Global Dermal Fillers Market Size, Share, Trends & Growth Forecast Report By Product (Absorbable or Biodegradable and Non-Absorbable or Non-Biodegradable), Therapeutic Area (Wrinkles, Deep Facial Lines, Sagging Skin and Scars) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2025 to 2033

Global Dermal Fillers Market Size

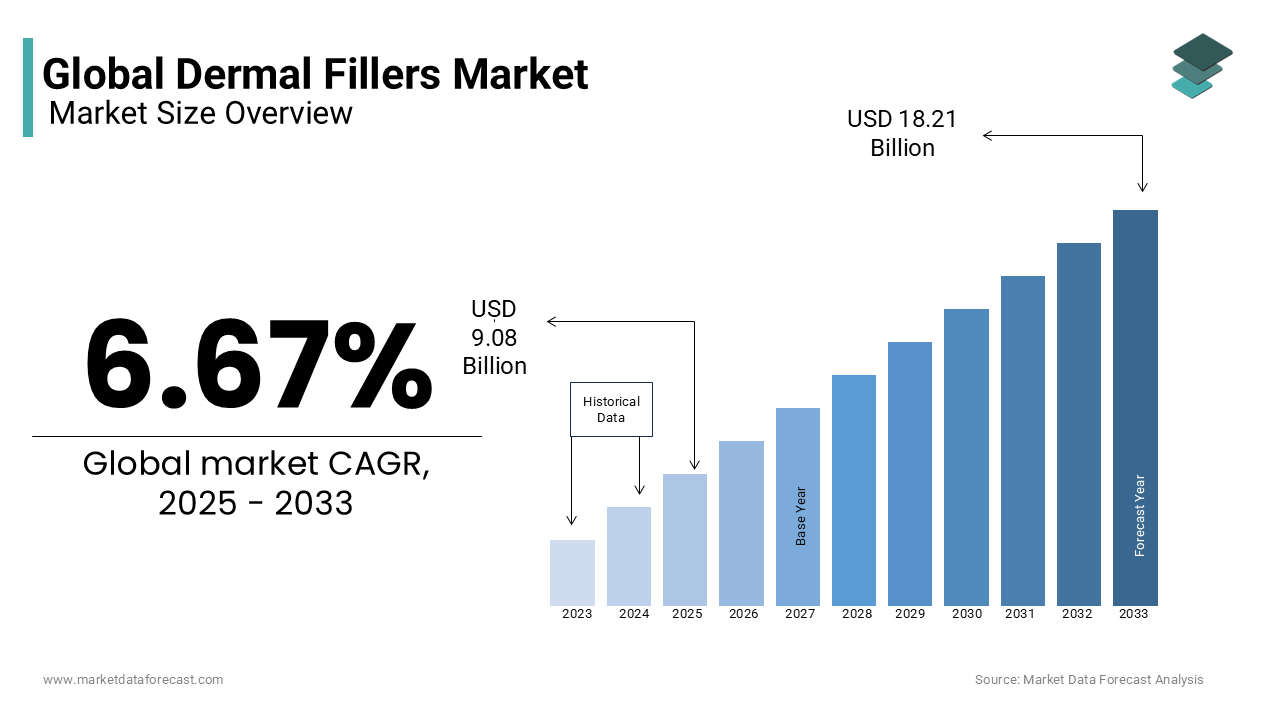

In 2024, the global dermal fillers market was valued at USD 8.32 Billion and it is expected to reach USD 18.21 Billion by 2033 from USD 9.08 Billion in 2025, growing at a CAGR of 9.09% during the forecast period.

Dermal fillers are approved by the Food and Drug Administration for use in adults of 22 or above of age. FDA has approved only the safest and most effective dermal fillers after many regulatory tests, whereas many other products are not yet accepted. Dermal fillers are an invasive procedure that showcases effective results immediately where the person can normally do their daily activities without any time to rest or relax. Early aging is one of the common words we hear these days. Lifestyle changes and lack of physical activity are common factors that cause early aging symptoms in millennial people. Dermal fillers act as a perfect treatment procedure to reverse the signs of aging. Dermal fillers help restore the hydraulic levels that were lost due to too much sun exposure and hereditary factors. Millennial and Gen Z people are more inclined to focus on beauty, which is prompting the dermal fillers market’s growth rate.

MARKET DRIVERS

Rising Adoption of Aesthetic or Cosmetic Devices in Developed Countries

The FDA recommends that all dermal filler packets be thoroughly inspected for authenticity. In March 2017, July 2018, and October 2018, the FDA became aware of counterfeit products being sold and used in the United States, reported by the FDA. With growing awareness of cosmetic anti-aging processes and the rise in the prevalence of minimally invasive surgeries throughout the forecast period, the market is expected to grow lucratively. Moreover, the emergence of technologically advanced and user-friendly products coupled with other factors, such as increasing social acceptance for aesthetic products and the expansion strategies of market players in emerging countries, are expected to drive market growth over the coming years.

