Asia Pacific Data Center Cooling Market Research Report – Segmented By Solution (Air Conditioning, Liquid Cooling System), Component, Services, Type of Cooling, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Data Center Cooling Market Size

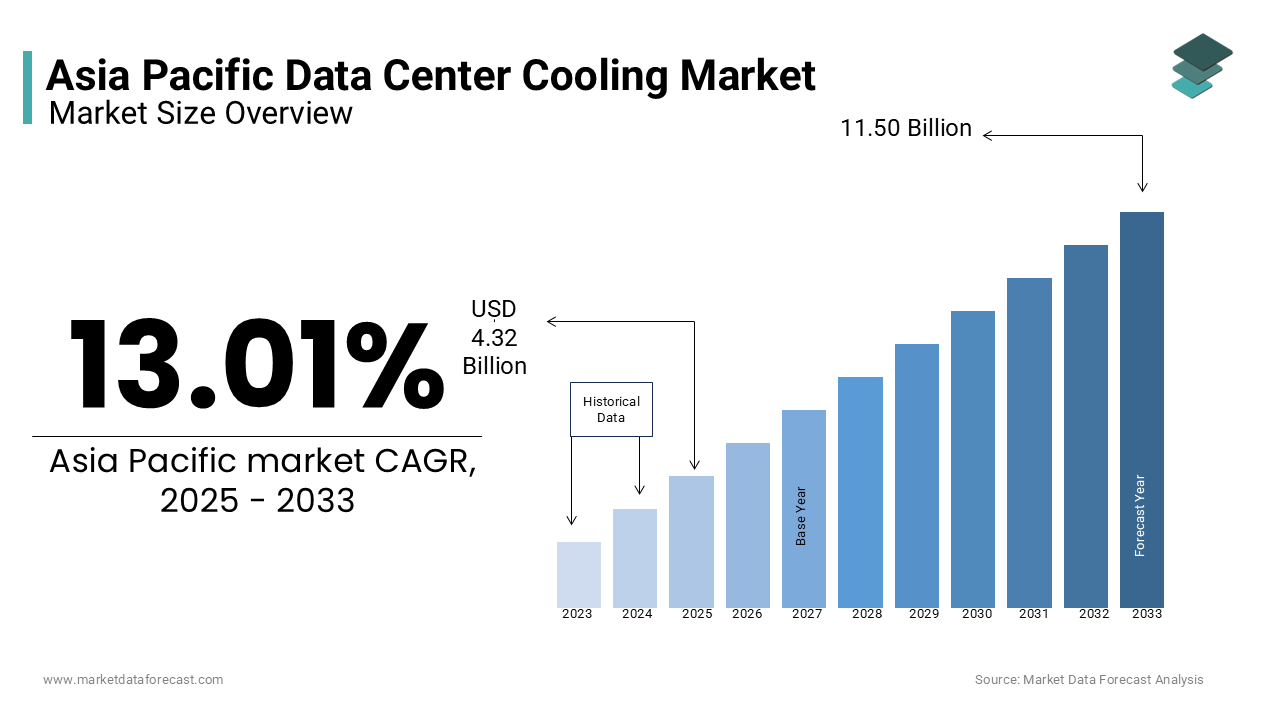

The Asia Pacific data center cooling market was worth USD 3.82 billion in 2024. The Asia Pacific market is expected to reach USD 11.50 billion by 2033 from USD 4.32 billion in 2025, rising at a CAGR of 13.01% from 2025 to 2033.

MARKET DRIVERS

Surging Demand for Hyperscale Data Centers

A significant driver of the Asia Pacific data center cooling market is the exponential growth of hyperscale data centers which is fueled by the rising demand for cloud computing and big data analytics. Like, hyperscale facilities in the region grew significantly in 2023, with a large portion of these located in China and India. A key factor is the emphasis on precision cooling. Also, advancements in liquid cooling systems have enabled hyperscale data centers to maintain optimal temperatures while reducing energy consumption. Additionally, governments are promoting energy-efficient practices have accelerated the adoption of advanced cooling technologies, strengthening their role in supporting hyperscale operations.

