Asia Pacific Dermal Fillers Market Research Report – Segmented By Product (Absorbable, Non-absorbable), Material, Application, End-Use, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia-Pacific Dermal Fillers Market Size

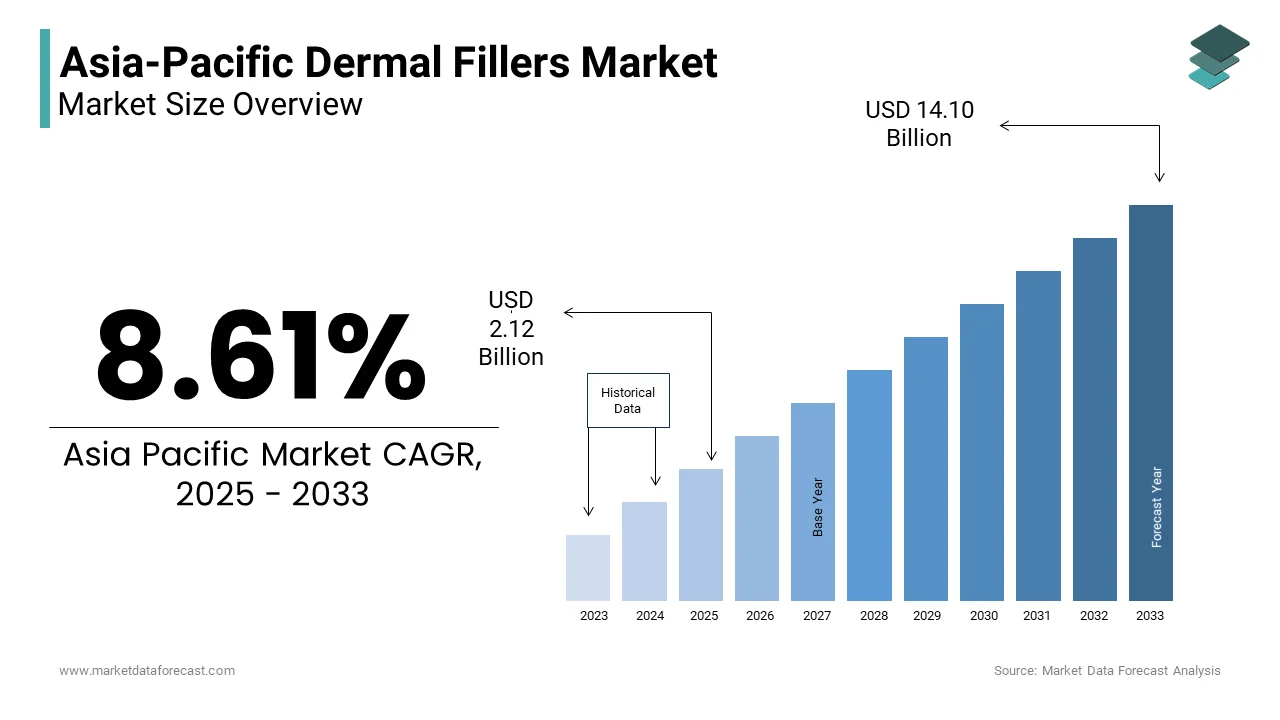

The asia-pacific dermal fillers market size was valued at USD 1.95 billion in 2024. The asia-pacific dermal fillers market size is expected to have 8.61% CAGR from 2025 to 2033 and be worth USD 4.10 billion by 2033 from USD 2.12 billion in 2025.

MARKET DRIVERS

Rising Awareness and Acceptance of Aesthetic Procedures

The growing awareness and acceptance of aesthetic procedures are key drivers propelling the Asia Pacific dermal fillers market. For instance, hyaluronic acid-based fillers account for a significant share of all non-surgical cosmetic procedures, driven by their minimal downtime and natural results. Social media platforms further amplify adoption. A study notes that influencers and celebrities in India and China promote dermal fillers, reaching a notable number of users on platforms like Instagram and TikTok. This trend fosters a culture of self-care, encouraging younger demographics to explore aesthetic enhancements.

