Asia Pacific Data Center Market Research Report – Segmented By Component (Hardware, Software, Services), Type, Server Rack Density, Data Center Redundancy, PUE, Design, Tier Level, Enterprise Size, End-Use , Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Data Center Market Size

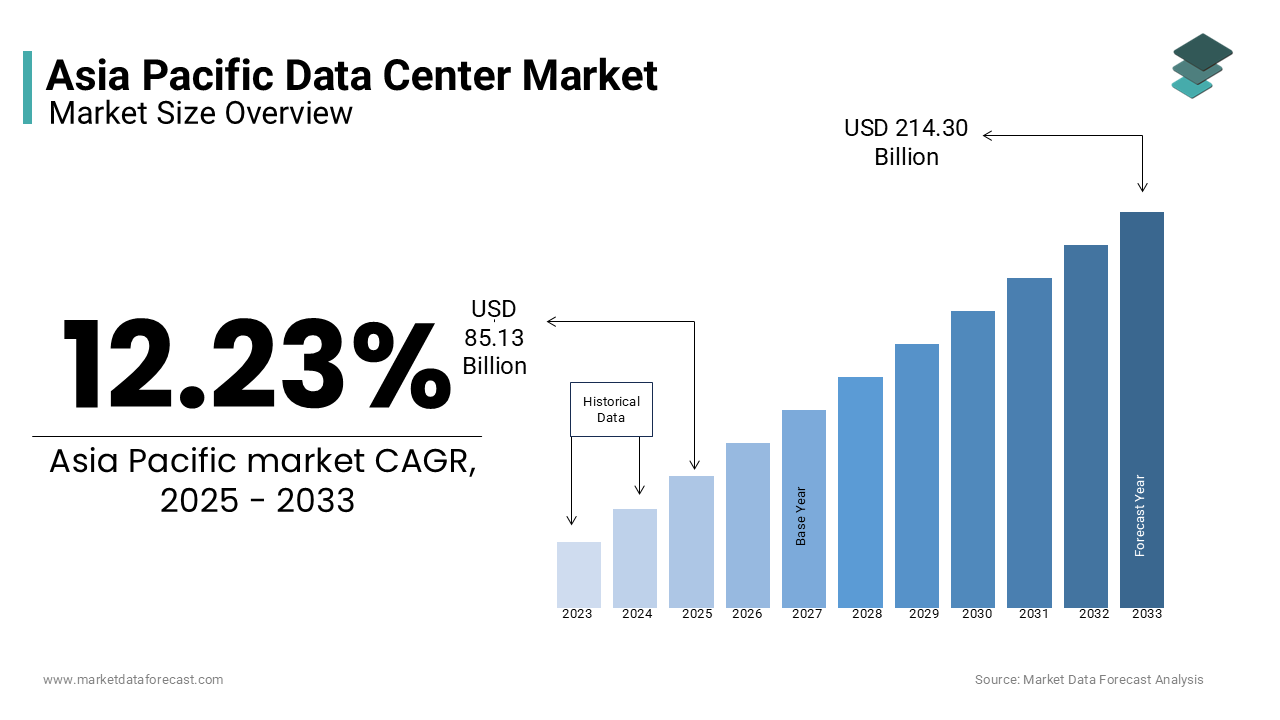

The Asia Pacific data center market was worth USD 75.83 billion in 2024. The Asia Pacific market is expected to reach USD 214.30 billion by 2033 from USD 85.13 billion in 2025, rising at a CAGR of 12.23% from 2025 to 2033.

The Asia Pacific data center market growth is likely to be driven by the region’s rapid digital transformation and increasing reliance on cloud computing. Countries like China, India, and Singapore are at the forefront, with governments actively investing in smart city initiatives and digital infrastructure. Moreover, the proliferation of IoT devices and 5G networks is amplifying demand for robust data storage and processing capabilities. According to Cisco, the number of connected devices in the region is expected to exceed 5 billion by 2024, necessitating scalable data center solutions. In Singapore, Equinix operates one of the largest data center hubs in Southeast Asia, catering to enterprises requiring low-latency connectivity.

MARKET DRIVERS

Surge in Cloud Computing Adoption

The widespread adoption of cloud computing is a major driver propelling the Asia Pacific data center market forward. For example, in Japan, over 70% of businesses have adopted hybrid cloud models, as per Fujitsu, which is creating a surge in demand for data center facilities to support these operations. Additionally, hyperscale data centers are being established to meet the needs of global cloud providers like Amazon Web Services (AWS) and Microsoft Azure.