Increasing Focus on Energy Efficiency and Sustainability

Another major driver is the growing focus on energy efficiency and sustainability, driven by stringent environmental regulations and corporate responsibility goals. For example, Singapore’s Green Data Centre Technology Roadmap mandates the use of energy-efficient cooling systems, reducing carbon emissions in urban areas. A major aspect is the integration of renewable energy sources into cooling solutions. Many new data center projects in Japan and South Korea incorporate solar-powered cooling systems, aligning with sustainability goals. Additionally, investments in AI-driven thermal management have enhanced operational efficiency, driving widespread adoption of eco-friendly cooling technologies.

MARKET RESTRAINTS

High Initial Investment Costs

A significant restraint in the Asia Pacific data center cooling market is the high initial investment required for deploying advanced cooling systems. Like, installing liquid cooling or free cooling systems can cost a significant amount per facility, deterring smaller enterprises from adopting these technologies. For instance, small-scale data centers in countries like Thailand and Vietnam often lack the financial resources to integrate energy-efficient solutions, leaving them reliant on traditional air conditioning methods. Besides, maintenance costs pose a further challenge. As indicated by the World Economic Forum, annual upkeep expenses for advanced cooling systems can exceed 15% of the initial investment, straining public finances. Without adequate funding or international aid, these financial barriers hinder widespread adoption, particularly in rural areas where infrastructure development is already lagging.

Technological Complexity and Skill Gaps

Another major restraint is the technological complexity associated with advanced cooling systems and the skill gaps in managing them. According to a study by the International SOS Foundation, over 40% of data center operators in the region reported challenges in maintaining liquid cooling systems due to a lack of trained professionals. Furthermore, the transition from traditional systems to advanced technologies requires extensive training programs, which many organizations struggle to implement effectively. Without clear communication and incentives, such as performance bonuses for early adopters, user engagement remains low, limiting the scalability of advanced cooling systems.

MARKET OPPORTUNITIES

Integration with Smart City Initiatives

A significant opportunity in the Asia Pacific data center cooling market lies in its integration with broader smart city initiatives. According to the United Nations Economic and Social Commission for Asia and the Pacific, over 60% of the region’s population will reside in urban areas by 2030, driving the need for intelligent infrastructure solutions. These integrations not only enhance operational efficiency but also reduce energy consumption by optimizing resource allocation. In addition, investments in IoT-enabled infrastructure have enabled cooling systems to communicate with other smart utilities, such as power grids and water management systems. This interconnected ecosystem fosters greater convenience for operators while generating valuable insights for decision-makers.

Expansion into Emerging Markets

Another promising opportunity is the expansion of advanced cooling systems into emerging markets, where digital infrastructure development is gaining momentum. According to the World Bank, over 50% of data center facilities in countries like Indonesia and Malaysia are located in semi-urban and rural regions, presenting untapped potential for cooling technology adoption. Additionally, the introduction of modular and scalable cooling solutions has made it feasible to deploy systems in remote areas with limited power and communication infrastructure. These innovations not only bridge the urban-rural divide but also support regional economic growth by facilitating smoother industrial operations.

MARKET CHALLENGES

Interoperability Issues Across Systems

A pressing challenge for the Asia Pacific data center cooling market is the lack of interoperability between different cooling systems and data center platforms. According to the Asian Development Bank, over 60% of cross-industry collaborations in the ASEAN region face delays due to incompatible technologies and fragmented regulatory frameworks. Furthermore, the absence of unified standards for cooling protocols complicates efforts to create seamless integration across industries. While initiatives like the ASEAN Digital Masterplan aim to address these gaps, progress remains slow due to varying levels of technological readiness among member states. These interoperability issues not only hinder regional trade but also undermine the efficiency gains promised by advanced cooling systems, posing a significant obstacle to their widespread adoption.

