Asia Pacific Electric Toothbrush Market Size, Share, Trends & Growth Forecast Report By Product Type (Battery Powered, Rechargeable), End-user (Male, Female), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Electric Toothbrush Market Size

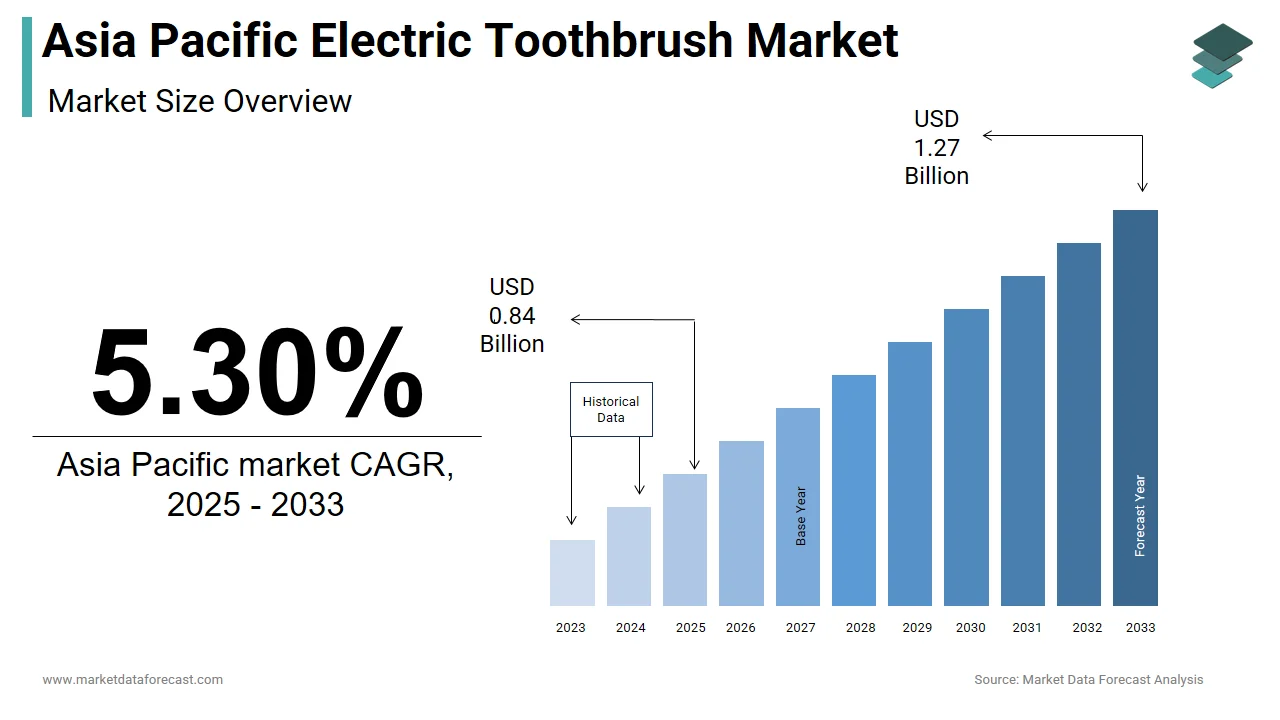

The size of the Asia Pacific electric toothbrush market was valued at USD 0.80 billion in 2024. This market is expected to grow at a CAGR of 5.30% from 2025 to 2033 and be worth USD 1.27 billion by 2033 from USD 0.84 billion in 2025.

The Asia Pacific electric toothbrush market is experiencing steady growth which is driven by increasing awareness about oral hygiene and rising disposable incomes. Also, the growing middle-class population in countries like India and Indonesia has fueled demand for premium personal care products, including electric toothbrushes. Additionally, government initiatives promoting dental health have raised awareness about the importance of preventive care. With technological advancements enhancing product functionality and affordability, the market is poised for sustained expansion.

