is fuelling the need for more clinical trial activities, which is majorly driving segmental growth. In addition, the growing preference from pharmaceutical and biotechnology companies to outsource their clinical trial activities is anticipated to fuel the segment's growth rate in the coming years.

On the other hand, the early phase development services segment is predicted to witness a promising CAGR during the forecast period.

By Therapeutic Area Insights

The oncology segment is predicted to account for the largest share of the global CRO services market during the forecast period and led the market in 2024. The rising prevalence of cancer and the increasing need for new cancer treatments are majorly propelling segmental growth. According to the data published by the World Cancer Research Fund (WCRF), 18.1 million new cancer cases were registered in 2020. According to WHO, around 10 million people died of cancer in 2020, equivalent to one in every six deaths worldwide. In addition, factors such as the rising preference for personalized medicine in oncology and increasing interest from pharmaceutical and biotechnology companies to outsource their clinical trial activities to conduct in-depth oncology research to develop new treatments are anticipated to fuel the segment's growth rate.

The CNS segment is anticipated to witness a healthy CAGR during the forecast period.

By End-User Insights

The pharmaceutical segment had a significant share of the global CRO services market in 2024. During the forecast period, the pharmaceutical segment is estimated to showcase a promising CAGR owing to the growing number of R&D activities.

On the other hand, the medical device companies segment is anticipated to showcase the highest CAGR during the forecast period.

REGIONAL ANALYSIS

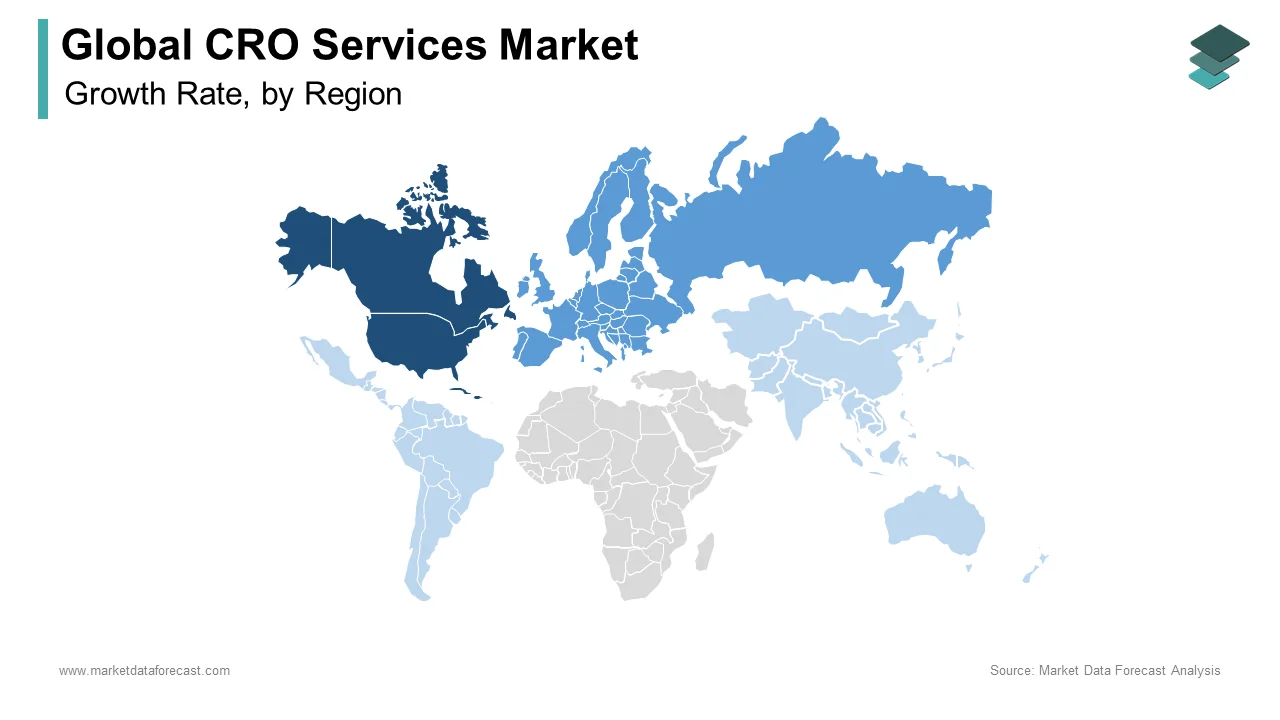

The North American region had the largest share of the global CRO services market in 2024. During the forecast period, the North American market is expected to hold the most significant share of the global market owing to the presence of pharmaceutical, biopharmaceutical, biotechnology, and medical companies, high-quality pharmaceutical industry standards, swift growth in the biosimilars and biologics market, increased demand for outsourcing services by pharmaceutical and biopharmaceutical companies and rise in the number of clinical trials. In addition, the presence of sophisticated healthcare infrastructure in North American countries is expected to fuel the growth rate of the North American CRO services market.