Resistance to Behavioral Change Among Operators

Another critical challenge is the resistance to behavioral change among operators unfamiliar with advanced cooling systems. According to the International Transport Forum, a significant portion of operators in rural areas of countries like Indonesia and Vietnam prefer traditional air conditioning due to mistrust or lack of awareness about advanced cooling benefits. Besides, the transition from traditional systems to digital platforms requires extensive training programs, which many organizations struggle to implement effectively. Without clear communication and incentives, such as performance bonuses for early adopters, user engagement remains low, limiting the scalability of advanced cooling systems.

SEGMENTAL ANALYSIS

By Solution Insights

The air conditioning segment dominated the Asia Pacific data center cooling market by commanding a 35.5% share in 2024. This leading position is because of its widespread adoption across hyperscale and colocation data centers due to its reliability and scalability. A key driver is the growing emphasis on energy efficiency. Like, advancements in inverter technology and variable refrigerant flow systems have reduced energy consumption, making air conditioning a cost-effective choice. Additionally, as per McKinsey & Company, governments across the region are promoting green data centers have accelerated the adoption of energy-efficient air conditioning systems, strengthening their dominance in the market.

The liquid cooling systems segment represented the fastest-growing in the Asia Pacific data center cooling market, with a CAGR of 18.5% from 2025 to 2033. This is fueled by the increasing deployment of high-density servers and AI-driven workloads that generate significant heat. For example, liquid cooling systems are being adopted in industries like finance and healthcare, where precision cooling is critical for maintaining performance. A crucial aspect is the integration of advanced materials and designs into liquid cooling systems. Additionally, investments in modular and scalable liquid cooling systems have enhanced their accessibility, accelerating adoption rates across the region.

By Component Insights

The solution component segment was at the forefront of the Asia Pacific data center cooling market with a substantial share in 2024. This prominence is driven by the extensive deployment of cooling technologies like air conditioning units, chillers, and liquid cooling systems across data centers. A main point is the focus on innovation and customization. Also, advancements in AI and IoT have enabled predictive maintenance and real-time monitoring, enhancing the reliability of cooling solutions. Additionally, partnerships with global manufacturers have ensured the availability of cutting-edge solutions tailored to regional needs, reinforcing their leadership position.

The services segment represented the fastest expanding component in the Asia Pacific data center cooling market, with a CAGR of 16.2%. This sudden rise is propelled by the increasing complexity of cooling systems and the need for professional support in installation, maintenance, and optimization. For example, services such as consulting and maintenance are being adopted to address challenges like system downtime and energy inefficiency. A major factor is the rise of managed services and outsourcing.

By Services Insights

The maintenance & support segment prevailed in the Asia Pacific data center cooling market by accounting for 45.4% of the total services category in 2024. This leading position is attributed to the critical need for ensuring uninterrupted operations and extending the lifespan of cooling systems. Like, many hyperscale data centers in countries like Japan and South Korea rely on regular maintenance services to prevent system failures and reduce energy consumption. An important element is the growing emphasis on predictive maintenance. Also, advancements in AI and IoT have enabled real-time monitoring and fault detection, reducing downtime. Additionally, partnerships with specialized service providers have ensured high-quality support, reinforcing the segment's dominance.

The installation & deployment segment is witnessing a rapid expansion in the Asia Pacific data center cooling market, with a CAGR of 19.8%. This development is propelled by the increasing number of new data center projects and the complexity of integrating advanced cooling technologies. For instance, installation services are being adopted to ensure seamless deployment of liquid cooling systems in high-density environments. A significant point is the rise of modular and prefabricated data centers. Additionally, investments in training programs have enhanced the availability of skilled professionals, accelerating adoption rates.

By Type of Cooling Insights

The room-based cooling segment is expected to have the maximum influence in the Asia Pacific data center cooling market, with a 60% share in 2024. This control over the market is credited to its cost-effectiveness and ease of implementation, particularly in traditional data centers. Similarly, a notable share of small and medium-sized data centers in countries like India and Thailand rely on room-based cooling systems to maintain ambient temperatures and ensure operational continuity. A key driver is the growing emphasis on scalability and flexibility. Like, advancements in airflow management and containment systems have improved the efficiency of room-based cooling, reducing energy consumption.