Rising Internet Penetration and Digital Transformation

Rising internet penetration and the push for digital transformation across industries are also significant drivers. For instance, in Indonesia, the government’s Go Digital Vision program has spurred investments in data centers to support e-commerce and fintech startups, as per the Indonesian Investment Coordinating Board. Furthermore, a study by PwC states that companies undergoing digital transformation spend 25% more on data center infrastructure, which is reflecting the growing importance of these facilities in enabling business innovation and efficiency.

MARKET RESTRAINTS

High Energy Consumption and Environmental Concerns

One of the primary restraints of the Asia Pacific data center market is the high energy consumption associated with these facilities, raising environmental concerns. According to the Uptime Institute, data centers consume approximately 3% of the region’s total electricity, with cooling systems accounting for over 40% of energy usage. In countries like Singapore, where land and energy resources are limited, this poses a significant challenge. As per the Singapore Green Plan 2030, the government mandates stricter energy efficiency standards, pushing operators to adopt sustainable practices. However, transitioning to green technologies requires substantial investment, which can deter smaller players from entering the market.

Stringent Regulatory Frameworks

Another restraint is the complex and often fragmented regulatory frameworks governing data centers across the region. According to Deloitte, over 60% of operators face challenges in navigating inconsistent policies related to data localization and cybersecurity. For example, in China, the Cybersecurity Law mandates that all data generated within the country must be stored locally, creating operational complexities for multinational companies. Similarly, in Australia, stringent compliance requirements under the Privacy Act increase operational costs, as noted by the Australian Cyber Security Centre.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging economies like Vietnam and the Philippines present untapped opportunities for data center operators. The data center investments in Southeast Asia is explicitly growing from past few years due to the rising demand for cloud services and e-commerce platforms. These markets offer immense potential for operators seeking to expand their footprint in the region.

Adoption of Edge Computing Technologies

The growing adoption of edge computing presents another significant opportunity for the Asia Pacific data center market. According to Accenture, edge computing can reduce latency by up to 50% by making it ideal for applications like autonomous vehicles and smart cities. For example, in South Korea, SK Telecom has partnered with local governments to deploy edge data centers by enhancing real-time data processing capabilities. The enterprises in the region plan to integrate edge computing into their operations by 2024, which is creating demand for specialized data center infrastructure. This trend positions edge computing as a transformative force in the market.

MARKET CHALLENGES

Land and Resource Constraints

A significant challenge facing the Asia Pacific data center market is the scarcity of land and critical resources in densely populated urban areas. In Singapore, the government has imposed a moratorium on new data center developments due to land and energy constraints, as per the Infocomm Media Development Authority. These limitations force operators to explore alternative locations or adopt modular designs, which can increase costs and complicate scalability efforts.

Cybersecurity Threats and Data Breaches

Cybersecurity threats and data breaches pose another major challenge for the data center market. For example, in Australia, over 40% of data centers reported cyberattacks in 2022, as per the Australian Cyber Security Centre. These incidents not only disrupt operations but also erode customer trust, leading to financial losses. Additionally, the lack of skilled cybersecurity professionals exacerbates the problem, as noted by LinkedIn, which reports a 35% gap between demand and supply of experts in the region.

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment was the largest and held 55.4% of the Asia Pacific data center market share in 2024 with the increasing demand for servers, storage systems, and networking equipment to support growing workloads. According to Dell Technologies, over 70% of enterprises in the region have upgraded their hardware infrastructure to accommodate cloud computing and AI applications. For instance, in Japan, Fujitsu has deployed high-performance servers in hyperscale data centers, enabling faster processing speeds for financial institutions. Another factor is the rise in IoT devices, which require robust hardware to manage data-intensive operations. As per Cisco, IoT devices in the region are expected to exceed 5 billion by 2024, which is creating a surge in demand for scalable hardware solutions.

The services segment is likely to register a CAGR of 18.3% in the next coming years. This growth is fueled by the rising adoption of managed services and consulting to optimize data center operations. According to a report by PwC, over 60% of enterprises in Southeast Asia outsource data center management to reduce operational costs. For example, in Singapore, Equinix offers colocation services to global tech giants by helping them achieve energy efficiency and scalability. Additionally, the integration of AI-driven analytics into service offerings enhances predictive maintenance capabilities. These innovations position services as a transformative force, enabling businesses to focus on core competencies while ensuring seamless IT infrastructure management.