The Growing Aging Population Worldwide

The growing geriatric population behaves as a rendering factor of high impact on the expansion of the industry. Increasing numbers of older people undergoing dermal filler therapy should increase business growth to restore lost volume and elevate sagging skin. According to WHO, there will be 1.5 billion people above 60 in 2050. For example, although France probably takes 150 years to adjust to a shift from 10% to 20% of the population over 60, Brazil, China, and India would take slightly less than 20 years. A growing number of facilities and professionals in developing countries. Due to growing awareness about dermal fillers, a government initiative in developing countries like India, China, Japan, etc. Increasing medical tourism, coupled with increasing consumer spending power.

Increasing Usage of Hyaluronic Acid (HA) Among People

The key market players are working on new and more advanced techniques to improve the treatment and expand the product portfolio as the treatment lasts for 6 to 12 months, which is expected to drive the dermal filler market growth. In addition, there is an increasing demand for youth, and aesthetic facial skin is one of the market drivers. In addition, factors such as growing demand for non-invasive procedures for beauty appearance, increasing adoption of technological developments to manufacture adequate and safer dermal fillers, growing awareness and adoption of dermal fillers in multiple countries, increasing disposable income among people in the developed and developing countries are anticipated to fuel the growth rate of the global dermal fillers market.

The escalating demand for minimally invasive aesthetic procedures and the expanding demand for facial aesthetics are the significant factors propelling the market growth rate. The rising aged population worldwide and growing concerns regarding physical appearance, especially among the female population, are driving the global market growth. For Instance, according to the American Society of Plastic Surgeons 2023 report, approximately 23,672,269 minimally invasive cosmetic procedures occurred in 2023. The increasing investments in research and developmental activities to enhance the efficacy of the existing products and to introduce innovative procedures along with continuous product launches are augmenting the market growth opportunities.

The rising disposable incomes, growing awareness among the people regarding the benefits of dermal fillers, and its successful results are enhancing the market growth rate. The increasing trend of male aesthetics is enhancing the demand for dermal fillers among the male population, which is estimated to have a positive influence on global market growth. The new product launches and diverse applications are contributing to the demand for dermal fillers, leading to substantial market growth.

MARKET RESTRAINTS

High Costs Of Aesthetic Procedures

The high costs associated with aesthetic procedures and products are the significant factor limiting the adoption rate, especially among the developing nation population with restricted budgets, which is hampering the global market growth. The variation in product prices and procedures depends on the expertise and qualifications, which act as challenges to market expansion. The adverse reactions caused by the procedures and some products are another factor restraining the market growth. The most common side effects experienced by people are pain, bruising, infections, swelling, lumps, and bumps, which are limiting the adoption rate and leading to hindered market growth. The rare adverse reactions may cause vision loss and severe scarring to people, and the need for skilled professionals and the requirement for increased awareness among underdeveloped and developing nations are impeding global market growth. The stringent regulations regarding product and procedure approvals, which include high complexity, act as a significant challenge to market expansion.

However, the potential risk with the dermal fillers is certainly to limit the growth rate of the market. Many people face some complications after the treatment procedure, such as skin redness, swelling, lumps, bruising, bleeding from the injection site, and others. In very rare cases, the side effects may be worse due to a lack of proper treatment process. All these factors may solely hinder the growth rate of the dermal fillers market. The procedure must be performed by experienced and well-trained persons where a minor mistake can lead to negative results with severe complications, which may hamper the growth rate of the dermal fillers market. Difficulty in finding well-trained people to perform these procedures is expected to slowly degrade the growth rate of the market. Stringent rules and regulations by government authorities to only approve high-quality treatment procedures in favor of public safety additionally degrade the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product, Therapeutic Area, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Allergan Inc., AQTIS Medical, Bio ha Laboratories, Suneva Medical, Galderma, Merz Aesthetics, Cynosure, Syneron, and Cytophil Inc. |

SEGMENTAL ANALYSIS

By Product Insights

The biodegradable fillers segment ruled the market by accounting for 82% in 2024 and is estimated to continue its domination in the global market throughout the forecast period due to the porous assets. In addition, there is a rise in the demand to improve the quality of treatment procedures, which is favoring segmental growth.

The non-biodegradable segment is estimated to present a CAGR of 9.2% during the forecast period. Furthermore, these non-absorbable fillers' outcomes can be seen for 6-24 months. Therefore, the market postulate for non-absorbable will show sufficient growth in the forthcoming years.