MARKET DRIVERS

Rising Awareness about Oral Hygiene

Growing awareness about oral health is a significant driver of the Asia Pacific electric toothbrush market. According to the World Health Organization, a significant portion of adults in the region suffer from dental issues such as cavities and gum disease, prompting consumers to adopt preventive measures. Campaigns by dental associations, such as the Australian Dental Association, emphasize the benefits of electric toothbrushes in reducing plaque and improving gum health, influencing purchasing decisions. This evidence-based advocacy has resonated with urban populations, particularly millennials and Gen Z, who prioritize health-conscious lifestyles. Furthermore, social media influencers and digital campaigns by brands like Philips and Oral-B have amplified awareness, reaching a substantial number of urban consumers in South Korea and Singapore. These efforts have normalized the use of electric toothbrushes, positioning them as essential tools for maintaining oral hygiene.

Increasing Disposable Income and Urbanization

The surge in disposable income and rapid urbanization across the Asia Pacific region has significantly bolstered demand for electric toothbrushes. Urban centers, in particular, exhibit heightened demand, with cities like Shanghai, Tokyo, and Mumbai driving sales of high-end gadgets. This trend aligns with rapid urbanization. As cities expand, so does the appetite for advanced oral care solutions, creating a fertile ground for market expansion.

MARKET RESTRAINTS

High Initial Costs and Affordability Concerns

The high upfront cost of electric toothbrushes remains a significant restraint for the Asia Pacific market, particularly in price-sensitive regions like Southeast Asia and rural India. Also, the average price of an electric toothbrush is higher than that of a manual toothbrush, deterring budget-conscious consumers. For instance, many households in Vietnam and the Philippines prioritize essential expenses over luxury personal care products, limiting adoption rates. Even in urban areas, misconceptions about the necessity of electric toothbrushes persist, discouraging potential buyers. Additionally, the need for replacement brush heads adds to the overall expense, further discouraging repeat purchases. Without affordable pricing strategies or financing options, manufacturers risk losing consumer trust, hindering widespread adoption.

Limited Awareness in Rural Areas

Limited awareness about the benefits of electric toothbrushes in rural areas poses another challenge to the growth of the Asia Pacific market. Even in semi-urban regions, misconceptions about complexity and usability persist, discouraging potential buyers. This perception creates resistance, particularly among older demographics who rely on conventional methods. Furthermore, the lack of skilled dental professionals capable of educating consumers compounds the issue. Also, only a small fraction of rural populations in the region have access to professional dental advice, resulting in prolonged ignorance about advanced oral care tools.

MARKET OPPORTUNITIES

Growing Demand for Smart and Connected Devices

The integration of smart features into electric toothbrushes presents a lucrative opportunity for the Asia Pacific market. Brands like Oral-B and Philips have capitalized on this trend by introducing models with Bluetooth connectivity, allowing users to monitor brushing habits and receive real-time guidance. Additionally, the proliferation of IoT platforms enhances user experience by analyzing data and automating adjustments. This trend is particularly prominent in affluent markets like Japan and Australia, where consumers seek unique and immersive experiences.

Expansion of E-commerce Platforms

The proliferation of e-commerce platforms is reshaping the electric toothbrush landscape in the Asia Pacific. China leads this charge, with e-commerce accounting for a major share of total retail sales. This digital shift enables brands to reach remote and underserved areas, bypassing traditional distribution barriers. For example, Xiaomi leveraged online channels to capture a key market share in India, targeting price-sensitive consumers with budget-friendly offerings. Besides, the integration of augmented reality (AR) tools on e-commerce sites allows customers to virtually test products, enhancing purchasing decisions. With internet penetration high in urban areas, the potential for growth remains vast.

