Global Mouthwash Market Size, Share, Trends & Growth Forecast Report By Product Type (Therapeutic Mouthwash and Cosmetic Mouthwash), End-User (Household and Hospital and Dental Clinics) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Mouthwash Market Size

The size of the global mouthwash market was worth USD 8.73 billion in 2024. The global market is anticipated to grow at a CAGR of 6.48% from 2025 to 2033 and be worth USD 15.36 billion by 2033 from USD 9.3 billion in 2025.

Mouthwash is a liquid that promotes oral care. Many people use mouthwash to freshen their breath and give a clean feeling in the mouth. In recent years, the usage of mouthwash has increased significantly in developed and developing countries owing to the increasing awareness among people regarding the advantages, such as helping kill bacteria, avoiding bad breath, preventing or reducing plaque build-up, and promoting healthy gums. However, mouthwash is not a replacement for brushing and flossing. Mouthwash must be used as per the instructions on the label. Mouthwash cannot be swallowed and can damage health if swallowed in large quantities as it contains alcohol. The usage levels of mouthwash are expected to hike in the coming years due to the increasing awareness among people regarding oral hygiene.

MARKET DRIVERS

The growing awareness of oral care among people primarily drives the global mouthwash market growth.

Many people have understood the importance of oral hygiene in recent days and the health risks associated with poor maintenance of oral health. Mouthwash is an integral part of the oral care routine to prevent issues such as cavities, gingivitis, and bad breath. Many dental organizations recommend that people add mouthwash to their oral care routine. Many governments and market players have conducted several awareness programs over the last few years to spread awareness about oral hygiene. For instance, the 2018 World Oral Health Day campaign by the World Dental Association (FDI) was considered one of the most successful oral hygiene campaigns in history, reaching 700 million people worldwide. Likewise, the growing realization from people to pay attention to oral healthcare and the risks associated with the negligence of oral care leading to serious health problems are anticipated to contribute to the growth of the mouthwash market.

The growing prevalence of oral diseases is further fuelling the mouthwash market growth.

The patient count suffering from dental diseases such as periodontitis, dental caries, and halitosis in developed and developing countries is growing significantly. As per the data published by the World Health Organization (WHO) in 2024, an estimated 3.5 billion people suffer from oral diseases worldwide, and 1 billion suffer from severe periodontitis. The patient population suffering from dental diseases is more in low and middle-income countries than in developed countries as low and middle-income countries have limited access to dental care. Mouthwash can be an effective solution for preventing and treating oral diseases. Knowing the same, the number of people including mouthwash products in their oral care routine is gradually increasing, resulting in the market’s growth rate.

The rising demand for cosmetic mouthwash is anticipated to fuel the overall growth rate of the mouthwash market.

Cosmetic mouthwash can give fresh breath and white teeth, and the adoption of these products is high among the younger generation as they increasingly use them to improve their appearance. This trend is likely to continue in the coming years and boost the growth rate of the mouthwash market. For instance, according to a survey conducted by the American Academy of Cosmetic Dentistry (AACD), 99.7% of people believed that a good smile is a valuable social asset, and 96% of the adults agreed that an attractive smile is capable of feeling appealing to the people of the opposite gender.

In addition, the growing disposable income of consumers is expected to favor the growth of the mouthwash market. With growing income, people are more likely to spend on personal hygiene and health products, including mouthwash products. Furthermore, the availability of a wide range of mouthwash products is estimated to boost the market’s growth rate. Mouthwash products are available in several types, such as antiseptic, fluoride, and herbal mouthwash, and various flavors, such as mint, lemon, and cinnamon. Furthermore, factors such as the growing adoption of e-commerce products to purchase consumer goods and increasing demand for mouthwash products from developing countries are anticipated to promote the mouthwash market growth during the forecast period.

MARKET RESTRAINTS

The availability of alternative products for mouthwashes is one of the major factors hampering the market growth. Health concerns associated with the consumption of mouthwash limit the adoption of these products and inhibit the market growth. In addition, Mouthwash contains alcohol and other chemicals. Due to this, some people hesitate to include these products in their oral care routine. Poor awareness levels among people regarding the benefits associated with using mouthwash products are another significant obstacle to mouthwash market growth. Furthermore, issues associated with availability, competition, and cultural beliefs are anticipated to hinder market growth.