Advancements in Filler Technologies

Technological advancements in dermal fillers are transforming the market landscape, enhancing safety, efficacy, and patient satisfaction. Similarly, next-generation fillers incorporating biocompatible materials have reduced adverse reactions , making them more appealing to consumers. Additionally, the role of precision injectables in targeting specific facial areas, improving outcomes. Collaborations between biotech firms and academic institutions further accelerate innovation, ensuring these advancements meet evolving consumer demands while maintaining regulatory compliance.

MARKET RESTRAINTS

High Costs and Limited Accessibility

One of the primary restraints hindering the Asia Pacific dermal fillers market is the high cost of treatments, which limits accessibility for many consumers. In India, a small fraction of rural consumers can afford premium fillers, despite their proven efficacy. Limited insurance coverage further exacerbates affordability challenges. A study by the Asian Development Bank notes that only small percentage of aesthetic procedures in Southeast Asia are covered by health insurance plans, restricting access to advanced treatments. This financial barrier constrains market penetration, particularly in underserved regions where demand is rising but affordability remains a concern.

Stringent Regulatory Frameworks

Another critical restraint is the stringent regulatory frameworks governing the approval and use of dermal fillers. For instance, China’s National Medical Products Administration mandates extensive clinical trials, often requiring data from local populations to ensure safety and efficacy. Similarly, India’s Central Drugs Standard Control Organization imposes rigorous post-market surveillance requirements, increasing compliance costs for manufacturers. These delays hinder patient access to cutting-edge fillers, particularly in countries with limited domestic R&D capabilities.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Expanding dermal filler services into emerging markets presents significant opportunities for growth in the Asia Pacific region. Governments and private players are addressing this gap through franchised clinics and mobile services. For example, Thailand’s Ministry of Public Health collaborates with NGOs to provide subsidized treatments, achieving an increase in patient enrollment. Public-private partnerships further amplify efforts. The Philippines’ Department of Health supports training programs for dermatologists, ensuring safe and effective procedures. These strategies position emerging markets as key growth drivers, unlocking new revenue streams while meeting rising consumer demands.

Integration with Medical Tourism

Medical tourism offers immense potential for the Asia Pacific dermal fillers market, particularly in countries like South Korea, Thailand, and India. Also, South Korea attracts a substantial number of medical tourists annually, with aesthetic procedures accounting for notable share of total visits. Government initiatives further accelerate adoption. Thailand’s Board of Investment provides tax incentives to clinics offering dermal fillers, ensuring competitive pricing and high-quality services.

MARKET CHALLENGES

Limited Consumer Awareness in Rural Areas

A significant challenge facing the Asia Pacific dermal fillers market is the limited awareness and understanding of these treatments among rural populations. Misconceptions about safety and efficacy persist, particularly in regions with low literacy rates and minimal outreach programs. For instance, Indonesia’s Ministry of Health highlights that a small fraction of rural clinics offer aesthetic treatments due to a lack of trained professionals and resources. A study exhibits the need for educational campaigns to bridge this gap, ensuring informed decision-making.

Shortage of Skilled Practitioners

Another pressing challenge is the shortage of skilled practitioners capable of administering dermal fillers safely and effectively. According to the Asian Society of Aesthetic Plastic Surgery, a significant percentage of dermatologists in rural Southeast Asia are trained in advanced injection techniques, limiting accessibility. Training programs remain insufficient to meet demand. A report by Deloitte Insights notes that less than 5% of medical graduates in the region specialize in aesthetic medicine, further exacerbating workforce shortages.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.3% |

|

Segments Covered |

By Product, Material, Application, End-Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Cutera Inc, Galderma SA, Teoxane Laboratories, Sinclair Pharma, Revance Therapeutics, Elan Aesthetics Inc, Vital Esthetique Laboratories, Merz Pharma GmbH and Co. KGaA, Bioxis Pharmaceutical, and AbbVie Laboratories, and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The absorbable fillers segment dominated the Asia Pacific dermal fillers market by capturing a substantial portion of the total share in 2024. Their prominence is due to their biocompatibility and safety, making them ideal for temporary aesthetic enhancements. Consumer preferences further amplify adoption. Additionally, government regulations favour these products, ensuring broader accessibility. These factors shows how absorbable fillers balance innovation and safety, maintaining their leadership in the region.

