Global Molecular Weight Marker Market Size, Share, Trends & Growth Analysis Report By Product, Type, Application, End-user and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Molecular Weight Marker Market Size

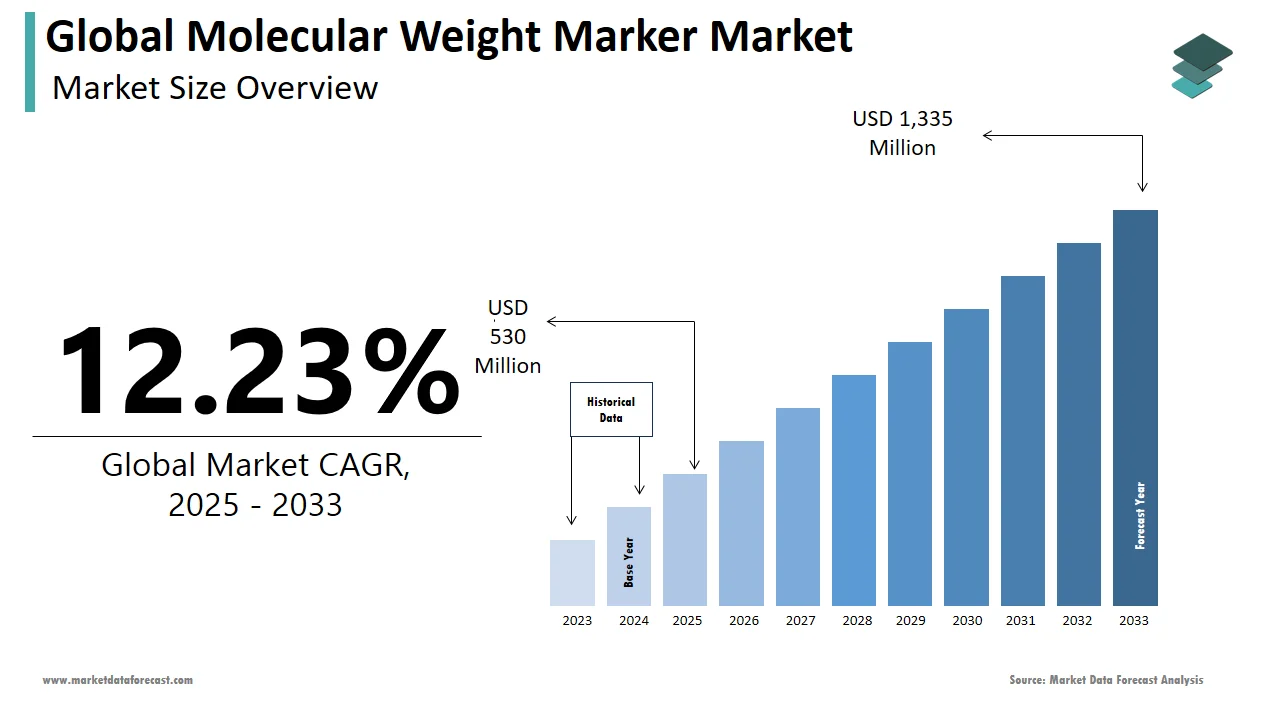

The size of the global molecular weight marker market was worth USD 473 million in 2024. The global market is anticipated to grow at a CAGR of 12.23% from 2025 to 2033 and be worth USD 1,335 million by 2033 from USD 530 million in 2025.

A molecular weight marker is used to determine the size of a molecule approximately run on gel electrophoresis. In general, it refers to the protein ladder, DNA ladder, or RNA ladder. The molecular weight marker techniques vary throughout the years, and the new inventions are distributed to the specific types accordingly. Based on the migration rate being inversely proportional to the molecular weight principle applied to the gel matrix, the molecular weight is identified in this process. Finally, these markers are loaded adjacently to the sample lane to determine the weight and size of the samples, such as RNA, DNA, or protein.

MARKET DRIVERS

The rising focus on proteomics and genomics in R&D centers propels the growth of the global molecular weight marker market.

