Global Oral Care Market Size, Share, Trends & Growth Forecast Report By Product (Toothpaste, Toothbrushes & Accessories, Mouthwashes/Rinses, Dental Accessories/Ancillaries, Denture Products and Dental Prosthesis Cleaning Solutions), Distribution Channel and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Oral Care Market Size

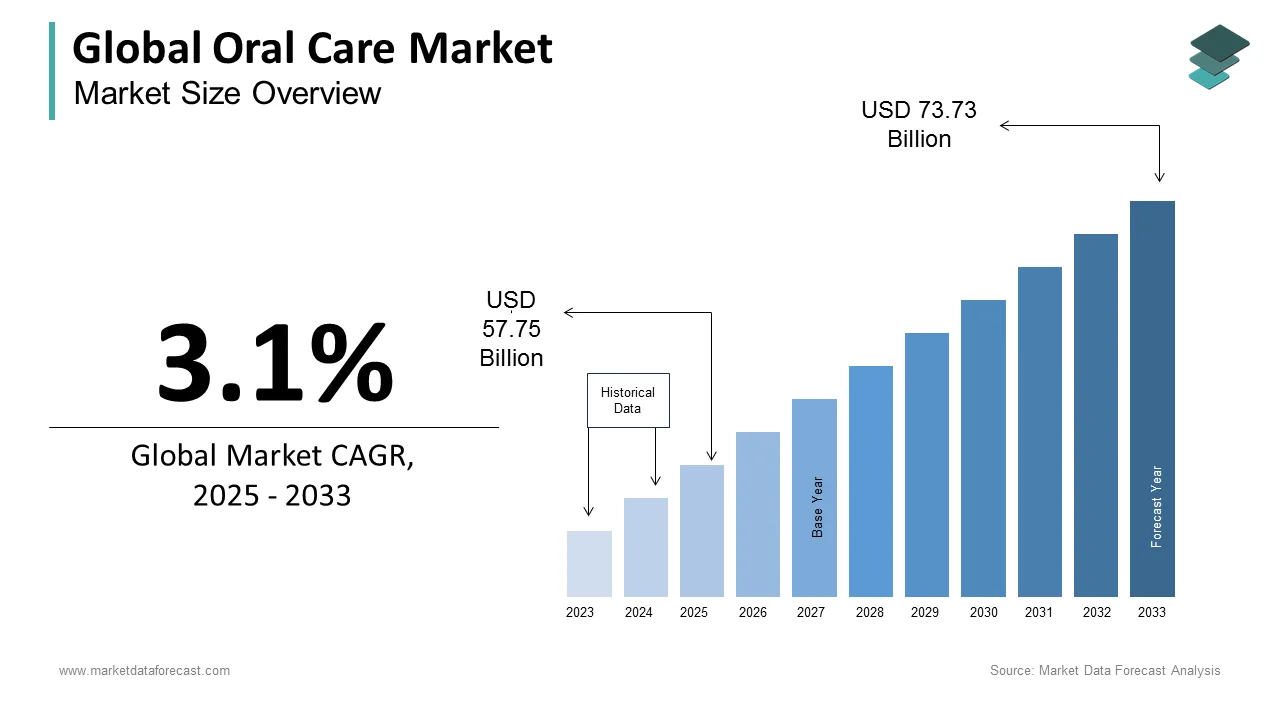

The size of the global oral care market was worth USD 56.01 billion in 2024. The global market is anticipated to grow at a CAGR of 3.1% from 2025 to 2033 and be worth USD 73.73 billion by 2033 from USD 57.75 billion in 2025.

Product innovations and massive investment in marketing and promotional activities by the key players positively impact the global oral care market. Nevertheless, low awareness among consumers about technological innovations in the oral care market hinders the growth rate. The concern towards oral hygiene among people has been significantly growing worldwide. Increasing awareness regarding maintaining healthy oral hygiene and fresh and pleasant breath influences the demand for oral care products. Many new oral care products have been introduced with technological advancements.

According to the World Health Organization reports, it is stated that over 530 million children suffer from dental caries of primary teeth. Key market participants such as Procter & Gamble and Colgate-Palmolive have taken initiatives to spread dental hygiene awareness. Leading market players are focussing on innovative products concerning customer interest. Products include innovative features such as a linear magnetic drive, an intelligent display with personalized brushing mode, and a redesigned brush head to offer optimal oral health.

MARKET DRIVERS

The growing awareness among public regarding the importance of oral care is primarily fueling the global oral care market growth.

The rigorous efforts made by dentists and market participants to increase the awareness levels of good oral hygiene among people. Y-O-Y growth in the prevalence of dental caries in children and adults is expected to drive the oral hygiene market during the forecast period. Factors such as periodontal diseases and other diseases, growing awareness about oral hygiene, and the rising number of small and medium private clinics worldwide propel market growth. Besides, government initiatives to conduct medical camps to create oral hygiene awareness in emerging countries and investments from private organizations for improving healthcare infrastructure are further anticipated to expand the global oral care market growth. Companies in this market focus on innovative dental products that enable patients to opt for suitable products. Other factors, such as growing technological advancements and new procedures and treatments, are estimated to improve the market's growth rate. Orthodontic treatments were mainly used for children and teens, and now many adults are opting for these treatments is considered a significant growth factor. Moreover, increased variety and targeted solution-seeking customers accelerate the development of the market.