Impact Of Covid-19 On The Global Mouthwash Market

The COVID-19 pandemic has had a mixed impact on the global mouthwash market. The demand and sales for mouthwash products have grown significantly during the COVID-19 pandemic, as many people worldwide have prioritized their hygiene and health. During the COVID-19 pandemic, understanding the importance of being fit and healthy, including oral health, has grown notably and favored the mouthwash market growth. On the other hand, many governments have initiated lockdowns and asked companies and manufacturing facilities to shut down their activities temporarily to limit the spread of the virus, which has hampered the production activities of mouthwash products and resulted negatively in market growth. In addition, the COVID-19 pandemic caused severe disruptions in the supply chain ecosystem worldwide. Due to this, the manufacturers have experienced a shortage of certain ingredients and packaging materials and this has resulted in increased manufacturing costs for the market players and has shown a negative impact on the global mouthwash market growth. Likewise, the COVID-19 pandemic has impacted the global mouthwash market positively and negatively. However, considering the reduced impact of the COVID-19 pandemic, the global mouthwash market is anticipated to witness a healthy CAGR during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.48% |

|

Segments Covered |

By Product Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AMWAY, Church & Dwight Inc, SmartMouth Oral Health Laboratories, The Himalaya Drug Company, GlaxoSmithKline Plc, Colgate-Palmolive Company, Procter &Gamble, Unilever, Johnson and Johnson Services Inc., and Lion Corporation, and Others. |

SEGMENTAL ANALYSIS

By Product Type

Based on the type, the cosmetic mouthwash segment accounted for the largest share of the global mouthwash market in 2024. The segment’s domination is anticipated to continue throughout the forecast period. The segment's growth is primarily driven by the advantages associated with cosmetic mouthwash products, such as good oral health, teeth appearance, and oral cavity. In addition, the easy availability of cosmetic mouthwash products is another major factor contributing to the segment's growth rate. Furthermore, their cost-effectiveness and easy usability further drive the adoption of Cosmetic mouthwash products. Furthermore, growing disposable income and increasing desire from youngers to have an appealing white tooth are propelling segmental growth.The therapeutic mouthwash segment is expected to hold a considerable share of the worldwide market during the forecast period. Unlike cosmetic mouthwash products, therapeutic mouthwash products require a prescription. Therapeutic mouthwash products treat oral health problems such as gum disease, cavities, and bad breath. These products contain active ingredients such as fluoride, chlorhexidine, and essential oils that can fight bacteria and reduce inflammation possibility in the mouth. The growing awareness among healthcare providers regarding the benefits of using therapeutic mouthwash products such as the reduced risk of tooth decay and gum diseases and providing fresh breath, is majorly promoting the segment’s growth rate.

By End-user

Based on end-user, the hospital and dental clinics segment had a considerable share of the global mouthwash market in 2024 and is anticipated to grow at a healthy CAGR during the forecast period as mouthwash products are commonly used before and after several dental procedures such as including routine check-ups, extractions, and root canals. In addition, the growing patient population suffering from various oral diseases and visiting hospitals and dental clinics for treatment procedures is contributing to the segmental growth.On the other hand, the household segment is predicted to grow at a notable CAGR during the forecast period owing to the growing awareness among people regarding the benefits of using mouthwash products and the increasing availability of various mouthwash products.