Molecular weight markers are used for various purposes in research and development centers, such as protein analysis, DNA sequencing, and gene expression analysis. These markers significantly help scientists analyze the structure and function of proteins and nucleic acids and help identify the genetic variations associated with some diseases. In addition, the growing usage of mass spectrometry in multiple sectors, such as biotechnology, pharmaceuticals, and healthcare, is anticipated to result in the growing usage of molecular weight markers.

The growing prevalence of genetic disorders and chronic diseases is promoting the molecular weight marker market growth.

Molecular weight markers are widely used in genetic testing and the diagnosis of chronic diseases to determine the genetic reasons for various chronic diseases such as cancer, diabetes, and CVDs. In addition, molecular weight marker plays a crucial role in biotechnology laboratories and life science. For instance, molecular weight markers are used to analyze the genetic mutation that can cause various diseases and monitor the progression of these diseases over time.

In addition, the growing preference towards precision medicine, increasing adoption of a sedentary lifestyle, and changes in food habits support the market growth of the molecular weight marker. Furthermore, the increasing investments to conduct R&D activities to develop innovative techniques with the latest technological advancements are favoring market growth. Furthermore, the growing disposable income in developed and developing countries, the manufacturing of new drugs, and increasing demand for biotechnology patents contribute to the growth of the molecular weight marker market.

MARKET RESTRAINTS

However, stringent regulations regarding people’s safety are one of the significant concerns to the growth of the molecular weight marker market. Furthermore, the lack of skilled laboratory technicians due to fewer training programs limits the molecular weight marker market’s growth rate. In addition, the lack of proper equipment in research centers, especially in rural areas, remains a challenging factor for the market players. Furthermore, lack of standardization is another attribute hampering the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application, Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional and country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

F Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Agilent Technologies, Sigma-Aldrich, Affymetrix, Inc., QIAGEN, Takara Bio Inc., Bio-Rad Laboratories, Promega Corporation, and New England Biolabs. |