The row/rack-based cooling segment is quickly advancing in the Asia Pacific data center cooling market, with a CAGR of 20.3%. This growth is fueled by the increasing deployment of high-density racks and AI-driven workloads that require targeted cooling solutions. For example, row/rack-based systems are being adopted in hyperscale facilities to enhance precision cooling and reduce energy costs. A major aspect is the integration of advanced designs and materials. Additionally, investments in smart cooling technologies have enhanced scalability, driving rapid adoption across the region.

REGIONAL ANALYSIS

China is leading the Asia Pacific data center cooling market by contributing 35.5% to the regional share in 2024. This prominence is driven by the country’s robust digital economy and aggressive investments in hyperscale data centers. According to Deloitte, China spent over $10 billion on cooling technologies in 2023, enabling seamless operations across industries like e-commerce and cloud computing.

Japan holds a notable market share. It is because of its expertise in robotics and advanced manufacturing, which require precision cooling. Like, Japan’s adoption rate is high, supported by subsidies and user-friendly policies.

India is having an impressive rise in the market, as per the Ministry of Electronics and Information Technology. Its prominence is underpinned by the growing demand for colocation facilities and government initiatives promoting digital infrastructure.

South Korea is holding a decent market share. This is fueled by the widespread adoption of AI and IoT, which drives the need for advanced cooling solutions. Also, South Korea’s investments in smart cooling technologies have set benchmarks for energy efficiency.

Singapore is another key player. It is driven by its status as a global data hub and its focus on sustainability. Like, Singapore’s adoption of liquid cooling systems has reduced energy consumption, underscoring its commitment to green practices.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Schneider Electric, Vertiv Group Corp., Stulz GmbH, Rittal GmbH & Co. KG, Huawei Technologies, Fujitsu Limited, Eaton Corporation, Hitachi Ltd., Daikin Industries, Mitsubishi Electric, Johnson Controls, Delta Electronics, Asetek, CoolIT Systems, and Lennox International are some of the key market players in the Asia Pacific data center cooling market.

The Asia Pacific data center cooling market is characterized by intense competition, driven by the presence of global giants like Schneider Electric, Vertiv Co., and Rittal GmbH & Co. KG, alongside regional players striving to carve out their niche. The competitive landscape is shaped by innovation, customization, and strategic collaborations, with companies vying to offer scalable and interoperable solutions. A key differentiator is the focus on sustainability, with firms adopting green technologies to align with environmental goals. Additionally, partnerships with local stakeholders and investments in digital tools are critical for addressing the unique demands of the region. Regulatory mandates promoting energy-efficient practices further intensify competition, requiring participants to adopt agile strategies. Despite challenges like high implementation costs and technological complexities, the market fosters innovation and drives continuous improvement, benefiting both operators and end-users.

Top Players in the Asia Pacific Data Center Cooling Market

Schneider Electric

Schneider Electric is a leading player in the Asia Pacific data center cooling market, renowned for its innovative solutions that integrate energy efficiency and sustainability. The company’s contribution to the global market lies in its ability to deliver scalable and modular cooling systems tailored to diverse data center needs. By leveraging IoT and AI-driven technologies, Schneider Electric ensures real-time monitoring and predictive maintenance, enhancing operational reliability. Its focus on eco-friendly designs aligns with global environmental goals, making it a trusted partner for hyperscale and colocation facilities.

Vertiv Co.

Vertiv Co. stands out for its comprehensive portfolio of cooling solutions, ranging from room-based systems to advanced liquid cooling technologies. The company’s global influence is evident in its ability to cater to high-density environments, particularly in industries like finance and healthcare. In the Asia Pacific region, Vertiv has strengthened its presence by offering customized solutions that align with regional demands for energy-efficient and cost-effective thermal management. Its emphasis on precision cooling and seamless integration has earned it a reputation as a leader in the market.