Non-absorbable fillers segment is projected to grow at a CAGR of 12% from 2025 to 2033. This rapid expansion is fueled by increasing demand for long-lasting solutions and advancements in material science. Urbanization also plays a role. Furthermore, their role in addressing lipoatrophy, targeting a notable increase in patient satisfaction by 2030.

By Material Type Insights

The hyaluronic acid (HA) segment commanded the Asia Pacific dermal fillers market by holding a 65.4% share in 2024. This is supported by its versatility and safety profile, making it suitable for a wide range of applications, including wrinkle reduction and lip enhancement. For instance, HA-based fillers achieve high patient satisfaction rates, ensuring widespread adoption. Government support further bolsters adoption. Like, HA fillers account for a significant portion of all non-surgical procedures in South Korea, supported by subsidies.

The Poly-L-lactic acid segment is predicted to grow at a CAGR of 15%. This quick expansion is fueled by increasing awareness of collagen-stimulating fillers and their ability to provide long-lasting results. For example, Thailand’s Ministry of Public Health emphasizes that poly-L-lactic acid treatments have increased over the past five years, driven by their efficacy in facial corrections. Public-private partnerships further accelerate adoption. New Zealand’s Dermatology Association collaborates with biotech firms to subsidize treatments, achieving a reduction in procedure costs.

By Application Insights

The Wrinkle reduction segment accounted for 40.6% of the Asia Pacific dermal fillers market in 2024. It is due to the aging population and rising consumer awareness of anti-aging solutions. For instance, a significant number of people aged 45 and above seek aesthetic treatments, creating a robust demand for wrinkle-reducing fillers. Government initiatives further amplify adoption. Also, public awareness campaigns have increased early intervention rates, ensuring timely access to advanced treatments. These efforts demonstrate how wrinkle reduction remains a critical focus area, driving the adoption of innovative solutions.

Lip enhancement is projected to grow at a CAGR of 18%. This rapid expansion is fueled by increasing social media influence and shifting beauty standards. Urbanization also plays a role. Additionally, South Korea’s Ministry of Health supports training programs for practitioners, ensuring safe and effective procedures. These trends position lip enhancement as the fastest-growing application.

By End-Use Insights

The dermatology clinics segment led the Asia Pacific dermal fillers market by capturing a 55.3% of the total share in 2024. This leading position is because of their specialized expertise and ability to offer personalized treatments, ensuring high patient satisfaction. Like, a significant portion of dermal filler procedures are performed in dermatology clinics due to their reputation for safety and efficacy. Government support further bolsters adoption. Also, public-private partnerships have increased clinic accessibility notably, particularly in urban areas.

The hospitals are projected to grow at a CAGR of 14%, as per Deloitte Insights. This swift development is caused by increasing demand for integrated healthcare services and collaborations with global brands. For example, China’s National Medical Products Administration mandates that hospitals offering dermal fillers meet stringent safety standards, boosting consumer confidence. These dynamics position hospitals as the fastest-growing end-use segment.

COUNTRY LEVEL ANALYSIS

South Korea led the Asia Pacific dermal fillers market with a 25.6% share in 2024. It is driven by the country’s reputation as a global hub for aesthetic procedures. Government initiatives, such as tax incentives for clinics, ensure affordability and accessibility, reducing costs. Innovation hubs further amplify adoption. Seoul’s Gangnam district hosts a large number of clinics specializing in advanced fillers, ensuring cutting-edge treatments. Also, collaborations with international firms ensure access to premium technologies, positioning South Korea as a leader in aesthetic innovation.