SEGMENTAL ANALYSIS

By Product Insights

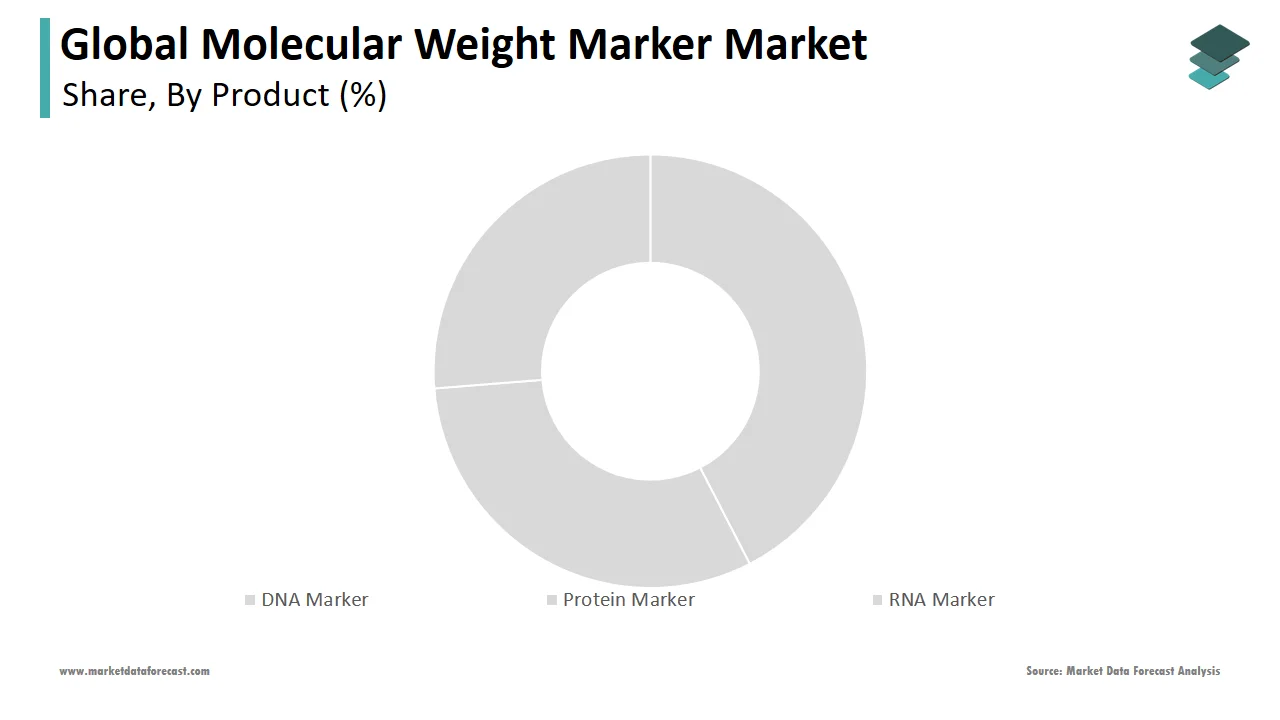

The DNA marker segment dominated the global molecular weight marker market in 2024 and is anticipated to lead the market during the forecast period owing to the increasing awareness of the availability of various treatment procedures for genetic disorders. In addition, the emergence of the latest genomics technology will likely outshine the segment's growth rate.

By Application Insights

The nucleic acid segment is estimated to hold a dominating share of the global molecular weight marker market during the forecast period.

On the other hand, the proteomics segment is estimated to grow faster during the forecast period owing to the ongoing research on developing new techniques favoring the end-users and increasing support from government bodies.

By Type Insights

The prestained marker segment is expected to play the leading role in the worldwide market during the forecast period. The growing awareness regarding the availability of various products in laboratories and the growing scale of research centers and laboratories are propelling the segment's growth rate.