Rittal GmbH & Co. KG

Rittal GmbH & Co. KG is a key player in the Asia Pacific data center cooling market, known for its expertise in modular and scalable cooling systems. The company’s global impact stems from its ability to deliver robust and reliable solutions that address the growing complexity of data center operations. In the region, Rittal has differentiated itself by focusing on compact and energy-efficient designs, catering to emerging markets. Its commitment to digital transformation and Industry 4.0 aligns with the increasing demand for smart cooling solutions.

Top Strategies Used by Key Players in the Asia Pacific Data Center Cooling Market

Focus on Sustainability and Energy Efficiency

A major strategy adopted by key players is the emphasis on sustainability and energy efficiency to meet evolving customer expectations and regulatory requirements. Companies are integrating advanced technologies like AI, IoT, and renewable energy sources into their cooling systems to reduce carbon footprints and operational costs. For instance, adopting liquid cooling systems and free cooling techniques allows operators to achieve significant energy savings while maintaining optimal performance.

Strategic Partnerships and Collaborations

Another significant strategy is forming strategic partnerships with governments, technology providers, and industry stakeholders. These collaborations enable companies to share expertise, access funding, and develop localized solutions that align with regional infrastructure needs. For example, partnering with local manufacturers facilitates customization and scalability, enhancing user adoption. Additionally, alliances with global tech firms ensure access to cutting-edge innovations, strengthening competitive positioning. Such partnerships are critical for scaling operations and addressing the diverse needs of the Asia Pacific region, which spans both developed and emerging economies.

Emphasis on Innovation and Customization

The third key strategy involves prioritizing innovation and customization to meet the unique demands of different data center environments. Companies are developing modular and scalable cooling solutions that can be tailored to specific requirements, such as high-density racks or AI-driven workloads. Simultaneously, they are focusing on enhancing user convenience through features like real-time monitoring, predictive maintenance, and remote management.

RECENT MARKET DEVELOPMENTS

- In April 2024, SS8 Networks, a provider of lawful interception solutions, partnered with European cybersecurity firm CyberShield to enhance its data monitoring capabilities. This collaboration is anticipated to strengthen SS8’s position in the European market by offering more robust compliance tools.

- In June 2023, Utimaco, a leading provider of encryption solutions, acquired a German-based lawful interception software developer. This acquisition enabled Utimaco to expand its portfolio and address the growing demand for secure interception technologies.

- In September 2022, Verint Systems launched a new AI-driven analytics platform for lawful interception in Europe. This move was aimed at improving real-time data processing and enhancing investigative accuracy for law enforcement agencies.

- In January 2023, Cisco Systems integrated advanced lawful interception features into its networking solutions, targeting European telecom operators. This initiative reinforced Cisco’s leadership in providing a secure communication infrastructure.

- In November 2022, Aqsacom, a provider of regulatory compliance solutions, signed a strategic agreement with a European government agency to deploy a nationwide lawful interception system. This project is expected to bolster Aqsacom’s presence in the region and set new standards for data security.

MARKET SEGMENTATION

This research report on the Asia Pacific data center cooling market is segmented and sub-segmented into the following categories.

By Solution

- Air Conditioning

- Liquid Cooling System

By Component

- Solution

- Services

By Services

- Maintenance & Support

- Installation & Deployment

By Type of Cooling

- Room-based Cooling

- Row/Rack-based Cooling

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What factors are driving growth in the Asia Pacific Data Center Cooling Market?

Key drivers for the Asia Pacific Data Center Cooling Market include rapid data center expansion, increased demand for cloud services, the rise of hyperscale facilities, and a growing focus on energy efficiency and sustainability.

What are the emerging trends in the Asia Pacific Data Center Cooling Market?

Trends in the Asia Pacific Data Center Cooling Market include liquid cooling adoption, AI-driven thermal management, modular cooling units, and increased use of renewable energy-powered cooling systems.

What is the growth outlook for the Asia Pacific Data Center Cooling Market?

The Asia Pacific Data Center Cooling Market is expected to grow significantly due to the expansion of digital infrastructure, increasing hyperscale data center projects, and stricter regulations on energy efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]