The biodegradable or absorbable segment dominated the global dermal fillers market with a prominent share and is expected to maintain the domination during the forecast period. The diverse availability and the extensive applications of biodegradable products are escalating the segment growth rate. The biodegradable products are estimated to provide improved aesthetics compared to the non-biodegradable products is fueling the segment expansion. The escalation in the research and developmental activities by the market players is enhancing the segment growth opportunities.

The non-biodegradable segment is estimated to record a steady growth rate during the forecast period. The non-temporary nature of the non-biodegradable products is the major factor limiting their adoption.

By Therapeutic Area Insights

The deep facial lines and wrinkles segments accounted for most of the dermal fillers market share in 2024. These segments are also anticipated to showcase a promising CAGR during the forecast period. Factors such as the growing aging population across the globe and increasing demand for cosmetic surgeries propel the segment's growth rate. In addition, the rising adoption of non-invasive cosmetic treatment procedures among aging people to treat signs such as wrinkles and fine lines is boosting segmental growth. In addition, increasing adoption of sedentary lifestyles and changing food habits further contribute to the segment's growth. Furthermore, the growing influence of social media and celebrities regarding beauty appearance products and services is anticipated to have a favorable impact on the segment's growth rate.

On the other hand, segments such as sagging skin and scars are predicted to witness a healthy CAGR and hold a considerable share of the global dermal fillers market in the coming years.

The wrinkles segment held the most significant share in the dermal fillers market revenue, and it is expected to grow prominently during the forecast period. The escalation in demand for wrinkle correction treatment procedures and the increasing middle-aged population are enhancing the demand for wrinkle correction, which augments the segment's growth revenue. Wrinkles are the major symptom that appears on people's faces, making it a prominent concern, and with the growing advancements in technology, the rising introduction of new and innovative methods is propelling the segment revenue expansion.

The deep facial lines segment is projected to register considerable growth during the forecast period. Facial lines and wrinkles are the early symptoms of aging in people, which is becoming a major concern, especially among the female population, and is driving the segment growth opportunities.

REGIONAL ANALYSIS

The North American region accounted for the most significant share of the global market and is anticipated to maintain its domination during the forecast period. The increased awareness among the people, the presence of well-established infrastructure, and a number of hospitals and clinics across the region are a few significant factors driving the regional market share growth. For Instance, according to the American Society of Plastic Surgeons (ASPS), approximately 1,498,361 cosmetic procedures will be performed in the United States in 2022. The growing number of new product launches and favorable regulatory networks are escalating regional market revenue growth.

The European region held the second-largest market share and is predicted to record substantial growth in the coming years. The increased expenditure on research and developmental activities and the availability of high-end technologies in the major European countries, along with growing awareness among the people, is propelling the regional market revenue.

The Asia Pacific region is projected to have a rapid growth rate during the forecast period with prominent growth. The expanding healthcare industry, rising disposable incomes of the people, enlarging aging people, and growing concerns regarding physical appearance are proliferating the regional market share.

The Latin America market is predicted to witness a steady CAGR during the forecast period owing to the rapid adoption of cosmetic procedures.

The dermal fillers market in MEA is estimated to hold a moderate share of the worldwide market in the coming years.

KEY MARKET PARTICIPANTS

Companies such as Allergan Inc., AQTIS Medical, Bio ha Laboratories, Suneva Medical, Galderma, Merz Aesthetics, Cynosure, Syneron, and Cytophil Inc. are playing a leading role in the global dermal fillers market.

RECENT HAPPENINGS IN THE MARKET

- In August 2023, Maypharm announced the launch of a hyaluronic acid dermal filler called SEDY FILL, which is used for non-surgical b006Fdy shape correction.

- In May 2023, Galderma announced the launch of Restylane eyesight in Canada, which is a hyaluronic acid injectable dermal filler that helps to reduce under-eye grooves caused by lack of volume in the under-eye area.

MARKET SEGMENTATION

This market research report on the global dermal fillers market has been segmented and sub-segmented based on the product, therapeutic area, and region.

By Product

- Absorbable or Biodegradable

- Non-Absorbable or Non-Biodegradable

By Therapeutic Area

- Wrinkles

- Deep Facial Lines

- Sagging Skin

- Scars

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global dermal fillers market going to be worth by 2033?

As per our research report, the global dermal fillers market size is projected to be USD 18.21 billion by 2033.

Which region is growing the fastest in the global dermal fillers market?

Geographically, the North American dermal fillers market accounted for the largest share of the global market in 2024.

At What CAGR, the global dermal fillers market is expected to grow during the forecast period?

The global dermal fillers market is estimated to grow at a CAGR of 6.67% during the forecast period.

Which are the significant players operating in the dermal fillers market?

Allergan Inc., AQTIS Medical, Bio ha Laboratories, Suneva Medical, Galderma, Merz Aesthetics, Cynosure, and Syneron are some of the significant players operating in the dermal fillers market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com