The growing number of players working at the regional level has further increased the competition in the market.

The rise of local players in developing markets such as India, China, and Brazil also increases global players' pricing pressure. Regional players offer similar products at lower prices than multi-national companies and sell the products on e-commerce websites at low prices, creating pricing pressure on international players. Prominent players in the market are highly dependent on consumer stores, as they are the manufacturers' immediate clients.

Additionally, mouth cancer incidents and the growing appeal for good aesthetic appearance also support the market's growth. Furthermore, oral hygiene products also include personal care and beauty products, like mouth fresheners, teeth whiteners, etc., which leads to growth for the market.

MARKET RESTRAINTS

Competitive pricing burden on the prominent market players, the risk associated with the oral care treatments, and unfavorable healthcare reforms hamper the global oral care market growth. In addition, supermarkets like Wal-Mart, Target, and Costco have a high negotiating strength; retailer consolidation could create cost and margin pressure on production companies. Furthermore, the increased bargaining power of buyers may negatively impact the manufacturers' business.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Sunstar Suisse SA, Henkel AG & Co. KGaA, GlaxoSmithKline PLC, Unilever, Johnson & Johnson, Procter & Gamble, Colgate-Palmolive Company, and Church & Dwight Co. |

SEGMENTAL ANALYSIS

By Product Insights

The toothpaste segment controlled the largest market share in 2024 and is predicted to grow at a promising CAGR during the forecast period due to its increased adoption and utility in maintaining proper oral hygiene and preventing dental problems. Teeth whitening toothpaste is one of the most popular products holding the largest share. Manufacturers continually focus on implementing innovative strategies and introducing a broad portfolio of products to improve their market position.

The toothbrushes and accessories segment is expected to is projected to be the fastest growing segment in the global market over the forecast period and emerge dominant by 2033. The introduction of advanced variants of toothbrushes such as electric and battery-powered ones is primarily boosting the expansion of the toothbrushes and accessories segment in the global market. These products offer additional advantages like total mouth improvement, including different modes for usage such as deep clean, daily clean, tongue cleaning, whitening, and massaging.

The mouthwash segment is anticipated to register prominent growth over the forecast period because of its increasing oral hygiene maintenance usage. However, despite its benefits, side effects are similar to staining teeth, damage to the oral tissue layer and adverse reactions if ingested, particularly in kids. These factors are likely to restrain their usage.

By Distribution Channel Insights

The general convenience stores segment is predicted to control a significant share of the global oral care market by distribution channels during the forecast period due to their numbers and close to consumers. Convenience stores are the most common sellers of daily necessities and are frequently visited by multiple customers supporting the segment's growth. As oral hygiene products like toothpaste, toothbrush, mouth fresheners, etc., are ubiquitous, they are easily available in these stores.

The retail pharmacies segment is expected to have a substantial share of the global market during the forecast period due to the presence of good dental products with a wide range for all kinds of teeth in these sellers. In addition, pharmacies have even advanced varieties of hygiene products that are commonly unavailable at ordinary convenience stores leading to demand for the segment.