MARKET CHALLENGES

Price Competition and Marginal Profits

Price wars among manufacturers pose a formidable challenge to profitability in the Asia Pacific electric toothbrush market. In highly saturated markets like India and Indonesia, brands such as Xiaomi and Realme aggressively undercut competitors, eroding profit margins. This relentless focus on affordability often compromises product quality, leading to shorter device lifespans and increased waste. Moreover, smaller players struggle to compete with established giants, resulting in market consolidation. With consumer expectations for low-cost, high-performance devices rising, companies face the daunting task of balancing innovation with cost management. This pressure threatens long-term sustainability, forcing firms to explore alternative revenue streams or risk obsolescence.

Rapid Technological Obsolescence

The pace of technological advancement in the Asia Pacific electric toothbrush market introduces the challenge of rapid obsolescence. This trend is particularly pronounced in categories like smart toothbrushes, where hardware upgrades occur biannually. For example, Philips' introduction of AI-driven brushing analytics rendered previous models less appealing, impacting resale values and consumer loyalty. In addition, the constant need for innovation drives up R&D costs, with firms allocating a notable share of revenues to stay competitive. Consumers, accustomed to frequent upgrades, exhibit shorter brand loyalty, exacerbating the issue. This cycle not only strains manufacturers financially but also contributes to mounting electronic waste. Navigating this challenge requires strategic planning to extend product lifespans while maintaining relevance in a fast-evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Colgate-Palmolive Company (U.S), The Procter & Gamble Company (U.S), Koninklijke Philips N.V. (Netherlands), Xiaomi (China), Ionsei USA (U.S.), Panasonic Corporation (Japan), Water Pik, Inc. (U.S.), DenMat Holdings, LLC (U.S.), Shenzhen Risun Technology Co. Ltd. (China), Foreo (Sweden), and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The segment of rechargeable electric toothbrushes commanded the Asia Pacific market by capturing a 65.8% of the total revenue in 2024. This is caused by their superior performance and longer lifespan compared to battery-powered variants. Rechargeable models offer advanced features such as pressure sensors, timers, and app connectivity, which appeal to tech-savvy consumers. In addition, government campaigns promoting energy-efficient products have further boosted adoption, with China endorsing rechargeable devices as part of its green initiatives. The convenience of recharging at home also reduces recurring costs associated with battery replacements, making them more economical in the long run.

The battery-powered electric toothbrush segment is the quickest-growing, with a projected CAGR of 8.5%. This growth is fueled by increasing demand in rural and semi-urban areas, where access to consistent electricity remains limited. Battery-powered toothbrushes are also more affordable, with prices typically lower than rechargeable models, making them accessible to price-sensitive consumers. Furthermore, advancements in battery technology, such as longer-lasting lithium-ion cells, have improved product reliability, addressing earlier concerns about performance.

By End-User Insights

The female users accounted for the largest share of the Asia Pacific electric toothbrush market by contributing a 55.5% of total sales in 2024. This dominance is attributed to the growing emphasis on personal grooming and oral hygiene among women. Additionally, social media influencers and digital marketing campaigns targeting women have amplified awareness, with platforms like Instagram driving engagement. The integration of aesthetic designs and personalized features, such as color options and app connectivity, further enhances appeal. These dynamics shows the pivotal role female consumers play in shaping market trends.

The male user segment is experiencing significant growth, with a projected CAGR of 9.2% from 2025 to 2033. This is driven by rising awareness about oral health and the influence of celebrity endorsements. In addition, the rise of smart toothbrushes with features like real-time feedback and gamification appeals to tech-savvy males. A study reveals that male users are more likely to adopt connected devices, underscoring the potential for cross-selling opportunities.

COUNTRY LEVEL ANALYSIS

China stood as the largest contributor to the Asia Pacific electric toothbrush market by commanding nearly 35.5% of the regional share in 2024. It is underpinned by robust manufacturing capabilities and aggressive investments in consumer education. A major share of urban households in cities like Shanghai and Beijing have adopted electric toothbrushes, driven by campaigns promoting oral health and modern living. For instance, the Chinese Dental Association has launched initiatives to educate consumers about the benefits of advanced dental care tools, boosting adoption rates. Additionally, the proliferation of e-commerce platforms like Alibaba and JD.com has made these products easily accessible, particularly in tier-2 and tier-3 cities.