China commands a notable market share which is propelled by its aging population and rising disposable incomes. Government support further drives adoption. China’s National Medical Products Administration expedites approval processes for innovative products, reducing timelines. Further, public awareness campaigns have increased early intervention rates, ensuring timely access to advanced treatments.

Japan remains a key player in the market. This is driven by its focus on precision medicine and government support. Research initiatives further drive adoption. Japan’s Strategic Innovation Promotion Program funds a significant portion of clinical trials annually, focusing on next-generation materials. Additionally, public awareness campaigns have increased early diagnosis rates, ensuring broader access to innovative solutions.

India holds an smaller market share and is driven by its growing beauty consciousness and government initiatives promoting medical tourism. The Indian Association of Dermatologists reports that a large number of aesthetic procedures are performed annually, creating a strong demand for affordable solutions. Public-private partnerships further amplify adoption. Tata Memorial Hospital collaborates with NGOs to provide subsidized treatments, achieving a increase in patient enrollment.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cutera Inc, Galderma SA, Teoxane Laboratories, Sinclair Pharma, Revance Therapeutics, Elan Aesthetics Inc, Vital Esthetique Laboratories, Merz Pharma GmbH and Co. KGaA, Bioxis Pharmaceutical, and AbbVie Laboratories are playing dominating role in the Asia Pacific dermal fillers market.

The Asia Pacific dermal fillers market is characterized by intense competition, driven by rapid advancements in technology and increasing consumer demand for non-invasive aesthetic procedures. Key players vie for dominance through innovation, strategic collaborations, and aggressive market penetration tactics. Established giants like Allergan and Galderma compete alongside specialized firms like Merz Aesthetics, each leveraging unique strengths to capture market share. The race to develop cost-effective and efficient solutions fuels continuous R&D efforts, resulting in a dynamic landscape marked by frequent product launches and technological breakthroughs. Governments play a pivotal role by offering subsidies and creating favorable policies, intensifying competition among participants striving to capitalize on these incentives. Emerging startups further disrupt the status quo by introducing niche applications, challenging incumbents to adapt quickly. Additionally, collaborations between international and regional players blur traditional boundaries, fostering an ecosystem where innovation thrives. As the market evolves, competition will likely intensify, pushing companies to refine strategies and explore untapped opportunities to maintain their edge.

TOP PLAYERS IN THE MARKET

Allergan (AbbVie)

Allergan, now a part of AbbVie, is a global leader in the dermal fillers market, particularly through its flagship product, Juvederm. The company’s focus on innovation and safety has made it a trusted brand across Asia Pacific. Its commitment to research and development positions it as a key contributor to the global aesthetic industry. By addressing diverse consumer needs, Allergen continues to shape the future of non-invasive cosmetic treatments.

Galderma

Galderma leverages its expertise in dermatology to deliver cutting-edge dermal filler solutions tailored to the Asia Pacific market. The company’s Restylane line is widely recognized for its efficacy in wrinkle reduction and facial corrections. Its emphasis on sustainability and patient-centric approaches underscores its leadership in advancing safe and effective treatments. Galderma’s innovative strategies ensure its prominence in the rapidly evolving dermal fillers landscape.

Merz Aesthetics

Merz Aesthetics is renowned for its advanced technologies and high-quality products, such as Belotero and Radiesse, which cater to a wide range of aesthetic applications. The company focuses on precision injectables and collagen-stimulating materials, enhancing outcomes for patients across the region. Its commitment to education and training ensures that practitioners deliver safe and effective treatments. Merz’s dedication to innovation reinforces its role as a pioneer in the global dermal fillers market.

TOP STRATEGIES USED BY KEY PLAYERS

Focus on Innovation and Research

Key players in the Asia Pacific dermal fillers market prioritize innovation and research to maintain their competitive edge. Companies like Allergan and Galderma invest heavily in developing next-generation materials, such as biocompatible hyaluronic acid and collagen-stimulating fillers, to enhance safety and efficacy. These efforts not only improve patient outcomes but also ensure compliance with stringent regulatory standards.