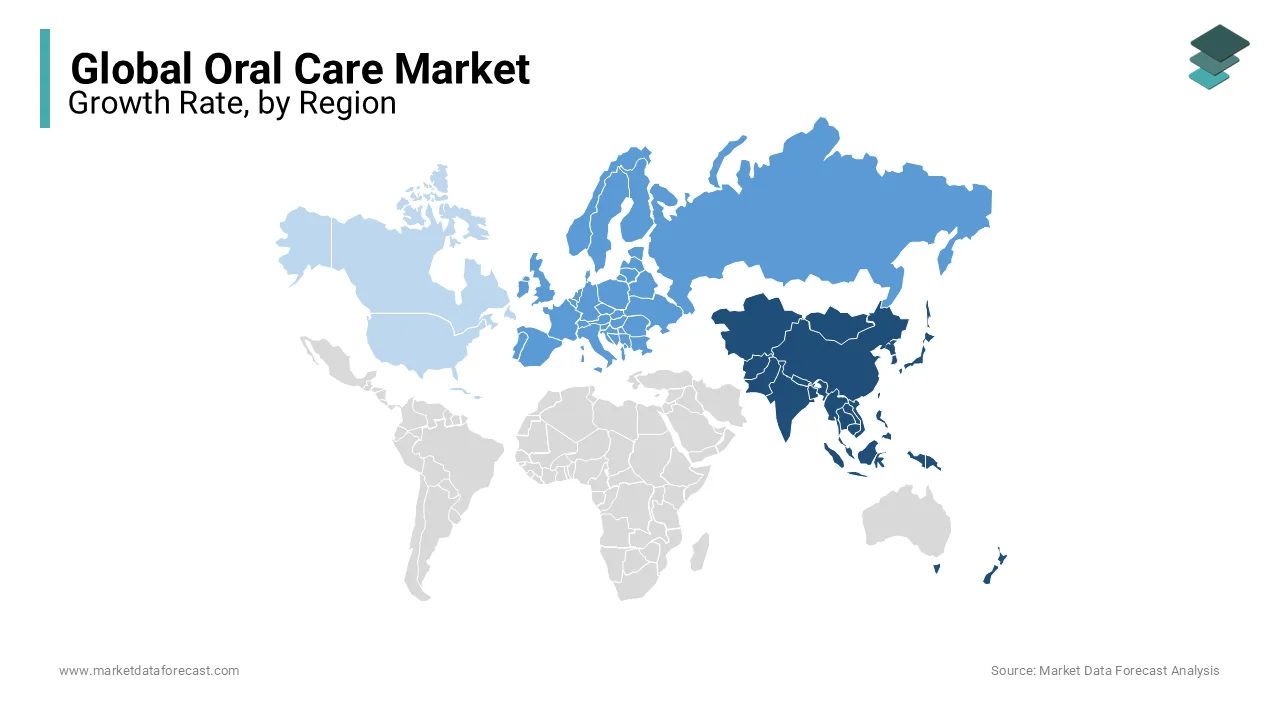

REGIONAL ANALYSIS

The global market was dominated by the Asia-Pacific region in 2024 and is predicted to show the highest growth rate during the forecast period. The high growth rate of the Asia Pacific Oral Care Market can mainly be attributed to an increase in the number of geriatric populations associated with edentulism, an increase in the prevalence of dental caries and other periodontal diseases in children and adults, an increase in healthcare expenditure, increased awareness of oral healthcare, and a greater willingness to spend more on dental care. Increased focus on market leaders in emerging Asian countries will also further facilitate this Region's growth. Consumers in developed countries like China and Japan know oral health techniques, so the demand for oral care products is high. Ayurvedic or natural ingredient products drive the oral care market in India. Ayurvedic revolution products are the focus of major companies in India.

Europe had the second-largest share of the global market in 2024 and is expected to witness a healthy CAGR during the forecast period due to the growing prevalence of oral diseases, especially in its eastern parts. In addition, a massive geriatric population base boosts the market growth.

The U.S. market is projected to grow at a healthy CAGR during the forecast period. Higher affordability in developed countries like the U.S. has fuelled the demand for the latest products like electric toothbrushes and fresh breath strips, leading to a significant revenue share of the North American market in 2019. Moreover, skilled dental hygienists project higher growth in the U.S.

KEY MARKET PARTICIPANTS

Sunstar Suisse SA, Henkel AG & Co. KGaA, GlaxoSmithKline PLC, Unilever, Johnson & Johnson, Procter & Gamble, Colgate-Palmolive Company, and Church & Dwight Co. Inc. are some of the key players in the global oral care market. R&D and new product launches are the most used strategies by the key market participants to maximize their share in the global oral care market.

RECENT HAPPENINGS IN THIS MARKET

- In February 2023, Ionic Ventures cut its stakes in Bruush oral care (BRSH).

- In February 2023, Philips and Candid partnered to provide effective and more efficient orthodontic solutions to professionals working in dentistry.

- GlaxoSmithKline Consumer Healthcare Limited (India) and Hindustan Unilever Limited (HUL) merger in April 2020 made HUL responsible for distributing GSK's Consumer Healthcare brands, like its leading oral healthcare brand, Sensodyne, in India.

- In April 2020, Perrigo Company plc (Ireland) acquired the oral care assets of High Ridge Brands (U.S.), which includes Dr. Fresh, LLC.

- In January 2020, Perrigo Company plc's Ranir subsidiary acquired Steripod, Bonfit America Inc (U.S.), a leading toothbrush accessory and inventor brand.

- In December 2019, Colgate-Palmolive Company launched Colgate Optic White Renewal Toothpaste.

MARKET SEGMENTATION

This research report on the global oral care market has been segmented based on the product, distribution channel, and region.

By Product

- Toothpaste

- Toothbrushes & Accessories

- Mouthwashes/Rinses

- Dental Accessories/Ancillaries

- Denture Products

- Dental Prosthesis Cleaning Solutions

By Distribution Channel

- General Convenience Stores

- Retail Pharmacies

- Online Distribution

- Dental Dispensaries

By Region

- Asia Pacific

- Europe

- North America

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global oral care market going to be worth by 2033?

As per our research report, the global oral care market size is estimated to be worth USD 73.73 Billion by 2033.

What is the growth rate of the global oral care market?

The global oral care market is estimated to grow at a CAGR of 3.1% from 2025 to 2033.

Which region is showing the fastest growth in the global oral care market in the future?

Geographically, the Asia-Pacific regional market is forecasted to showcase the fastest CAGR from 2025 to 2033.

Which are the prominent players operating in the oral care market?

Companies playing a major role in the global oral care market are Sunstar Suisse SA, Henkel AG & Co. KGaA, GlaxoSmithKline PLC, Unilever, Johnson & Johnson, Procter & Gamble, Colgate-Palmolive Company, and Church & Dwight Co. Inc.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com