Japan is a significant player in the Asia-Pacific electric toothbrush market. Known for its precision engineering and focus on wellness, Japan excels in developing high-end electric toothbrushes with advanced features like AI-driven analytics and app connectivity. For example, Panasonic has introduced models equipped with pressure sensors and timers, appealing to health-conscious consumers. Also, the country’s aging population has increased demand for ergonomic designs.

South Korea holds a pivotal position in the Asia Pacific electric toothbrush market. Renowned for its beauty-conscious population, the country has embraced electric toothbrushes as part of its broader personal care agenda. Cities like Seoul have witnessed a surge in demand for smart toothbrushes that integrate with mobile apps, enabling users to track brushing habits and receive personalized feedback. Additionally, government initiatives promoting preventive healthcare have spurred adoption, particularly among urban professionals. These strengths position South Korea as a trailblazer in the electric toothbrush domain.

India emerges as a rapidly growing player in the Asia Pacific electric toothbrush market. The country’s burgeoning middle class and increasing awareness about oral hygiene have fueled demand for premium personal care products. For instance, cities like Mumbai and Bangalore have seen a significant increase in electric toothbrush sales, driven by campaigns led by brands like Colgate and Oral-B. Additionally, government programs like the National Oral Health Program have raised awareness about the importance of preventive care, encouraging adoption.

Australia is expected to expand considerably. The country’s affluent population and high disposable incomes enable the adoption of premium electric toothbrushes, particularly among urban professionals. Additionally, the rise of smart toothbrushes with features like Bluetooth connectivity and app integration has captured the attention of tech-savvy users. Also, electric toothbrush users experience a notable reduction in plaque compared to manual brush users, supporting their popularity.

KEY MARKET PLAYERS

Companies dominating the Asia-Pacific electric toothbrush market profiled in this report are Colgate-Palmolive Company (U.S), The Procter & Gamble Company (U.S), Koninklijke Philips N.V. (Netherlands), Xiaomi (China), Ionsei USA (U.S.), Panasonic Corporation (Japan), Water Pik, Inc. (U.S.), DenMat Holdings, LLC (U.S.), Shenzhen Risun Technology Co. Ltd. (China), Foreo (Sweden), and others.

TOP LEADING PLAYERS IN THE MARKET

Philips (Koninklijke Philips N.V.)

Philips is a global leader in the electric toothbrush market and a dominant player in the Asia Pacific region, renowned for its Sonicare range of products. The company’s focus on innovation has enabled it to introduce advanced features such as AI-driven brushing analytics and app connectivity, setting industry benchmarks. Philips leverages strategic partnerships with dental associations and influencers to promote oral hygiene awareness, enhancing brand trust. By addressing diverse consumer needs, from affordability to premium functionality, Philips maintains a strong foothold in both urban and rural markets.

Procter & Gamble (Oral-B)

Procter & Gamble, through its Oral-B brand, is a key contributor to the Asia Pacific electric toothbrush market. Known for its robust product portfolio, Oral-B offers models catering to various demographics, from budget-conscious consumers to tech-savvy professionals. The brand’s emphasis on clinical research and collaboration with dental experts reinforces its credibility. Oral-B’s marketing strategies, including celebrity endorsements and digital campaigns, have amplified its reach across the region. By integrating smart features and ergonomic designs, Oral-B continues to innovate, positioning itself as a trusted name in oral care solutions.

Panasonic Corporation

Panasonic is a major player in the Asia Pacific electric toothbrush market, leveraging its expertise in electronics and energy-efficient technologies. The company’s focus on precision engineering ensures superior performance and reliability, appealing to health-conscious consumers. Panasonic’s localized strategies, such as offering affordable yet high-quality products, enable it to penetrate emerging markets like India and Indonesia.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships with Dental Experts

Key players in the Asia Pacific electric toothbrush market often collaborate with dental associations and healthcare professionals to enhance credibility and promote oral hygiene awareness. For instance, brands like Philips and Oral-B partner with dental clinics and universities to conduct workshops and campaigns, educating consumers about the benefits of electric toothbrushes. These alliances not only build trust but also position companies as advocates for preventive care.