By Type Insights

The hyperscale segment dominated the Asia Pacific data center market and held 55.4% of the share in 2024 owing to the proliferation of cloud computing and the need for large-scale infrastructure to support enterprise workloads. For instance, in China, Alibaba Cloud operates one of the largest hyperscale data centers, which is catering to over 2 million businesses. Another factor is the rise of AI and big data analytics, which require high-performance computing capabilities. As per Intel, hyperscale data centers reduce latency by 40% by making them ideal for real-time applications like e-commerce and fintech.

The edge data centers segment is likely to grow with a CAGR of 22.5% in the next coming years with the increasing adoption of IoT and 5G technologies, which demand low-latency processing. Many enterprises in the region plan to integrate edge computing into their operations by 2025. These developments position edge data centers as a critical enabler of smart city initiatives and real-time applications which is driving rapid market expansion.

By Server Rack Density Insights

The 10-19kW server rack density segment was accounted in holding for 35.5% of the Asia Pacific data centers market share in 2024 owing to its balance between performance and energy efficiency, making it ideal for mid-sized enterprises. According to Schneider Electric, this density range supports over 60% of workloads in industries like retail and healthcare. For instance, in Malaysia, hospitals use 10-19kW racks to manage electronic health records by ensuring reliable data access. Another factor is the growing adoption of hybrid cloud models, which require scalable yet cost-effective solutions.

The >50kW segment is projected to witness a CAGR of 25.7% in the next coming years with the rise of AI and machine learning applications, which demand high-density racks for intensive computations. For example, in Japan, NTT Data uses >50kW racks to power AI-driven analytics platforms by improving processing speeds by 30%. Additionally, a report by Accenture highlights that hyperscale data centers are increasingly adopting high-density racks to meet evolving demands. These trends position >50kW racks as a cornerstone of next-generation data center infrastructure.

By Data Center Redundancy Insights

The N+1 redundancy model dominated the Asia Pacific data center market with 45.4% of share in 2024 due to its cost-effectiveness and reliability by making it suitable for small to medium-sized enterprises. According to Siemens, over 70% of colocation facilities in the region adopt N+1 configurations to ensure uninterrupted operations. For instance, in Thailand, True IDC uses N+1 redundancy to support e-commerce platforms by reducing downtime by 35%.

The 2N redundancy model is swiftly emerging with a CAGR of 20.3% in the next coming years. The growth of the segment is driven by the increasing demand for mission-critical applications in industries like finance and healthcare.

By PUE Insights

The 1.5 - 2.0 PUE range segment held 50.4% of the Asia Pacific data center market share in 2024 owing to its widespread adoption in traditional data centers, where energy efficiency is balanced with operational costs.

The less than 1.2 PUE segment is anticipated to register a CAGR of 24.5% during the forecast period. The growth of the segment is fueled by the adoption of advanced cooling technologies and renewable energy sources. For example, in Singapore, Keppel Data Centers use liquid cooling systems to achieve sub-1.2 PUE levels by reducing energy costs by 30%. Additionally, a report by Accenture highlights that hyperscale facilities are increasingly targeting ultra-efficient designs to meet environmental standards. These innovations position sub-1.2 PUE systems as a benchmark for sustainable data center operations.

By Design Insights

The traditional data center designs segment was accounted in holding a prominent share of the Asia Pacific data center market share in 2024 due to their widespread adoption in established industries like banking and government. According to IBM, over 70% of legacy systems in Japan rely on traditional designs to ensure compatibility with existing infrastructure. For instance, in Indonesia, state-owned enterprises use traditional facilities to manage public services, ensuring stability and reliability.

The modular data centers segment is to grow with an anticipated CAGR of 23.7% during the forecast period. The growth of the segment is fueled by their flexibility and scalability, which is making them ideal for emerging markets. For example, in the Philippines, Globe Telecom uses modular designs to deploy data centers in rural areas that is reducing deployment times by 50%.

By Tier Level Insights

Tier 3 data centers segment dominated the Asia Pacific data center market with 50.4% of the share in 2024 due to their balance between reliability and cost-effectiveness, which is making them ideal for enterprises requiring minimal downtime. For instance, in Malaysia, Telekom Malaysia operates Tier 3 data centers to cater to government agencies, which is reducing operational disruptions by 40%. Another factor is regulatory compliance; as highlighted by the Asian Development Bank, Tier 3 designs align with regional standards for energy efficiency and redundancy, ensuring long-term viability.