The European region is expected to hold a considerable share of the worldwide market during the forecast period and was the second regional segment in 2024. The growth of the European market is anticipated to be driven by the increasing demand for cost-effective clinical trials. Europe is home to several small and medium-sized CROs, one of the major factors promoting regional market growth. Increased adoption of technological developments in the work procedures by CROs has been noticed in the European region, and this trend is likely to continue in the coming years. It is expected to result in the growth of the CRO services market. In addition, Europe has a favorable regulatory environment for clinical trials, which is a plus for the European CRO services market. During the forecast period, Germany, France, the UK, and Italy are expected to hold a significant share of the European market.

The Asia-Pacific region is expected to grow the most in the coming years. It is mainly due to the rapid growth in the pharmaceutical industry, favorable government policies, an increase in the number of pharmaceutical companies establishing manufacturing facilities, and lower cost of clinical trials in the region. As a result, the number of CROs is growing considerably in the APAC region, which is expected to drive regional market growth. In addition, APAC is one of the lucrative regions for CRO services due to the lower cost structure, diverse patient population, and improved infrastructure.

The Latin American market is anticipated to register a healthy CAGR during the forecast period. The market in MEA is expected to hold a moderate share of the worldwide market in the coming years.

KEY MARKET PLAYERS

Companies playing a dominating role in the global CRO services market profiled in this report are Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech.

MARKET RECENT HAPPENINGS

- In February 2023, Crown Bioscience, one of the players in the global CROs market, had an agreement with Indivumed GmbH to acquire its IndivuServ business unit.

- In January 2023, Be The Match BioTherapies, a U.S.-based company, announced CRO cell and gene therapy development services.

- In April 2019, FHI 360 launched a new CRO service called FHI Clinical. The company focuses on helping companies in the hard-to-reach market and limited resources settings.

- In 2018, Cereno Scientific collaborated with CRO OCT' to enhance business operations and increase productivity.

- In August 2017, Chiltern was acquired by LabCorp. The acquisition helped LabCorp become a market leader in CROs by expanding mid-market biopharmaceuticals and improving medical device operations.

- In July 2017, Mapi Group was acquired by ICON; the acquisition helped boost ICON's business and added analytics, real-world data, a significant trading presence, and regulatory expertise.

MARKET SEGMENTATION

This research report on the global CRO services market has been segmented and sub-segmented based on type, therapeutic area, end-user, and region.

By Type

- Clinical Research Services

- Phase I Clinical Research Services

- Phase II Clinical Research Services

- Phase III Clinical Research Services

- Phase IV Clinical Research Services

- Early-Phase Development Services

- Discovery Studies

- Chemistry, Manufacturing, & Control (CMC)

- Preclinical Services

- Pharmacokinetics/Pharmacodynamics (PK/PD)

- Toxicology Testing Services

- Other Preclinical Services

- Laboratory Services

- Bioanalytical Testing Services

- Analytical Testing Services

- Physical Characterization

- Raw Material Testing

- Batch-Release Testing

- Stability Testing

- Other Analytical Testing Services

- Consulting Services

By Therapeutic Area

- Oncology

- CNS

- Cardiovascular

By End User

- Pharmaceutical

- Biopharmaceutical

- Medical Device Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. How much was the global CRO services market worth in 2024?

The global CRO services market size was valued at USD 44.78 billion in 2024.

2. Does this report include the impact of COVID-19 on the CRO services market?

A detailed analysis of how COVID-19 has impacted the CRO services market in this report.

3. Which region is predicted to lead the CRO services market in the future?

Geographically, the North American region is projected to play a leading role in the global CRO services market during the forecast period.

4. Who are the major players operating in the CRO services market?

Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech are a few of the notable players in the CRO services market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]