Emphasis on Innovation and Smart Features

Innovation remains a cornerstone of success in the electric toothbrush sector. Leading companies invest heavily in R&D to develop cutting-edge technologies, such as AI-driven analytics and app connectivity. For example, smart toothbrushes that track brushing habits and provide real-time feedback appeal to tech-savvy users, particularly in urban areas. Additionally, ergonomic designs and aesthetic appeal cater to diverse consumer preferences.

Localization and Affordability Initiatives

The key players adopt localized strategies tailored to specific countries and cultures. This involves customizing product features, pricing models, and marketing campaigns to align with local preferences. For instance, affordable solutions are introduced in price-sensitive markets like India and Indonesia, while premium editions target affluent buyers in Japan and Australia. Brands also leverage social media influencers and regional celebrities to amplify their messaging.

COMPETITION OVERVIEW

The Asia Pacific electric toothbrush market is characterized by intense competition, driven by a mix of established multinational corporations and regional players vying for dominance. Global giants like Philips, Oral-B, and Panasonic compete fiercely with local manufacturers such as Xiaomi and Syska, creating a dynamic landscape marked by rapid innovation and aggressive pricing strategies. The market’s diversity—spanning developed economies like Japan and Australia to emerging markets like India and Vietnam—requires companies to adopt multifaceted approaches to succeed. While larger firms leverage economies of scale and technological expertise, smaller enterprises focus on affordability and niche innovations to carve out their share. Regulatory pressures, environmental concerns, and shifting consumer behaviors further intensify rivalry, compelling brands to prioritize sustainability and digital transformation. E-commerce platforms have also leveled the playing field, enabling new entrants to disrupt traditional distribution channels. The result is a vibrant ecosystem where innovation thrives but only the most adaptable survive.

RECENT MARKET DEVELOPMENTS

- In April 2024, Philips launched a campaign in collaboration with the Indian Dental Association to promote oral hygiene awareness. This initiative aimed to educate consumers about the benefits of electric toothbrushes and drive adoption in tier-2 and tier-3 cities.

- In June 2023, Oral-B partnered with a leading influencer in South Korea to promote its smart toothbrush range. This collaboration focused on showing app connectivity features, capturing the attention of tech-savvy millennials.

- In September 2023, Panasonic introduced an affordable electric toothbrush model in Indonesia, priced competitively to appeal to middle-income households. This move aimed to increase penetration in rural areas and strengthen its regional presence.

- In February 2024, Xiaomi expanded its electric toothbrush portfolio in India, launching a budget-friendly variant equipped with basic smart features. This strategy targeted first-time buyers and enhanced accessibility.

- In November 2023, Colgate-Palmolive conducted a series of workshops in Australian schools to educate students about oral hygiene. This initiative positioned the brand as a trusted advocate for preventive care, boosting consumer trust.

MARKET SEGMENTATION

This research report on the Asia Pacific electric toothbrush market has been segmented and sub-segmented based on coverage, animal, sales channel, and country.

By Product Type

- Battery Powered

- Rechargeable

By End-user

- Male

- Female

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific electric toothbrush market?

The Asia Pacific electric toothbrush market is driven by rising oral hygiene awareness, higher disposable incomes, and rapid urbanization, especially in China, Japan, and India

2. What challenges affect the Asia Pacific electric toothbrush market?

High product costs, limited awareness in rural areas, and price sensitivity in emerging economies hinder the Asia Pacific electric toothbrush market’s growth

3. What opportunities exist in the Asia Pacific electric toothbrush market?

Smart technology integration, e-commerce expansion, and eco-friendly product innovations offer strong opportunities for the Asia Pacific electric toothbrush market

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]