Tier 4 data centers segment is likely to exhibit a CAGR of 21.5% in the next coming years with the increasing demand for mission-critical infrastructure in industries like BFSI and healthcare. As per a report by Deloitte, Tier 4 designs enhance disaster recovery capabilities by 50%, which is making them indispensable for enterprises prioritizing resilience.

By Enterprise Size Insights

The large enterprises dominated the Asia Pacific data center market with a significant share in 2024 due to their ability to invest in advanced infrastructure and hyperscale facilities. According to Microsoft, over 80% of cloud workloads in the region are processed by large enterprises, underscoring their reliance on robust data center solutions. For instance, in China, Alibaba Cloud operates one of the largest data centers, which is catering to global enterprises and reducing latency by 30%. Another factor is the adoption of AI and big data analytics, which require scalable systems.

Small and medium enterprises (SMEs) segment is emerging with a CAGR of 19.8% in the foreseen years due to the rising adoption of cloud services and colocation facilities by enabling SMEs to access enterprise-grade infrastructure at affordable costs. For example, in Singapore, Equinix offers tailored solutions for SMEs by reducing IT overheads by 40%, as noted by the Infocomm Media Development Authority.

By End-use Insights

The cloud service providers segment was the largest in holding 42.4% of the Asia Pacific data center market share in 2024 with the exponential growth of cloud computing and the need for scalable infrastructure. According to Amazon Web Services (AWS), over 70% of enterprises in the region have migrated workloads to the cloud, creating a surge in demand for data centers. For instance, in India, Reliance Jio operates hyperscale facilities to support its cloud platform, processing over 1 billion transactions daily. Another factor is the rise of IoT and AI applications, which require high-performance computing capabilities.

The healthcare sector is likely to register a CAGR of 22.3% in the next coming years with the increasing adoption of telemedicine and electronic health records (EHRs). For example, in Australia, hospitals use data centers to manage over 10 million patient records annually by ensuring secure and reliable access, as per the Australian Digital Health Agency. Additionally, a report by Deloitte states that healthcare providers leveraging data centers improve diagnostic accuracy by 30% by enhancing patient outcomes.

REGIONAL ANALYSIS

China led the Asia Pacific data center market by holding 30.4% of share in 2024 owing to its massive population and rapid digital transformation initiatives. The Ministry of Industry and Information Technology reports that over 200 new data centers were established in 2022. For instance, Alibaba Cloud operates one of the largest hyperscale facilities by catering to over 2 million businesses. Additionally, advancements in 5G technology have enhanced data center capabilities, as per Huawei, which reports a 40% improvement in service delivery speeds.

India data center market held 20.4% of share in 2024 with its vast population and significant internet penetration. The Ministry of Electronics and Information Technology reports that over 700 million internet users create immense demand for data storage and processing. Initiatives like the Digital India campaign have propelled adoption, with companies like Reliance Jio investing heavily in hyperscale facilities. Additionally, private players like CtrlS operate Tier 4 data centers, serving over 10,000 enterprises. These efforts position India as a hub for data center innovation and accessibility.

Japan’s data center market growth is driven due to its aging population and stringent healthcare regulations. The Act on Medical Care Support mandates telemedicine adoption, benefiting over 30% of elderly patients. According to Fujitsu, telehealth platforms have reduced travel time for patients by 50% by improving accessibility. Additionally, partnerships with tech giants like Sony have led to innovations in remote diagnostics by positioning Japan as a leader in advanced data center solutions.

Singapore’s dominance is driven by its Smart Nation initiative and advanced ecosystem. The Ministry of Health reports that over 50% of citizens use telemedicine services, facilitated by platforms like MaNaDr. Additionally, collaborations with global players like IBM have enhanced AI-driven diagnostics, improving patient outcomes. According to Accenture, Singapore’s data center market is projected to grow by 30% annually, reflecting its commitment to leveraging technology for transformation.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

NTT Communications, Equinix, Digital Realty, ST Telemedia Global Data Centres, China Telecom, China Unicom, Alibaba Cloud, Tencent Cloud, and Amazon Web Services (AWS are some of the key market players in the data center market.

The Asia Pacific data center market is highly competitive, characterized by the presence of global giants like Equinix and NTT Ltd., alongside regional innovators like Alibaba Cloud. Global players leverage their technological expertise and extensive networks to cater to large-scale enterprises, while regional players focus on affordability and accessibility to serve underserved communities. The competitive landscape is shaped by rapid advancements in AI, IoT, and cloud computing, which are integrated into data center platforms to enhance efficiency. Strategic collaborations with governments and ISPs further intensify competition, as firms aim to expand their reach. For instance, partnerships with local healthcare providers have become a focal point for gaining market traction. Additionally, regulatory alignment and data security measures are critical differentiators by ensuring compliance with stringent healthcare laws.