REGIONAL ANALYSIS

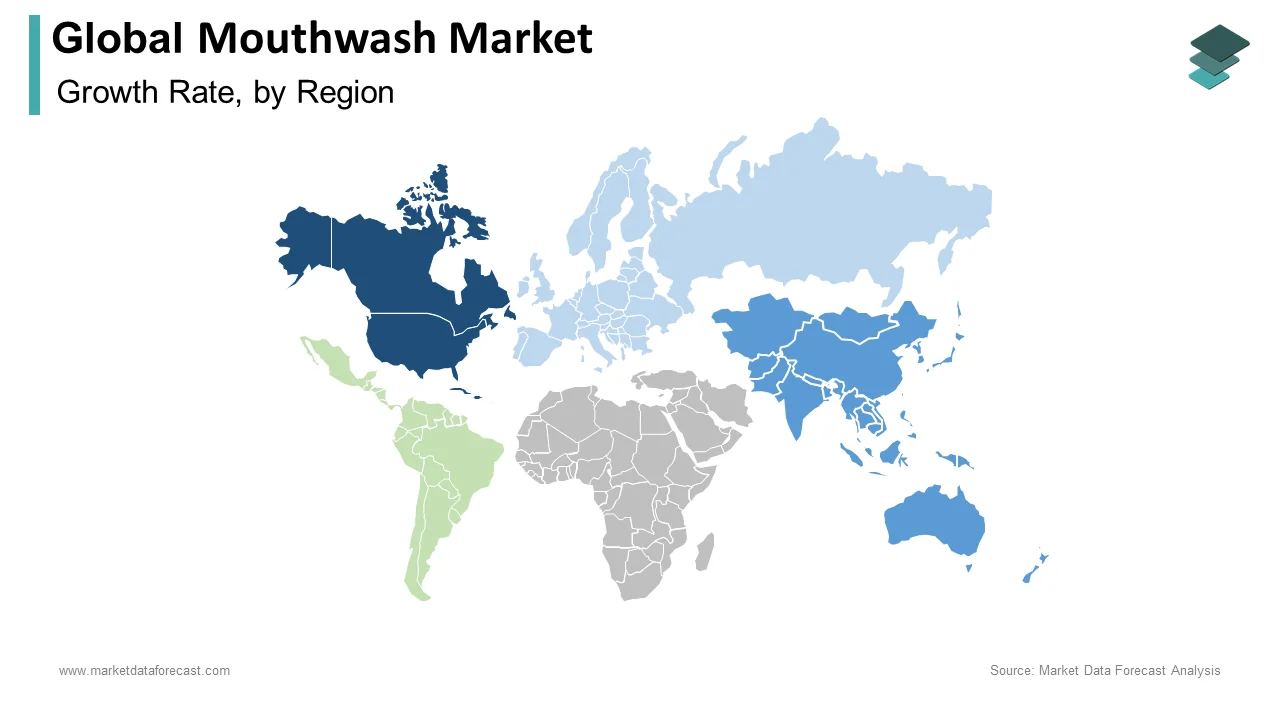

Geographically, the North American region was the most significant regional segment in the worldwide market in 2024. The domination of the North American market is anticipated to continue during the forecast period. The growth of the North American regional market is primarily attributed to the growing awareness among people of the importance of oral care and the growing patient count suffering from oral diseases. In addition, the presence of the key market players in the North American region favors the mouthwash market growth in North America. The U.S. mouthwash market accounted for the largest share of the North American market, followed by Canada in 2024. The same trend is expected to be seen throughout the forecast period.

The APAC mouthwash market is expected to experience rapid growth during the forecast period. Factors such as rising oral care awareness among the population of the APAC countries, increasing disposable income, and a growing patient population with dental diseases are contributing to the growth of the mouthwash market in the Asia-Pacific region. As a result, countries such as India, China, and Japan are anticipated to hold a major share of the APAC market during the forecast period.

The Europe mouthwash market captured a substantial share of the worldwide market in 2024 and is expected to grow at a prominent CAGR during the forecast period. The growing adoption of natural and organic mouthwash products in the European region is majorly propelling regional market growth. As a result, countries such as the UK, Germany and Spain are anticipated to capture the major share of the European market during the forecast period.

The Latin American mouthwash market is anticipated to hold a considerable share of the worldwide market during the forecast period.

The MEA mouthwash market is expected to grow at a sluggish CAGR in the coming years.

KEY MARKET PLAYERS

AMWAY, Church & Dwight Inc, SmartMouth Oral Health Laboratories, The Himalaya Drug Company, GlaxoSmithKline Plc, Colgate-Palmolive Company, Procter &Gamble, Unilever, Johnson and Johnson Services Inc., and Lion Corporation are a few of the noteworthy companies in the global mouthwash market profiled in this report.

RECENT MARKET HAPPENINGS

-

Hello Products LLC, a portfolio company of Tenth Avenue Holdings, a private, diversified holding company based in New York City, was acquired by Colgate-Palmolive Company in January 2020. It's one of the fastest-growing premium oral-care brands in the United States.

-

Unilever Research Laboratories discovered in November 2020 that rinsing with mouthwash containing CPC Technology for 30 seconds reduced the viral load of SARS-CoV-2, the virus that causes Covid-19, by 99.9%.

- Procter & Gamble announced its HDPE recyclable toothpaste tubes for its Crest, Oral-B, and Blend-a-Mend brands across North America in December 2020, confirming its commitment to sustainability.

- In July 2022, the Taiwan Food and Drug Administration (FDA) announced on Monday that two different types of ointments and a brand of mouthwash are now being recalled due to either being found to have impurities beyond the permitted standard or irregular amounts of the primary ingredients. In addition, an FDA section chief named Hung Kuo-teng () informed CNA that due to a high concentration of impurities, approximately 1,500 bottles of Best Pharma Co., Ltd.'s COMFFLAM-C Anti-Inflammatory Antiseptic Solution, a medicinal mouthwash primarily used to relieve mouth and throat pain, will be removed from the market.

MARKET SEGMENTATION

This research report on the global mouthwash market has been segmented and sub-segmented based on product type, end-user, and region.

By Product Type

- Therapeutic Mouthwash

- Cosmetic Mouthwash

By End-user

- Household

- Hospital and Dental Clinics

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the value of the global mouthwash market in 2024?

The global mouthwash market size was valued at USD 8.73 billion in 2024.

Which are the leading companies in the global mouthwash market?

Companies playing a key role in the global mouthwash market are Church & Dwight Co. Inc., Colgate-Palmolive Company, Royal Philips N.V., Henkel AG & Co. KGaA, Kao Corporation, Johnson & Johnson, GlaxoSmithKline Plc., Reckitt Benckiser Group Plc., Amway, Caldwell Consumer Health, Dr. Harold Katz, Sunstar Group, Dentyl Active, Procter & Gamble Company, 3M Company, Unilever Plc., Hawley & Hazel, Jason Natural Care, Lotus Brands Inc., and Rowpar Pharmaceuticals Inc.

Which is the fastest growing region in the global mouthwash market?

The Asia-Pacific mouthwash market is anticipated to be the fastest-growing region in the global market in the coming future and is expected to showcase a CAGR of 8.41% from 2025 to 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com