REGIONAL ANALYSIS

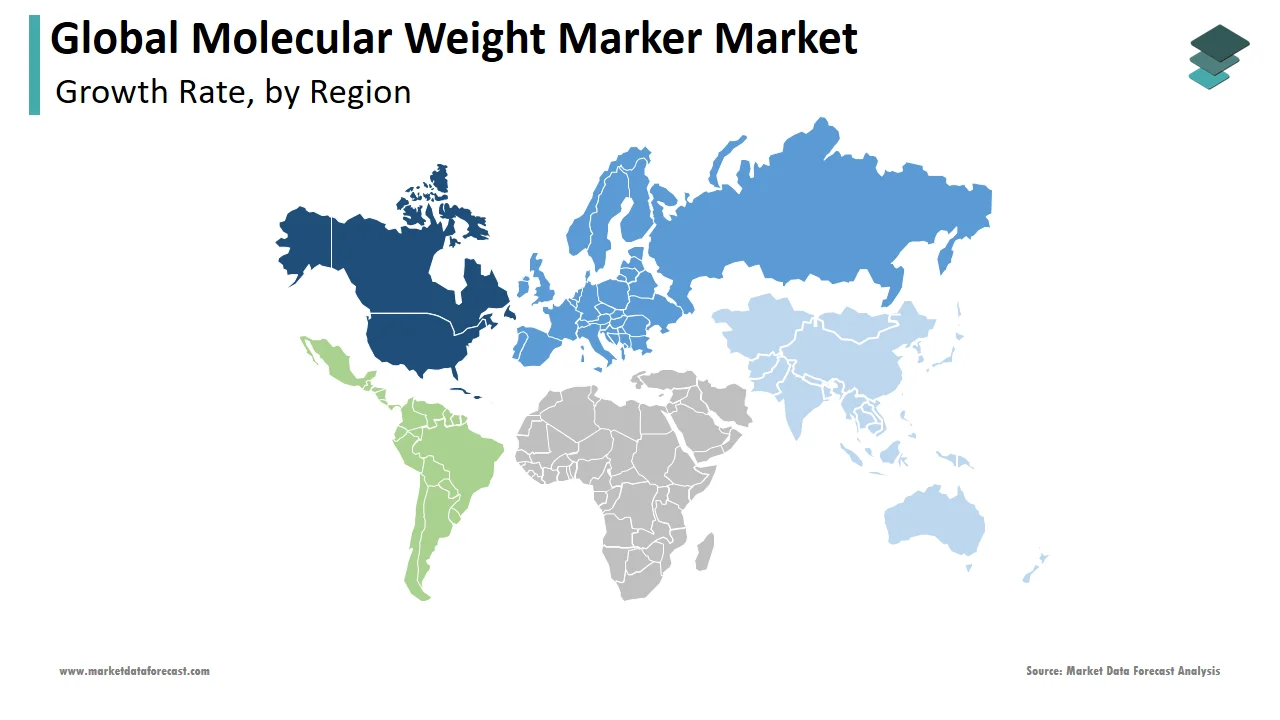

North America dominated the market and is anticipated to play the dominating role in the worldwide market during the forecast period owing to the growing adoption of the latest technological developments. In addition, the launch of innovative applications in proteomics and genomics is promoting the growth rate of the regional market. As a result, the U.S. market accounted for the major share of the North American market in 2024, followed by Canada. Therefore, the U.S. market is anticipated to hold a promising share of the North American market during the forecast period. On the other hand, the Canadian market is estimated to showcase a healthy CAGR in the coming years.

Europe accounted for a substantial share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period. Factors such as the increasing investments in the R&D institutes and the launch of various methods in DNA sequencing with these markers are propelling the regional market growth. As a result, the UK, Germany, Spain, and France have accounted for a major share of the European market in 2024.

The Asia-Pacific is expected to hit the highest CAGR in foreseen years. Constant economic growth is one of the factors for market growth in this region. Besides, the growing population and the prevalence of effective treatment procedures at any cost are increasing the demand for the molecular weight marker market. In addition, an increasing number of pharmaceutical companies are likely to magnify the growth rate of the regional market.

Latin America and MEA are estimated to hold a moderate share of the worldwide market in the coming years.

KEY MARKET PLAYERS

Some promising companies dominating the global molecular weight marker market are F Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Agilent Technologies, Sigma-Aldrich, Affymetrix, Inc., QIAGEN, Takara Bio Inc., Bio-Rad Laboratories, Promega Corporation, and New England Biolabs.

RECENT HAPPENINGS IN THE MARKET

- In Feb 2021, Thermo Fisher Scientific Inc., an American provisioner of scientific instrumentation, reagents & consumables, and software and services to healthcare, life science, and other laboratories in academia, government, and industry, announced that it had completed the acquisition of a privately held point-of-care molecular diagnostic company, Mesa Biotech, Inc.

- Agilent Technologies Inc., an analytical instrumentation development and manufacturing company that offers its products and services to markets worldwide, has introduced the Agilent 8697 Headspace Sampler, the first headspace sampler the integrated gas chromatography communication, which can mark the expansion of intelligence capability that was first launched with the Agilent Intuvo 9000 GC System in 2016 and later in 2019 with the Agilent 8890 and 8860 GC Systems.

- QIAGEN GmbH, one of the key players in the global molecular weight marker market and a biotechnology company focused on the discovery, development, and commercialization of synthetic DNA products, named Inovio Pharmaceuticals, Inc., has expanded their collaboration for developing Next Generation Sequencing (NGS) companion diagnostic for INOVIO's VGX-3100 for Advanced Cervical Dysplasia.

- In November 2015, Merck KGaA and Sigma Aldrich Co. LLC's acquisition strengthened the life science techniques.

MARKET SEGMENTATION

This research report on the global molecular weight marker market has been segmented & sub-segmented based on the product, application, type, end-user, and region.

By Product

- DNA Marker

- Protein Marker

- RNA Marker

By Application

- Nucleic Acid

- PCR

- Northern Blotting

- Southern Blotting

- Molecular Cloning

- Proteomics Application

- Western Blotting

- Gel Extraction

By Type

- Prestained Marker

- Unstained marker

- Specialty Marker

By End User

- Academic Institutes

- Pharmaceutical Companies

- Contract Research Organizations (CRO)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global molecular weight marker market worth in 2024?

The Asia-Pacific region is anticipated to grow at the fastest CAGR in the worldwide market during the forecast period.

Which region is growing the fastest in the global molecular weight marker market?

Yes, we have studied and included the COVID-19 impact on the global molecular weight marker market in this report.

What are the companies playing a leading role in the molecular weight marker market?

The global molecular weight marker market size was valued at USD 473 million in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com