Top Players in the Asia Pacific Data Center Market

Equinix

Equinix is a global leader in the Asia Pacific data center market, offering colocation and interconnection services to enterprises across industries. The company operates over 50 data centers in the region, catering to cloud service providers, financial institutions, and telecom companies. In 2023, Equinix launched its xScale data centers in partnership with AWS and Microsoft Azure, enhancing hyperscale capabilities for cloud workloads. Additionally, the company expanded its footprint in Singapore by acquiring land for a new facility, supporting the growing demand for digital infrastructure.

NTT Ltd.

NTT Ltd. plays a pivotal role in the Asia Pacific data center market through its robust portfolio of hyperscale and modular facilities. The company serves over 10,000 clients, including large enterprises and SMEs, by providing tailored solutions like managed hosting and disaster recovery. In 2022, NTT unveiled its largest hyperscale campus in Malaysia, equipped with advanced cooling systems to improve energy efficiency. Furthermore, the company partnered with local governments in Japan to deploy edge data centers, which is reducing latency for IoT applications.

Alibaba Cloud

Alibaba Cloud dominates the Asia Pacific data center market by leveraging its expertise in cloud computing and AI-driven analytics. The company operates hyperscale facilities in China, India, and Indonesia, supporting e-commerce platforms and fintech startups. In 2023, Alibaba Cloud introduced its Carbon-Free Data Center initiative, aiming to achieve net-zero emissions by 2030. Additionally, the company collaborated with local ISPs in Thailand to enhance connectivity for rural businesses. These strategic moves position Alibaba Cloud as a leader in driving green and inclusive digital transformation.

Top Strategies Used by Key Market Participants

Key players in the Asia Pacific data center market employ strategies like partnerships, sustainability initiatives, and localization to strengthen their positions. Collaborations with cloud providers and ISPs enable scalable infrastructure deployment. For instance, partnerships with hyperscalers like AWS and Microsoft Azure ensure seamless integration of workloads. Sustainability initiatives focus on adopting renewable energy and advanced cooling technologies to reduce carbon footprints. Localization efforts include compliance with regional regulations and multilingual support. Acquisitions also play a critical role; acquiring niche firms enhances capabilities.

RECENT MARKET DEVELOPMENTS

- In April 2023, Equinix acquired land in Singapore to build a new hyperscale facility, which is enhancing its capacity to support cloud workloads and enterprise clients.

- In July 2023, NTT Ltd. launched its largest hyperscale campus in Malaysia by featuring advanced cooling systems to improve energy efficiency by 30%.

- In September 2022, Alibaba Cloud introduced its Carbon-Free Data Center initiative by aiming to achieve net-zero emissions by 2030 and aligning with global sustainability goals.

- In January 2024, Keppel Data Centers partnered with Shell Energy to power its facilities in Singapore using renewable energy, which is reducing its carbon footprint significantly.

- In November 2023, AirTrunk expanded its Sydney data center campus, adding 100MW of capacity to meet the growing demand for cloud services in Australia and New Zealand.

MARKET SEGMENTATION

This research report on the Asia Pacific data center market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Type

- On-premise

- Hyperscale

- HPC

- Colocation

- Edge

By Server Rack Density

- <10kW

- 10-19kW

- 20-29kW

- 30-39kW

- 40-49k

- >50kW

By Data Center Redundancy

- N+1

- 2N

- N+2

- N

By PUE

- Less than 1.2

- 1.2 - 1.5

- 1.5 - 2.0

- Greater than 2.0

By Design

- Traditional

- Containerized

- Modular

By Tier Level

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

By End-use

- Cloud Service Provider

- Technology Provider

- Telecom,

- Healthcare

- BFSI

- Retail & E-commerce

- Entertainment & Media

- Energy

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the major trends in the Asia Pacific Data Center Market?

Trends in the Asia Pacific Data Center Market include the rise of green data centers, edge computing, artificial intelligence integration, and large-scale cloud infrastructure deployment.

What is the growth outlook for the Asia Pacific Data Center Market?

The Asia Pacific Data Center Market is expected to witness strong growth due to increasing demand for digital services, cloud computing, and data storage solutions across industries.

Which industries drive demand in the Asia Pacific Data Center Market?

Major industries fueling the Asia Pacific Data Center Market include BFSI, IT & Telecom, Government, Healthcare, Retail, and Media & Entertainment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]