Expansion into Emerging Markets

Expanding into emerging markets is a key strategy adopted by leading players to tap into untapped opportunities. Companies like Merz Aesthetics and Galderma establish partnerships with local clinics and governments to offer affordable and scalable solutions. Public awareness campaigns further amplify adoption, educating consumers about the benefits of dermal fillers.

Strategic Partnerships and Collaborations

Strategic partnerships with governments, academic institutions, and healthcare providers are critical for strengthening market presence. Companies like Allergan collaborate with local stakeholders to develop training programs for practitioners, ensuring safe and effective procedures. Public-private collaborations further amplify efforts, ensuring broader patient access to advanced treatments.

RECENT HAPPENINGS IN THE MARKET

-

In January 2023, Allergan launched a nationwide training program in India, focusing on educating dermatologists about the safe administration of Juvederm fillers, supported by collaborations with local medical associations.

-

In March 2023, Galderma announced a partnership with Thailand’s Ministry of Public Health to provide subsidized Restylane treatments in rural areas, ensuring broader access to advanced aesthetic solutions.

- In June 2023, Merz Aesthetics completed the acquisition of a South Korean biotech startup specializing in collagen-stimulating materials, strengthening its capabilities in precision injectables and expanding its footprint in the Asia Pacific region.

- In September 2023, Allergan signed a memorandum of understanding with China’s National Medical Products Administration to expedite approval processes for its next-generation hyaluronic acid fillers, reducing timelines significantly.

- In December 2023, Galderma introduced a new line of eco-friendly packaging for its Restylane products in Australia, aligning with the country’s sustainability goals and promoting environmentally conscious practices in the aesthetic industry.

MARKET SEGMENTATION

This research report on the asia pacific dermal fillers market has been segmented and sub-segmented based on the following categories.

By product type

- Absorbable

- Non-absorbable

Material type

- Hyaluronic acid (HA)

- Face lift

- Facial corrections

- Wrinkles reduction

- Breast enhancement

- Acne scar treatment

- Lip enhancement

- Other applications

- Calcium hydroxylapatite

- Facial corrections

- Wrinkles reduction

- Acne scar treatment

- Other applications

- Poly-L-lactic acid

- Facial corrections

- Wrinkles reduction

- Breast enhancement

- Acne scar treatment

- Other applications

- Polymethyl-methacrylate microspheres (PMMA)

- Facial corrections

- Wrinkles Reduction

- Acne scar treatment

- Collagen

- Face lift

- Facial corrections

- Wrinkles Reduction

- Breast enhancement

- Acne scar treatment

- Other applications

- Fat fillers

- Face lift

- Facial corrections

- Wrinkles Reduction

- Breast enhancement

- Acne scar treatment

- Other applications

- Other material types

- Wrinkles Reduction

- Hand rejuvenation

- Acne scar

Application

- Face lift

- Facial corrections

- Wrinkles reduction

- Acne scar

- Lipoatrophy

- Lip enhancement

- Hip augmentation

- Breast enhancement

- Hand rejuvenation

- Penis enlargement

- Blepharoplasty

- Neck & chin lift

- Other applications

End-use

- Hospitals

- Dermatology clinics

- Other end-users

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

How the dermal fillers market in APAC is expected to grow in the coming years?

The dermal fillers market in APAC is growing stable and is predicted to witness a healthy CAGR of 8.61% from 2025 to 2033.

What are the countries of APAC covered in this dermal fillers market research report?

Countries of APAC covered in this report are India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC.

Which are the companies playing a dominating role in the APAC dermal fillers market?

Allergan Inc., AQTIS Medical, Bioha Laboratories, Suneva Medical, Galderma, Merz Aesthetics, Cynosure, Syneron, and Cytophil Inc. are some of the major players in the APAC dermal fillers market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com